Business Spend Management (BSM) Software Market Size, Share & Industry Analysis, By Solution (Procure-to-Pay Solutions, Supplier & Risk Management, Travel & Expense Management, Contract & e-Tender Management, Spend Management/Spend Analytics, and Others (Source-To-Contract, Treasury Management)), By Deployment (Cloud and On-premise), By Enterprise Type (SMEs and Large Enterprises), By End-user (BFSI, Travel & Tourism, Hospitality, Healthcare, IT & Telecom, Energy & Utility, Retail & E-Commerce, and Others (Logistics and Education)), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

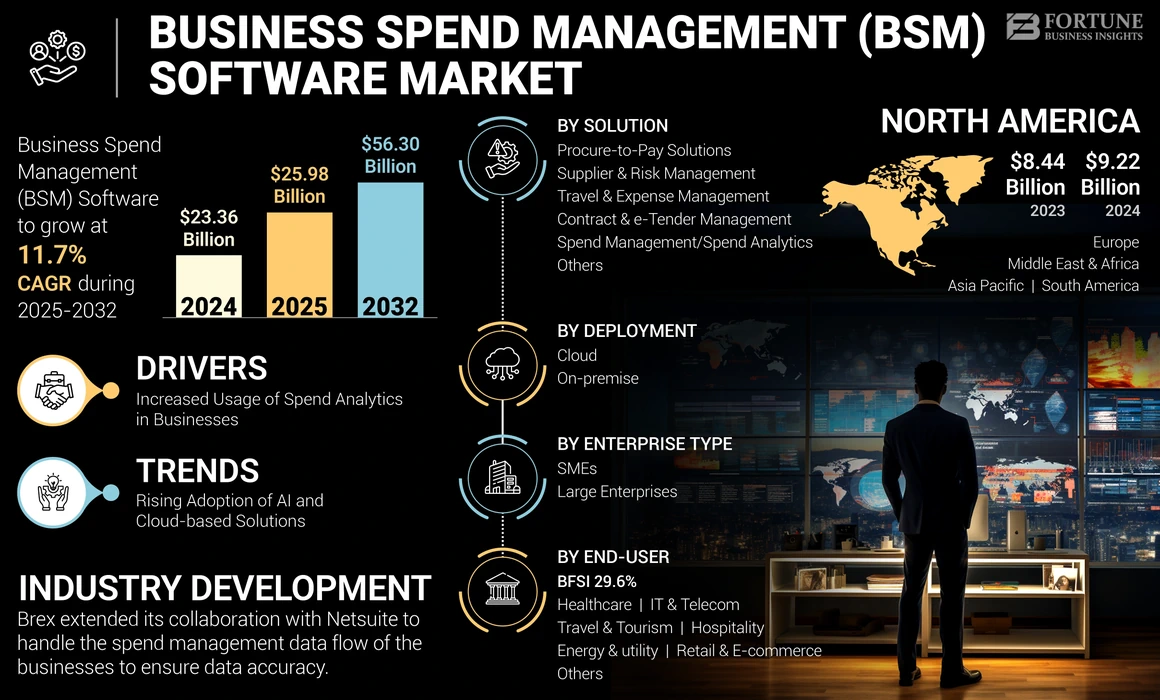

The global business spend management (BSM) software market size was valued at USD 23.36 billion in 2024. The market is projected to grow from USD 25.98 billion in 2025 to USD 56.30 billion by 2032, exhibiting a CAGR of 11.7% during the forecast period. North America dominated the global market with a share of 39.47% in 2024.

Business spend management (BSM) software collects, collates, maintains, categorizes, and evaluates spending data to minimize procurement costs, control and monitor workflows, regulate compliance, and improve efficiency. The solutions considered in the scope include procure-to-pay solutions, supplier & risk management, travel & expense management, contract & e-tender management, spend management/spend analytics, and others (source-to-contract, treasury management). The BSM software helps organizations to provide a broad view of a company’s spending in real time to make accurate, informed decisions with greater visibility.

