Antimicrobial Additives Market Size, Share & Industry Analysis, By Type (Organic and Inorganic), By Application (Plastics, Paints & Coatings, Pulp & Paper, and Others), By End-use Industry (Healthcare, Packaging, Food & Beverage, Construction, Automotive, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

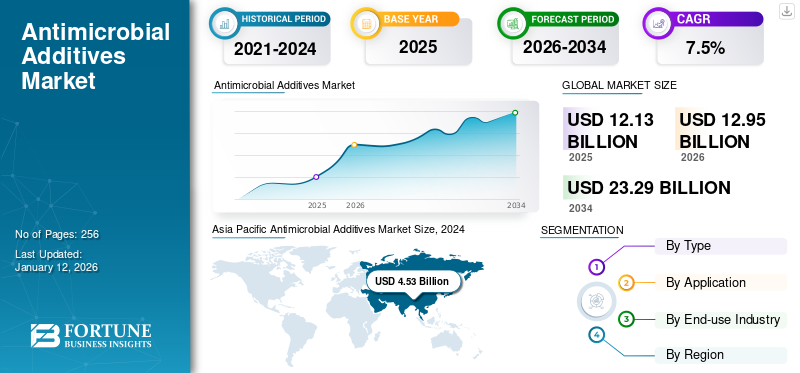

The global antimicrobial additives market size was valued at USD 12.13 billion in 2025. The market is projected to grow from USD 12.95 billion in 2026 to USD 23.29 billion by 2034 at a CAGR of 7.5% during the forecast period of 2026-2034. Asia Pacific dominated the antimicrobial additives market with a market share of 40.06% in 2025.

Antimicrobial additives are substances or materials that are added to the products to stop the growth of microorganisms, such as bacteria, algae, fungi, and mold. These additives prevent these microorganisms from reproducing and growing on surfaces, thereby increasing the product's lifespan, preserving its appearance, and ensuring its cleanliness and safety. The product can be utilized in a variety of applications, including plastics, textiles, paints, coatings, medical devices, and construction materials, to give protection against long-lasting antimicrobial properties.

Global Antimicrobial Additives Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 12.13 billion

- 2026 Market Size: USD 12.95 billion

- 2034 Forecast Market Size: USD 23.29 billion

- CAGR: 7.5% from 2026–2034

Market Share:

- Asia Pacific dominated the antimicrobial additives market with a 39.77% share in 2024, driven by the rapid expansion of industries such as packaging, healthcare, and food & beverages in countries like China, India, Thailand, and Singapore, along with growing government investments in healthcare infrastructure.

- By type, the inorganic segment is expected to retain the largest market share in 2025, due to its strong presence in the healthcare industry and its proven effectiveness in combating pathogens.

Key Country Highlights:

- United States: Increasing consumer awareness of hygiene and stringent regulations are promoting the use of antimicrobial additives in healthcare and food packaging. Technological advancements and product innovation are further driving market growth.

- China & India: Massive industrialization and urbanization in Asia Pacific, especially in China and India, along with government-backed healthcare improvements, continue to fuel high demand for antimicrobial products.

- Europe: Stringent regulatory standards in construction and healthcare sectors, aligned with hygiene and safety concerns, support the steady adoption of antimicrobial solutions.

- Japan: The country’s mature healthcare infrastructure and aging population drive demand for antimicrobial-enhanced medical devices and hygiene solutions.

Antimicrobial Additives Market Trends

Technological Advancements and Product Innovation to Boost Market Growth

The market is witnessing significant growth and development due to technological advancements and product innovation. The products are increasingly integrated into textiles, plastics, coatings, and healthcare supplies. Innovations in these areas are driving demand as consumers and industries recognize the benefits of enhanced hygiene and durability. For example, the use of antimicrobial treatments in textiles assists in preserving freshness and minimizing odors, which is particularly crucial in sportswear and healthcare PPE.

Download Free sample to learn more about this report.

Market Dynamics

Market Drivers

Growing Use of Antimicrobial Additives in Healthcare Industry Drives Market Growth

In the healthcare industry, incorporating antimicrobial additives is a crucial advancement for enhancing infection control measures. These additives are added to a variety of products and materials used in healthcare settings, such as medical devices, hospital curtains, bed linens, and even paints. The integration of antimicrobial properties directly into these products aims to decrease the risk of pathogen transmission, address hospital-acquired infections, and provide an extra layer of safety for both healthcare professionals and patients. This approach contributes to better health outcomes and supports existing hygiene and sanitation protocols in healthcare facilities.

