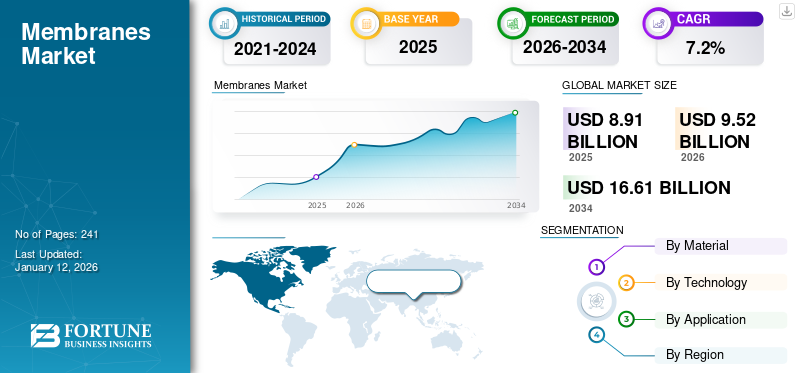

Membranes Market Size, Share & Industry Analysis, By Material (Polymeric, Ceramic, and Others), By Technology (RO/FO, UF, NF, MF, and Others), By Application (Water & Wastewater Treatment, Food & Beverage, Gas Separation, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global membranes market size was valued at USD 8.91 billion in 2025. The market is projected to grow from USD 9.52 billion in 2026 to USD 16.61 billion by 2034, exhibiting a CAGR of 7.20% during the forecast period. Asia pacific dominated the membranes market with a market share of 38% in 2025.

Membranes are barrier films that allow the passing of selected molecules and particles depending on their size. In other words, they are semi-permeable. On the basis of size, technologies, such as MF (microfiltration), UF (ultrafiltration), NF (nanofiltration), and others, are used for a variety of applications depending upon the size of substrates to be separated. Microfiltration and Ultrafiltration are among the first large-scale applications of these barrier films and are being used in many water treatment plants globally. These barrier films are manufactured using natural or synthetic polymers or sintering metallic powders, ceramics, or zeolites. Ceramic ones are highly inert and are preferentially used in highly acidic and basic environments. Zeolite barrier films are preferred in gas separation processes due to their uniform pore distribution.

Leading companies are significantly investing in the regional market to stay ahead of increasing competition. For instance, in January 2021, SUEZ SA completed the asset purchase of LANXESS's Reverse Osmosis (RO) membrane product line. With this acquisition, SUEZ added a new RO membrane technology to its portfolio. This will strengthen the Water Technologies & Solutions division's offering and allow SUEZ to provide customers with even more help in water treatment. TORAY INDUSTRIES, INC., DuPont, Pentair plc, and Hydranautics are the key players operating in the market.

Membranes Market Trends

Increasing Adoption in Pharmaceutical Industry to Drive Market Development

There has been a rapid technological advancement in the pharmaceutical and biomedical industries in recent years. Be it the recovery of valuable intermediate or substrate or reducing the concentration of the effluent stream, they have an important application in the industry. Nano-filtration and pervaporation processes are generally used to reduce the harmful constituents in the effluent stream in the pharmaceutical industry. Nanofiltration barrier films are generally employed to remove dyes, colors, BOD/COD, endocrine disruptors, medicinal residue, microplastics, and other impurities. Increasing rules and regulations associated with wastewater treatment and pre-treatment effluents are expected to surge the product demand.

The manufacturing of biopharmaceuticals is highly regulated, with strict quality requirements and sanitary standards. Single-use technologies reduce cross-product contamination, minimize operation costs, improve quality, and reduce process time. Single-use filtration membranes and cartridges have become standard equipment for the processing of pharmaceuticals, biotechnology, food, and other regulated industries. These products have enabled end-users to achieve regulatory compliance for their processes at a cheaper cost.

Download Free sample to learn more about this report.

