U.S. Residential Lithium-ion Battery Energy Storage System Market Size, Share & COVID-19 Impact Analysis, By Power Rating (3kW-6kW, 6kW-15kW, 15kW-30kW), By Connectivity (On-grid, Off-grid), By Operation (Standalone, Solar), and Forecast, 2025-2032

KEY MARKET INSIGHTS

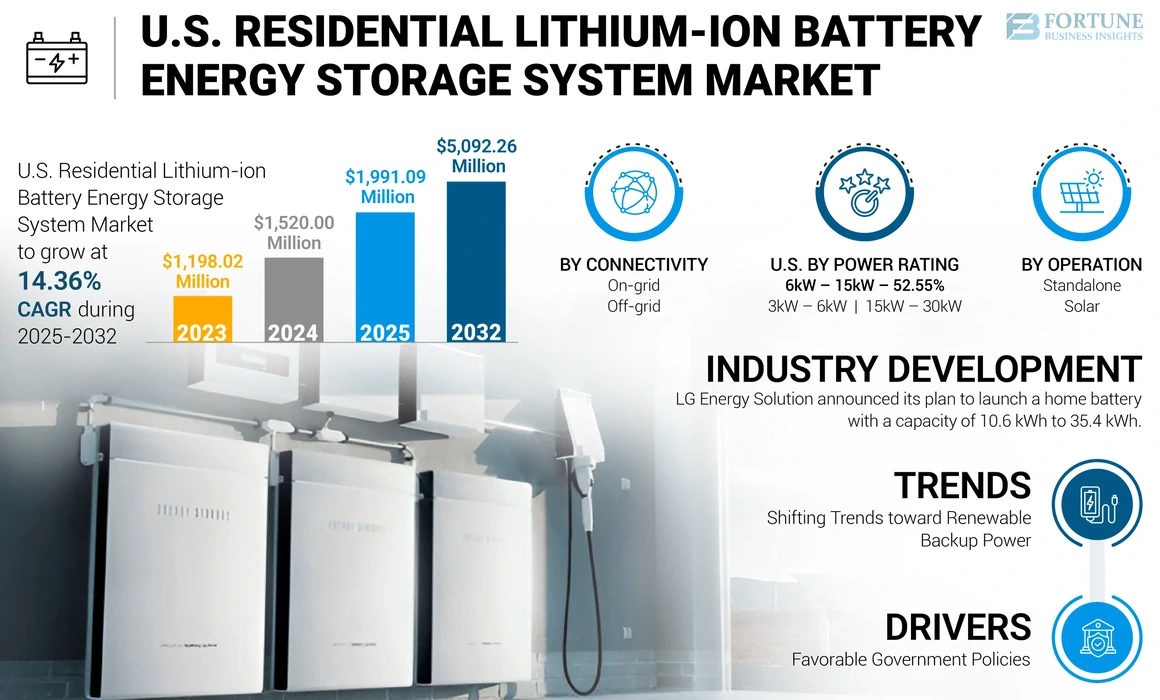

The U.S. Residential Lithium-ion Battery Energy Storage System Market size was valued at USD 1,520.00 million in 2024. The market is projected to grow from USD 1,991.09 million in 2025 to USD 5,092.26 million by 2032, exhibiting a CAGR of 14.36% during the forecast period.

The growth of the battery storage systems market has been remarkable over the last few years; however, the rapid growth of the residential energy storage sector in the U.S. is outpacing the growth of the commercial and utility battery storage systems market. The U.S. has emerged as the leading global residential energy storage market. Increased adoption of solar energy: with the declining cost of solar panels and advancements in power storage technology, more homeowners are installing solar panels and opting for ESS to store excess energy for later use. Compared to lead acid batteries, lithium-ion batteries are becoming the go-to choice for residential ESS due to their high energy density, long life, and low self-discharge rate.

