Waterproofing Membrane Market Size, Share & Industry Analysis, By Type (Liquid Applied [Silicone, Polyurethane, Cementitious, and Others] and Sheet Based [Modified Bitumen, Thermoplastic Polyolefin, EPDM, Fluoropolymer Sheet, Fiber-reinforced polymer, PVC, and Others]), By Application (Roofing, Walls, Building Structures, Landfill & Tunnels, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

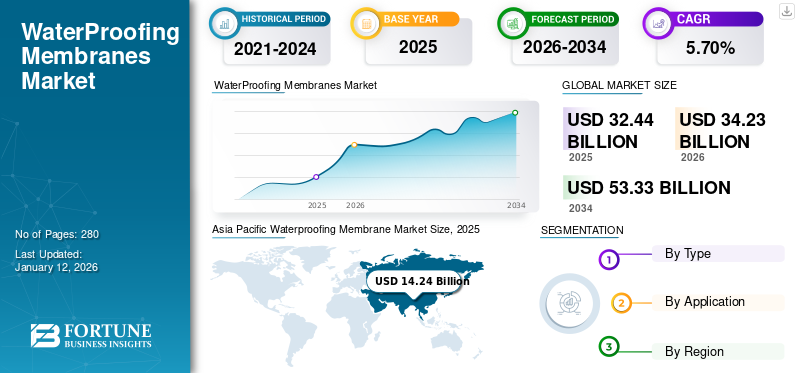

The global waterproofing membrane market size was valued at USD 32.44 billion in 2025. The market is projected to grow from USD 34.23 billion in 2026 to USD 53.33 billion by 2034 at a CAGR of 5.70% during the forecast period of 2026-2034. Asia Pacific dominated the waterproofing membrane market with a market share of 44% in 2025.

A waterproofing membrane is a layer of material designed to prevent water from penetrating and damaging structures. It is commonly used in construction, to protect buildings, roofs, foundations, and other structures from water infiltration. These membranes act as barriers, ensuring that water does not seep through surfaces that are prone to moisture exposure. The increasing focus on building safety, sustainability, and health will significantly boost the demand for high-quality membranes.

Global logistics and transportation were severely affected by the COVID-19 pandemic, with restrictions on movement and port closures. These disruptions hindered the timely delivery of raw materials and finished products, impacting the ability of manufacturers to meet demand. Increased freight costs and logistical complexities added further strain on the supply chain, exacerbating the challenges faced by the waterproofing membrane market. However, the crisis also presented opportunities for the industry to accelerate technological adoption, emphasize sustainability, and build more resilient supply chains. As the construction sector gradually recovers, the market is expected to focus on innovation, efficiency, and sustainability.

Global Waterproofing Membrane Market Key Takeaways

Market Size & Forecast:

- 2025 Market Size: USD 32.44 billion

- 2026 Market Size: USD 34.23 billion

- 2034 Forecast Market Size: USD 53.33 billion

- CAGR: 5.70% from 2026–2034

Market Share:

- Asia Pacific dominated the waterproofing membrane market with a 44% share in 2025, driven by increased construction activity, urbanization, and demand for advanced waterproofing solutions in China, India, and Southeast Asia.

- By type, sheet based membranes are expected to retain the largest market share in 2025, supported by advancements in raw materials like modified bitumen, PVC, TPO, and EPDM offering durability, flexibility, and chemical resistance.

Key Country Highlights:

- United States: Market growth is driven by rising construction activity, investments in affordable housing, and increasing focus on building durability and sustainability.

- China: Demand is supported by rapid infrastructure development, urban expansion, and large-scale projects under the Belt and Road Initiative.

- India: Urbanization, public infrastructure expansion, and renovation projects are boosting the use of high-performance waterproofing systems.

- Germany: Growth is fueled by aging infrastructure renovation, environmental regulations, and the demand for advanced materials in modern buildings.

- Saudi Arabia: Strong demand from residential and industrial construction and participation of global manufacturers are accelerating market expansion.