Market Restraints

Toxic Nature of Antimicrobial Agents and Regulatory Constraints Limit Market Growth

Market growth is being limited primarily by the toxic nature of certain antimicrobial agents and regulatory constraints. Environmental and health concerns have been raised about many antimicrobial additives, especially those containing metals such as silver, copper, and zinc, due to their toxicity. These substances have the potential to seep into the environment, impacting aquatic ecosystems and posing potential risks to human health. Research has indicated that silver-based antimicrobial coatings can release significant levels of silver into water, posing risks to vulnerable organisms such as crustaceans and algae.

Additionally, stringent regulations, such as the Biocidal Products Regulation (BPR) in the EU, require extensive testing for safety and efficacy before the products can be marketed. These regulations are designed to mitigate the risks associated with toxic substances, but they can also result in delays in product development and market entry.

Market Opportunities

Adoption of Antimicrobial Additives in Construction and Building Materials will Create Significant Growth Opportunities

The integration of product additives into construction and building materials presents significant growth opportunities in the industry. The pandemic has increased awareness of the necessity for hygiene in both public and private spaces. These additives can help minimize the spread of bacteria, viruses, and fungi, making environments safer for occupants. They can be incorporated into various materials, such as paints, coatings, flooring, countertops, door handles, and HVAC systems, providing long-lasting protection against pathogens.

Homeowners are increasingly looking for materials that promote a healthier living environment. Antimicrobial additives in countertops, flooring, and wall paints are becoming popular choices in residential construction. Additionally, property developers and managers in the commercial real estate sector are using antimicrobial materials to attract tenants and buyers who prioritize health and safety. Construction companies and material suppliers are also incorporating antimicrobial properties as a value-added feature to differentiate their products in the market.

Market Challenges

Increase in Production Costs Could Lead to Several Market Challenges

The high production costs associated with antimicrobial additives can affect pricing strategies and profit margins. The primary raw materials used in these additives, such as silver, copper, and zinc, are expensive and subject to price fluctuations. These fluctuations can significantly affect the final cost of product additives, making them less competitive in the market.

Despite their excellent antimicrobial properties, silver-based additives are particularly costly. The high production costs of these additives increase the overall product cost, impacting manufacturers' profit margins and limiting their use in various applications.

Regulatory Compliance May Hurdles the Market

Regulatory compliance indeed poses significant hurdles for the market despite its growth potential. The market is heavily regulated by bodies such as the FDA in the U.S. and the EFSA in Europe. These regulations ensure safety and efficacy but require extensive testing and documentation, increasing development costs and time-to-market for manufacturers. Addressing these regulatory challenges through standardization and technological advancements is crucial for a more harmonized market environment.

Impact of COVID-19

Stalled Supply Chain Due to Pandemic Hampered Market Growth

The COVID-19 pandemic had a mixed impact on various industries, including those reliant on antimicrobial additives. This has led to disruptions in the supply chain and shifts in product demand. While product demand fluctuated during the pandemic, the heightened focus on hygiene and antimicrobial products resulted in significant growth for the market. The COVID-19 pandemic further accelerated the product demand due to increased focus on sanitation and infection control.

Trade Protectionism and Geopolitical Impact

Trade protectionism and geopolitical dynamics are significantly reshaping the market, creating both challenges and strategic opportunities. Protectionism in advanced economies has accelerated industrial upgrading in countries such as India, where initiatives such as "Make in India" bolster local antimicrobial additive production.

Geopolitical conflicts, such as the ongoing war in Ukraine and the sanctions imposed on Russia, have intensified discussions about the economic repercussions of trade policies. These conflicts have prompted a reevaluation of the benefits of open trade, as nations prioritize national security and economic independence over mutual economic benefits. The shift toward protectionism can limit interdependence among countries, which may have significant implications for various markets, including the antimicrobial additives market.

