Base Station Antenna Market Size, Share & Industry Analysis, By Type (Omni Antenna, Sector Antenna, Dipole Antenna, Multibeam Antenna, Small Cell, and Others), By Provision/Sector (Semi-urban, Urban, and Rural), By Technology (3G, 4G/LTE, and 5G), By Application (Mobile Communication, Intelligent Transport, Industrial IoT, Smart City, Military & Defense, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

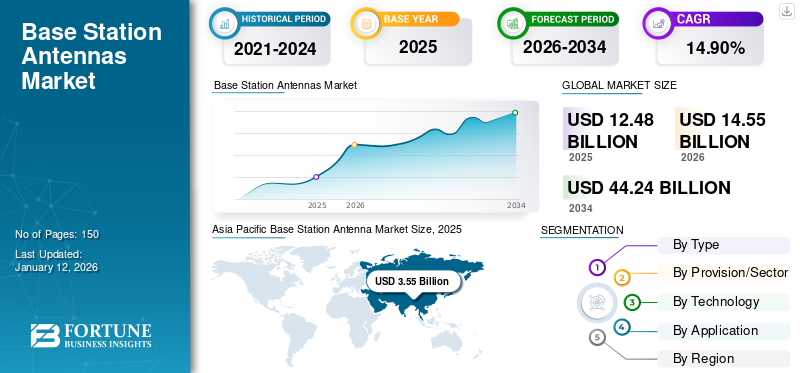

The global base station antenna market size was valued at USD 12.48 billion in 2025. The market is projected to grow from USD 14.55 billion in 2026 to USD 44.24 billion by 2034, exhibiting a CAGR of 14.90% during the forecast period. Asia Pacific dominated the global market with a share of 28.40% in 2025. Additionally, the U.S. base station antenna market is predicted to grow significantly, reaching an estimated value of USD 4,236.6 million by 2032.

The market is expected to show significant growth owing to wide applications of base station (BST) in 4G/LTE and 5G communication infrastructures. The rising implementation of 5G infrastructures across countries to enhance network service performance and user experience is likely to surge the demand for base station antenna. Base station antennas play a vital role in advanced broadcast communications. They are fundamental components of remote communication systems, empowering the transmission and gathering of radio signals between base stations and portable gadgets.

As per industry experts, antennas are witnessing tremendous demand in areas, such as connected cars, precision agriculture, military & defense, and smart cities, among others, owing to their efficient and reliable wireless communication capabilities. They also offer excellent connectivity in the highly-dense network areas, which is important for ensuring stability in mobile communication and 5G infrastructures. For example,

- In February 2020, CommScope Inc. launched an enhanced small cell solution under its OneCell profile to support the 5G deployment of mobile operators. It includes connectors, small cells, antennas, and power solutions to boost the 5G rollout.

The coronavirus outbreak significantly impacted manufacturing plants and factories globally. The pandemic also affected the antenna manufacturing factories. Due to the outbreak, 5G infrastructure providers announced the extension in 5G rollout plans during 2020. For instance, CommScope Holding Company’s net sales fell by USD 70 million in 2020 due to supply chain disruptions. Considering the present scenario and the uncertainty of the pandemic, the company postponed its entire 2020 work plan to another year.

Furthermore, the unavailability of components and equipment required for antennas disrupted several production plants. Component providers faced delivery issues amid the temporary closure of borders and other disruptions in the supply chain. The disruption in 5G infrastructure plans, manufacturing delay and supply chain disruption amid the pandemic negatively impacted the market growth. However, post-pandemic, as the economy improves, the market trend is expected to return to its original growth rate.

Base Station Antenna Market Trends

High Capacity Smart Antennas to Improve Mobile Communication Infrastructure

Smart antennas offer superior wireless network capacity and coverage range to cater to the seamless voice, data, and control services of 4G and 5G technologies. These antennas have emerged as a promising technology to improve the performance of mobile communication. Smart antennas use the beamforming technique that reduces interference levels and improves the network capacity of the network operator.