COVID-19 IMPACT

COVID-19 Pandemic Slackened the Growth of Residential Lithium-ion Battery Energy Storage Systems Installations

The COVID-19 pandemic significantly impacted the residential lithium-ion battery energy storage systems industry, curbing investments and threatening to slow the expansion of key clean energy technologies. The U.S. economy faces unprecedented challenges from the COVID-19 crisis, with millions of Americans suffering from impacts on health, family, and financial conditions. The residential energy storage sector in the U.S. faced several challenges, including canceled shipments of components, travel restrictions, lack of direct customer contact, and reduced demand from end-users. Though this market witnessed substantial growth in 2020 and 2021, it could have experienced immense growth without COVID.

U.S. Residential Lithium-ion Battery Energy Storage System Market Trends

Shifting Trends toward Renewable Backup Power to Create Lucrative Opportunities

Advancing technologies and declining solar system prices empower the trend toward renewable backup power. Residential lithium-ion battery energy storage systems can provide a reliable backup power source during outages, making them increasingly popular. Moreover, combining battery energy storage with solar panels creates lucrative opportunities for residential energy storage system providers. Energy storage with solar panels can manage evening energy ramps, provide black start capability, backup power, and more. It can also reduce electricity prices through arbitrage. As demand and manufacturing have increased to support electric grid applications and energy storage systems, the upfront costs of lithium-ion batteries, the most common type of storage paired with solar, have rapidly decreased.

Download Free sample to learn more about this report.

U.S. Residential Lithium-ion Battery Energy Storage System Market Growth Factors

Favorable Government Policies to Upkeep Market Growth

Favorable government policies, including the Self-Generation Incentive Program (SGIP) & Investment Tax Credit (ITC), has been the major growth driver for the U.S. residential energy storage systems market. The SGIP offers reimbursements for installing battery energy storage technology. The California Public Utility Commission (CPUC) has approved over USD 1 billion in funding by 2024 for SGIP. Apart from that, ITC has been among the major supportive policies for residential & commercial energy storage with solar systems. Moreover, as per the Energy Storage Tax Incentive and Deployment Act (S. 627 / H.R. 1648), ITC can be availed for energy storage systems without solar panels, which are standalone energy storage systems, further stimulating the U.S. Residential Lithium-ion Battery Energy Storage System Market growth during the forecast period.

RESTRAINING FACTORS

Increasing Dependency on China to Challenge Market Growth

The energy market is shifting from conventional fossil fuels to immensely growing renewables. Moreover, residential lithium-ion battery energy storage systems hold significant growth among renewables, and developments in lithium-ion and lead-acid batteries are the primary growth drivers for the energy storage systems market. China is the global leader in the manufacturing of lithium-ion batteries, with more than 60% share, while the U.S. holds around 10%. The U.S. residential energy storage systems market witnessed swift growth in the last few years. As a result, imports of residential ESS have rapidly increased after 2020. South Korea was the most prominent residential ESS supplier for the U.S.; however, the increasing share of imports was seized by China and Vietnam. Considering the ongoing U.S.-China trade war, increasing dependence on China will likely hamper the U.S market growth.

U.S. Residential Lithium-ion Battery Energy Storage System Market Segmentation Analysis

By Power Rating Analysis

Rising Adoption of Residential ESS with Multiple Batteries Leading to Higher Demand for 6kW -15kW Systems

By power rating, the market is divided into 3kW-6kW, 6kW-15kW, and 15kW-30kW.

Residential lithium-ion energy storage system data is separated based on the total power rating of the system. The 6kW-15kW segment dominates the market. This is accredited to the growing demand for energy and the rising adoption of residential ESS with multiple batteries.

To know how our report can help streamline your business, Speak to Analyst

By Connectivity Analysis

Large Number of Grid-tied Households to Reflect Higher Demand for On-grid Residential ESS

Based on connectivity, the market is categorized into on-grid and off-grid.