Business Spend Management Software Market Overview

Market Size:

- 2024 Value: USD 23.36 billion

- 2025 Value: USD 25.98 billion

- 2032 Forecast Value: USD 56.30 billion

- CAGR (2025–2032): 11.7%

Market Share:

- Regional Leader: North America dominated the market with a 39.47% share in 2024

- Fastest-Growing Region: Asia Pacific is expected to show the highest growth rate during the forecast period, supported by digital transformation and increasing internet users.

Industry Trends:

- Increasing adoption of cloud-based BSM solutions for enhanced scalability and flexibility.

- Growing integration of AI and automation for smarter spend analysis and management.

- Expansion of BSM functionalities covering procure-to-pay, supplier risk management, travel & expense, and contract management.

- Rising demand for mobile-optimized and user-friendly platforms.

Driving Factors:

- Need for greater spend visibility and transparency to improve financial decision-making.

- Demand for cost control and operational efficiency across enterprises.

- Regulatory compliance requirements prompting adoption of structured spend management tools.

- Accelerating digital transformation initiatives in organizations globally.

In the study, we have considered various BSM software offered by the market players, such as SAP SE’s SAP ARIBA, SAP Concur, SAP Fieldglass, and Coupa Software Inc.’s suite of comprehensive business spend management platforms. In addition, our study also covered GEP’s GEP SMART, GEP NEXXE, and Proactis Holdings Limited’s purchase-to-pay system and source-to-contract system.

The COVID-19 pandemic had a moderate influence on the BSM software market, resulting in an increase in spend management concerns and risk of loss. This trend is predicted to continue in the second half of the year, as demand rises and companies are concerned about effectively managing their spending. The pandemic had a moderate impact on the U.K. market.

- For instance, according to the Bank of England, sales in the U.K. dropped by 30% during the second quarter of 2020, while, at the same time, employment dropped by 5% and investment by 33%.

Post-COVID-19 pandemic, the need for solutions and services was higher than assumed in 2021, which reflected a strong business performance that is expected to propel revenue growth.

Business Spend Management (BSM) Software Market Trends

Rising Adoption of AI and Cloud-based Solutions to Propel Market Growth

The velocity of change in spend management of businesses has been astounding as the adoption of technologies, such as Artificial Intelligence (AI), cloud, Machine Learning (ML), Robotic Process Automation (RPA), and the Internet of Things (IoT), continues to surge in the businesses. For instance,

- Coupa AI Spend Categorization uses Machine Learning and Artificial Intelligence to standardize, classify, and augment spend across ERP systems, eliminating manual classification labor.

Companies use the capabilities of a digital platform to develop flexible procurement procedures that will meet future demands. SAP Analytics Cloud provides enterprises with overall spend visibility across departments, spend categories, and suppliers to provide real-time spend insights. For instance,

- SAP Business Technology Platform (SAP BTP) and SAP procurement solutions assist employees by providing easy, rapid, and unified procurement procedures, total expenditure visibility and supplier monitoring.

By managing the business spend, automation has clearly emerged as a crucial enabler for enhancing productivity and achieving critical business goals while lowering effort and expenses associated with manual and repetitive procedures. As a result, the most accessible parts of automation, such as AI, cloud, and RPA analytics tools, have led the adoption push.

Artificial Intelligence (AI), as a more complicated concept, is likely to achieve roughly half the adoption rates for digital spending initiatives in the coming years, with greater industry awareness.

Thus, the aforementioned factors are expected to be a trend in the forecast period.

Download Free sample to learn more about this report.

Business Spend Management (BSM) Software Market Growth Factors

Increased Usage of Spend Analytics in Businesses to Propel Market Growth

Spend management is an umbrella term used to refer to the process of requesting and approving spend, capturing transaction details, making payments, booking, tracking, and analyzing business expenditures. Currently, businesses are becoming more data-driven in the way they handle their finances, particularly when it comes to their spending. According to a research study, the demand for big data and business analytics solutions will reach USD 274.3 billion by the end of 2022.

Spend analytics software helps gather, process, organize, and analyze procurement data to make data-driven decisions. It significantly provides a way to reduce cost, enhance purchase efficiency, and manage the supply chain risks to optimize the procurement spending process.