Waterproofing Membrane Market Trends

Increasing Awareness about Green Roofs to Spur Market Growth

Green roofs, also known as vegetative or eco-roofs, involve the installation of vegetation over a waterproofing membrane on top of a building. This sustainable building practice is gaining popularity worldwide due to its numerous environmental, economic, and social benefits. The increasing awareness and adoption of green roofs are driving the demand for high-performance membranes, specifically designed to support these living ecosystems.

Traditional roofs contribute to runoff, which can overwhelm drainage systems and lead to flooding and water pollution. Green roofs absorb and retain rainwater, reducing the volume and slowing the rate of runoff. This helps in mitigating urban flooding and improves water quality by filtering pollutants.

The growing awareness of environmental issues and the benefits of sustainable building practices are driving the demand for green roofs. Building owners, developers, and architects are increasingly prioritizing green building certifications and sustainable design principles, leading to a rise in green roof installations.

Download Free sample to learn more about this report.

Waterproofing Membrane Market Growth Factors

Rapid Urbanization and Infrastructure Development to Boost Market Growth

Rapid urbanization is a significant driver for the global market. As the global population grows, particularly in urban areas, there is a heightened demand for residential, commercial, and industrial construction. According to the United Nations, the world’s urban population is expected to increase by 68% till 2050, adding approximately 2.5 billion people to urban areas. This massive shift necessitates substantial infrastructure development to accommodate the growing urban population, including housing, transportation networks, and public facilities.

In developing economies, the focus on improving infrastructure to support economic growth is particularly strong. China, India, and Brazil are investing heavily in infrastructure projects, such as highways, bridges, airports, and water management systems. These projects require robust waterproofing solutions to ensure longevity and functionality. For instance, China’s Belt and Road Initiative, a massive infrastructure and economic development project spanning Asia, Europe, and Africa, is anticipated to drive substantial demand for waterproofing membranes in various construction projects.

In addition to new construction, the renovation and retrofitting of existing buildings to meet modern standards also contribute to the waterproofing membrane market growth. Aging infrastructure in developed regions, such as North America and Europe necessitates significant investment in renovation projects, which often include installing or upgrading waterproofing systems. The drive to improve the energy efficiency and structural integrity of old buildings further boosts the demand for advanced waterproofing solutions.

RESTRAINING FACTORS

Volatile Raw Material Prices to Impede Market Growth

The production of waterproofing membranes involves high-quality raw materials, such as bitumen, synthetic polymers, and other specialized compounds. The costs of these materials are subject to fluctuations in global commodity markets, often leading to increased prices for the end product. The production processes for membranes are complex and require advanced machinery and technology. These processes include refining raw materials, ensuring consistent quality, and meeting stringent regulatory standards, all of which add to the overall cost.

For construction firms, especially smaller ones, the elevated costs can significantly affect the project budgets. Higher material costs can lead to increased project bids, making it difficult for these companies to remain competitive. Similarly, for property developers and owners, the high upfront investment required for quality waterproofing can deter them from incorporating these materials into their projects, potentially compromising long-term building integrity.

Government and public sector projects often operate under strict budget constraints. The high cost of membranes can limit the extent to which these materials are used in public infrastructure, affecting the durability and lifespan of public buildings and facilities.

Waterproofing Membrane Market Segmentation Analysis

By Type Analysis

Sheet Based Segment Dominates Owing to Rising Development of Advanced Raw Materials

Based on type, the market is classified into liquid applied and sheet based.

The sheet based segment held the highest share of 50.80% in 2026 and is estimated to record a significant growth rate during the forecast period. Sheet based membranes are pre-fabricated sheets of material that are applied to surfaces to prevent water ingress. Factory-produced sheets ensure uniform thickness across the membrane and are often more resistant to mechanical damage and punctures. They are further segmented into modified bitumen, thermoplastic polyolefin, EPDM, fluoropolymer sheet, fiber-reinforced polymer, PVC, and others. The development of advanced materials, such as modified bitumen, PVC, TPO, and EPDM membranes, that offer enhanced durability, flexibility, and resistance to UV radiation and chemicals is likely to propel the demand for sheet-based membranes in the region.

