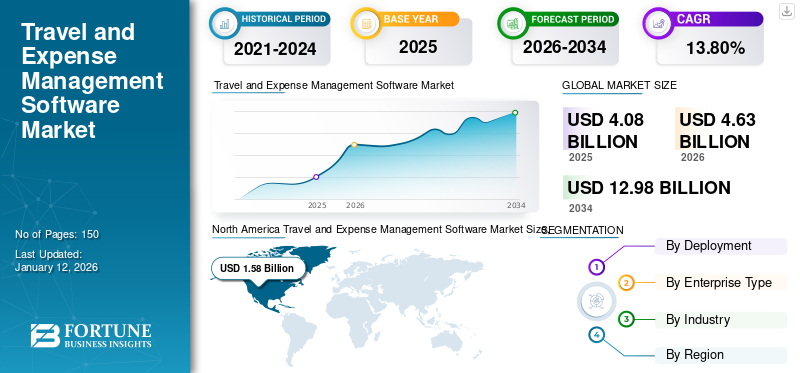

Travel and Expense Management Software Market Size, Share & Industry Analysis, By Deployment (Cloud and On-premises), By Enterprise Type (Large Enterprise and Small & Medium Enterprise), By Industry (BFSI, Healthcare, IT & Telecom, Education, Manufacturing, Retail and E-Commerce, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global travel and expense management software market was valued at USD 4.08 billion in 2025. The market is projected to grow from USD 4.63 billion in 2026 and reach USD 12.98 billion by 2034, exhibiting a CAGR of 13.80%% during the forecast period. North America dominated the global travel and expense management software market with a share of 38.90% in 2025.

Travel and expense management software solutions are developed to automate and manage travel and expense-related processes that are sold, purchased, and used by businesses and organizations. This market includes the development, sale, and implementation of software solutions tailored to the needs of managing travel, tracking expenses, and optimizing related financial processes. The major components of the market include buyers and users, software providers, integration partners, consulting, and implementation services.

Key factors such as the rising penetration of mobile devices, increasing demand for lower operating costs and expenses, and the surging need for hassle-free reimbursement are key factors driving the growth of this market. Further, the rapid growth of travel technology companies presents growth opportunities that drive market growth. However, the lack of skilled labor may hamper industry expansion.

The COVID-19 pandemic fundamentally impacted numerous supply chain networks and business travels. Amid the pandemic, numerous key industries were progressively adopting new norms, such as working from home, which increased the usage of e-commerce, online streaming services, and cloud provision, among others. Business travel was a major issue initially due to stringent regulations and the early phase of work-from-home adoption. This negatively impacted the deployment and utilization of TEM software, which slightly declined the growth of the market.

Travel and Expense Management Software Market Trends

Application of Artificial Intelligence (AI) and Machine Learning in Corporate Travel is Driving the Market Growth

The adoption of AI and machine learning in travel and expense management software aids in improving employees' corporate travel experience by customizing trips, efficient transportation, expense tracking, and language translation, among other operations. Machine learning lessens the pressure on travellers regarding safety and privacy by analyzing traveller data such as personal details, credit card details, company information, and itineraries and ensures the data is accurate.

Machine learning reduces the time and cost of data management analytics, allowing travel managers to focus on executing the actions verified by travel and expenditure data while providing and handling the data in the background. The implementation allows the commuters to understand the transaction details, inform about provider negotiation, and influence the traveller’s behaviour. For instance,

- TrackEx aims to simplify the business travel experience utilizing AI and machine learning technology, allowing businesses in various industry segments to manage travel-related reimbursement and reporting quickly. With AI and machine learning, TrackEx supports optical character recognition and automates mileage tracking for business travels and immediate expenditure reporting with Quickbooks.

Thus, enterprises that support and encourage a flexible routine by arranging a corporate travel management platform that allows employees to book and account for individual tours drive the TEM software market.

Download Free sample to learn more about this report.

