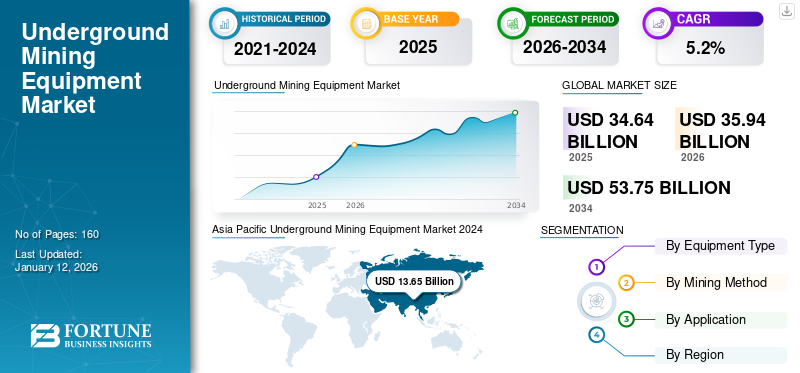

Underground Mining Equipment Market Size, Share & Industry Analysis, By Equipment Type (Loaders, Trucks, Bolters, Drills, and Others), By Mining Method (Longwall Mining, Room and Pillar Mining, Blast Mining, and Others), By Application (Coal Mining, Metal Mining, and Mineral Mining), and Regional Forecast, 2026-2034

Underground Mining Equipment Market Size

The global underground mining equipment market size was valued at USD 34.64 billion in 2025 and is projected to grow from USD 35.94 billion in 2026 to USD 53.75 billion by 2034, exhibiting a CAGR of 5.2% during the forecast period. Asia Pacific dominated the underground mining equipment market with a share of 41.1% in 2025.

Underground mining requires machinery for harvesting precious minerals, materials, and commodities from under the earth’s surface. Underground mining is done to extract minerals, metals, and coals from the underground earth's surface. Loaders, trucks, bolters, drills, scalers, and underground trains are used for underground mining applications. These systems are utilized by mining firms to extract ores and minerals. Underground mining equipment is used in applications, such as coal mining, metal mining, and mineral mining.

Increasing demand for metals and minerals, such as iron, gold, copper, coal, aluminum, and silver across the developed and developing regions, uplift the growth of the market. Increasing urban development necessitates significant construction materials, such as cement, which is produced from coal and limestone. Metals, such as iron, copper, and aluminum are essential for building infrastructure and meeting the needs of a growing urban population. Additionally, government policies and incentives in certain Latin American countries have encouraged activities, increasing the exploration and extraction of metals and minerals. Furthermore, large-scale infrastructure projects, such as road construction, bridges, and railways, require substantial amounts of metals and minerals, boosting the demand for such equipment to excavate metal and minerals from underground spaces. Additionally, according to the International Energy Agency (IEA), the demand for minerals will be increased by 500% by the year 2040. All such factors enhance the growth of the market.

The mining industry across the globe relies heavily on a complex global supply chain for mining equipment and spare parts. The COVID-19-related lockdowns, restrictions, and transportation challenges affected the supply chain, led to delays in equipment delivery, increased costs, and difficulties in maintaining operations. Many mining companies in the Latin America, and Middle East region had to reduce their on-site workforce arrangements to curb the virus. This led to lower productivity and challenges in meeting the production targets. Also, the mining sector dropped during the COVID-19 pandemic, in which all the industrial sectors registered a drop in the net revenue generated by mining sectors across the globe, which in turn, restricted the growth of the market.

Global markets showed volatility during the pandemic, the reason being lockdown restrictions and supply chain disruptions across several economies. However, the market growth has rebounded, post-pandemic owing to steady growth in minerals and metals, and new mining 5.0 practices. Such product strategies are expected to boost the growth of the global market during the projected period.

Underground Mining Equipment Market Trends

Technological Advancements in Equipment to Trigger Market Growth

Major players, such as Sandvik AB, AB Volvo, Komtsu Ltd, Caterpillar Inc., and others are engaged in providing technologically advanced equipment for various applications, such as coal mining, metal mining, and mineral mining activities, which fuels the market growth. An increasing priority is sustainable and eco-friendly mining practices to reduce the environmental impact. As a result, there is a growing shift toward electric-powered equipment in underground mining operations. Electric vehicles offer several advantages, including lower emissions, reduced noise pollution, and improved energy efficiency. Similarly, the penetration of artificial intelligence (AI) in the mining industry ultimately helps boost decision-making ability and provides faster and more accurate data-driven insights.