Smart antennas are suitable for carrying out seamless mobile communication in long straight spaces, such as highways or railways by integrating with signal processing and sensing elements. These antennas are capable of enhancing the quality of mobile communication with low energy consumption. The implementation of smart antennas increases the system's user capacity and coverage, and thus supports providing superior quality services. Also, they offer a maximum data rate, which helps operators provide efficient services for multiple users at the same time. This is boosting the application of smart antennas in mobile communication services. Similarly, the advancements in wireless systems are creating strong demand for smart, high-efficiency, and intelligent adaptive antennas. Thus, the capabilities of smart antennas are likely to surge their demand in mobile communication infrastructure.

Download Free sample to learn more about this report.

Base Station Antenna Market Growth Factors

Growing 5G Infrastructure to Drive the BST Antenna Market Growth

5G infrastructures offer high speed, low latency, and maximum coverage networks, causing the demand for 5G technology to rise rapidly across countries. China, the U.S., the U.K., and South Korea are aggressively implementing 5G technology to provide better quality communication services. Additionally, rise in the usage of 5G IoT ecosystem is the key factor which offers significant opportunities for the development of the 5G base station.

The BST antenna is one of the key components in 5G infrastructures as it supports its high network capacity and data rates. The rapid implementation of 5G technology is expected to boost the demand for base station antenna. For instance,

- In September 2021, Huawei Investment & Holding Co., Ltd. released various products and solutions catering to the 5G target network. It supports promoting multi-antenna technology to accelerate the 5G network for all bands. These multi-antennas offer improved experience and help in efficiently deploying the 5G network.

- In March 2021, CommScope Inc. introduced new antennas to support and accelerate the 5G network rollout. The antennas include a C-band antenna, CBRS antenna, customizable combiners, and more. These new modular antennas are helping in reducing cell-site clutter and simplifying the planning application process.

Thus, the growing demand for 5G technology is expected to surge the demand for these antennas.

RESTRAINING FACTORS

Adverse Health Impacts of RF Radiation to Hamper the Market Growth

The network of the base station is essential for the transmission of wireless connections. The antennas deployed at the base station transmit and receive radio waves as radio frequency from the connected devices to the base station. To establish a wireless connection for communication, these radio waves are very important. As the number of cellular subscriptions is increasing, the number of base station antennas is increasing rapidly.

However, users have growing concerns regarding the negative impacts on antennas’ RF radiation. Various medical research was carried out in the past year to understand the impact of base station RF radiation. Some of these medical researches include epidemiological studies, in-vitro studies, animal studies, and human volunteer studies, among others. These studies reported little adverse evidence of these RF radiations on health. This is expected to hamper the market share.

Base Station Antenna Market Segmentation Analysis

By Type Analysis

Omni Antenna Segment to Dominate owing to its Stable Connections

Based on type, the market is categorized into omni antenna, sector antenna, dipole antenna, multibeam antenna, small cell, and others. Among these, omni antenna segment is expected to dominate the type segment during the forecast period. The Omni Antenna segment is forecast to represent 22.30% of total market share in 2026. These antennas offer uniform 360-degree directional vertical coverage, which helps provide stable connections in congested network areas. Several base station antenna solution providers are focusing on developing omnidirectional antennas for 5G networks to deliver better connectivity across the globe.

Small cell segment is expected to gain considerable traction due to their high wireless network capacity offering in densely connected areas. The exponentially growing demand for mobile networks and indoor applications is likely to drive the demand for small cell antennas. The deployment of these antennas is also growing on account of their high coverage capabilities for indoor and outdoor services.

Similarly, the multibeam antenna segment is gaining steady traction as these antennas offer better network coverage at affordable prices. These antennas cover frequency band ranges from 575 to 960 and 1427 to 2700 MHz with enhanced network capacity. Their better service quality at lower costs is driving the demand for multibeam antennas in 3G/4G LTE.

By Provision/Sector Analysis

Demand for Cellular Connections to Drive the Antenna Adoption in Urban Areas

Based on provision/sector, the market is divided into semi-urban, urban, and rural. Among these, the deployment of base stations is more in urban and semi-urban areas owing to the huge population requiring cellular connections, a growing number of smart projects, and rapid growth in smart infrastructures, among others. In 2026, the Urban segment is projected to lead the market with a 52.56% share.

However, the rural segment is expected to show potential growth opportunities during the forecast period. The adoption of antennas is likely to grow in rural areas, owing to increasing demand for maximum area coverage.

