Antiscalants Market Size, Share & Industry Analysis, By Type (Phosphorus Antiscalants, Synthetic Polymeric Antiscalants, and Natural Green Antiscalants), By Type (Reverse Osmosis (RO) Systems, Boilers and Heating Systems, Cooling Water Systems, Supersaturated Salts, Seawater Desalination, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

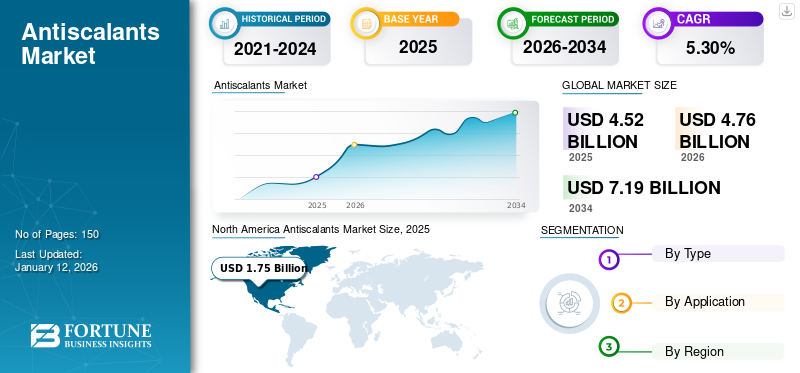

The global antiscalants market size was valued at USD 4.52 billion in 2025. The market is projected to grow from USD 4.76 billion in 2026 to USD 7.19 billion by 2034 at a CAGR of 5.30% during the forecast period (2026-2034). North America dominated the antiscalants market with a market share of 39% in 2025.

Antiscalants are chemical substances added to water, particularly in systems such as reverse osmosis (RO) plants and boilers, to prevent the formation of scale. Scale is the buildup of mineral deposits, such as calcium carbonate or calcium sulfate, on surfaces within the system. Antiscalants work by inhibiting the precipitation of these minerals or by modifying their crystal structure, preventing them from forming hard, adherent deposits that can reduce system efficiency and damage equipment. They cover formulations and delivery systems, including smart dosing and sensor-enabled solutions. They are mainly used in water systems across industries such as municipal water treatment and desalination, mining, oil & gas, power generation, chemical, food & beverage, and pulp & paper.

The market is experiencing substantial growth, driven by increasing industrialization, urbanization, and the rising demand for water treatment solutions across various sectors. Moreover, the growing water treatment industry worldwide, along with rising technological advancements in reverse osmosis, will further fuel the segment's growth during the forecast period.

ANTISCALANTS MARKET TRENDS

Growing Technological Innovation to Upsurge the Market Growth

The market is experiencing substantial growth primarily due to ongoing advancements in technology and research and development, which are leading to the creation of more effective and environmentally friendly antiscalant formulations. Ongoing research and development are leading to more effective and efficient antiscalant formulations. These innovations include biodegradable antiscalant products, as highlighted by Netsol Water Solutions, and targeted formulations designed to address specific scaling concerns such as calcium sulfate, silica, and barium sulfate. Additionally, pilot applications of nanotechnology and nano-scale antiscalant particles are also showing promising results for enhanced efficiency in scale inhibition.

Moreover, the increasing adoption of water treatment technologies across emerging and developed economies, coupled with the adoption of AI-enabled smart dosing systems and sensor integrations to optimize dosage in real time, is further driving the demand for biodegradable and less harmful antiscalants.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Growing Product Demand from Various Industries Globally to Boost Market Growth

The market is experiencing significant growth due to the increasing demand for antiscalants from industries such as chemical manufacturing, power generation, mining, oil & gas, and food and beverage, all of which rely on water for their operations. The solutions prevent scale buildup in equipment, improving efficiency and reducing operational costs. In power generation, the product plays a vital role in maintaining the efficiency of boilers, heat exchangers, and cooling systems in power plants, preventing scale damage that can reduce energy efficiency and increase costs.

On the other hand, in chemical manufacturing, the product is used to safeguard equipment from scaling issues, ensuring uninterrupted production of chemicals and preventing costly downtime for maintenance. Moreover, growing product demand from mining for extraction and processing, coupled with the growth of food & beverages that surge the use of antiscalants to maintain equipment hygiene and product quality, will further fuel the market growth. Hence, the continuous expansion of these industries, fueled by global economic growth and urbanization, will augment the antiscalants market growth.