Market Dynamics

Market Drivers

Scarcity of Fresh Drinking Water to Fuel Market Growth

Freshwater for drinking is an essential element for the survival of human life. With a rapid increase in population, the water crisis has only worsened, and it has become the need of the hour to use available resources efficiently. Advancements in technology have reduced the tension on existing freshwater resources. Seawater can now be converted to potable water using this technology. Desalination plants using this technology have become a boon for people and countries where water resources are limited. For instance, in regions such as the Middle East and Africa, people have a large dependency on desalination plants for many activities, including farming, industrial, and day-to-day requirements. As the population is rising globally, the water crises are getting worse, and it is evident from the increasing number of desalination projects that this technology is evolving as a game-changer. Moreover, an increasing number of household water purifiers based on this technology also significantly contribute to consumption. Furthermore, the shift from the chemical treatment of water to the adoption of physical methods, strict regulations on water treatment, and changing climate conditions are fueling the demand for products.

Rising Aquatic Pollution to Drive Market Growth

Water scarcity due to severe pollution levels has hampered the quality of water resources. The majority of the population in developing economies is exposed to harmful water pollutants, such as pesticides, dyes, heavy metals, antibiotics, and microbiological contaminants. In recent years, membrane separation technologies have gained a lot of attention due to their high efficiency, high degree of automation, low emissions, and small carbon footprint. Various market products, such as nanofiltration, microfiltration, and electrodialysis products, have been deployed for wastewater treatment, municipal sewage recovery, desalination, and water purification.

Industries contribute to a large amount of water pollution, and with urbanization & rapid industrialization in developing countries, the strain on water resources has significantly increased. The rising environmental concerns have compelled lawmakers to frame stringent industry discharge norms to curb water pollution. Many industries use this technology to reduce the severity and level of pollutants in their discharge streams to comply with the norms. The concept of zero discharge is relatively new, and products play a pivotal role in achieving zero liquid discharge (ZLD), thus reducing the environmental impact of industries. As industrialization continues to strive in the development process, reducing the impact is the only way to maintain sustained growth. These factors are driving the membranes market growth.

MARKET RESTRAINTS

Fouling Results in Frequent Replacements to Affect Membrane Adoption

Fouling is a major problem, and it has adverse effects on its operations. It decreases its efficiency and flux, resulting in increased energy consumption and spoiling the water or stream quality. Chemical cleaning or replacements are the only options (both require considerable expenses) to eliminate fouled products. Considering these costs, applications and their adoption are confined to specific industries, thus affecting the market growth.

MARKET OPPORTUNITIES

Rising Demand for Pharmaceutical Industry Opens New Avenues for Market Growth

The global pharmaceutical industry is expanding steadily as people live longer, need more medical care, and rely on a wider range of medicines. This growth increases the need for clean and safe production environments, where water must be purified at a very high level. As pharmaceutical companies work to improve product quality and meet strict safety standards, they increasingly depend on membrane systems to support their manufacturing processes. This wider use of purification units creates strong opportunities for the market, especially in regions investing heavily in healthcare.

The World Health Organization (WHO) notes that the demand for medicines continues to rise across both developed and developing countries due to growing populations and a higher number of chronic illnesses. As more medicines enter the market, more facilities are required to maintain clean production conditions, which strengthens the need for dependable water purification systems. Membrane solutions help support this expansion by providing clean water that meets pharmaceutical-grade requirements, helping companies produce safer and more consistent products. Many governments are also increasing investments in healthcare systems, which boosts pharmaceutical manufacturing. The United Nations Industrial Development Organization (UNIDO) highlights that several countries are building new pharma plants to reduce dependency on imported medicines. These new plants, making membrane technology an important part of facility planning.

MARKET CHALLENGES

Capital-Intensive Infrastructure Requirements May Hurdle Market Growth

Large-scale reverse osmosis (RO) and nanofiltration (NF) systems entail significant capital investment due to the need for specialized pumps, robust housings, advanced instrumentation, pre-treatment units, and energy recovery devices. The complexity of integrating these components into existing industrial or municipal facilities further escalates costs and technical challenges. Such integration requires comprehensive engineering modifications to ensure optimal system performance and compatibility with legacy infrastructure.

