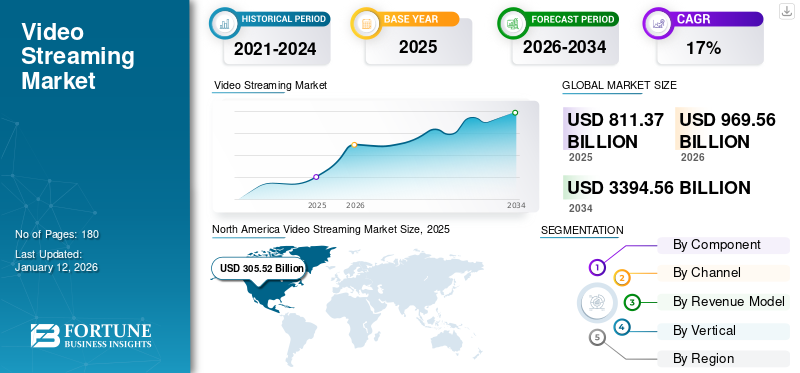

Video Streaming Market Size, Share & Industry Analysis, By Component (Software and Content Delivery Services), By Channel (Satellite TV, Cable TV, Internet Protocol Television (IPTV), and OTT Streaming), By Revenue Model (Subscription-based, Transactional-based, and Advertising-based), By Vertical (Education/E-learning, Healthcare, Government, Sports/eSports, Gaming, Enterprise and Corporate, Auction and Bidding, Fitness & Lifestyle, Music & Entertainment, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global video streaming market size was valued at USD 811.37 billion in 2025. The market is projected to grow from USD 969.56 billion in 2026 to USD 3,394.56 billion by 2034, exhibiting a CAGR of 17.00% during the forecast period. North America dominated the global market with a share of 37.70% in 2025. Additionally, the U.S. video streaming market is predicted to grow significantly, reaching an estimated value of USD 610.59 billion by 2032.

The report includes various software and content delivery platforms offered by players, such as Netflix Inc., Hulu LLC, IBM Corporation, Amazon.com Inc., and others. These companies are offering various streaming channels and platforms, such as HBO Max, Amazon Prime Video, Crackle, Paramount Plus, Disney Plus, Acorn TV, and others.

Increasing popularity of social media platforms and rising internet connectivity have resulted in the growth of the global market. For instance, in May 2021, Meta (Facebook Inc.), a social media platform, had more than 2.40 billion users. Also, social media platforms, such as WhatsApp and YouTube have over 1 billion users each.

In addition to this, increasing video data traffic around the globe owing to a surge in the demand for videos with better resolution has propelled the market growth. Also, players in the market are developing advanced platforms to meet the growing demand across the education sector. For instance,

- In March 2022, Y2k Solutions Inc. launched an advanced Beta 1.0 video streaming platform for educational video courses. The platform offers free streaming solutions & services, video hosting, cloud hosting, and web hosting.

The COVID-19 pandemic had a considerably positive impact on the global market size. This is attributed to the substantial growth in the adoption of live streaming platforms supported by favorable regulations and a decline in in-person visits. The global market observed a humongous growth rate of 5.7% in 2020 compared to 9.8% in 2019. The market’s revenue also increased to USD 297.40 billion in 2020.

IMPACT of GENERATIVE AI

Immersive Experiences For The Users and Subscribers by Integrating AI Jolts The Market Growth

The emergence of Gen AI in the media & entertainment industry is reshaping the market’s landscape. It aims to deliver personalized and immersive experiences to the users and subscribers present across the globe. Generative AI can help revolutionize content with special effects, reduce costs, and improve efficiency. The rising integration of generative AI with streaming platforms and services opens opportunities for content creators to use Gen AI algorithms and attract millions of viewers to deliver a unique user experience.

Streaming services, such as Netflix and YouTube use generative AI to recommend content based on a user's past viewing habits and similarity to others. It also strengthens content providers' control by identifying and removing inappropriate content and protecting users from violent content, hate speech, and false information. Usage of Large Language Models (LLMs), such as GPT-4 in content creation processes helps in developing automated articles, stories, and captions along with video editing and production. It also helps dub audio & video content and enhance the video quality via upscaling, color corrections, and noise reduction to deliver a better visual experience.

Video Streaming Market Trends

Rising Adoption of Low Latency Streaming Protocol Videos to Drive Market Growth

Rising adoption of low latency video streaming platforms and surging use of live streaming apps by consumers through social media platforms will aid the market growth. Also, leading players in the market are developing advanced low latency live video streaming platforms, thereby aiding the global video streaming market growth. For instance,

- In January 2022: THEO Technologies Inc., a video technology company, introduced a live streaming, low-latency platform hesp.live. It is an HTTP-based low latency real-time video streaming platform that disrupts the industry’s standard of multiple seconds and provides the fastest growing live streaming solution. THEO Technologies uses High Efficiency Streaming Protocol (HESP) for live video interactivity at a large scale for various industries, including betting, gaming, auctioning, sports, and live events.