MARKET RESTRAINTS

Environmental and Health Concerns related to the Product Could Restrict Market Growth

Environmental and health concerns are significant restraints on the market due to traditional chemical formulations. These concerns stem from traditional antiscalants that contain substances that are harmful to the environment and human health. Specifically, these chemicals can leach into water sources, potentially impacting aquatic life and posing risks through the consumption of contaminated water. However, the shift toward eco-friendly alternatives and stricter regulations is favoring companies that can offer safer and more sustainable solutions.

MARKET OPPORTUNITY

Regulatory Pressure and Environmental Concerns Driving Shift Toward Sustainable & Bio-based Antiscalants

The global antiscalants market is witnessing a strong shift toward sustainable and bio-based formulations as industries respond to environmental concerns and stricter regulatory frameworks. Conventional phosphonate- and polymer-based antiscalants, though effective, raise issues of poor biodegradability and secondary pollution, prompting restrictions in regions like the EU and North America. This is creating opportunities for bio-based alternatives derived from natural polymers such as lignin, starch, and polysaccharides, designed to minimize toxicity and environmental impact. These eco-friendly formulations align with sustainability goals, helping industries in desalination, power generation, and food processing meet ESG commitments while maintaining system efficiency. Beyond compliance, bio-based antiscalants offer long-term value by reducing wastewater treatment costs, mitigating regulatory risks, and enhancing corporate reputation. As a result, chemical companies investing in research and development of green antiscalants are well-positioned to capture future demand across emerging and developed markets.

MARKET CHALLENGES

Volatility of Raw Material Costs and Availability of Substitutes Pose as Challenges for Market Expansion

Volatility of raw material costs is affecting manufacturing margins and the pricing of antiscalants. Phosphonates and polymers, the key raw materials used in the production of antiscalant, are subject to fluctuating costs influenced by factors such as crude oil prices. This can lead to a squeeze in margins, where production costs escalate while sales prices may struggle to keep pace, impacting long-term profitability. On the other hand, growing competition from substitute water treatment technologies such as membrane filtration and ion exchange further create challenges for the market.

IMPACT OF COVID-19

Pandemic Impacted Product Distribution and Transportation with Supply Chain Disruptions

The COVID-19 pandemic significantly disrupted global supply chains, impacting the distribution and transportation of raw materials for antiscalants. Restrictions imposed by governments, such as lockdowns and travel limitations, caused delays, shortages, and increased costs for manufacturers. This included a decline in industrial production, particularly in sectors such as oil and gas, which initially lowered the demand for antiscalants used in these applications. However, the pandemic also created new opportunities and boosted the industry in several key ways, such as heightened hygiene concerns and the need for clean, reliable water, which spurred demand in this sector. Further, growing manufacturers' shift toward developing more eco-friendly and biodegradable antiscalant formulations to meet stricter environmental standards has influenced growth.

SEGMENTATION ANALYSIS

By Type

Phosphorus Segment Held the Largest Share in this Market Due to Its Characteristics

Based on type, the market includes phosphorus antiscalants, synthetic polymeric antiscalants, and natural green antiscalants.

The phosphorus segment held the highest antiscalants market with a share of 42.44% in 2026. Phosphorus-based antiscalants, known for their ability to sequester metal ions such as calcium and magnesium, preventing them from forming scale. They are widely used in water treatment processes, including reverse osmosis (RO) systems, to prevent mineral scale buildup on membranes. These chemicals work by interfering with the crystallization process of scale-forming salts such as calcium carbonate and calcium sulfate, either by inhibiting crystal growth or by distorting the crystal structure.

Synthetic polymeric antiscalants, on the other hand, is growing at a sustainable growth during the forecasted timeframe. These antiscalants are synthesized compounds with functional groups such as acrylic acid, carboxylic acid, sulfonic acid, or phosphonic acid. Growing demand from applications such as cooling towers, RO systems, and other industrial water systems will drive the market growth during the forecasted timeframe.

The segment comprising natural and biodegradable antiscalants, often referred to as "green antiscalants", is experiencing significant growth due to increasing environmental awareness and stricter regulations. Natural polymers such as starch are usually present in green antiscalants, which are being more extensively investigated due to discharge requirements. Moreover, the growing development of novel and eco-friendly alternatives to traditional solutions will accelerate the segment growth during the forecast timeframe.

By Application

To know how our report can help streamline your business, Speak to Analyst

Reverse Osmosis (RO) Systems Segment is the Largest Application due to Rising Water Treatment Solutions

Based on application, the market is segmented into reverse osmosis (RO) systems, boilers and heating systems, cooling water systems, supersaturated salts, seawater desalination, and others.