Upgrading aging plants or municipal water systems to accommodate advanced membrane technologies typically involves extended investment horizons, often spanning multiple years. This protracted timeline can delay the market adoption of membrane solutions, posing a significant barrier for stakeholders and slowing overall industry growth. The substantial upfront capital requirements and lengthy implementation cycles remain critical factors influencing strategic decision-making within the membrane market.

Segmentation Analysis

By Material

Cost-Effectiveness Offered by Polymeric Materials to Boost Segment Growth

Based on the material, the market is segmented into polymeric, ceramic, and other materials.

Among these segments, the polymeric segment held the largest market share of 79.94% in 2026. Global demand for polymeric products is rising as countries intensify investments in modern water treatment and desalination systems to mitigate scarcity, contamination, and tightening environmental norms. These products remain preferred due to their adaptable designs, moderate operating costs, and compatibility with widespread municipal upgrades. Moreover, improvements in thin-film composite architecture are enabling higher flux, improved fouling resistance, and better long-term stability, making polymeric systems suitable for sustained utility performance. Additionally, expanding adoption in emerging economies, driven by urbanization and regulatory reform, is accelerating project deployments, reinforcing the global prominence of polymeric products across municipal and industrial treatment landscapes globally.

Global adoption of ceramic products is accelerating as industries require filtration systems capable of enduring corrosive, abrasive, and high-temperature environments. Their extended service life reduces downtime, making them attractive for petrochemical, mining, and chemical-processing operations. Moreover, expansion of bioprocessing, microelectronics, and precision materials is increasing reliance on market products that deliver stable, reproducible separation performance. Furthermore, global sustainability programs promoting water reuse and stricter effluent standards are encouraging industries to adopt durable ceramic platforms that maintain reliability across diverse operating conditions and demanding industrial applications worldwide, ensuring continued growth across global markets.

Other materials used include metal, carbon, zeolites, and liquid membranes. Metal-based products are used in GS and membrane reactors. Zeolites find their applications in products used in membrane reactors, gas separation, solid-state batteries, and water desalination.

By Technology

RO/FO Technology to Retain its Dominance in Future Owing to Wide Adoption

Based on technology, the market is classified into RO/FO, UF, NF, MF, and others.

RO/FO segment held the largest market share of 40.13% in 2026. RO/FO technology is the most widely used and cost-effective technology and is expected to grow during the forecast period due to its high adoption in water and wastewater treatment. Besides, it has healthy adoption in industrial applications, ensuring its sound growth in the industry. As water crises continue to escalate, RO system technology is poised to grow the fastest in the market.

Microfiltration (MF) products are experiencing rising global demand as industries and utilities increasingly require reliable removal of suspended solids, pathogens, and fine particulates to ensure stable water quality across treatment chains. MF systems are widely used in food processing, beverage clarification, and biopharmaceutical operations where consistent microbiological control is essential.

Nanofiltration (NF) products are experiencing expanding global demand as industries increasingly require targeted removal of divalent ions, color compounds, and medium-sized organic molecules within moderate pressure ranges. NF is widely adopted for partial softening, dye purification, and advanced wastewater polishing where selective retention delivers operational advantages.

The other segments include ion-exchange technology, pervaporation, dialysis, and electrodialysis. The growth of the segment is driven by a rise in awareness of water and wastewater treatment due to depleting levels of freshwater sources and the need for selective separation to meet quality standards. Furthermore, sustainability policies pertaining to the environment are supporting the segment's growth.

By Application

Increasing Need for Clean Water to Boost Growth of Water & Wastewater Treatment Segment

By application, the market is classified into water & waste treatment, food & beverage, gas separation, and others.

The water & wastewater treatment segment dominated the market with a share of 56.72% in 2026 and is anticipated to retain its position during the forecast period. The rising water pollution due to rapid industrialization and urbanization is the key factor driving the segment’s growth. Water & wastewater treatment has been the primary purpose for developing market products. Later, with the evolution of technology, the applications extended into various industries, including food & beverage, pharmaceutical, biomedical, and others. With depleting water resources, purification technologies have become promising technologies to supply and fulfill potable water needs.