Along with, automation, penetration of Industry 4.0 practices, and Internet of Things (IoT), GPS Sensing, and 3D imagination in these equipment, observing real-time monitoring practices in mining equipment, fuels the market growth. For instance, in March 2020, Sandvik AB launched a new “Intelligent Automine System” for an unnamed haulage system for underground mining applications. Increasing technology integration with underground mining equipment helps reduce environmental harm and enhance labor productivity. Underground mining equipment reduces equipment damage, and emphasize higher efficiency to underground mining operations. Moreover, major players are trying to launch hybrid, and battery-powered equipment for the market. All such aforementioned factors are the key drivers of the underground mining equipment market growth.

Download Free sample to learn more about this report.

Underground Mining Equipment Market Growth Factors

Increasing Demand for Minerals and Metal across the Globe Drive the Market Growth

Industrial development across various sectors, including automotive, electronics, and manufacturing, has further driven the demand for metals and minerals. These industries require a steady supply of raw materials to produce goods and meet consumer demands. Additionally, government policies and incentives implemented by various nations in the globe have encouraged activities, increasing the exploration and extraction of metals and minerals. Furthermore, large-scale infrastructure projects, such as road construction, bridges, and railways, require substantial amounts of metals and minerals, boosting the demand for underground mining equipment to excavate metal and minerals from underground spaces.

Foreign mining companies and investors are attracted to vast mineral reserves, promoting increased exploration and extraction activities across the globe. Using electric machinery for underground mining guarantees safer working conditions, low noise levels, and lower temperatures. This factor plays a vital role in conducting metals and minerals mining operations for a longer duration. As the demand continues to rise, mining companies invest in advanced equipment and technologies to extract and process these valuable resources, ensuring continued market expansion. In addition, growth in metal and mineral production in Brazil increased by 11% from 2022 as compared to 2021. Such an increasing growth and development of metals and minerals enhances the growth of global market.

RESTRAINING FACTORS

High Capital Investment and Operating Cost to Impede the Market Growth

Underground mining equipment can be expensive to purchase and maintain. The initial investment required for equipment, such as drills, loaders, and trucks can be a significant barrier for mining companies, especially smaller ones. Operating and maintenance costs for such equipment can be substantial. Fuel, electricity, labor, and maintenance expenses can add up, affecting profitability. The increasing awareness of the environmental impact of mining has become a significant concern in the region.

The cost of underground mining material is higher than that of above-ground mining. The underground mining equipment cost ranging from USD 500,000 to USD 1.5 million depending on underground mining. Also, this huge cost is not bearable for small as well as medium enterprises. All such the aforementioned factors restrict the growth of the market.

Underground Mining Equipment Market Segmentation Analysis

By Equipment Type Analysis

The Loaders Segment to Dominate the Market due to Increasing Demand from Underground Mining Sector

Based on equipment type, the market is segmented into loaders, trucks, bolters, drills, and others.

The loaders segment is anticipated to dominate the market due to rising demand for excavated minerals, such as nickel, cobalt, copper, and gold materials. Additionally, the rising disposable income of end users, which shows a strong demand for such materials, which enhances the demand for such equipment, drives the market growth. The underground mining loader is divided by its versatility, durability, and addition of new features that enable it to manage the challenging conditions often seen in underground mining environments—for example, harsh geological conditions, narrow tunnels, and uneven terrain, among others. The segment gained 32.88% of the market share in 2026.

The trucks segment is projected to grow with substantial growth during the forecast period, due to increasing mining activities across the globe. Also, the growing demand for electric and autonomous trucks for underground mining applications, uplifts the market growth.

Additionally, bolters and drills are projected to grow with significant growth during the forecast period, owing to the increasing count of mining projects and investment in the mining projects, which creates the demand for this equipment, and fuels the market growth.

Other segments consist of feed breakers and scalers. This type of equipment is used for underground mining applications. These types of equipment are used for cutting hard rock in mining applications. All such factors fuel the market growth.

To know how our report can help streamline your business, Speak to Analyst

By Mining Method Analysis

Longwall Mining Segment to Lead the Market due to Rising Demand for Coal and Metal across Diversified Locations

Based on the mining method, the market is segmented into longwall mining, room and pillar mining, blast mining, and others.