On-grid residential lithium-ion energy storage systems tied to the power grid are considered under this segment. Off-grid systems are not connected to grids and are usually in areas with an unreliable or no power grid. On-grid segment will likely dominate the market. This is accredited to a large number of existing on-grid customers.

By Operation Analysis

Declining Solar System Prices to Stimulate Adoption of Solar-paired Residential ESS

Based on operation, the market is categorized into standalone and solar.

Solar segment dominated the market in 2022 and will likely continue the trend during the forecast period. This is attributed to the declining solar system prices and incentives offered by the government.

COUNTRY INSIGHTS

Geographically, the U.S. Residential Lithium-ion Battery Energy Storage System Market share is studied across the U.S. and California. California is the largest consumer of residential lithium-ion battery energy storage systems in the U.S. and holds more than 50% share of the total market in the U.S. This is accredited to declining solar system prices, rising adoption of renewables, and favorable government policies, including SGIP and ITC.

KEY INDUSTRY PLAYERS

Companies Focus on Mergers & Acquisitions and Partnerships to Gain Competitive Edge

Several residential lithium-ion battery energy storage systems companies compete in the U.S. market, which has grown immensely over the last few years. As California holds the majority share of the residential energy storage market in the U.S., it replicates the similar competitive landscape as the U.S. Tesla and LG Chem constitute the majority of the market share in both the U.S. and California residential markets. However, Tesla is widely considered the dominant player in the market. Its Powerwall product portfolio is one of the U.S. and California's most well-known and widely used residential lithium-ion battery energy storage systems. This is attributed to the early entry of Tesla into the residential energy storage space, which has been investing heavily in developing its energy storage products for several years. This has allowed Tesla to build up a strong brand and reputation for quality and reliability, which has helped it to win over many customers in the U.S.

List of Top U.S. Residential Lithium-ion Battery Energy Storage System Companies:

- Tesla (U.S.)

- Generac (U.S.)

- Panasonic (Japan)

- LG Chem (South Korea)

- Enphase (U.S.)

- Eguana (Canada)

- Sonnen (Germany)

- Fortress (U.S.)

- SimpliPhi (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- February 2023 - Pramac GmbH, a part of Generac Power Systems, Inc., announced the acquisition of REFU Storage Systems GmbH, a developer of battery storage hardware products for the commercial and industrial market. This acquisition would likely expand Generac’s presence outside of the U.S. market.

- September 2022 - LG Energy Solution announced its plan to launch a home battery in 2023. The new addition to the portfolio of home batteries is likely to offer a capacity of 10.6 kWh to 35.4 kWh, varying as per the installed battery modules.

- November 2021 - Panasonic (Panasonic Corporation of North America) announced the launch of its Total Home Energy Solution offering, the EverVolt 2.0.

- October 2021 - Enphase Energy, Inc., a U.S. based provider of micro inverter-based solar battery systems, announced that it started supplying its Encharge battery storage systems to customers in Belgium. This move is likely to expand its presence in the Europe market.

- September 2021 - Briggs & Stratton announced the acquisition of SimpliPhi Power, a California-based manufacturer of residential lithium-ion battery energy storage systems. This acquisition would help the company enhance its presence in the market share.

REPORT COVERAGE

The report provides detailed market analysis and focuses on key aspects such as leading companies, product/service types, and leading product applications. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the market's growth in recent years.

To gain extensive insights into the market, Download for Customization

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 14.36% from 2025 to 2032 |

|

Unit |

Volume (MW), Value (USD Million) |

|

Segmentation |

By Power Rating

|

|

By Connectivity

|

|

|

By Operation

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 1,520.00 million in 2024.

The market is likely to grow at a CAGR of 14.36% over the forecast period (2025-2032).

Favorable government policies, incentives, and declining solar system prices are the major driving factors for the market.

Some of the top players in the market are Tesla, LG Chem, and Enphase.

Rising dependency on China for lithium-ion batteries and growing geopolitical tensions between the U.S. and China are expected to restrain the deployment of the product.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us