Used Cooking Oil Market Size, Share & Industry Analysis By Source (Food Services and Households), By Application (Industrial Usage [Biofuels, Cosmetics, and Others] and Animal Feed), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

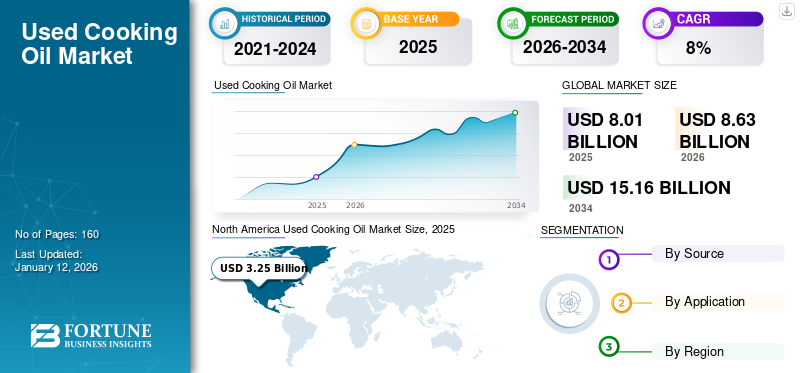

The global used cooking oil market size was valued at USD 8.01 billion in 2025. The market is projected to grow from USD 8.63 billion in 2026 to USD 15.16 billion by 2034, exhibiting a CAGR of 8.31% during the forecast period. North America dominated the used cooking oil market with a market share of 43.69% in 2025. The used cooking oil market is poised for substantial growth in the coming years, driven by sustainability initiatives, technological advancements, and increasing demand for renewable energy sources.

The Used Cooking Oil (UCO) industry refers to the commercial sector that deals with the collection, processing, and utilization of used cooking oil, which is generated from the repeated use of vegetable oils in cooking and frying. The waste cooking oil market encompasses the household and commercial sectors, with significant volumes generated from restaurants, food processing industries, and households. The market is characterized by its potential for growth driven by increasing demand for sustainable practices, government regulations promoting recycling, and advancements in processing technologies. Valley Proteins, Inc., Arrow Oils Ltd., and Grand Natural, Inc. are some of the prominent players analyzed for the global used cooking oil market forecast. These players are actively involved in expanding their customer reach and enhancing their oil processing facilities to gain better output from the used cooking oil.

Used Cooking Oil Market Snapshot & Highlights

Market Size & Forecast

- 2025 Market Size: USD 8.01 billion

- 2026 Market Size: USD 8.63 billion

- 2034 Forecast Market Size: USD 15.16 billion

- CAGR: 8.31% from 2026–2034

Market Share

- North America dominated the used cooking oil market with a 43.69% share in 2025, driven by high biodiesel production capacity, government recycling incentives, and strong infrastructure for UCO collection.

- By source, the foodservice sector is expected to retain the largest market share in 2025, supported by high oil usage in restaurants and increasing regulation around oil waste management.

Key Country Highlights

- U.S.: Market projected to reach over USD 5 billion by 2032, led by growth in biodiesel output, renewable fuel mandates, and local collection initiatives.

- Germany: Strong regulatory support under the Renewable Energy Directive (RED) and rising demand for sustainable fuel alternatives fuel market momentum.

- India: Government initiatives like the Extended Producer Responsibility (EPR) draft regulation are formalizing oil recycling, boosting UCO availability.

- Brazil: Leading biodiesel producer in South America; rising demand for alternative feedstocks and government-backed sustainability programs are driving growth.

Market Dynamics

Market Drivers

Rising Government Efforts to Reduce Oil Wastage Will Emerge in Favor of Market Growth

Rising government efforts to reduce oil wastage are positively influencing the Used Cooking Oil (UCO) market Growth. These initiatives are aimed at promoting sustainability, enhancing resource efficiency, and encouraging the recycling of waste materials. Governments worldwide are implementing regulations that mandate the collection and recycling of used cooking oil. For instance, in May 2023, in India, the Ministry of Environment introduced a draft notification on Extended Producer Responsibility (EPR) for waste oil to formalize oil collection and recycling processes. This initiative requires producers and bulk generators to register and meet specific recycling targets, thereby increasing the availability of UCO for biodiesel production.

