Anticoagulation Monitoring Devices Market Size, Share & Industry Analysis, By Device Type (PT-INR Testing Devices, Activated Clotting Time (ACT), and Activated Partial Thromboplastin Time (aPTT)), By End-user (Hospitals & Clinics, Homecare, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

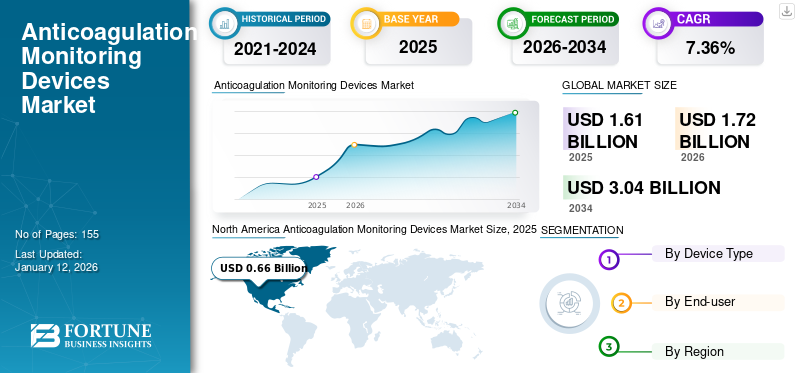

The global anticoagulation monitoring devices market size was valued at USD 1.61 billion in 2025. The market is projected to grow from USD 1.72 billion in 2026 to USD 3.04 billion by 2034, exhibiting a CAGR of 7.36% during the forecast period. North America dominated the anticoagulation monitoring devices market with a market share of 41.26% in 2025.

Anticoagulation monitoring involves the use of a portable instrument specifically designed to measure the efficacy of anticoagulation therapy. These devices allow for convenient and rapid monitoring of anticoagulation levels, playing a crucial role in reducing complications and improving patient outcomes. The device offers benefits such as dose adjustment, faster turnaround time, and superior convenience. The growth of the anticoagulation monitoring devices market is attributed to the growing incidence of cardiovascular conditions, a considerable occurrence of bleeding disorders, technological advancements, and the introduction of anticoagulant drugs.

- For instance, according to data published by the American College of Cardiology Foundation, in 2022, an estimated 315 million cases of coronary artery disease (CAD) were observed globally.

Some of the key players in the market include Werfen, Helena Diagnostics Corporation, and Medtronic. The companies are focusing on strategic collaborations, agreements, and the introduction of new products to expand their market share.

Global Anticoagulation Monitoring Devices Market Overview & Key Metrics

Market Size & Forecast:

- 2025 Market Size: USD 1.61 billion

- 2026 Market Size: USD 1.72 billion

- 2034 Forecast Market Size: USD 3.04 billion

- CAGR: 7.36% from 2026–2034

Market Share:

- North America dominated the anticoagulation monitoring devices market with a 41.26% share in 2025, driven by the high prevalence of cardiovascular diseases, robust healthcare infrastructure, and advanced reimbursement systems.

- By device type, PT-INR testing devices are expected to retain the largest market share due to their ability to reduce adverse clotting events, provide superior patient care, and deliver rapid results.

Key Country Highlights:

- United States: Growth is driven by the aging population, widespread use of warfarin therapy, and increased adoption of remote INR monitoring tools supported by telehealth expansion.

- Europe: The market is expanding due to rising demand for technologically advanced coagulation monitoring devices and continuous product introductions enhancing diagnostic capabilities.

- China: Increasing prevalence of stroke and thromboembolic disorders, coupled with expanding healthcare infrastructure and rising awareness regarding cardiovascular risk, supports market growth.

- Japan: The rapidly aging population and increasing focus on non-invasive coagulation monitoring solutions are propelling demand for advanced point-of-care devices in healthcare settings.