Organizations are improving their supply chain management by utilizing spend analysis tools. It provides real-time information and visibility into product lines, service offers, and supplier relationships. As a result, more control over various processes in the supply chain is gained. Spend analytics provides a clearer picture of the supply chain's sourcing, contracting, and purchasing operations. This enables refocusing on resources to address bottlenecks in present initiatives. Companies are developing new tools to help them manage their spending. For instance,

- IBM Travel Manager, in collaboration with Travelpor, developed an AI-based tool for managing business travel spend. This cloud-based solution makes use of IBM Watson to manage, track, analyze, and predict travel costs all in one place. This assists businesses in optimizing their travel programs. This new platform has assisted the organization in increasing its business spend management software market share.

RESTRAINING FACTORS

Lack of Technical Skills to Inhibit Market Growth

Procurement teams in businesses are swamped with normal purchasing tasks, supplier management, purchasing order processing, and so on. Expenditure management, on the other hand, necessitates committed efforts to define, collate, assess, and execute spending opportunities for data savings on a regular basis.

According to Ivalua, a prominent provider of spend management cloud solutions, the majority of U.K. organizations (86%) encounter considerable impediments to building digital procurement skills. According to the research, one of the primary challenges restricting the U.K. businesses from acquiring the digital skills they want is a paucity of digitally savvy individuals (31%), lack of knowledge of the abilities required (13%), and lack of training for technical and soft skills (28%). Furthermore, more than half (55%) of the U.K. businesses believe that digital skills in procurement are less advanced than in other departments.

When a business person does not have a thorough understanding of the company's spending, it is difficult to assess it or develop a strategy for managing it. Unfortunately, a prevalent issue is the lack of real-time visibility. This is especially true for growth-stage firms with large capital expenditures (CAPEX), limited or nonexistent finance staff, and a lack of specific systems to handle spending and budgeting.

These problems also contribute to disorganized financial records and insufficient spend data. Thus, the aforementioned factors are expected to hamper business spend management (BSM) software growth.

Business Spend Management (BSM) Software Market Segmentation Analysis

By Solution Analysis

Integration of Advanced Technologies Expected to Create Demand for Spend Management Solutions

By solution, the market is classified into procure-to-pay solutions, supplier & risk management, travel & expense management, contract & e-tender management, spend management/spend analytics, and others (source-to-contract, treasury management). Increasing demand for spend management solutions such as spend analytics, travel & expense management, and others is driving the demand for spend management solutions.

The BSM software players are focusing on product enhancement and integration of cutting-edge technologies across the solutions to increase the customer base and demand for solutions. The spend management software helps to focus on data security and privacy of the accounting operations by doing real-time reporting and data analysis. Due to this factor, the demand for spend management/spend analytics software is projected to grow with the highest CAGR during the forecast period. For instance,

- In March 2022, Xeeva launched Spend Analytics with additional intelligent opportunities. Through this new release of the XVA platform, it enables customers to evaluate savings and sourcing through the improved user interface.

Furthermore, procure-to-pay (P2P) solutions held the largest market share in 2023. This is due to the growing usage of (P2P) solutions for automating the entire procurement process, which includes contract management, inventory management, and invoice management to analyze the organization's performance.

By Deployment Analysis

Cloud-based Deployment to Grow with Higher Growth Trajectory Due to Increasing Adoption Of Cloud Technology

By deployment, the market is divided into on-premise and cloud.

Cloud-based business spend management software deployment is expected to surge during the forecast period. On-premise deployments are anticipated to showcase steady growth in the coming years due to the increasing adoption of cloud technology by small & medium-sized enterprises. The growing adoption of cloud-based software across organizations due to the COVID-19 pandemic will drive business spend management software market growth in the coming years. For instance,

- In June 2021, Kissflow, a SaaS company, launched a cloud-based procure-to-pay solution, Kissflow Procurement Cloud. The platform enables organizations to unify functionalities for inventory management, AP automation, eProcurement, expense management, supplier portal, punchout catalogues, supplier management, and custom integrations across one platform.

By Enterprise Type Analysis

Large Enterprises to Lead Due to Demand For Advanced Spend Management Solutions

By enterprise type, the market is segmented into small and medium enterprises and large enterprises. The SME segment is expected to grow with remarkable CAGR owing to growing investment and funding led by leading organizations. For instance,

- In April 2022, India-based spend management startup Enkash raised USD 20 million in funding. The company aims to utilize this funding to expand its business presence and product offerings.