According to our analysis, the longwall mining segment is projected to dominate the market with substantial growth during the forecast period. The primary driver for the longwall mining segment is the demand for coal, which is used in electricity generation, steel production, and other industries. The energy needs of emerging economies and the steel industry's requirements can significantly influence the market. The segment is likely to attain 47.41% of the market share in 2026.

The room & pillar mining segment is expected to grow with a CAGR of 4.83% during the forecast period (2025-2032), owing to this mining method being largely utilized in underground mining applications. Also, the process for this mining are easy to use and requires a lot of manpower.

The blast mining segment is anticipated to grow with moderate growth, owing to industrial explosives being used in underground mining blasting. Also, this mining method is applicable for dangerous, and hard rock mining activities. This process requires huge costs as compared to other mining methods.

Others included sublevel caving, and block caving. This mining method is anticipated to grow with moderate growth. Also, the growing demand for specific minerals, such as copper gold, and some base metals, uplifted the underground mining equipment market share.

By Application Analysis

Metal Mining to Register Fastest CAGR owing to Increasing Demand for Metals and Minerals

Based on the application, the market is segmented into coal mining, metal mining, and mineral mining.

According to our analysis, the metal mining segment is projected to grow with the maximum CAGR during the forecast period, owing to the increasing count of metal mining projects across economies globally. Moreover, an increasing demand for metals and related substances for electricity purpose, and storage purposes, uplift the growth of global market. The segment is set to grow with a market share of 43.35% in 2026.

The coal mining segment is expected to grow with a considerable CAGR of 4.78% during the forecast period (2025-2032), owing to rising demand for such products for excavating coal from underground applications. In addition, the increasing number of coal mining projects across Latin America, which driving the growth of the market. Mineral mining is projected to grow with moderate growth during the forecast period, owing to rising demand for minerals such as nickel, cobalt, sodium, calcium, magnesium, and zinc.

REGIONAL INSIGHTS

The market report covers an in-depth scope and deep-dive analysis of five main regions: North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

Asia Pacific Underground Mining Equipment Market 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific held the largest market share valued at USD 14.23 billion in 2025 and USD 14.9 billion in 2026. According to our analysis, Asia Pacific dominates the market with the largest market share, owing to factors, such as the demand for minerals, metals, and coal, as well as infrastructure development. The growing energy needs of emerging economies and the demand for raw materials play a crucial role in market growth. Strong population growth, industrialization, and increased demand for minerals and metals from China, Japan, and India, which enhances the growth of the Asia Pacific market. India is foreseen to be worth USD 2.37 billion in 2026, while Japan is poised to hit USD 2.95 billion in the same year.

China to Dominate the Market Owing to Increasing Demand from Various Mining Applications

China is one of the world's largest producers and consumers of coal and various metals, which drives the demand for underground mining equipment in the country. The China market includes various machinery and equipment used for mining operations beneath the Earth's surface. All such aforementioned factors drive the market growth in the country. The rise in population drives infrastructure development-related projects, mainly in developing countries such as China, India, Brazil, and the Middle East, leading to development in the mining equipment industry. China is projected to hold USD 6.61 billion in 2026.

To know how our report can help streamline your business, Speak to Analyst

North America is the second largest market set to be valued at USD 6.69 billion in 2026, exhibiting a CAGR of 4.23% during the forecast period (2025-2032). The region is projected to grow with potential growth during the forecast period, owing to strong economy, rising disposable income of population, government policies for implementing mining activities, and technological advancements in these systems. Also, major governments are planned to invest in underground mining activities across the U.S. and Canada, uplift the market growth. All such aforementioned factors drive the market growth. The U.S. market anticipated to hold USD 4.95 billion in 2026.

Europe is the third largest market estimated to be worth USD 6.16 billion in 2026. The U.K. market continues to expand, projected to reach USD 0.92 billion in 2026. The region is projected to grow with potential growth during the forecast period, due to strong economic growth, increasing mineral production, and increasing demand for ore, and metals from various countries, such as Germany, France, U.K., and Italy, fuels the market growth. Germany is set to grow with a value of USD 1.59 billion in 2026, while France is estimated to acquire USD 1.52 billion in 2025.

Middle East & Africa are projected to grow decently, due to increasing mining activities, and rising demand for minerals from Brazil, GCC, and other countries. Along with, rising investment in mining and underground mining activities, which cater the growth of market. According to Diamond World, in 2022, the South Africa government planned to invest around USD 2.3 billion for underground mining activities to improve the production capacity of diamonds, and minerals. All such instances drive market growth. The GCC market is expected to hold USD 3.45 billion in 2026.