Travel and Expense Management Software Market Growth Factors

Need for Trouble-free Dues and Reimbursements is Increasing the Demand for Travel and Expense Management Software

Business travel expenses are one of the highest costs for any enterprise and, thus, are a crucial segment to manage. Every enterprise wants an organized expense tracking system and reimbursement process that manages and controls travel expenses while handling the expenditure away from employees and the finance managers. Employees can book tickets in the same place with one booking platform or software application, eliminating the chaos of collecting receipts and chasing emails. With the assistance of travel and expense management software, enterprises can control travel spending before it occurs by displaying policy-compliant, curated choices for hotels and airlines. They can construct complex policy streams on such platforms instead of implementing fixed charges.

Furthermore, as the industries are expecting efficiency and consolidation between several software platforms, the enterprise service providers are promptly deploying integrated software applications to cater to the industry demands. These integrations include common software services such as workforce management, human capital management, supply chain management, and enterprise resource planning.

A combined TEM software solution aids transparency on travel spending data that assists cost leakages such as exception allowance, out-of-policy expenditure, and others. For instance,

- SAP Concur is a TEM software provider with secondary features such as on-travel and booking assistance. The company assists in creating TEM solutions by integrating its product offering, consisting of Concur Travel (self-reservation for employees), Concur Expense (policy setting, receipt capturing, and reimbursement), Concur Invoice (vendor payments), and Concur Detect (policy compliance and fraud detection).

Thus, such factors positively impact the industries and propel the TEM software market growth.

RESTRAINING FACTORS

The Increasing Rate of Cybercrimes Puts Data Confidentiality and Security of Transactions in Danger

Travel and expense management software contains data such as employee name, mail-id, business credit card details, business-related actions, transaction details, and other financial histories. Thus, it becomes a crucial concern for businesses, as enterprises tend to be more careful when selecting a travel and expense management software solution.

According to the Global Business Travel Association and Air Plus International report, 68% of business travellers are affected by a third-party payment data breach. Most data breaches for privacy and payment happen from third-party vendors such as hotel booking, airline fares, or other retailers.

Numerous travel departments and providers are utilizing multiple payment security applications. These applications include security regulations such as setting payment security policies, educating travellers about security policies, evaluating data security standards, and responding to online fraud loss. Enterprises integrate data security standards through official portals, seminars, or newsletters but rarely update them. Thus, it becomes very difficult to achieve complete security over the platforms. According to GBTA and Air Plus international reports, over 62% of organizations provide data security guidelines, but they should also communicate them more proactively via emails or booking platforms to avoid fraud.

The impact of such factors is limiting the adoption of travel and expense management software in the market.

Travel and Expense Management Software Market Segmentation Analysis

By Deployment Analysis

Remote Access and Virtual Booking to Fuel Cloud Demand

By deployment, the market is divided into on-premise and cloud. Cloud-based deployment controls greater market share of 65.02% in 2026, and as per our findings, it is to expand at the highest CAGR during the forecast period. Cloud-based deployment enables remote access and virtual bookings that contribute to improving the service. The enterprises are integrating TEM software with other essential solutions, such as Enterprise Resource Planning (ERP) software and Human Capital Management (HCM), among others, along with interface customizations. This aids in improving customer engagement and clientele demands.

On-premise deployment improves the functionality of TEM software by improving scalability and providing access without an internet connection while lowering periodically billed internet costs. However, due to convenience and features, several enterprises are moving toward cloud implementation and deploying TEM software via cloud vendors.

By Enterprise Type Analysis

Global Surge of Adoption Rate in SMEs owing to Economical Pricing and Convenience

Based on enterprise type, the market is classified into large enterprises and Small & Medium Enterprise (SME).

Our findings suggest SMEs should exhibit marginally higher share of 61.56% in 2026, accounting for higher CAGR as compared to large enterprises. The rising trend of digital transformation and affordable pricing structure of the software resulted in the utilization of TEM software in SMEs. This aided the enterprise in reducing manual travel and business expense reimbursements while saving the workforce for other, more efficient tasks. These types of enterprises focus on reducing extra expenditure and increasing use-case based implementation, which involves business travel and expense management. This highlights the factors that impact the adoption of TEM software in SMEs.