The platform helps mobile users with low latency streaming for real time broadcasting of streaming events, such as online courses, sports games, game streaming, and e-commerce platforms.

Currently, the video streaming industry is showing interest in low-latency video streaming protocols as it is focusing on delivering video content with a 5-second delay as compared to live broadcast on TV systems. Achieving low latency is crucial for streaming live sports, online learning courses, gaming, and other interactive video applications. As the demand for real-time applications and AR/VR content increases, there will be a challenge for service providers to meet such demands through the latest innovations and quick adoption of changing user preferences.

Download Free sample to learn more about this report.

Video Streaming Market Growth Factors

Increasing Demand for Video on Demand (VoD) Streaming Services to Aid Market Growth

The rising number of video on demand service users around the globe owing to surging consumer spending on media and entertainment will aid the market growth.

According to a Motion Picture Association report, in 2021, online video subscriptions from streaming service providers, such as Netflix Inc. and Disney+ increased by 14%, reaching around 1.3 billion new subscriptions compared to 2020. Such an increase in subscribers of the OTT platforms has created a massive demand for the product.

The Video-on-Demand (VoD) sector is booming since the last decade and will continue to hold the largest share of the global OTT revenue during the forecast period. This is because a majority of VoD subscribers plan to renew their services and the trend among subscribers who are ‘likely to keep’ their subscription states the latest lean toward mid-tier platforms. However, VoD service providers are required to work on smart and data-related strategies to keep their current customers engaged.

RESTRAINING FACTORS

Rising Concerns Related to Content Piracy and Protection to Hinder Market Expansion

Rising concerns among users related to content piracy and protection are expected to hinder corporate operations, reducing consumers' viewing of content. This is projected to negatively impact market growth in the following years. For instance,

- According to MUSO.Com, visits to pirated sites increased by more than 20% in the first half of 2022. MUSO stated that subscription services of pirated sites are worth billions of dollars in the U.S. alone.

Video Streaming Market Segmentation Analysis

By Component Analysis

Content Delivery Services Holds Largest Market Share Due to Increased Spending on OTT Platform

Based on component, the market is divided into software and content delivery services. Under the software segment, transcoding & processing, video delivery & distribution, video management, and others are included.

The content delivery services segment is expected to hold the largest part in the video streaming market with a share of 66.04% in 2026. The rising adoption of content delivery OTT platforms among consumers and increasing consumer spending on entertainment will aid the segment’s growth. The content delivery services scope includes live broadcasting, VOD & complementary content accounting for 31.16% market share in 2026, and low latency streaming services.

The software segment is growing at a moderate pace owing to a surge in the development of advanced streaming platforms by leading market players. For instance,

- In September 2021, Amazon.com, Inc. introduced aggregating video and live streaming software, which consists of eight local and global streaming services in India.

By Channel Analysis

OTT Streaming Channel to Record Highest CAGR Due to Rising Number of OTT Users

By channel, the market is divided into satellite TV, cable TV, IPTV, and OTT streaming.

The OTT streaming segment is expected to record the highest CAGR during the forecast period owing to surge in OTT platform adoption in developing countries, such as India, Brazil, and others. According to the industry experts, in 2021, India had around 70 to 80 million paid users of the OTT platforms. Such increase in OTT users is expected to drive the OTT streaming segment.

The cable TV segment held the largest market with a share of 37.86% in 2026, owing to a surge in its adoption by households across the globe.

By Revenue Model Analysis

Subscription-based Revenue Model to Record Highest CAGR Due to Growth of On-Demand Content by Subscribers

Based on revenue model, the market is segregated into subscription-based, transactional-based, and advertising-based models.

The subscription-based revenue model segment held the largest video streaming market share in 2024 and will record the highest growth rate due to the increasing number of services and presence of subsequent subscribers across the globe.

Rising usage of streaming services, such as Netflix, Disney+, and Spotify to gain on-demand access on a monthly or annual subscription basis to a wide variety of TV shows, movies, and music for entertainment purposes will fuel the growth of the segment during the forecast period. These platforms offer greater flexibility to users with unlimited access to a wide library of content.

Furthermore, the demand for an advertising-based revenue model grows with moderate CAGR as it offers a wide variety of content to users without paying a subscription fee but with advertisements.

By Vertical Analysis

To know how our report can help streamline your business, Speak to Analyst

Sports/Esports Segment Held Largest Share Due to Rising Sports Audience

On the basis of vertical, the market is segregated into education/e-learning, healthcare, government, sports/esports, gaming, enterprise & corporate, auction & bidding, fitness & lifestyle, music & entertainment, and others (transportation).

The sports/esports segment held the largest market share in 2024 owing to surge in the volume of esports platform users.

The healthcare segment is expected to record a significant CAGR owing to surge in the use of live streaming platforms for online consulting of patients during the pandemic.

REGIONAL INSIGHTS

Geographically, the market is fragmented into five prime regions, such as North America, Europe, Asia Pacific, South America, and the Middle East & Africa. They are further classified into countries.