MARKET DYNAMICS

Market Drivers

Rising Burden of Cardiovascular Diseases Coupled with Bleeding Disorders to Boost Market Growth

The global healthcare ecosystem is witnessing a considerable rise in cardiovascular conditions. Certain factors, such as a sedentary lifestyle, physiological factors, and nutritional deficiencies, are responsible for the occurrence of cardiovascular conditions. Some of the cardiovascular conditions, such as heart failure and congenital heart disease, are directly associated with bleeding disorders, leading to a surge in demand for anticoagulation monitoring devices. Moreover, the prevalence of bleeding disorders is also projected to grow, further propelling the global anticoagulation monitoring devices market growth.

- For instance, according to data published by the Centers for Disease Control and Prevention in July 2023, the prevalence of hemophilia in the U.S. is estimated at around 12 males per 100,000 cases. Moreover, according to the same source, an estimated 1 birth per 5,617 males is susceptible to hemophilia.

Additionally, increasing awareness among healthcare professionals and patients about the importance of maintaining therapeutic INR (International Normalized Ratio) levels has elevated the clinical need for regular monitoring. Furthermore, supportive reimbursement policies in developed countries and expanding access to healthcare services in emerging regions are also estimated to foster the global market expansion during the forecast period.

Market Restraints

High Cost of Anticoagulation Monitoring Devices to Deter Market Growth

The high cost of point-of-care and home-based anticoagulation monitoring devices is one of the key factors deterring the growth of the market. Many patients, especially in low- and middle-income countries, find it difficult to afford these devices due to limited healthcare coverage or out-of-pocket payment requirements.

- For instance, the cost of analyzers for PT/INR testing ranges from USD 300 to USD 3,000, while test strips range from USD 7 to USD 18 per test.

The initial cost of purchasing the device, along with the recurring expenses of test strips and calibration supplies, can be financially burdensome for long-term users. Even in developed countries, inconsistent reimbursement policies across healthcare systems further discourage widespread adoption, thereby hampering market growth.

Market Opportunities

Rising Prevalence of Cardiovascular Diseases to Support Industry Development

The global market for anticoagulation monitoring devices is witnessing steady growth, primarily driven by the rising prevalence of cardiovascular diseases, atrial fibrillation, and venous thromboembolism. Along with these factors, continual research and development activities are leading to the production of advanced products that are capable of providing accurate results within a minimal turnaround time.

- For instance, in April 2024, HemoSonics received FDA approval for its Quantra hemostasis analyzer, which offers comprehensive blood analysis associated with bleeding disorders. Along with bleeding disorders, the analyzer can also be used for venous and arterial blood samples in cardiac patients.

Moreover, technological advancements have fueled adoption by making devices more compact, user-friendly, and integrated with digital health platforms, allowing for real-time data sharing and remote patient management.

Market Challenges

Lack of Standardization in PT/INR Testing Poses Significant Market Challenge

The lack of standardization in International Normalized Ratio (INR) testing is the major challenge hampering the market's growth. INR is a crucial metric for patients undergoing warfarin therapy. However, inconsistencies often arise due to reagent variations, calibration methods, and device sensitivity. This variation can lead to misinterpretation of results, increasing the risk of bleeding or thromboembolic events.

In addition, the problem is further exacerbated in regions with fragmented healthcare infrastructure, where the implementation of standard protocol testing is limited. This lack of standardization damages the clinical utility of anticoagulation monitoring devices and obstructs widespread adoption.

Anticoagulation Monitoring Devices Market Trends

Rise in Usage of Direct Oral Anticoagulants (DOACs) to Drive Demand for New Monitoring Approaches

A notable trend shaping the anticoagulation monitoring landscape is the rising use of Direct Oral Anticoagulants (DOACs), such as apixaban, rivaroxaban, and dabigatran. Unlike warfarin, DOACs offer fixed dosing and fewer dietary or drug interactions, which traditionally reduces the need for routine monitoring. Moreover, regulatory bodies and clinicians are showing increased interest in precision medicine, which further propels the need for occasional but accurate monitoring of DOAC therapy.

Download Free sample to learn more about this report.