Increasing Use of UCO in Biodiesel Industry Drives Market Growth

Recent technological advancements in waste recycling have encouraged people to recycle waste products and convert them into useful products that benefit the environment. The product has a massive potential to be refined into various bio-fuels to generate power. Biodiesel produced using waste cooking oil has a lower carbon footprint and is burn cleaner. They also release less carbon monoxide and are cost-effective compared to petroleum diesel. The increasing demand for recycled UCO for biodiesel production primarily drives the trends in the global used cooking oil market. The recycling process generates by-products, which are useful in manufacturing soap and glycerine, increasing their demand. According to the Biomass Board of Research and Development, the global biodiesel supply reached 39,654 million liters in 2015 and is expected to reach 50,334 million liters by 2025.

Market Restraints

Regulatory Challenges to Impede Market’s Growth

The regulatory landscape surrounding the collection, transportation, and processing of used cooking oil can be complex and vary widely by region. Stricter regulations may impose additional compliance costs on businesses involved in UCO recycling, which can deter participation in the market. Moreover, inconsistent regulations across different jurisdictions can create barriers for companies looking to operate on a larger scale.

Market Opportunities

Enhanced Collection Infrastructure to Ensure Success for Market in Foreseeable Future

The increased collection infrastructure for Used Cooking Oil presents significant opportunities for market growth and sustainability. Improved collection infrastructure can streamline the logistics of gathering used cooking oil from various sources, such as restaurants, households, and food processing facilities. This efficiency ensures a consistent and reliable supply of UCO for processing into biodiesel and other products, ultimately supporting market stability and growth.

Market Challenges

Presence of Impurities to Pose Challenge for Market Growth

The presence of impurities such as free fatty acids and water in used cooking oil can complicate processing and refinement. These impurities must be removed before transesterification, which is essential for producing high-quality biodiesel. High levels of impurities can lead to poor biodiesel yields and limit the utilization of UCO in applications, such as animal feed, due to safety concerns.

Used Cooking Oil Market Trends

Utilization of Sustainable & Green Energy to Tackle Environmental Issues to Fuel Product Demand

The increasing population, rapid urbanization, and increasing pollution across the world have created several issues related to climate change, alternatives to reducing greenhouse gas emissions, and other environmental issues by helping transform used cooking oil market trends. Governments across several countries and a few leading energy & fuel companies are adopting policies supporting the green economy. Biodiesel manufactured from used edible oil is an emerging category in the green energy space. Consumer preference has shifted from petroleum diesel to biodiesel in recent years due to its environmental welfare counterparts. Furthermore, the growing awareness regarding food wastage among consumers and stringent safety regulations associated with the product contribute to the increased availability of used edible oil for fuel production.

Download Free sample to learn more about this report.

Impact of COVID-19

The COVID-19 pandemic had a significant impact on the global Used Cooking Oil (UCO) market, affecting various aspects of production, supply, and demand. The pandemic led to widespread lockdowns and restrictions, resulting in the closure of restaurants and food service establishments. This caused a substantial decrease in the generation of used cooking oil, as fewer meals were prepared in commercial kitchens. The pandemic disrupted supply chains globally, affecting logistics and transportation. The inability to collect and process used cooking oil efficiently led to challenges in market stability. Many key players in the UCO industry faced operational suspensions due to labor shortages and restrictions on movement, further exacerbating supply issues.

Segmentation Analysis

By Source

Foodservice Segment Holds Major Market Share Due to High Utilization of Product across Various Sectors

In terms of source, the market has been categorized into food services and households.

The food services segment held the major share of the global used cooking oil market share of 73.93% in 2026 and is expected to grow at a CAGR of 7.83% during the forecast period (2025-2032). The emerging culture of dining out influences the growth of the food services segment. The expansion of cafes and restaurants across the globe has increased the product’s demand. The growing interest in trying out exotic cuisines among consumers has propelled the utilization of exotic cooking oils across the food service industry.

The households segment is expected to grow significantly with a share of 20% in 2025. The rising prices of fresh vegetable oils have made used cooking oil a more attractive alternative for various applications, including biodiesel production. Households are incentivized to recycle their used oil as it can be converted into a valuable resource rather than discarded. This cost-effectiveness enhances the appeal of recycling among consumers.