The liquid applied segment will register significant growth during the forecast period. The liquid waterproofing membrane is a coating applied in a liquid form that cures to form a seamless, rubber-like, elastomeric waterproof membrane. It is used in various applications, including waterproofing membranes for showers, roofs, walls, foundations, and other structures. Liquid-applied membranes provide a versatile and effective solution for many waterproofing needs, offering durability and flexibility that can adapt to a variety of conditions and surfaces. The liquid membrane waterproofing provides long-term protection, reducing maintenance costs. The demand for liquid-applied membranes is expected to grow, driven by ongoing construction activities, increased focus on building longevity, and advancements in product formulations.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Roofing Application Holds the Largest Market Share Due to Increasing Construction Activities

In terms of application, the market is segmented into roofing, walls, building structures, landfill & tunnels, and others.

The roofing segment held the largest waterproofing membrane market share of 33.42% in 2026 driven by the need for durable, efficient, and sustainable roofing solutions. Innovations in materials and application techniques and increasing construction activities globally are expected to propel the segment’s growth. Bituminous membranes are commonly used for roofing applications due to their durability and cost-effectiveness.

The walls segment is predicted to witness notable growth in the coming years. Waterproofing membranes for walls prevent water infiltration and protect building structures from moisture-related damage. This is particularly important for below-grade walls, retaining walls, and exterior walls exposed to severe weather conditions. Government and private sector investments in infrastructure projects, such as tunnels, bridges, and public buildings necessitate effective waterproofing to ensure longevity and structural integrity.

The building structures segment is expected to witness rapid growth during the forecast period. Waterproofing membranes for building structures include applications, such as foundations and basements. The segment’s growth is driven by factors, such as increased construction activity, technological advancements, regulatory requirements, and growing consumer awareness of the importance of water damage prevention. As urbanization and infrastructure development continue to rise, and as the effects of climate change become more pronounced, the demand for effective waterproofing solutions for building structures is expected to grow.

REGIONAL INSIGHTS

By region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific Waterproofing Membrane Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific dominated the market with a valuation of USD 14.24 billion in 2025 and USD 15.8 billion in 2026.. In Asia Pacific, demand for waterproofing membranes is expanding due to the growing construction sector, which includes new construction and renovation activities. The increase in industrial operations, especially in China and India, coupled with a growing population, has led to increased demand for construction and building activities, thus boosting the demand for the market. The Japan market is projected to reach USD 1.76 billion by 2026, the China market is projected to reach USD 7.82 billion by 2026, and the India market is projected to reach USD 2.71 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

North America occupies the dominant share of the global market accounting for 16% share in 2025. In North America, factors such as rising commercial real estate investments, higher consumer spending, and increased industrial activity drive the market growth of architectural membrane demand in the region. Industrial and commercial construction is growing due to increased investment in the U.S. and Canadian real estate sectors, thus favoring the region’s market growth. The U.S. market is projected to reach USD 4.68 billion by 2026.

Europe

Europe is expected to showcase significant growth in the global market share 25% in 2025. Investments in infrastructure renewal and development projects across Europe are anticipated to boost market growth. Moreover, strict building codes and environmental regulations are driving the demand for high-performance waterproofing membranes. Demand for eco-friendly membranes and systems that contribute to green building certifications, such as LEED are likely to propel the market in the region. The UK market is projected to reach USD 1.86 billion by 2026, while the Germany market is projected to reach USD 2.21 billion by 2026.

Latin America and Middle East & Africa

Latin America experiences diverse climatic conditions, including heavy rainfall and tropical climates, which necessitate robust waterproofing solutions to protect buildings and infrastructure.

Middle East & Africa is expected to showcase significant growth in the global market share 9% in 2025. The demand for waterproofing membranes in the Middle East & Africa is majorly driven by the rapid growth of the commercial building sector in Kenya, Nigeria, Egypt, and Ethiopia. In addition, considerable demand for the market is created by the ongoing construction boom in Qatar, Saudi Arabia, and the UAE.