Impact of COVID-19

The COVID-19 pandemic had a dual impact on the anticoagulation monitoring devices market, driving both positive and negative outcomes. The market observed a sharp increase in demand for anticoagulation therapy due to the prothrombotic nature of severe COVID-19 infections, especially among hospitalized patients. This resulted in heightened usage of heparin and warfarin, thereby creating a surge in the need for regular coagulation monitoring

- In December 2023, a group of researchers at the São Paulo Research Foundation published a study that proves that severe COVID-19 exhibits strong thrombotic characteristics. The study also highlighted that several patients experienced impaired lung vascularization, leading to blood capillaries and thrombosis.

In terms of negative impact, lockdowns and mobility restrictions severely disrupted access to centralized testing facilities, prompting a shift toward decentralized and home-based INR monitoring solutions.

Segmentation Analysis

By Device Type

PT-INR Testing Devices Led the Market Due to Their Superior Patient Care

Based on device type, the market is classified into PT-INR testing devices, Activated Clotting Time (ACT), and Activated Partial Thromboplastin Time (aPTT). The PT-INR testing devices segment dominated the market due to its benefits, such as reduction in blood clotting adverse events, superior patient care, and rapid results. Moreover, technological advancements in PT-INR testing devices are also estimated to have a positive impact on the growth of the segment during the forecast period.

- For instance, in July 2023, ARKRAY USA, Inc., in collaboration with CoaguSense, Inc., announced the launch of a new PT/INR monitoring system. The newly launched system is capable of providing improved operational efficiency for PT/INR testing.

Activated Clotting Time (ACT) devices held a considerable market share and are projected to register the second-largest CAGR over the forecast period. The growing incidence of bleeding disorders, coupled with rising emphasis on anticoagulant therapies, is likely to have a positive impact on the segment growth.

By End-user

Hospitals & Clinics Segment to Dominate Due to Availability of Advanced Devices

Based on end-user, the market is divided into hospitals & clinics, homecare, and others. The hospitals & clinics segment leads and is estimated to hold a substantial global anticoagulation monitoring devices market share during the forecast period. Certain factors, such as the availability of advanced devices, substantial investments, and adequate resources to deal with complicated situations, are driving the growth of the hospitals & clinics segment in the global market.

The homecare segment is projected to register considerable CAGR in the coming years, owing to increased patient convenience and the launch of advanced analyzers. Moreover, growing awareness about the product is also estimated to have a positive impact on segment growth.

- For instance, in July 2024, Perosphere Technologies Inc. entered into a strategic agreement with CoRRect Medical GmbH to supply its Point-of-Care (PoC) Coagulometer in the German market. This agreement would help Perosphere Technologies Inc. to expand its customer base.

ANTICOAGULATION MONITORING DEVICES MARKET REGIONAL OUTLOOK

By geography, the market is categorized into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

North America

North America Anticoagulation Monitoring Devices Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 0.66 billion in 2025 and USD 0.71 billion in 2026. This dominance is due to the high prevalence of cardiovascular diseases, robust healthcare infrastructure, and advanced reimbursement systems. The U.S. accounts for the majority share, which is attributed to the aging population and widespread use of warfarin therapy, particularly for cardiac and blood conditions.

- For instance, according to data published in the Journal of Cardiac Failure in 2024, an estimated 6.7 million Americans over the age of 20 years suffer from heart failure (HF). Additionally, the prevalence of HF is likely to rise to 11.4 million by 2050 in the country.

Canada is also witnessing notable growth due to the increased adoption of remote INR monitoring tools, which is prominently driven by telehealth expansion and improved patient access to diagnostics in rural areas. Moreover, the rising prevalence of cardiovascular and bleeding disorders is also estimated to augment market growth during the forecast period.

Europe

Europe held a substantial share in 2024, owing to rising demand for technologically advanced coagulation monitoring and testing devices, coupled with robust healthcare infrastructure. Furthermore, the growing number of product introductions is also projected to have a positive impact on the market growth.

- In February 2022, HORIBA UK Limited showcased its new product, Yumizen G1550, in the U.K. It is an automated hemostasis analyzer capable of effective assessment and screening of bleeding disorders.