By Technology Analysis

Growing Number of Connected Devices to Boost 5G Demand

Based on technology, the market is classified into 3G, 4G/LTE, and 5G. The 4G/LTE segment is expected to lead throughout the forecast period as 4G offers fast data transmission compared to 3G technology. The 4G/LTE segment is forecast to represent 60.25% of total market share in 2026. 4G technology is expected to dominate the market in the forecast period despite the 5G infrastructure rollouts. According to GSMA’s 2020 report, 52% of global connections are still connected through 4G and are expected to grow to 56% by 2025.

5G technology is expected to show a substantial growth rate during the forecast period owing to the growing demand for higher bandwidth and wider coverage network for handling increasing data traffic. The rapid implementation of 5G technology is expected to boost the demand for more advanced base station antenna. The growing need to connect devices and equipment is likely to drive the market.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Increasing Demand for Network Services to Boost the Mobile Communication

Based on application, the market is segmented into mobile communication, intelligent transport, Industrial Internet of Things (IIoT), smart city, military & defense, and others (precision agriculture, remote monitoring & control).

The mobile communication segment holds larger base station antenna market share and is expected to continue its dominance during the forecast period. The increasing number of network connections is likely to drive the demand for antennas. These antennas offer excellent network coverage to provide better connectivity and user experience. The ongoing projects related to 5G mobile communication technologies are further expected to accelerate the demand for these antennas.

The military & defense segment depends heavily on secure communication and precision connectivity. The increasing demand for antennas for conveying critical field data in challenging environments is expected to drive the adoption of base station antenna in military and defense applications.

Further, the need for these antennas in smart cities for continuous real-time connection between devices and solutions is expected to fuel the growth of the market during the forecast period.

Similarly, intelligent transportation is likely to gain steady growth during the forecast period. The growing demand for a wider connectivity range and capacity in smart transportations, such as connected cars, driver-assisted cars, and smart traffic insights, among others, is likely to surge the demand for base station antenna. These antennas enhance the connectivity and performance of connected vehicles to provide efficient services.

REGIONAL INSIGHTS

The global market scope is classified across five regions, North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Asia Pacific Base Station Antenna Market Size, 2025 (USD billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific dominated the market with a valuation of USD 3.55 billion in 2025 and USD 4 billion in 2026. The increasing intensity of 5G rollouts across countries, such as China, South Korea, and Japan, is expected to drive the base station antenna demand in this region. China is expected to lead the market during the forecast period. As per the Ministry of Industry and Information Technology (MIIT) of China 2020, 5G mobile shipments reached 59.85 million units. India is also expected to gain prominence owing to the rapidly transforming telecom industry and an increasing number of mobile subscribers. Similarly, South Korea is also growing significantly, owing to the increasing focus on 5G infrastructure. The Japan market is projected to reach USD 0.82 billion by 2026, the China market is projected to reach USD 0.9 billion by 2026, and the India market is projected to reach USD 0.72 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Europe

The market in Europe is expected to grow at a maximum growth rate during the forecast period, owing to the expanding mobile network services and infrastructures. The rising investments in 5G infrastructures are likely to boost the market in the region. At present, Nokia, Ericsson, and Huawei are believed to be the most reliable and credible 5G antenna suppliers in Europe. The UK market is projected to reach USD 0.75 billion by 2026, while the Germany market is projected to reach USD 0.89 billion by 2026.

North America

North America is expected to hold the second-largest market share and is predicted to showcase steady growth during the forecast period. The U.S. is expected to gain traction owing to the vast rollout of 5G infrastructures. Also, the U.S. mobile users’ growing interest in live events, super bowl stadium matches, and concerts is driving the demand for efficient antennas for better coverage. The U.S. market is projected to reach USD 2.33 billion by 2026.

Middle East & Africa

The Middle East & Africa is expected to display significant growth during the forecast period, owing to increasing investments in 5G infrastructures. The GCC countries are highly focused on providing 5G mobile services to smartphone users.

South America

South America is also expected to show significant growth owing to increasing internet penetration and mobile users. The rapidly growing subscriber base is driving the demand for efficient antennas.