Food & beverage accounts for the second largest share in the global market. The rising disposable income, combined with shifting consumer preference toward processed foods and strict food safety regulations, are the major factors influencing the food & beverage segment's growth. The increasing demand for products for carbon capture is expected to drive the growth of the gas separation segment.

The other segments include pharmaceutical, biomedical, and other industries. The primary growth factor for the segment is the rapid growth of the biopharmaceutical and pharmaceutical industries. Furthermore, the incorporation of single-use membrane technologies due to cost-efficiency is supporting the segment growth.

To know how our report can help streamline your business, Speak to Analyst

MEMBRANES MARKET REGIONAL OUTLOOK

Regionally, the market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific dominated the market with a valuation of USD 3.39 billion in 2025 and USD 3.64 billion in 2026. Asia Pacific dominated the membranes market share in 2024 on the back of China, Japan, India, Australia, and several other Southeast Asian countries. Emerging economies, such as India and China, are the most promising markets in terms of growth. China accounted for the largest share of the Asia Pacific market in 2024. The growth is primarily attributed to the increasing number of regulations pertaining to the protection of natural water bodies. China revised existing laws and acted to accommodate the changing climatic conditions and water scarcity levels, such as the Water Pollution Prevention and Control Law and Environmental Protection Law. In India, the city of Chennai already has two desalination plants, each with a capacity of 100 million liters per day (MLD). The third plant, with a capacity of 150 MLD, was announced in 2019 by the local government and is set to begin operations in 2024. These initiatives are expected to generate good business for the market over the foreseeable period and beyond. Japan is the leading producer of market products in the world, and as per WIPO data, the country also leads in the intellectual rights for a majority of the products. The Japan market is valued at USD 0.34 billion by 2026, the China market is valued at USD 1.6 billion by 2026, and the India market is valued at USD 0.65 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

The North American market is shaped by stringent water-quality regulations, aging infrastructure, and rapid adoption of advanced purification technologies across municipal and industrial sectors. The U.S. is driving demand through PFAS mitigation, water reuse initiatives, and investment in high-specification filtration for microelectronics, pharmaceuticals, and power generation. Canada emphasizes sustainability-led upgrades and industrial compliance, strengthening membrane integration across process industries. Growth is reinforced by federal incentives supporting clean hydrogen, biogas upgrading, and carbon-management projects, which accelerate adoption of high-selectivity membrane systems. Overall, North America’s market expansion is strongly tied to regulatory enforcement, infrastructure modernization, and energy-transition investments. The U.S. market is valued at USD 2.05 billion by 2026.

Europe

Rigorous environmental regulations, circular-water initiatives, and high-value industrial applications strongly influence Europe’s market. EU directives targeting nutrient removal, micropollutants, and water reuse push utilities toward advanced barrier technologies. Industrial clusters in Germany, France, Italy, and the Netherlands utilize products for pharmaceuticals, specialty chemicals, dairy processing, and high-purity manufacturing. Southern Europe drives adoption via desalination and water-security programs. The UK market is valued at USD 0.31 billion by 2026, while the Germany market is valued at USD 0.45 billion by 2026.

Latin America

Latin America’s market growth is driven by water scarcity, modernization of municipal treatment networks, and rising industrial compliance requirements. Countries such as Brazil, Mexico, and Chile are investing in advanced treatment to address contamination issues, aging facilities, and increasing urban demand. Mining corridors in Peru and Chile require durable and selective membrane systems for metal-laden wastewater and process-water recovery.

Middle East & Africa

Middle East & Africa’s market is deeply shaped by extreme water scarcity, desalination dominance, and expanding industrial corridors. Gulf nations particularly Saudi Arabia, UAE, Oman, and Qatar continue to invest in massive potable-water systems and wastewater reuse frameworks, making products indispensable.

Key Industry Players

Key Players to Focus on Expanding their Existing Production Capacities

The global market is highly fragmented, with over several 1000 membrane manufacturers and integrators. China alone has more than 1000 manufacturers. The market is quite competitive and has a tight supply. The purchasing power of a buyer is far greater than the seller. However, players such as DuPont, Toray Industries, KOCH, GE, and others have recognizable shares in the market. Research and development of innovative technologies hold an important place for the players. As a result, players spend healthy amounts of their revenue on R&D activities.