Asia Pacific

The market in Asia Pacific is expected to witness the highest CAGR during the forecast period. The growth is attributed to increasing incidences of stroke, heart failure, and other thromboembolic disorders, particularly in rapidly aging populations such as Japan, China, and South Korea. The rising awareness regarding cardiovascular risk and the expansion of healthcare infrastructure are also contributing significantly to the demand for both hospital-based and home-use coagulation monitoring devices.

- In October 2021, Trivitron Healthcare announced the launch of its new coagulation analyzer, which is manufactured by Diagon Ltd. The product line enhances decision-making and broadens the scope of patient management.

Latin America and Middle East & Africa

The Latin American market is expected to grow at a considerable CAGR during the forecast period. Certain factors, such as the rising prevalence of cardiac conditions and growing investments in the consolidation of healthcare infrastructure, are expected to drive market growth. The Middle East & Africa region is also expected to witness steady market growth due to active government involvement in better patient care and growing demand for cutting-edge coagulation analyzers.

- In January 2025, Sysmex America, Inc. announced its plan to install a new reagent manufacturing, distribution, and service center in Brazil. The new facility will be built to provide full operational support to the existing Sysmex facility in the region.

COMPETITIVE LANDSCAPE

Key Industry Players

Market Players Focus on Investing in R&D Activities to Boost Their Market Share

The global anticoagulation monitoring devices market is dominated by major players such as Werfen, Helena Diagnostics Corporation, and Sysmex, which together account for a majority of the market share in 2024.

The share of these companies is attributed to their focus on developing new technology, substantial geographical presence, and massive investments in research & development activities. In addition, emphasis on inorganic strategies such as partnerships and collaborations is also assisting companies to boost their market share.

- For instance, in February 2021, Sysmex Corporation and Siemens Healthineers announced the renewal of agreements between the duo about distributorship, supply, sales, and service. The agreement includes a series of automated blood coagulation analyzers.

Other companies operating in the global market include Abbott, F. Hoffmann-La Roche AG, Siemens Healthineers AG, and other small & medium-sized players. These companies focus on geographical expansion and product launches, and others to improve their market presence

LIST OF KEY ANTICOAGULATION MONITORING DEVICE COMPANIES PROFILED

- Werfen (Spain)

- Helena Diagnostics Corporation (U.S.)

- Abbott (U.S.)

- Hoffmann-La Roche AG (Switzerland)

- Siemens Healthineers AG (Germany)

- Koninklijke Philips N.V. (Netherlands)

- HORIBA, Ltd. (Japan)

- Sysmex (Japan)

KEY INDUSTRY DEVELOPMENTS

- March 2021: Takeda and Enzyre entered into a strategic partnership to develop and commercialize an at-home coagulation monitoring device capable of detecting blood disorders, including hemophilia.

- December 2020: Coagulo Medical Technologies raised USD 6.5 million through rounds of series funding. This funding was utilized for the development of new instruments by incorporating new technology for anticoagulation monitoring.

- July 2020: Enzyre raised USD 1.6 million through rounds of series funding to enhance its portable coagulation monitoring device. The funding has been provided by Corona Bridge Loan.

- April 2019: CoaguSense, Inc., received FDA approval for its second-generation PT/INR monitoring system. The new product allows monitoring of Coumadin and provides results to connected devices through Bluetooth technology.

- March 2019: HemoSonics received De Novo classification for its point-of-care coagulation device, Quantra QPlus.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.36% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Device Type

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 1.72 billion in 2026 and is projected to reach USD 3.04 billion by 2034.

In 2025, the market value stood at USD 1.61 billion.

The market is expected to exhibit a CAGR of 7.36% during the forecast period of 2026-2034.

By device type, the PT-INR testing devices segment led the market.

The key factors driving the market are the increasing burden of bleeding disorders and the introduction of new products.

Werfen, Helena Diagnostics Corporation, Medtronic, and Sysmex are the top players in the market.

North America dominated the anticoagulation monitoring devices market with a market share of 41.26% in 2025.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us