5G Infrastructure Market Size, Share & Industry Analysis, By Communication Infrastructure (RAN, Transport Technology, and Core Technology), By Spectrum Band (Low Band (<1 GHz), Mid Band (1-6GHz), and High Band (24-40 GHz)), By Network Architecture (Non-standalone and Standalone), By End User (Residential, Commercial, Industrial, and Government), and Regional Forecast, 2026-2034

5G Infrastructure Market Size

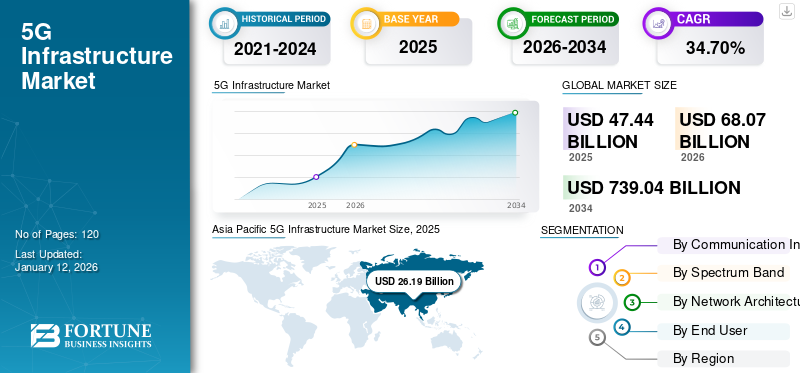

The global 5G infrastructure market was valued at USD 47.44 billion in 2025. The market is projected to be worth USD 68.07 billion in 2026 and reach USD 739.04 billion by 2034, exhibiting a CAGR of 34.70% during the forecast period. Asia Pacific dominated the global 5g infrastructure market with a share of 38.08 in 2025.

5G infrastructure comprises Radio Access Network (RAN), core, and transport technology to offer high throughput, low latency, high mobility, and high connection density. The emergence of 5G is expected to create several business opportunities for telecom operators, enterprises, stakeholders, as well as consumers. For instance, deploying 5G is expected to assist telecom operators in adopting advanced connectivity and collaborating with various sectors, such as retail, finance, healthcare, and transport to deliver enhanced services to businesses and consumers.

Challenges associated with the pandemic halted the progression of 5G in several countries across the globe. Countries, such as Spain, France, India, Austria, and the U.S. had to postpone their auction for the 5G spectrum. However, few vendors started focusing on creating an aggressive 5G rollout plan in 2020-2021, and thus, 5G started showcasing vast potential across several industries during the pandemic. Even though this initiative started gaining traction, delays in the deployment of the 5G network limited its overall adoption.

Global 5G Infrastructure Market Overview

Market Size:

- 2025 Value: USD 47.44 billion

- 2026 Value: USD 68.07 billion

- 2034 Forecast Value: USD 739.04 billion, with a CAGR of 34.70%% from 2026 to 2034

Market Share:

- Regional Leader: Asia Pacific held the largest market share in 2024, driven by extensive 5G deployment in countries like China and South Korea.

- Fastest-Growing Region: Middle East & Africa, fueled by rising government investments and telecom expansion.

Industry Trends:

- Rise in mid-band spectrum (1–6 GHz) deployment to balance coverage and capacity

- Increased implementation of core and transport network solutions like SDN, NFV, and edge computing

- Strong push toward private 5G networks for industrial use cases

Driving Factors:

- Surge in IoT-connected devices and smart city initiatives

- Demand for ultra-low latency to support automation, AR/VR, and autonomous vehicles

- Government and private investments in nationwide 5G rollouts

- Expansion of cloud-native telecom infrastructure.

Emerging technologies, such as Virtual and Augmented Reality, Artificial Intelligence, Internet of Things (IoT), and connected cars, among others, need a fast and efficient communication infrastructure. This is supporting the growth of 5G network solutions across the globe. Considering the 5G capabilities, hardware companies are focusing on providing 5G-enabled devices. For instance, according to predictions by GSMA Intelligence, new 5G networks were expected to be deployed in over 30 countries in 2023 and the number of 5G connections is anticipated to be doubled by 2025.

5G Infrastructure Market Trends

Network Slicing to Pave Way for Adoption of 5G Network

Network slicing is the use of network virtualization to split single network connections into several virtual connections to deliver different volumes of resources to different types of traffic. They assist mobile operators and telecom vendors in providing portions of their networks for specific customer use cases, such as IoT factories, smart homes, smart energy grids, and connected cars, among others. Network slicing is a key tool for providers to address the different requirements of enterprises. The technique allows the provider to create a dedicated virtual network as per specific use cases or customer service needs. For instance, the network requirement for healthcare providers will be vastly different from those of the agriculture sector. Network slicing also provides higher security for mission-critical services. When the network slices are reserved for specific services, they enhance their reliability and offer simplification.