Research And Development (R&D) Trends

The market is undergoing transformative R&D shifts driven by technological innovation, regulatory pressures, and evolving end-user demands. Rising investments in bio-based antimicrobial agents aim to replace toxic or non-biodegradable additives, driven by regulations such as the European Green Deal and REACH. In addition, Next-gen products target bacteria, viruses, fungi, and allergens simultaneously, replacing single-purpose agents. This trend is prominent in medical devices and food packaging.

Segmentation Analysis

By Type

Inorganic Segment Dominated the Market Owing to Its Increasing Use in the Healthcare Industry

Based on type, the market is classified into organic and inorganic.

The inorganic segment held the largest share of 7.64% of the global market in 2026 and is expected to experience substantial growth, primarily driven by increasing demand in the healthcare sector and heightened awareness of hygiene and health-related issues. The healthcare industry is a major end-user of inorganic antimicrobial agents, which play a crucial for preventing infections and maintaining hygiene in medical settings.

The organic segment is projected to experience significant growth in the coming years. They are commonly used in household products such as filtration systems, laundry care, and floor cleaners.

By Application

Plastics Segment to Dominate the Market Owing to Its Extensive Applications

Based on application, the market is classified into plastics, paints & coatings, pulp & paper, and others.

The plastics segment is projected to dominate the market due to its extensive applications and the inherent vulnerabilities of plastic surfaces to microbial growth. Plastics are prevalent across various industries, including healthcare, automotive, electronics, and packaging. Antimicrobial additives are increasingly incorporated into these applications to enhance product longevity and maintain cleanliness, as bacteria and fungi tend to thrive on plastic surfaces. The segment is expected to dominate the market share of 36.99% in 2026.

Antimicrobial additives in paints & coatings provide additional protective features, such as resistance to mold, mildew, and bacteria. This is crucial for maintaining the aesthetic and functional integrity of surfaces, particularly in humid environments where microbial growth is prevalent. This segment is anticipated to forecast a CAGR of 7.60% during the forecast period.

The pulp and paper segment is contributing to the rise of the global antimicrobial additives market share. Paper products are susceptible to microbial contamination, which can lead to spoilage, degradation, and health risks. The products are essential for enhancing the durability and hygiene of paper products, especially in applications such as tissue production and food packaging.

By End-use Industry

To know how our report can help streamline your business, Speak to Analyst

Healthcare Segment Dominates the Market Due to Increasing Use of Various Plastic and Polymer-based Medical Devices

In terms of end-use industry, the market is segmented into healthcare, packaging, food & beverage, construction, automotive, and others.

The healthcare industry dominates the market, with antimicrobial additives commonly incorporated into various plastic and polymer-based medical devices, such as catheters, surgical instruments, and personal protective equipment (PPE). These applications are essential for maintaining hygiene standards and improving patient safety. The segment is expected to dominate the market share of 33.9% in 2026.

The packaging segment is also experiencing favorable growth. This segment is anticipated to forecast a CAGR of 7.80% during the forecast period. The increasing global demand for packaged food products is boosting the adoption of antimicrobial additives in food packaging. These additives help preserve food ingredients, prevent microbial growth, and minimize the risk of foodborne illnesses, making them essential for food safety and shelf life extension.

The construction and automotive segments are also registering positive growth in the market. Products are being utilized in a variety of automotive applications, including interior materials, upholstery, and certain exterior coatings. This versatility is contributing to steady growth in the segment.

Antimicrobial Additives Market Regional Outlook

By region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Asia Pacific

Asia Pacific dominates the market and is projected to register the highest CAGR over the forecast period. The regional market value in 2025 was USD 4.86 billion, and in 2023, the market value led the region by USD 4.24 billion. The rapid expansion of industries such as packaging, healthcare, food & beverages in countries such as China, India, Thailand, and Singapore is a significant factor driving this growth. Government initiatives aimed at improving healthcare facilities further contribute to market expansion in this region. The market value in China is expected to be USD 2.32 billion in 2026.

On the other hand, Japan is projecting to hit USD 0.42 billion and India is likely to hold USD 1.19 billion in 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

Asia Pacific Antimicrobial Additives Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America is anticipated to account for the second-highest market size of USD 3.31 billion in 2026, exhibiting the second-fastest growing CAGR of 7.70% during the forecast period. The North American market is witnessing growth due to increasing consumer awareness about hygiene and safety, particularly in healthcare and food packaging. Innovations in antimicrobial technologies and materials are expected to bolster antimicrobial additives market growth in this region.