- The large enterprises segment held the major market share in 2021 due to the demand for advanced spend management solutions to manage business spending, including procurement, travel & expense, contracts, and spending.

By End-user Analysis

To know how our report can help streamline your business, Speak to Analyst

Adoption of Spend Management Solutions in the BFSI Industry to Fuel the Market Growth

By end-user, the market is classified into BFSI, travel & tourism, hospitality, healthcare, IT & telecom, energy & utility, retail & e-commerce, and others.

The BFSI segment is expected to hold a major market share during the projected period. The adoption of spend management solutions is majorly found across banking and financial institutions.

The growing partnerships and adoption of spend management platforms across banks and financial institutions will enhance the BSM software market size.

Similarly, the healthcare sector is expected to create new opportunities for market growth owing to increased demand for supply chain risk management solutions during the COVID-19 pandemic.

REGIONAL INSIGHTS

Geographically, the market is divided into five major regions: North America, South America, Europe, the Middle East & Africa, and Asia Pacific.

North America Business Spend Management (BSM) Software Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America holds the major market share owing to the presence of prominent market players, including Coupa Software Inc., Ivalua Inc., Zycus, Jaggear, Xeeva, GEP, and others. Key market players in the region are focusing on partnerships, collaborations, mergers, and acquisitions, which are expected to fuel the business demand for spend management solutions and services across North America in the coming years.

- In January 2021, Ivalua partnered with Parkland Corporation to deploy a source-to-pay suite. Through this partnership, the solution will enable accurate and rapid purchase processing. Similarly, Ivalua will help to transform the procurement process of Parkland.

The Canada market is expected to grow with remarkable CAGR owing to a surge in investment by spend management vendors. For instance,

- In November 2021, Float, a Canada-based spend management organization, secured USD 30 million in a series A funding round. The capital will help organizations to expand their comprehensive spend management software and corporate cards.

The Europe market is diverse, owing to rising investments by the government and key players. Players in the market are focusing on expanding their geographical presence by offering customized services to clients across nations worldwide.

In Europe, the buying and implementation of BSM software was highly impacted during the pandemic period owing to supply chain disruptions and nationwide lockdowns. As per Proactis Holdings Ltd., the number of new deals in 2020 decreased in the U.K., France, and Germany as compared to 2019. The pandemic also impacted business process outsourcing and managed service auctions. Whereas sales and new deals in the Netherlands increased by 13% in 2020 compared to 2019.

Post-COVID-19 pandemic, organizations have focused on investments and technology adoption to manage travel and expense management, spend management, and contract management. For instance,

- In July 2021, SAP SE, a Germany-based spend management software provider, stated companies are digitizing their spend management, procurement, and supply chain management. Further, the company stated Molson Coors Beverage Co., the Florida Department of Management Services, Grupo Financiero Banorte, and S.A.B. de C.V. Alcon Vision, among others, adopted spend management solutions in the second quarter of 2021.

Asia Pacific is anticipated to showcase the highest growth rate during the projected period. The growing investment by developing economies for digital transformation, such as India, Japan, Singapore, South Korea, South East Asia, and others, is contributing to market growth. The market players are focusing on the expansion of product offerings and business operations across India, Singapore, Australia, Japan, and South Korea. For instance,

- In April 2022, Singapore-based energy company, Puma Energy, adopted GEP spend management platform. The company integrated the GEP SMART to evaluate, identify, and qualify suppliers and agreements and efficiently operate a global supply chain.

- In March 2022, Oil India Limited automated its procure-to-pay processes for accounts payable invoice automation and supplier collaboration. Through the adoption of automation, Oil India aims to deliver better supplier engagement via the Avaali Velocious Supplier Relationship Management (SRM) solution.

Such active implementation of the software organizations by the organizations is projected to surge the demand for BSM software in this region.

Across the Middle East and Africa, Business Spend Management software is expected to gain traction in the coming years. Startups and SMEs across the region focus on funding and investments, which is projected to propel the demand for business spend management software and services. For instance,

- In March 2022, UAE-based spend management finance technology, Alaan, raised USD 2.5 million in seed funding. The platform enables SMEs to spend through automated invoice payments and corporate cards.