Key Industry Players

Expansion of Antenna Business through Strategic Acquisitions and Collaborations

The leading players in the market are expanding their antenna product portfolio to gain maximum market share. The vendors are collaborating and acquiring key antenna manufacturers to widen their offerings and gain additional expertise related to the market. For instance, in 2019, CommScope Holding Company, Inc. secured antenna patents from the acquisition of Fractus S.A. Moreover, the company is also launching innovative base station antenna to cater to the rising need for 5G infrastructure.

The other key players, such as Huawei Technologies, Telefonaktiebolaget LM Ericsson, PCTEL, Inc., Amphenol Procom, and Nokia, among others, are making huge investments in developing new advanced antennas to meet the standard requirements needed for 5G infrastructure. The companies are investing in research services to develop innovative technologies. They are also collaborating with local players to expand their businesses globally.

- April 2021 – Baylin Technologies Inc. received approval for its two antennas to deploy 5G macro by a U.S. Tier1 carrier. The 8-port 5G antenna and a 20-port 4G/5G antenna received approval for broad use across North America.

- May 2021 – PCTEL, Inc. acquired Sweden-based company Smarteq Wireless, a developer of external antennas. This acquisition helped the PCTEL to expand in Europe, owing to strong local presence, channel partners, and expertise of Smarteq Wireless.

List of Top Base Station Antenna Companies:

- Radio Innovation Sweden AB (Sweden)

- CommScope Holding Company, Inc. (U.S.)

- Comba Telecom Systems Holdings Ltd. (China)

- Huawei Investment & Holding Co., Ltd. (China)

- PCTEL, Inc. (U.S.)

- Baylin Technologies Inc. (Canada)

- Rosenberger Hochfrequenztechnik GmbH & Co. KG (Germany)

- Nokia Corporation (Finland)

- Amphenol Procom Inc. (U.K.)

- Ace Technologies Corporation (Korea)

KEY INDUSTRY DEVELOPMENTS:

- May 2023 – Ericsson engaged in a partnership with KDDI Corporation, a Japan based telecommunication operator. Through this partnership, Ericsson aims to deploy manhole-shaped 5G base stations and supply sub-terrain antennas.

- March 2023 – Radio Frequency Systems collaborated with Nokia to launch a new antenna platform to support 5G network. The antenna is built in a compact design to 5G base station capabilities.

- October 2022 – Huawei Technologies Co., Ltd. launched its latest antenna solution, which includes the Maxwell platform and X2 antenna series for the evolution of 5G antenna. This new solution would help the company to enhance antenna configuration capability and deploy 5G more efficiently.

- March 2022 – Huawei Technologies Co., Ltd., in partnership with Telenor ASA, launched energy-efficient antennas to help base stations reduce emissions and conserve energy. The base station achieves 15% maximum energy saving through the newly launched antennas.

- June 2021 – NEC Corporation launched a radio unit to support the global 5G expansion. Its massive MIMO-based ultra-multi-element antennas and high-precision beamforming are helping in offering higher speed and high-capacity communication compatible with the 5G frequency band.

REPORT COVERAGE

The research report highlights leading regions across the world to offer a better understanding of the user. Furthermore, the report provides insights into the latest industry and market trends, competition landscape, market dynamics, and analyzes technologies deployed at a rapid pace at the global level. It further highlights some of the growth-stimulating factors and restraints, helping the reader gain in-depth knowledge about the market.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 14.90% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Type

By Provision/Sector

By Technology

By Application

By Region

|

Frequently Asked Questions

The market is value projected to reach USD 44.24 billion by 2034.

In 2026, the market value stood at USD 14.55 billion.

The market is projected to record a CAGR of 14.90% during the forecast period of 2026-2034.

By application, mobile communication is estimated to lead the market.

Growing 5G infrastructure will drive the market growth.

Radio Innovation Sweden AB, CommScope Holding Company, Inc., Comba Telecom Systems Holdings, Ltd., Huawei Investment & Holding Co., Ltd., PCTEL, Inc., Baylin Technologies Inc., Rosenberger Hochfrequenztechnik GmbH & Co. KG, Nokia Corporation, and Amphenol Procom Inc. are the top players in the market.

Asia Pacific dominated the global market with a share of 28.40% in 2025.

Europe is expected to record the highest CAGR.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us