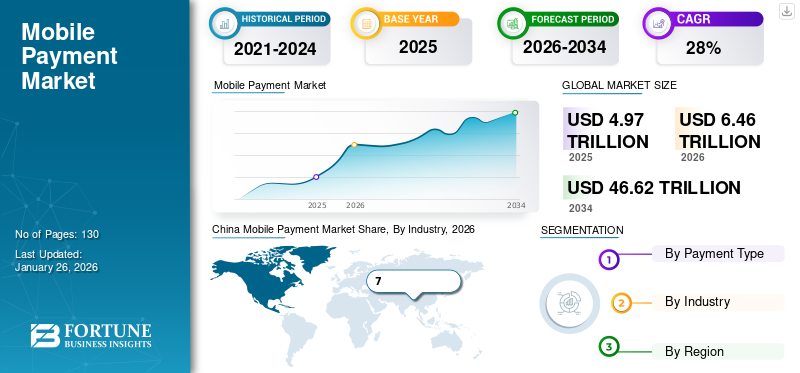

Mobile Payment Market Size, Share & Industry Analysis, By Payment Type (Proximity Payment and Remote Payment), By Industry (Media & Entertainment, Retail & E-commerce, BFSI, Automotive, Medical & Healthcare, Transportation, Consumer Electronics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global mobile payment market size was valued at USD 4.97 trillion in 2025. The market is projected to grow from USD 6.46 trillion in 2026 to USD 46.62 trillion by 2034, exhibiting a CAGR of 28.0% during the forecast period. Asia Pacific dominated the global market with a share of 46.10% in 2025. Additionally, the U.S. Mobile Payment Market is predicted to grow significantly, reaching an estimated value of USD 5.66 trillion by 2032.

Mobile payment enables instant money transfers and is a secured substitute for cash-based transactions for customers. The increasing availability of high-speed mobile networks, along with the increasing penetration of smartphones, is boosting the adoption of mobile-based payment solutions. The digitalization of payment services and growing e-commerce businesses are contributing to the growing market trends. The digital generation, i.e., generation Z, is likely to create vast opportunities for the payment industry to grow during the forecast period. Furthermore, to attract customers to pay through mobile devices, the market players are offering rewards, redemption points, loyalty points, and others. For instance,

- In February 2023, Japan-based mobile payment service provider KDDI Corporation announced a collaboration with Oracle Corporation to offer a faster and more effective customer loyalty program on its au Pay system.

The pandemic has drastically changed the channels and modes of transactions done by consumers and merchants. Today, people are more cautious about transacting in cash while shopping in public places. This has triggered a sudden spike in demand for contactless payment methods such as mobile wallets, NFC, QR codes and more. According to MasterCard's survey, 79% of consumers globally used contactless payments to maintain safety and cleanliness amid the pandemic.

Mobile Payment Market Trends

Growing Adoption of Artificial Intelligence-based Applications in Payments to Accelerate Market Growth

Artificial Intelligence (AI) is expected to increase demand for mobile payment solutions. AI assists enterprises in analyzing the data and recognizing patterns. Besides, it helps in identifying and monitoring the buying behavior of users. Enhanced customer engagement solutions offered across industries using AI help increase customer value. According to the 2021, PWC’s Digital Banking Consumer Survey, to boost long-term trust amongst customers, continuous and real-time efforts are required. Thus, the adoption of AI across digital payments will enhance customer service.

Similarly, as AI can detect patterns, it can be very useful in detecting fraudulent activities in these payments. With the right use cases and historical data patterns, artificial intelligence (AI) can detect fraudulent activity in real time. The rising implementation of artificial intelligence for better customer experience and secured mobile transactions will drive the mobile payment market growth. For instance,

- In November 2023, NatWest and IBM introduced a new version of the bank's Virtual Assistant Cora using generative AI, to make it possible for customers to have access to more information by way of conversation. To ensure that its digital services offer a safe, easy, and convenient user experience, the bank uses gen AI with virtual assistant.

Download Free sample to learn more about this report.

Mobile Payment Market Growth Factors

Paybacks and Reward Strategies to Boost Market Growth

Several payment service providers are investing in their businesses, thereby creating fierce competition in the consumer market. To maintain a loyal customer base and create new customers, payment app companies such as Google Pay, Alipay, Amazon Pay, and others are using new strategies. For instance, Google Pay offers scratch cards containing a certain amount that can be achieved with minimal transactions. Such initiatives are helping to maintain customer loyalty with users paying through smartphones. Furthermore, companies have started to offer rewards and cashback when customers opt for mobile channels for transactions. With the implementation of such reward facilities, customers tend to use mobile apps to pay for every transaction.