According to the GSMA Intelligence, network slicing technology is adopted at an increasing rate in the global IoT network as it supports several connected devices with diverse accessibility and mobility requirements. Thus, these capabilities of network slicing are likely to propel the 5G infrastructure market growth.

Download Free sample to learn more about this report.

5G Infrastructure Market Growth Factors

Growing Use of IoT Connected Devices to Augment Demand for 5G Technology

According to a study published by Forbes, over 80 billion devices are estimated to be connected to the Internet by 2025. The technology has a vast scope across several industry verticals, including manufacturing, smart city, logistics, healthcare, and automotive, among others. IoT requires an efficient communication infrastructure along with reliable connections and minimum latency. Nowadays, deployment of 5G networks is capable of providing the required modern infrastructure with their respective strengths and weaknesses. Thus, the introduction of 5G is expected to cater to the growing demand for advanced infrastructure.

5G offers techniques, such as network function virtualization and network slicing that help in providing customer-specific networks. Thus, 5G architecture can offer customized infrastructure for IoT applications to boost the efficiency of the industry. For instance, Industry 4.0 fully depends on robotics to increase the efficiency of a manufacturing plant. With the adoption of 5G, IoT-connected devices can use a dedicated network line with a high wireless data transfer that offers real-time information. This will automate the shop-floor operations and enhance the efficiency of the manufacturer. Similarly, it also has various applications, such as precision livestock farming, intelligent emergency response systems, automated valet parking, and communication in car manufacturing. Thus, the growing IoT implementation is likely to boost the demand for 5G network solutions.

Need for Ultra-Low Latency Expected to Drive Market Growth

The implementation of advanced technologies, such as Internet of Things (IoT), connected devices, Artificial Intelligence, Augmented & Virtual Reality, among others, is rapidly increasing. However, many industries are not able to utilize the full potential of these technologies owing to the high latency issue. 5G offers ultra-low latency capabilities to provide an advanced user experience.

The low latency capabilities of 5G are boosting its demand in mission-critical applications. One of the major applications of low latency can be telemedicine, where hospitals and healthcare providers can access real-time data without any delay during a critical situation. The low latency rate of this technology is likely to make remote robotic surgeries a reality in the future. Similarly, in the manufacturing industries, 5G can help manufacturers scale-up their connected robotic workforce. This is expected to boost the efficiency of Industrial IoT devices and connected machines.

5G is expected to improve assisted driving and transport services with real-time data alerts. The technology will provide data regarding the traffic situation and enhance safety during assisted driving. Besides, the low latency can be a game-changer in virtual and augmented reality applications. The technology is expected to provide a highly immersive experience to the user with its fast data transmission features. This is likely to fuel the demand for 5G infrastructure.

RESTRAINING FACTORS

Increasing Cybersecurity Threats to Hamper Market Growth

The chances of cybersecurity threats are likely to increase with the rapid adoption of 5G technology. The increasing use of connected devices and machines will lead to an increase in cyberattacks. Also, unlike traditional technologies, 5G offers a direct connection to the cellular network that further increases the risk of direct attacks. The attackers can take advantage of such security gaps and come up with advanced strategies to hack into a network. Thus, increasing 5G implementation is expected to raises the number of potential threats. This is likely to hamper the market growth.

5G Infrastructure Market Segmentation Analysis

By Communication Infrastructure Analysis

Rapidly Growing Data Traffic to Augment Demand for 5G RAN

Based on communication infrastructure, the market is categorized as RAN (Radio Access Network), transport technology, and core technology.

The RAN segment is expected to hold the maximum 5G infrastructure market share of 42.06% in 2026, as this infrastructure can cater to a wide range of spectrum bands. RAN is further segmented into C-RAN/V-RAN, small cell, and massive MIMO. The small cell segment is expected to grow exponentially owing to its capability of increasing network capacity. 5G small cell helps the operator connect maximum number of smartphones in a high user density area.

The rising mobile data traffic and increasing demand for high-bandwidth will subsequently lead to an increase in the demand for small cells. Similarly, the growing demand for new wireless network architecture is likely to drive the demand for cloud-RAN. Virtual-RAN offers a better user experience by providing improved network performance. This is expected to boost the demand for C-RAN and V-RAN in 5G infrastructure.

The transport technology segment is further bifurcated into Software-Defined Networking (SDN) and network slicing. Software-Defined Networking segment is expected to lead the market. The centralized control plane capabilities of SDN provide end to end visibility of network resources, which helps in maintaining and establishing optimized connectivity. Likewise, the capability of network slicing to provide a customer-specific network to support new business models is likely to drive its growth.