Large enterprise segment to gain gradual CAGR owing to the priority toward employee’s travel experience and investments in bleisure adoption. These enterprises are fixated on maintaining the integrity and deploying applications at a larger scale compared to SMEs. Thus, the rapid adoption of TEM software and an increasing number of start-ups & medium-scale enterprises are fueling the growth of the market.

By Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Constant Requirement of Corporate Cards to Fuel Software Adoption in the BFSI Industry

Based on industry, the market is sectioned into BFSI, education, healthcare, IT & telecom, manufacturing, retail and e-commerce, and others.

The BFSI segment is expected to stay dominant in terms of market share during the estimated time frame. Employees in the BFSI industry primarily travel for project handling, client project meetings, and for site visits. These factors, including the deployment of integrated corporate cards, further improve the consumer experience and lead the industry toward the adoption of TEM software.

The IT & telecom segment accumulates the major market share of 21.17% in 2026 and is proposed to remain stagnant in terms of growth during the forecast period. The industry improves its business growth by participating in numerous live events and physical meetings for product launches and endorsements. These factors influence the industry to implement TEM software with increasing business travel.

According to Deloitte, 43% of enterprises initiate business travel for leadership meetings and client project work. Also, 71% of enterprises believe in recovering the travel expenditure by the end of 2023 to the pre-pandemic levels.

The healthcare segment is projected to showcase a significant growth rate during the forecast period. With the increasing number of medical professionals using the travel platform, the industry is showing interest in the adoption of T&E management software.

REGIONAL INSIGHTS

In our research, we have reviewed the market in terms of geography into five regions, including North America, South America, Europe, the Middle East & Africa, and Asia Pacific. These regions are further categorized into several dominating countries.

North America Travel and Expense Management Software Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated dominated the market with a valuation of USD 1.58 billion in 2025 and USD 1.77 billion in 2026. The U.S., among other countries, recovered up to 27% in 2021 in the post-pandemic period. Business travel increased in the U.S. by the end of 2021 due to the vast availability of vaccines throughout the country. According to Deloitte, 34% of corporate travel managers were anticipating reaching half of 2019 standards of business travel expenditure, although only 8% were able to accomplish it. The U.S. market is projected to reach USD 1.1 billion by 2026.

Numerous enterprises also set up business strategies concerning business expenditures, such as strategic mergers, acquisitions, and advancements, toward product launch and innovation. It further fueled the demand for TEM software. For instance,

- In February 2022, Coupa Software launched the Coupa Travel and Expense solution, which contains software integration to other Coupa offerings such as treasury management, invoice, and supply chain design. Additionally, the company also offered integrations to common third-party ERP and workforce management providers such as SAP and Oracle to meet client requirements.

To know how our report can help streamline your business, Speak to Analyst

Europe

Europe holds the second largest market share due to growing opportunities for business travel in the region. Furthermore, it is suggested that a healthy growth rate is showcased throughout the forecast period. The industries in the region are innovating in IT and telecom, as well as retail and e-commerce, to expand their product portfolio and implement emerging technologies. For instance, in December 2021, TripActions launched LIQUID in Europe, which provided all-in-one travel and expense management with corporate card integration. This provided geographical expansion and aided in business growth. The UK market is projected to reach USD 0.29 billion by 2026, and the Germany market is projected to reach USD 0.31 billion by 2026.

Asia Pacific

The Asia Pacific region is projected to demonstrate the highest CAGR of the region-wise forecast period due to increased cloud adoption, resulting in digital transformation. India, followed by China, is to gain the most market share during the forecast period. According to the Indian National Investment Promotion and Facilitation Agency, India is projected to be among the top 5 on the global scale of the business travel market. The Japan market is projected to reach USD 0.11 billion by 2026, the China market is projected to reach USD 0.21 billion by 2026, and the India market is projected to reach USD 0.19 billion by 2026.