The companies are offering an app to keep track of points for the users. For instance, Samsung Pay offers reward points to its smartphone users for every purchase they make. Samsung reward points can be used to purchase their products. Many customer-oriented industries, such as travel & tourism, restaurants, retail stores, and hospitality sectors, have started adopting mobile apps with rewards and coupons. For instance, Hilton Worldwide started room booking and payments through their own app, Honors, to enhance customer engagement. This is expected to drive the mobile payment market share.

RESTRAINING FACTORS

Security Concerns and Inconvenience of Using Cash to Impact Mobile-based Transaction

Although mobile payment solutions provide several features such as better operability, reliability, and flexibility, a majority of end-users are still comprehensively dependent on cash for their daily activities. People have been using the traditional payment mode for several years, and thereby, they are reluctant to adopt new technologies. Customers, owing to their habits, feel safe using the traditional mode of payment when the transaction amount is huge. Also, the payment mode stores personal information such as location, amount balance, purchasing pattern, card PIN, and other details. This increases the risk of unauthorized usage of this personal data and increases security concerns amongst customers. This is likely to hamper the global market growth.

Mobile Payment Market Segmentation Analysis

By Payment Type Analysis

Instant Payment Facilities to Drive Proximity Payment Demand

Based on payment type, the market is categorized into proximity payment and remote payment.

The proximity payment segment is further sub-segmented into Near Field Communication (NFC) and QR code payment. Remote payments is further categorized into internet payments, direct operator billing, digital wallets, and SMS payments.

Proximity payment refers to in-store payment solutions using smartphones. The proximity payment is exhibiting rapid growth in the market owing to its instant payment offerings. Some of the mobile-based proximity payment options in the market include Google Pay/Send, Apple Pay, PayPal, PayTM, and more.

In the proximity payment segment, Near Field Communication (NFC) is gaining rapid growth. Many telecommunication companies such as China Mobile, AT&T, Vodafone Group, Bharti Airtel, and others, are providing SIM-based NFC, which can be instantly operated at the Point of Sale (POS). The QR code segment is expected to gain maximum market revenue from proximity payments. The Quick Response (QR) code has gained instant popularity in the market with its launch owing to its ease of payment process. With its unique barcode technology, QR codes can offer instant and secure transactions and are widely used for peer-to-peer transactions. NFC allows merchants to integrate loyalty programs into their payment systems, allowing customers to redeem vouchers immediately using mobile devices. The growth of the segment is anticipated to be driven by a rise in e-commerce platforms and the continuous use of modern technologies for financial transactions.

Remote payment to gain a significant share during the forecast period with a share of 50.79% in 2026. Remote payment offers the ease of contactless payment through the available real-time online terminal. It blocks unknown terminals from the network and provides fully secured transactions. In this segment, digital wallets will gain rapid growth owing to the various available wallets such as Freecharge, Amazon Pay, Payzapp, and more. Additionally, as remote payments do not require any direct interaction when making payments, the popularity of remote payments is increasing, especially due to the outbreak of the COVID-19 pandemic. The segment growth is projected to be driven by the rising acceptance of virtual terminals for remote payment services.

By Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Surge in Online Banking and Digitalization to Boost BFSI Segment Share

Based on industry, the market is segmented into media & entertainment, retail & e-commerce, BFSI, automotive, medical & healthcare, transportation, consumer electronics, and others.

BFSI to gain rapid growth and maximum revenue share during the forecast period with a share of 21.43% in 2026. Payment technology is providing promising opportunities for the BFSI industry, as this platform enables instant transactions without following a long process. The platform providers are partnering with banks and other banking service providers to integrate this technology into their payment platforms. This has led to the introduction of a mobile banking platform that allows users to make payments for shopping, retail payments, electricity payments, and others.

The retail & e-commerce industry is being highly impacted by the penetration of digitalization and technological innovation. The retail industry was an early adopter of payment technology. With the development of payment services, retailers are constantly re-evaluating their payment solutions. A better customer experience allows retailers to retain loyal customers and also attract new ones. Retailers are keen on providing convenient payment options to customers.

The medical and healthcare industry to showcase steady growth. Its adoption in the healthcare industry offers the ease of instantly paying medical bills for patients. Similarly, in media and entertainment, the user is now trusting mobile payment options for content subscriptions and more. The video streaming industry is offering movies and original TV series on subscription. Similarly, the adoption of mobile gaming is increasing, and gamers can directly purchase the games using digital wallets.

REGIONAL INSIGHTS

Geographically, the market is fragmented into five major regions such as North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. They are further categorized into countries.

Asia Pacific Mobile Payment Market Size, 2025 (USD Trillion)

To get more information on the regional analysis of this market, Download Free sample

According to the report, Asia Pacific (APAC) holds the dominant market share in 2025. In India, the adoption of digital wallets and QR code services has exponentially increased after the government’s demonetization action. Also, government initiatives such as digitalization are expected to further boost the market in India. China is expected to gain the maximum revenue share owing to the dominant presence of key players such as Alipay.com Co., Ltd. and WeChat by Tencent. The emergence of new e-commerce channels, rising online shopping, and new payment solutions are expected to support APAC’s growth during the forecast period.The Japan market is projected to reach USD 0.8 billion by 2026, the China market is projected to reach USD 1.26 billion by 2026, and the India market is projected to reach USD 0.62 billion by 2026.