The core technology is further bifurcated into Network Function Virtualization (NFV) and mobile edge computing. The growing requirement of low latency for essential IoT applications is expected to drive the growth of the mobile edge computing segment during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

By Spectrum Band Analysis

Increasing Demand for Enhanced Coverage Likely to Fuel Need for Mid Band Spectrum

Based on spectrum band, the market is divided into low band (<1 GHz), mid band (1-6GHz), and high band (24-40GHz).

The mid band (1-6GHz) segment is expected to capture the maximum share of 46.67% in 2026. Mid band spectrum offers better indoor and outdoor coverage with high data rates. For the initial deployment of 5G, this spectrum holds vast potential for international harmonization. The mid band is suitable for shorter network coverage, such as the city’s mobile network coverage and along the interstate highways.

The high band (24-40GHz) segment is expected to experience rapid growth during the forecast period owing to its potential to support the ultra-high speed of 5G. This spectrum caters to the requirements of a high concentration of users over a short distance. The high band is suitable for outdoor environments, such as train & bus stations, sports venues, manufacturing plants, hospitals, landmarks, and more.

Owing to exceptional coverage, the low band (<1 GHz) segment is likely to showcase steady growth during the forecast period.

By Network Architecture Analysis

Growing Demand for Higher Bandwidth and Data Speed to Propel Adoption of 5G Non-Standalone Architecture

Based on network architecture, the market is bifurcated into non-standalone and standalone.

The Non-standalone Architecture (NSA) segment, which consists of a 5G network (LTE combined), is expected to hold the maximum share of 68.88% in 2026, as the first rollouts of 5G networks are NSA deployments. NSA focuses on providing higher data bandwidth and reliable connectivity to telecom service providers. Thus, in the beginning, majority of the service providers who want to offer 5G services are relying on non-standalone architecture.

However, the standalone segment is anticipated to record a prominent CAGR during the forecast period to provide true 5G speed. The standalone architecture consists of New Radio and Core. The 5G core uses a cloud-aligned service-based architecture. It plays a vital role in supporting service discovery, control plane function interaction, and flexible connections.

By End User Analysis

Increasing Demand for High-Speed Internet to Fuel Growth of 5G Technology in Residential Sector

By end user, the market is categorized into residential, commercial, industrial, and government.

The residential segment holds the maximum share of 36.61% in 2026, the market as along with digital revolution, the demand for high speed internet connectivity has increased at an accelerated pace among individuals for various applications. These applications include, streaming full HD & 4K content videos, gaming, video calls & meetings, and smart home applications.

The industrial segment is anticipated to record the highest CAGR in the upcoming years owing to the growing demand for Industry 4.0. This technology includes process automation in various manufacturing and process industries. To execute all the processes seamlessly and efficiently in these industries, the flow of information at the right place and the right time is quite important. Implementation of 5G network infrastructure in these industries plays a vital role in achieving high speed and accuracy.

REGIONAL INSIGHTS

By region, the market has been analyzed across five major regions, North America, South America, Europe, the Middle East and Africa, and Asia Pacific.

Asia Pacific 5G Infrastructure Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific dominated the market with a valuation of USD 26.19 billion in 2025 and USD 38.08 billion in 2026. The presence of several 5G and communication service providers is expected to drive the product demand in the region. China held the major market share in 2024 as the country has witnessed a high level of investments in the 5G ecosystem. According to a report by the GSMA, China is projected to install 450 million 5G connections by 2025. The Japan market is projected to reach USD 7.16 billion by 2026, the China market is projected to reach USD 18.84 billion by 2026, and the India market is projected to reach USD 2.15 billion by 2026. Moreover,

- October 2023 - China developed over 3.19 million 5G base stations with the aim of accelerating the digital transformation of the real economy.

These recent developments are expected to fuel the demand for 5G infrastructure in the region during the forecast period.

According to the GSM Association, China aims to invest USD 184 billion in 5G by 2025. Japan is expected to grow exponentially during the forecast period owing to massive investments in 5G technology. In May 2023, Ericsson and KDDI engaged in a partnership to deploy Japan’s first Vault 5G Base stations to enhance urban connectivity. Moreover, in India, to give a boost to Digital India, Make in India, and Smart Cities & Smart Village missions, the government launched the 5G India 2020 forum.

Europe

Europe is expected to register a prominent CAGR during the forecast period owing to the increasing number of supportive government policies and associated regulations. For instance, in 2016, the European Commission launched 5G for the Europe Action Plan and established the 5G Infrastructure Public-Private Partnership. According to the GSMA, Europe is expected to achieve 203 million 5G connections by 2025. The UK market is projected to reach USD 2.95 billion by 2026, and the Germany market is projected to reach USD 2.6 billion by 2026.