To know how our report can help streamline your business, Speak to Analyst

By Application

Industrial Application Exhibits Robust Growth Owing to Rising Demand for Fuel Production

In terms of application, the market has been segregated into industrial usage (biofuels, cosmetics, and others) and animal feed.

The industrial usage segment is anticipated to capture the foremost share of the overall market valshare of 62.80% in 2026. The widespread applications of UCO for the production of fuels propel the growth of the industrial application segment. Technological advances used to process waste cooking oil have promoted its utilization in various industrial processes. Along with the biodiesel, the UCO can produce ozone-treated oil with a higher calorific value and lower ignition point. This oil is also used as a fermentation media component that further acts as a carbon source for microorganisms. The formation of beneficial by-products of certain components can be put to further use, which drives the segment's growth.

The animal feed segment of the global market is projected to experience significant CAGR of 7.28% during the forecast period (2025-2032). Used cooking oil serves as a cost-effective alternative to traditional vegetable oils in animal feed formulations. Its affordability makes it an attractive option for livestock producers looking to manage costs while maintaining feed quality. UCO is rich in energy and essential fatty acids, making it a beneficial supplement in animal diets. By incorporating UCO into feed, producers can enhance the energy density of the diet, which is crucial for optimal growth and production in livestock.

Used Cooking Oil Market Regional Outlook

North America

North America Used Cooking Oil Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America attained a major share of in the overall market valued at USD 3.25 billion in 2025 and USD 3.51 billion in 2026. A significant portion of used cooking oil is utilized for biodiesel production, which is a major driver of market growth in the region. According to the IEA Bioenergy organization, U.S. biofuel production capacity rose to 23.8 billion gallons per year (BGPY) in 2023, with a growth of over 1.7 billion gallons compared to 2022. The U.S. is increasingly focusing on environment-friendly and renewable energy sources, boosting demand for UCO. There are numerous government initiatives aimed at promoting the recycling and processing of used cooking oil. For instance, programs encouraging the conversion of waste cooking oil into biodiesel have been launched in various cities across North America. The U.S. market is set to be worth USD 2.58 billion in 2026.

Europe

Europe is the third largest market, expected to reach USD 1 billion in 2026. This region has established strategies and programs that are aimed at promoting renewable energy sources, including the Renewable Energy Directive (RED) and the Fuel Quality Directive. These regulations encourage the use of UCO in biodiesel production, making it a vital component of the EU's strategy, which aims to reduce greenhouse gas emissions and meet renewable energy targets. The U.K. market continues to grow and is projected to reach a market value of USD 0.17 billion in 2026. There is a growing cultural emphasis on environmental responsibility and sustainability within European societies. This awareness encourages both consumers and businesses to engage in practices that promote recycling and waste reduction, including the proper disposal and reuse of used cooking oil. Germany is projected to be valued at USD 0.21 billion in 2026, while France is poised to capture a share valued at USD 0.06 billion in the same year.

Asia Pacific

Asia Pacific is the second largest market and is expected to exhibit a significant CAGR of 8.93% during the forecast period (2025-2032) and capture a share of USD 2.35 billion in 2026, owing to the increased awareness regarding environmental welfare and sustainable energy resources. The increasing number of companies entering into the collection, refinement, and processing of waste cooking oil in this region will aid growth. China is set to be worth USD 1.12 billion in 2026.Companies operating in North America and Europe invest in UCO procurement from Asian countries to fulfill their raw material demand for biodiesel production. The evolution of the food and food service industry across the region also supports market growth. India is projected to be valued at USD 0.41 billion in 2026, while Japan is poised to capture a share valued at USD 0.26 billion in the same year.

South America

South America is the fourth largest market anticipated to hold a share of USD 0.58 billion in 2025. Brazil is one of the largest producers of biodiesel, and hence the demand for using alternative sources, such as feedstock, is also increasing. As more countries are using waste cooking oil to produce biodiesel, Brazil is also promoting its use in biodiesel production. Governments in South America are implementing policies that promote the recycling of used cooking oil. These regulations often provide financial incentives for businesses that participate in sustainable practices, thus enhancing the collection and processing of used cooking oil for biodiesel production.