China Mobile Payment Market Share, By Industry, 2026

To get more information on the regional analysis of this market, Download Free sample

North America is anticipated to account for the second-highest market share. The U.S. has well-developed payment methods, and a significant number of key players have their headquarters in the country. The players are attracting consumers in the U.S. and Canada by adopting strategies such as payback and reward systems, among others.The U.S. market is projected to reach USD 1.25 billion by 2026.

Whereas Europe offers various digital payment solutions, wherein the majority of people own bank accounts and payment cards. The introduction of innovative payment solutions through smartphones is boosting the adoption of payment services in the region. Also, strategic partnerships between network providers, banks, and payment services are likely to boost market growth. For instance, companies such as Apple Pay, Advanzia Bank, Vodafone, Payconiq, and more have invested in European countries to boost mobile-based transactions.The UK market is projected to reach USD 0.35 billion by 2026, while the Germany market is projected to reach USD 0.24 billion by 2026.

The Middle East and Africa region is expected to grow significantly during the forecast period. The existence of financial services, along with the good penetration of mobile phones and high-speed internet, are driving market growth in the region. For instance,

- In February 2023, Mobly Pay, in collaboration with Ericson’s wallet platform, announced a strategic plan to expand its services in Saudi Arabia.

Latin America is an emerging region in the global market owing to increasing smartphone adoption and demand for contactless payment.

Key Industry Players

Emphasis on Launch of New Payment Platforms to Drive Market Development

The key mobile payment companies are investing in the development of unique mobile device payment solutions. Various network operators and mobile payment providers are collaborating to enter the market. The key players across industries are using these payment solutions to provide value-added services and enhance the customer experience. To provide a convenient payment process, the companies are integrating payment options with their in-house app.

List of Top Mobile Payment Companies

- Alipay.com Co., Ltd. (China)

- Amazon.com, Inc. (U.S.)

- American Express Co. (U.S.)

- Boku Inc. (U.S.)

- Google LLC (U.S.)

- MasterCard International Inc. (U.S.)

- Obopay (U.S.)

- Fidelity National Information Services (FIS), Inc. (U.S.)

- PayPal, Inc. (U.S.)

- Visa, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- February 2023 – Visa Inc. announced a partnership with Tingo Mobile, to boost and expand its digital payment solutions across Africa. The company collaborated with Tingo Mobile to target its existing 9.3 million users to expand its payment business.

- January 2023 - Alipay.com Co., Ltd. to offer cash-free transactions introduced QR code payment methods for Asian travelers in mainland China.

- August 2022 - American Express Co. introduced its mobile-friendly platform, American Express Global Pay, for businesses and customers. It is connected to banks across 40 countries and provides a wide range of currencies.

- February 2022 – Clik2pay to expand its customer reach, launched a mobile app for small businesses. This new app offers secured and direct payment from the user’s bank account and facilitates invoices.

- September 2022 – Danske Bank announced the merger of its three mobile apps for payment - Vipps, Pivo, and MobilePay. The company announced the merger with the ambition of offering complete wallet to European customers.

- August 2021 – American Express Co. launched a web version and mobile app, Amex Pay, for the payments of taxes, insurance, cable bills, internet bills, and more. The new application also offers rewards and promotions to customers.

REPORT COVERAGE

The research report highlights leading regions across the world to offer a better understanding of the user. Furthermore, the report provides insights into the latest industry and market trends and analyzes technologies deployed at a rapid pace at the global level. In the scope, we have considered mobile payments done through Near Field Communication (NFC), QR codes, mobile wallets, SMS, internet, and operator billing. It further highlights some of the growth-stimulating factors and restraints, helping the reader gain in-depth knowledge about the market.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 28.0% from 2026 to 2034 |

|

Unit |

Value (USD trillion) |

|

Segmentation |

By Payment Type

By Industry

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 46.62 trillion by 2034.

In 2025, the market size stood at USD 4.97 trillion.

The market is projected to grow at a CAGR of 28.0% over the forecast period.

In 2025, Proximity payment segment led the market.

Increasing government initiative in digital payment to drive market growth.

Alipay.com Co., Ltd., Amazon.com, Inc., American Express Co., Boku Inc., Google Inc., MasterCard International Inc., and Obopay are the top players in the market.

In 2025, Asia Pacific held the highest market share.

Get 20% Free Customization

Expand Regional and Country Coverage, Segments Analysis, Company Profiles, Competitive Benchmarking, and End-user Insights.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us