LIST OF TOP MEMBRANES COMPANIES PROFILED:

- TORAY INDUSTRIES, INC. (Japan)

- DuPont (U.S.)

- SUEZ (France)

- Kovalus Separation Solutions (U.S.)

- Pentair plc (U.S.)

- TOYOBA (Japan)

- Hydranautics – A Nitto Group Company (U.S.)

- Pall Corporation (U.S.)

- Seccua GmbH (Germany)

- Synder Filtration (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- September 2025: Pall introduced its Membralox GP-IC ceramic membrane system, which uses a special “graduated permeability” design to improve filtration. It is mainly used in the food and beverage sector, where recovering valuable products from process streams is becoming more important.

- August 2025: Hydranautics introduced the ESNA5-LD membrane, designed to remove organic contaminants more efficiently while using less energy. This reflects the company’s focus on developing RO and NF products that handle challenging water conditions with better sustainability.

- March 2024: TORAY INDUSTRIES, INC. announced that it has developed a new reverse osmosis membrane. The newly launched product enables to save water, offers double chemical resistance and halves replacement and carbon dioxide

- September 2021: Synder announced the opening of a new sales office in its Vacaville, California headquarters. The Technical Sales Team and Project Engineers will operate in the 2600 sq. ft. office space, which is part of the 53,000 sq. ft. R&D center, system fabrication, and production facility.

- April 2021: KOCH Separation Solutions unveiled the addition of its new technology named INDU-COR HD (High Density) to its tubular membrane range, which is developed to treat industrial waste streams efficiently. INDU-COR HD has a 300% higher packing density than standard INDU-COR, making crossflow filtration more cost-effective while taking up less space. This new product configuration boosts operating efficiency and sustainability while lowering waste treatment costs for clients.

REPORT COVERAGE

The market report includes both qualitative as well as quantitative data in regards with the global market. Quantitative insights cover the global market value in USD billion across each segment, sub-segment, and region profiled in the scope of the study. Moreover, this research report provides market shares in 2024, growth rates of all segments & sub-segments, and key countries across each region. Qualitative data provide detailed analysis of key drivers, restraining factors, potential growth opportunities, and key market trends related to the market. The competitive landscape chapter highlights the detailed company profiles of the market players present in this market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 7.20% during 2026 to 2034 |

|

Segmentation |

By Material, Technology, Application, and Region |

|

By Material |

· Polymeric · Ceramic · Others |

|

By Technology |

· RO/FO · MF · UF · NF · Others |

|

By Application |

· Water & Wastewater Treatment · Food & Beverage · Gas Separation · Others |

|

By Region |

· North America (By Material, By Technology, By Application, and By Country) o U.S. (By Application) o Canada (By Application) · Europe (By Material, By Technology, By Application, and By Country) o Germany (By Application) o U.K. (By Application) o France (By Application) o Italy (By Application) o Spain (By Application) o Russia (By Application) o Rest of Europe (By Application) · Asia Pacific (By Material, By Technology, By Application, and By Country) o China (By Application) o India (By Application) o Japan (By Application) o South Korea (By Application) o Australia (By Application) o Rest of Asia Pacific (By Application) · Latin America (By Material, By Technology, By Application, and By Country) o Brazil (By Application) o Mexico (By Application) o Rest of Latin America (By Application) · Middle East & Africa (By Material, By Technology, By Application, and By Country) o Saudi Arabia (By Application) o UAE (By Application) o Kuwait (By Application) o Qatar (By Application) o Rest of the Middle East & Africa (By Application) |

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 8.91 billion in 2025 and is projected to reach USD 16.61 billion by 2034.

The global market is expected to grow at a compounded annual growth rate (CAGR) of 7.20% during the forecast period.

In 2025, the water & wastewater treatment segment leading application segment in the market.

The scarcity of fresh drinking water is the key factor driving the market growth.

DuPont, Toray, KOCH, GE, Suez, and others are the major companies in the global market.

Asia Pacific dominated the global market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us