North America

North America Video Streaming Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated by capturing around 40% of the global market share in 2024. North America dominated the global market in 2025, with a market size of USD 305.52 billion, owing to the presence of leading players, such as Netflix, Inc., Alphabet Inc., Amazon.com, Inc., Microsoft Corporation, and others. Furthermore, the increasing number of users of video-on-demand and video gaming platforms across the U.S. and Canada will aid the regional market growth. The U.S. market is projected to reach USD 255.66 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

Asia Pacific is expected to record a remarkable CAGR during the forecast period. This is owing to the rising adoption of several video streaming solutions, such as video-on-demand and OTT platforms among consumers. Also, leading players in Asia Pacific, such as Disney+ Hotstar, Tencent Holdings Ltd., and others are developing streaming software and expanding their services. The Japan market is projected to reach USD 35.54 billion by 2026, the China market is projected to reach USD 52.28 billion by 2026, and the India market is projected to reach USD 74.37 billion by 2026.

Europe

Furthermore, Europe is growing moderately owing to the rising demand for online live streaming videos and surge in the adoption of on-demand videos among consumers. Several players in European countries, such as Netflix Inc., Hulu LLC, and Disney Plus, are seeing an increase in the number of OTT subscribers. The UK market is projected to reach USD 48.87 billion by 2026, and the Germany market is projected to reach USD 62.87 billion by 2026.

Middle East & Africa and South America

The Middle East & Africa market is expected to exhibit a significant CAGR during the forecast period. The UAE, GCC, South Africa, and others are gaining popularity due to the growing use of online streaming platforms.

South America is growing at a moderate pace owing to the rising adoption and penetration of mobile internet in Argentina, Brazil, and other countries. According to a World Bank report, approximately 73.9% of the internet penetration in Brazil leads to a surge in online streaming spending.

Key Industry Players

Key Players are Focused On Strengthening their Market Position with Continuous Developments

The key players in the market are investing in advanced technologies for streaming services owing to increase in the adoption of streaming platforms. Also, prominent market players, such as Akamai Technologies, The Walt Disney Company, Netflix, Inc., Wowza Media Systems LLC, and others are adopting various business strategies, such as mergers, acquisitions, and others to expand their market presence.

List of Top Video Streaming Companies:

- IBM Corporation (U.S.)

- Alphabet Inc., (U.S.)

- Amazon.com, Inc. (U.S.)

- Netflix, Inc., (U.S.)

- Hulu LLC (The Walt Disney Company) (U.S.)

- Brightcove, Inc. (U.S.)

- Apple, Inc. (U.S.)

- Roku, Inc. (U.S.)

- Haivision, Inc. (U.S.)

- Tencent Holdings Ltd. (China)

KEY INDUSTRY DEVELOPMENTS:

- April 2024: Maybacks Global Entertainment entered a partnership with WiseDV, a streaming and broadcast technology provider, and launched iDreamCTV, a cutting-edge OTT platform to deliver a customized streaming experience to users present across the globe.

- January 2023: Haivision launched Haivision Hub, a FedRAMP video network service for governments, which allows different government agencies to share live stream videos among other government teams. The service aims to fulfil federal information assurance requirements.

- January 2022: IBM Corporation launched an advanced IBM streaming mobile application that enhances workplace communications globally. The mobile application was made available on the Apple Store and Play Store. IBM’s video streaming application allows users to broadcast and live stream videos. The company’s streaming enterprise-ready broadcasting tool offers businesses enriched security and impeccable features.

- January 2022: Walt Disney Company's streaming service, Disney+, announced that it will launch its operations in 42 countries, such as South Africa, Turkey, Poland, and the U.A.E. and 11 additional territories, including the Faroe Islands. This expansion will allow members to watch Pixar, Marvel, Star Wars, Disney, National Geographic, and other Star content.

- September 2021: Roku introduced a 4K streaming stick that offers faster user experience and access through Wi-Fi. The advanced streaming device, named Roku Streaming Stick 4K, was made available in two different versions. The two models featured HDMI port, TV support, and Dolby Vision.

REPORT COVERAGE

The research report highlights the leading regions to offer the user a better understanding of the market. Furthermore, it provides insights into the latest industry trends, market research, competitive landscape, and market growth trends, and analyzes technologies deployed at a rapid pace at the global level. It further highlights some of the driving factors and restraints, helping the reader gain in-depth knowledge about the market.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 17.00% from 2026 to 2034 |

|

Segmentation |

By Component

By Channel

By Revenue Model

By Vertical

By Region

|

Frequently Asked Questions

The market is projected to reach a valuation of USD 3,394.56 billion by 2034.

In 2025, the market was valued at USD 811.37 billion.

The market is projected to record a CAGR of 17.00% over the forecast period.

The content delivery services segment held a largest market share in 2025.

North America captured the largest market share in 2025.

Asia Pacific is expected to grow with a remarkable CAGR.

Akamai Technologies, the Walt Disney Company, Netflix, Inc., Wowza Media Systems Llc, Brightcove, Inc., and Apple, Inc. are major players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us