North America

North America is likely to hold a major market share following Asia Pacific. The region’s end users are rapidly embracing 5G, with the countries U.S. and Canada showcasing higher terms of 5G adoption. According to GSMA Intelligence, the U.S. and Canada are expected to rank among the top markets in terms of 5G adoption by 2025. Moreover, in the coming years, telco wireless network investments will be majorly aimed at 5G. More extensive use of 5G is expected to propel fixed wireless access and IoT ecosystem. The U.S. market is projected to reach USD 8.92 billion by 2026.

Middle East & Africa

The Middle East & Africa is expected to grow with the highest CAGR during the forecast period. GCC is expected to lead the market owing to various government initiatives such as Abu Dhabi Vision 2030. The growing demand for driverless cars, IoT, and robotic & AI is boosting the demand for 5G in the Gulf region.

The increasing initiatives to deploy advanced technologies in South America are expected to enhance the growth of the market.

List of Key Companies in 5G Infrastructure Market

Key Players are Focused on Offering Advanced 5G Infrastructure Solutions

Key players, such as Telefonaktiebolaget LM Ericsson, Qualcomm Technologies, Huawei Technologies Co., Ltd., Nokia Network, Dell EMC, and ZTE Corporation, are collaborating with other players to expand their global presence. The companies are offering advanced solutions and hardware, which will contribute to the growth of the market. For example, Samsung Electronics Co. Ltd. is expanding its 5G presence by strategically collaborating with infrastructure and network providers across the globe. The company is launching innovative solutions such as inter-band carrier aggregation, mobile NR core & integrated radio solutions, and more. It is also offering cloud-based deployment solutions for an efficient and fast connection.

- February 2023 – Astella Technologies Limited launched 5G infrastructure software products at the Mobile World Congress 2023 in Barcelona. The product launch included 5G integrated small cells and 5G core network for sub-6 and mmWave frequency bands.

LIST OF KEY COMPANIES PROFILED:

- Telefonaktiebolaget LM Ericsson (Sweden)

- Huawei Technologies Co., Ltd. (China)

- Nokia (Finland)

- ZTE Corporation (China)

- Samsung Electronics Co., Ltd. (South Korea)

- NEC Corporation (Japan)

- Mavenir (U.S.)

- Fujitsu (Japan)

- Qualcomm Technologies, Inc. (U.S.)

- Rohde & Schwarz (Germany)

KEY INDUSTRY DEVELOPMENTS:

- February 2024 - Wind Tre, an Italy-based network operator, completed the acquisition of OpNet, a fixed wireless access company (Linkem). With this collaboration, companies expect to continue the development of their respective businesses operating in full compliance with rules. The acquired company holds an important spectrum for 5G and helps Wind Tre expand its existing spectrum.

- January 2024 - T-Mobile partnered with Cisco with the aim of launching a new managed service, the Connected Workplace. This new introduction has been developed to help medium-sized companies that operate in multiple locations. With this initiative, the company is highlighting its attempt to create a new position in the Enterprise ecosystem.

- September 2023 - Siemens introduced a private 5G infrastructure that is dedicated to helping several industry end users. The new launch helps these companies develop their own local 5G networks that provide optimal support for automation applications.

- March 2023 – Cisco Systems, Inc. and NTT Data Corporation launched private 5G services for healthcare, automotive, public, retail, and logistics sectors. This launch is expected to enhance the Industry 4.0 capabilities.

- February 2023 – Qualcomm Technologies, Inc. and Viettel jointly launched the initial versions of Viettel's 5G Radio Unit (RU) and Distributed Unit (DU) built on the Qualcomm QRU100 5G RAN Platform and Qualcomm X100 5G RAN Accelerator Card.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The report covers a meticulous study of the market that is studied across five key regions such as North America, South America, Europe, Middle East & Africa, and Asia Pacific. Besides, it offers valuable insights into recent industry trends and analyzes technologies that are being integrated and adopted at a rapid pace across the globe. It also showcases several factors that are influencing the market positively and negatively, helping the reader gain in-depth knowledge about the market.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 34.70% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Communication Infrastructure

By Spectrum Band

By Network Architecture

By End User

By Region

|

Frequently Asked Questions

The market is projected to reach USD 739.04 billion by 2034.

In 2025, the market stood at USD 47.44 billion.

The market is projected to record a CAGR of 34.70% during the forecast period.

The RAN (Radio Access Network) segment is likely to lead the market.

The increasing number of IoT-connected devices is expected to drive the market growth.

Telefonaktiebolaget LM Ericsson, Huawei Technologies Co., Ltd., Nokia Network, ZTE Corporation, Samsung Electronics Co. Ltd., and ZTE Corporation are the top players in the market.

Asia Pacific dominated the global 5g infrastructure market with a share of 38.08 in 2025.

Middle East & Africa is expected to grow with the highest CAGR over the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us