Europe

The Europe region is to be anticipated the third-largest market with USD 2.84 billion in 2026. Europe is also a positive contributor to the market, with stricter regulations regarding hygiene and safety in construction and healthcare industries driving the demand for antimicrobial solutions in various applications. The market value in U.K. is expected to be USD 0.56 billion in 2026.

On the other hand, Germany is projecting to hit USD 0.92 billion in 2026 and France is likely to hold USD 0.58 billion in 2025.

Middle East & Africa and Latin America

The Middle East & Africa region is to be anticipated the fourth-largest market with USD 0.96 billion in 2026. The forecast period is expected to see a positive pace of growth in the market in the Middle East & Africa, and Latin America, driven by increased awareness of hygiene issues, which is likely to drive future growth. The GCC market is expected to hit USD 0.29 billion in 2025.

Competitive Landscape

Key Market Players

Key Players Adopted Expansion Growth Strategy to Maintain Their Dominance in the Market

In terms of the competitive landscape, the market represents the presence of emerging and established companies. BASF SE, Dupont, Microban International, Sanitized AG, and Avient Corporation are the major players in this market. These companies possess substantial production capabilities and manufacture products for industry-specific applications. They are also expanding their manufacturing capacity and sales and distribution network across the globe.

List of Key Antimicrobial Additive Companies Profiled

- BASF SE (Germany)

- Dupont (U.S.)

- Microban International (U.S.)

- Sanitized AG (Switzerland)

- Avient Corporation (U.S.)

- BioCote Limited (U.K.)

- Milliken Chemical (U.S.)

- King Plastic Corporation (U.S.)

- RTP Company (U.S.)

- Addmaster Limited (U.K.)

KEY INDUSTRY DEVELOPMENTS

- December 2023: Avient Corporation announced an expansion of its Cesa Withstand portfolio, which includes new grades of antimicrobial and antifungal additives. These new grades are developed to enhance the performance of thermoplastic polyurethane (TPU) film-laminated products and devices in applications (Medical and Outdoor) where combating microbe development is highly important.

- July 2023: BioCote Limited formed a strategic alliance with Eco Finish to utilize BioCote technology for creating antimicrobial surfaces in both residential and commercial pools. The antimicrobial components in the solution are designed to prevent the proliferation of bacteria, algae, viruses, and other microorganisms, providing enhanced safety and protection for individuals swimming in the pool.

- April 2023: Microban International entered a collaboration with Berry Global to launch Color Scents scented trash bags that incorporate antimicrobial technology. The objective of this collaboration was to merge Berry Global’s production expertise with Microban’s strong position in the market for antimicrobial technology solutions.

- May 2021: Avient revealed the introduction of GLS thermoplastic elastomer mixes that incorporate antimicrobial technology to provide defense against microbial proliferation. The antimicrobial agents help protect molded plastic parts by inhibiting 99.9% of bacterial growth and preventing the development of mold and fungi.

- January 2021: NovaGARD NR 100-G was launched by DuPont Nutrition & Biosciences in the Middle East and Africa. This antimicrobial solution is among the most efficient and environmentally friendly options for processed meat processors. Throughout the Middle East and Africa, DuPont introduced NovaGARD NR 100-G to bring this effective and label-friendly antimicrobial solution to processed meat packers in the region.

REPORT COVERAGE

The report provides a detailed analysis of the market. It focuses on key aspects, such as leading companies, types, compositions used to produce these product types, and product End-use Industry. Besides this, it offers insights into the market and current industry trends and highlights key industry developments. In addition to the factors mentioned above, it encompasses several factors contributing to the market's growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) and Volume (Kiloton) |

|

Growth Rate |

CAGR of 7.5% from 2026 to 2034 |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By End-use Industry

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 12.95 billion in 2026 and is projected to record a valuation of USD 23.29 billion by 2034.

In 2026, the Asia Pacific market value stood at USD 5.23 billion.

Recording a CAGR of 7.5%, the market will exhibit steady growth during the forecast period of 2026-2034.

By end-use industry, the healthcare segment leads the market.

Growing antimicrobial additive usage in the healthcare industry drives market growth.

Asia Pacific is poised to capture the highest market share during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us