Middle East & Africa

In the Middle East & Africa regions, many countries are transitioning from conventional energy resources to more efficient energy resources. In African countries, there is a significant opportunity for entrepreneurs, particularly those in informal and rural settlements, to use cooking oil or edible oils to produce and resell biodiesel. In Zambia, a young entrepreneur has grown his business from 200 liters of biodiesel produced from used cooking oil to 3,000 liters per month, selling it to local customers for use in vehicles and machinery. More such initiatives are expected to boost the use of this oil in the production of biodiesel.

Competitive Landscape

Key Market Players

The global Used Cooking Oil market is characterized by a competitive landscape that includes several established players and emerging companies focused on sustainability and recycling initiatives.

Major Players in the Used Cooking Oil Market

The global market is moderately consolidated, characterized by a mix of established companies and emerging players. Valley Proteins, Inc., Baker Commodities Inc., ABP Food Group, Arrow Oils Ltd., and others are some of the major players operating in the used cooking oil industry. These companies have significant market shares and are involved in various activities such as the collection, processing, and refining of used cooking oil for biodiesel production and other applications.

List of Key Companies Profiled

- Valley Proteins, Inc. (U.S.)

- Proper Oils Co. Ltd. (K.)

- ABP Food Group (Ireland)

- Arrow Oils Ltd. (U.K.)

- Baker Commodities, Inc. (S.)

- Grand Natural, Inc. (S.)

- Oz Oils Pty. Ltd. (Australia)

- Brocklesby Limited (U.K.)

- GreaseCycle (U.S.)

- MBP Solutions Ltd. (Switzerland)

Key Industry Developments

- September 2024: The Food Safety and Standards Authority of India (FSSAI) initiative, known as RUCO (Repurpose Used Cooking Oil), has led to a significant increase in the collection of used cooking oil in Kerala. In the fiscal year 2022-2023, the state collected 419,561 liters of used cooking oil, which more than doubled to 960,605 liters in 2023-2024. This initiative aims to prevent used cooking oil from re-entering the food chain by redirecting it toward biodiesel and soap manufacturing, addressing public health concerns, and promoting renewable energy.

- August 2024: M11 Industries Private Limited officially commenced operations at its new biodiesel plant located in Udupi district, Karnataka, India. This facility is notable for its capacity to convert used cooking and other waste oils into biodiesel, with a production capability of 450 tonnes per day.

- June 2023: ORLEN Unipetrol partnered with Czech Technical University in Prague and the Czech University of Life Sciences to launch a pilot project for cooking oil collection. The initiative aims to examine the recycling options of the product and its effective conversion into biofuel and petrochemicals.

- November 2022: Neste, one of the world’s leading producers of renewable diesel and sustainable aviation produced from leftover raw materials, agreed to acquire the UCO collection and aggregation business and related assets in the U.S. from Crimson Renewable Energy Holdings, LLC. This acquisition strengthened Nestle’s presence and operations in the U.S.

- November 2022: Kirti and Sushil Vaishnav, a couple from Delhi, have successfully converted over 3 million liters of Used Cooking Oil (UCO) into biodiesel through their startup, KNP Arises. This initiative addresses the significant health and environmental issues associated with the improper disposal of UCO, which can lead to serious health risks and pollution.

Report Coverage

The global used cooking oil market report analyzes the market in-depth and highlights crucial aspects such as prominent companies, region, segmentation, competitive landscape, product types, distribution channels, and application usage areas. Besides this, it provides insights into the market trends and highlights significant industry developments. In addition to the aspects mentioned earlier, it encompasses several factors contributing to the market's growth over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.31% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Source

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the worldwide market size was valued at USD 8.63 billion in 2026 and is anticipated to record a valuation of USD 15.16 billion by 2034.

Fortune Business Insights says that the global market value stood at USD 3.25 billion in 2025.

The global market is projected to grow at a significant CAGR of 8.31% during the forecast period.

The food services segment is predicted to dominate the global used cooking oil market trend during the forecast period.

Increasing demand for biodiesel is the key factor driving the growth of the market.

Valley Proteins Inc. and ABP Food Corps are the major players in the market.

North America dominated the global market in 2025.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us