South America

South America is to display a steady CAGR during the forecast period. The deployment of 5G infrastructure, superior network connection, and preferable travel experiences are expected to surge the demand for travel and expense management software platforms.

Middle East & Africa

The Middle East & Africa region is expected to increase opportunities and facilities for the travel and tourism industry, which will improve the growth of the business travel market. Additionally, GCC and South Africa are focusing on the implementation of advanced technologies, which is expected to fuel further the travel and expense management software market growth in the region.

Key Industry Players

Strong Design Customizations and Growing Emphasis on Multiple Integration to Lead the Market

The key players are deploying custom interface applications based on emerging technologies such as AI, cloud, and machine learning to merge industrial trends and cater to specific demands. To boost the product portfolio, these players are investing in strategic collaboration and mergers to implement third-party technologies and increase consumer engagement. Innovating their existing portfolio and inventing new products with emerging technologies to expand their market growth are two of the key business strategies enterprises use. The key players are also acquiring and partnering with distinct industry sectors across the globe to expand their market and discover further geographical markets.

List of Top Travel and Expense Management Software Companies:

- SAP Concur. (U.S.)

- Workday Inc. (Sweden)

- Coupa Software Inc. (U.S.)

- Basware Corporation (Finland)

- Expensify Inc. (U.S.)

- DATABASICS Inc. (U.S.)

- TripActions Inc. (U.S.)

- Infor Inc. (U.S.)

- Emburse Inc. (U.S.)

- Zoho Corporation Pvt. Ltd. (India)

KEY INDUSTRY DEVELOPMENTS:

- February 2024 – Marqeta and Internet Travel Solutions partnered on a commercial T&E credit card for the mid-market market. EasyCard corporate card program solutions enable companies to meet the various payment service needs of their employees across all roles and functions.

- August 2023 – HotelPlanner, a travel technology platform and hotel booking engine, announced the acquisition of Lucid Travel. This travel management software company serves sports teams, universities, and event managers. These are HotelPlanner's core business segments and growth areas and both companies share extensive expertise and operational synergies.

- October 2022 – TripActions partnered with Global Glimpse, which is a non-profit organization that supports younger-generation students by improving the travel experience, service learning, cultural immersion, and leadership. They also provided scholarship funds by recycling monitors and laptops.

- October 2022 – Infor Inc. expanded its infrastructure facilities in India by opening a research and development centre in Hyderabad. This facility has 3,700 employees and encompasses digital technologies such as data analytics, data structuration, artificial intelligence, and cloud IoT to provide features and functions for client organizations. This expansion also expanded their footprint and business options in the Asia Pacific region.

- September 2022 – Workday launched a receipt scanning feature to their Workday Mobile Suite, which introduced new features such as automating scans of transaction dates, vendor/merchant information, and transaction amounts. This feature used OCR technology, which enabled the use of multiple information gathering from scanned or captured documents for organizations.

REPORT COVERAGE

Our study on the market provides prime insights on global leading regions to improve business decisions and judgment, considering the market. Additionally, the report provides key insights into the recent developments of the market trends and industry, as well as a thorough review of emerging technologies that are being adopted worldwide. It also emphasizes the major growth-stimulating factors and elements, which allows the reader to obtain an in-depth perception of the market.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 13.80% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Deployment

By Enterprise Type

By Industry

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global market is projected to reach USD 12.98 billion by 2034.

In 2025, the market size stood at USD 4.08 billion.

The market is projected to grow at a CAGR of 13.80% over the forecast period (2026-2034).

By deployment, the cloud segment is likely to lead the market.

Demand for trouble-free invoice management and reimbursements to boost sales in the market.

Concur Technologies Inc., Coupa Software Inc., Emburse Inc., Expensify Inc., Zoho Corporation Pvt. Ltd., and TripActions Inc. are the top players in the market.

North America dominated the global travel and expense management software market with a share of 38.90% in 2025.

By industry, the BFSI segment is expected to grow with the highest CAGR.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us