Latin America is the fourth largest market set to be valued at USD 4.74 billion in 2026. Latin America market to witness considerable growth during the forecast period, owing to abundant reserves of minerals, rising demand across industry sectors, heavy investments in mining projects, and infrastructure development. Key players are adoption safe and efficient machines for underground mining activities to comply with industry standards.

KEY INDUSTRY PLAYERS

Key Players Focus on Introducing New Products to Strengthen the Market Competition

Market players, such as Sandvik AB, AB Volvo, Hitachi Construction Machinery, Caterpillar Inc., Epiroc AB, and others are engaged in introducing new technologically advanced underground mining equipment to strengthen the market competition and also to improve the supply chain of these systems that drives the market growth. For instance, in April 2023, MacLean launched the ML5 Multi-Lift, a purpose-built mining vehicle offering safety, versatility, and productivity for underground operations. With a 6.5-meter working height and 45-tonne payload, the battery-operated model ensured increased operator safety and ease of use through its advanced features and design.

LIST OF TOP UNDERGROUND MINING EQUIPMENT COMPANIES:

- AB Volvo (Sweden)

- Boart Longyear (U.S.)

- Caterpillar Inc. (U.S.)

- Epiroc AB (Sweden)

- J.H. Fletcher & Co. (Cannon Mining Equipment) (U.S.)

- Komatsu Ltd. (Japan)

- SMT Scharf GmbH (RDH Mining Equipment) (Germany)

- Schmidt, Kranz & Co. GmbH (U.S.)

- Sandvik AB (Sweden)

- XCMG Group (China)

KEY INDUSTRY DEVELOPMENTS

- November 2023: Epiroc AB, a mining and infrastructure equipment manufacturer, partnered with Byrnecut Mining Pty Ltd, a contract mining company, to develop a future electric drive low-emission automated underground loader.

- June 2023: 3D-P became powered by Epiroc, reflecting the integration of the two companies. The new logotype removed the tagline of Technology Connected and intensified the collaboration and communication with consumers. 3D-P excels in the South America region in terms of presence.

- March 2023: Volvo Trucks partnered with Boliden, the Swedish mining group, to introduce battery electric trucks for heavy underground transport in Boliden’s Kankberg mine, aiming to reduce CO2 emissions by over 25% and contribute to a more sustainable mining industry.

- December 2022: Sandvik Mining and Rock Solutions, a subsidiary of Sandvik AB launched new DD322i drill for underground mining application. It is highly compact, automated, and twin boom drill for underground development, and smart tunneling. This type of drill is used in tunneling and mining applications. Also, it requires a cheap cost as compared to other systems.

- November 2022: Miller Technology Incorporated based in Canada, introduced a new electric grader for performing in underground mining applications. It is retrofit by HBM Novas 110 M, and it is powered by Ionic drive systems.

- August 2022: Volvo Trucks partnered with Boliden, the Swedish mining group, to introduce battery electric trucks for heavy underground transport in Boliden’s Kankberg mine, aiming to reduce CO2 emissions by over 25% and contribute to a more sustainable mining industry.

REPORT COVERAGE

The global market research report covers a detailed depth analysis of the Equipment type, mining method, and application. It provides information about leading players in the underground mining equipment and their business overview, product offerings, investments (R&D and expansions), revenue analysis, types, and leading applications of the product. Besides, it offers insights into the competitive landscape, trends analysis, SWOT analysis, and current market trends and highlights key drivers and restraints. In addition to the abovementioned factors, the market report encompasses several factors contributing to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.2% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Equipment Type, By Mining Method, By Application, and By Region |

|

Segmentation |

By Equipment Type

By Mining Method

By Application

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 53.75 billion by 2034.

In 2026, the market was valued at USD 35.94 billion.

The market is projected to grow at a CAGR of 5.2% during the forecast period.

The loaders segment is expected to lead the market.

Increasing demand for metals and minerals, and focus of mining companies on sustainable mining, are the factors that drives the market growth.

AB Volvo, Boart Longyear, Caterpillar Inc., Epiroc AB, J.H. Fletcher & Co, Komatsu Ltd., SMT Scharf GmbH, Schmidt, Kranz & Co. GmbH, Sandvik AB, and XCMG Group are the top players in the market.

Asia Pacific region is expected to hold the highest market share.

By application, the metal mining segment is expected to have fastest CAGR market during forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us