- Similarly, in February 2022, Saudi Arabia-based spend management platform Sanad Cash raised USD 1.6 million in the seed round.

South America is projected to exhibit significant growth opportunities for business spend management software (BSM). An expansion of business operations across South American countries, including Brazil, Argentina, and others, drives the market growth. For instance,

- In December 2021, Calara, a corporate spend management solution provider in Latin America, started operations in Brazil. The company is backed by USD 70 million in a series B funding round led by Coatue, an investment firm.

Similarly, the investment by high-tech companies, such as Amazon.com Inc., Google LLC, IBM Corporation, and others, to establish cloud infrastructure is expected to fuel the market in the region.

Key Industry Players

Market Players to Drive Merger and Acquisition Strategies to Expand the Shares

Prominent players operating in the global market are focusing on expanding their presence and market share through merger and acquisition strategies. These companies are aiming to acquire small and local firms to expand their business presence.

List of Top Business Spend Management (BSM) Software Companies:

- Coupa Software Inc. (U.S.)

- Proactis Holdings Plc. (U.K.)

- GEP (U.S.)

- SAP SE (Germany)

- Basware (Finland)

- Ivalua Inc. (U.S.)

- SutiSoft Inc. (U.S.)

- Zycus Inc. (U.S.)

- Xeeva (U.S.)

- JAGGAER (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- February 2024: - Veriscape, a supply chain technology provider, entered into a partnership with Procurify, an intelligent spend management software provider, to revolutionize business spend management by providing supply chain technology solutions.

- January 2024: - Corpay develops “Corpay Complete”, an end-to-end spend management platform for customers in Canada and the U.S. It integrates payments and spending management into a mobile-compatible platform to manage corporate spending and payments.

- November 2023: - Mastercard, in partnership with Norwegian fintech company EedenBull, develops “Q Business platform”, a spend management solution and issuing cards to small and medium-sized businesses in the Asia Pacific region for managing and optimizing operational spending.

- November 2023: - Payhawk, a spend management software provider, deploys a new procure-to-pay solution to automate the procurement operations of the businesses.

- February 2023 – Taxback International entered into a partnership with Conovum to integrate Conovum’s solutions with Taxback’s VAT and compliance solutions by developing unique VAT and spend management solutions to handle the client’s VAT process.

- November 2022 - Ivalua formed a partnership with Raqmiyat, a leading system integrator and digital enabler, to bring digitalization in eProcurement solution across the UAE and Saudi Arabia.

- September 2022 - Brex expanded its collaboration with Netsuite to manage the spend management data flow of the businesses to ensure data accuracy.

- April 2022 – Brex. A corporate car provider, majorly for small-size enterprises, has launched a new spend management tool with a software platform named Brex Empower, which helps to generate receipts through the data collected from credit cards and its partner network.

- April 2022 – Proactis, the spend management professional, released the Proactis eRecovery Report, which specifies how major corporations invested in digital transformation since the outbreak of the COVID-19 pandemic to aid in their recovery.

- March 2022 - SAP SE acquired a controlling share in Taulia, a renowned provider of working capital management solutions. The acquisition broadens SAP's business network and boosts SAP's CFO office products.

REPORT COVERAGE

The research report provides a detailed analysis of the market. It focuses on key aspects such as leading companies, software types, and leading applications of software and services. Besides this, the report offers insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market in recent years.

To gain extensive insights into the market, Download for Customization

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Unit |

Value (USD billion) |

|

Growth Rate |

CAGR of 11.7% from 2025 to 2032 |

|

Segmentation |

By Solution

By Deployment

By Enterprise Type

By End-user

By Region

|

Frequently Asked Questions

The market is projected to reach USD 56.30 billion by 2032.

In 2024, the market value stood at USD 23.36 billion.

The market is projected to grow at a CAGR of 11.7% over the forecast period.

The solutions segment is likely to lead the market.

Increased usage of spend analytics in businesses to propel market growth.

SAP SE, Coupa Software Inc., Proactis Holdings Ltd., GEP, Basware, Jaggaer, Xeeva, Zycus Inc., Ivalua Inc., and Sutisoft Inc. are the top players in the global market.

North America is expected to hold the highest market share.

Asia Pacific is expected to exhibit the highest growth rate during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us