KEY INDUSTRY PLAYERS

Key Players Adopted Acquisition and Product Development Strategies to Maintain Dominance in Market

The competitive landscape of the market is fragmented. Sika AG, GCP Applied Technologies, Asian Paints, BASF SE, and Fosroc, Inc. are some of the key players in this market. Companies have adopted strategies, such as acquisitions and product developments, to increase their customer base. For example, Sika acquired a majority stake in Index Construction Systems and Products. In acquiring Index, Sika expanded its bitumen product range and boosted its position both in the Italian regions and abroad with over 100 distributors, including South Africa. Key players are partnering with regional building and construction companies to establish their regional presence. Furthermore, leading players are focusing on offering sustainable solutions to diversify their product ranges.

List of Top Waterproofing Membrane Companies:

- Sika AG (Switzerland)

- GCP (U.S.)

- Asian Paints (India)

- BASF SE (Germany)

- Fosroc, Inc. (UAE)

- MAPEI S.p.A. (Italy)

- Pidilite Industries Limited (India)

- RPM International Inc. (U.S.)

- Dow Inc. (U.S.)

- Tremco Incorporated (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- March 2024: Mapei opened a new plant in Cantanhede, Portugal, with an investment of USD 13.89 million. The new plant has cutting-edge technology that will enable the company to expand its production capacity, increase its product range, and provide service to local customers. The new facility will have the Mapei Academy, a training facility that will organize free events for retailers, designers, installers, and companies.

- March 2023: CertainTeed and GCP, part of the Saint-Gobain Group, introduced their new integrated commercial waterproofing system that protects all six sides of a building.

- August 2021: Tremco Incorporated launched spray applied waterproofing system S5 - Spray Applied Hybrid Polyurea system. TREMproof Micorea S5 is a 100% solid, flexible, two-component spray-applied hybrid polyurea system designed for waterproofing and coating application for concrete, metal, and other substrates. It is applied to a wide variety of applications on different substrates, such as concrete, metal, plastics, and others with appropriate primers.

REPORT COVERAGE

The report provides a detailed analysis of the market. It focuses on key aspects, such as leading companies, types, compositions used to produce these products, and end-use industries of the product. Besides this, it offers insights into the market and current industry trends and highlights key industry developments. In addition to the factors mentioned above, it encompasses several factors contributing to the market's growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) and Volume (Kiloton) |

|

Growth Rate |

CAGR of 5.70% from 2026 to 2034 |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global waterproofing membrane market size was valued at USD 32.44 billion in 2025 and is projected to reach USD 53.33 billion by 2034, growing at a CAGR of 5.70% during the forecast period.

Recording a CAGR of 5.70%, the market will exhibit steady growth during the forecast period of 2026-2034.

The key drivers include rapid urbanization, increasing infrastructure development, and the rising demand for durable and energy-efficient construction. Additionally, green roofing systems and government investment in sustainable buildings are boosting adoption.

Asia Pacific dominated the waterproofing membrane market with a market share of 44% in 2025.

The market is categorized into sheet-based and liquid-applied membranes. Sheet-based membranes (like modified bitumen, PVC, EPDM) lead the market due to their durability and ease of installation, while liquid-applied types offer seamless coverage and flexibility.

Waterproofing membranes are widely used in roofing, walls, building structures, tunnels, and landfills. The roofing segment leads due to the rising need for sustainable, weather-resistant roofing systems.

The market is seeing a surge in demand for eco-friendly and recyclable membranes that contribute to LEED and green building certifications. The adoption of green roofs is also fueling demand for specialized waterproofing solutions.

Volatile raw material prices and the high upfront costs of advanced membranes are key challenges. These factors affect construction budgets, especially in public infrastructure and small-scale developments.

Top companies include Sika AG, BASF SE, Asian Paints, GCP (U.S.), Fosroc Inc., MAPEI S.p.A., and RPM International Inc. These players focus on acquisitions, product innovation, and sustainable solutions to maintain market leadership.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us