The reverse osmosis (RO) systems segment accounting for 37.39% market share in 2026. The growing demand for chemical additives made from antiscalants in reverse osmosis (RO) systems to prevent scale formation on the membranes will fuel the segment's growth. These chemicals work by inhibiting the precipitation of mineral salts, which can lead to scaling and fouling of the RO membranes. Further, by preventing scale formation, they help maintain the efficiency and lifespan of RO systems.

The product demand is also increasing in boilers and heating systems and anticipated to grow in this segment positively during the forecasted timeframe. In this segment, antiscalants are used to prevent the formation of scale, which is the buildup of mineral deposits on heat transfer surfaces. Moreover, growing product consumption in maintaining the efficiency and longevity of these systems by inhibiting scale formation, reducing maintenance needs, and improving heat transfer will further flourish the market growth.

ANTISCALANTS MARKET REGIONAL OUTLOOK

Based on region, the market is segmented into North America, Europe, Asia Pacific, and rest of the world.

North America

North America Antiscalants Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The market size in North America stood at USD 1.65 billion by 2026. The regional market is experiencing highest growth, driven by stringent environmental regulations and the adoption of smart chemical dosing systems. Additionally, growing sustainability and regulatory pressure to manage wastewater discharge and minimize scaling impact, particularly from the U.S. Environmental Protection Agency (EPA), are accelerating the product demand. Furthermore, the rising need for efficient desalination and industrial water treatment processes is contributing significantly to the market's expansion.

To know how our report can help streamline your business, Speak to Analyst

Europe

Growing stringent EU regulations on scaling in boilers and heat exchangers are pushing industries to adopt antiscalant solutions, as it ensures compliance and operational efficiency and protection across industrial and municipal water sectors. Moreover, the growing demand for fresh water, particularly in European countries facing water scarcity, is leading to increased investment in desalination plants, surging product adoption for maintaining the efficiency of these plants by preventing scaling on membranes. The UK market is expected to reach USD 0.13 billion by 2026, and the Germany market is forecast to expand to USD 0.15 billion by 2026.

Asia Pacific

In the Asia Pacific region, developing economies are witnessing rapid industrial and urban growth, leading to a substantial increase in the demand for water treatment solutions. Furthermore, large-scale desalination projects and rapid industrialization in China, India, and Southeast Asian countries is further fueling the growth. The Japan market is anticipated to grow to USD 0.42 billion by 2026, the China market is set to reach USD 0.94 billion by 2026, and the India market is estimated to reach USD 0.15 billion by 2026.

Rest of the World

The rest of the world comprises Latin America and the Middle East & Africa. Latin America depicts the expansion of water-intensive industries such as power generation, mining, chemical manufacturing, and oil & gas, which is poised to propel industry expansion. In addition, the growth of seawater desalination projects in the Middle East & Africa will fuel the product demand during the forecasttimeframe.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Stricter Regulations Drive Sustainability and Consolidation in Market

The market is dominated by global players like Dow, BASF, Ecolab, Solenis, and Kemira, competing through advanced formulations, integrated services, and sustainable, phosphate-free solutions. Growing regulatory pressure and demand for efficiency drive innovation, while regional players in Asia and the Middle East intensify price competition. For instance, in July 2023, Solenis acquired Diversey Holdings to expand its industrial water-treatment portfolio, reinforcing its ability to deliver advanced antiscalant solutions with monitoring technologies, highlighting consolidation as a key competitive strategy.

LIST OF KEY ANTISCALANTS COMPANIES PROFILED

- Dow Chemicals (U.S.)

- BASF SE (Germany)

- Ecolab Inc. (U.S.)

- Kemira Oyg (Finland)

- ACURO ORGANICS LIMITED (India)

- Solenis (U.S.)

- Gradiant (U.S.)

- Univar Solutions LLC (U.S.)

- Veolia (France)

- Jayem Engineers (India)

KEY INDUSTRY DEVELOPMENTS

- In April 2024, Univar Solutions LLC and Italmatch USA Corp. announced a sole distribution agreement to expand their partnership in the Canada and United States in the industrial, homecare, and institutional (HI&I) cleaning ingredients markets. Also, with this agreement, the companies will provide DEQUEST PB Eco-Friendly antiscalants/dispersants for manufacturers seeking sustainable and biodegradable cleaning solutions.

- In April 2024, Gradiant launched CURE Chemicals that will provide product line for 300 proprietary formulations for antiscalants & cleaners, corrosion and scale inhibitors, biocides, process chemicals, and coagulants & flocculants. This launch will help the company to enhance the efficiency and effectiveness of water treatment processes while minimizing environmental footprint.

REPORT COVERAGE

The global market research report delivers a detailed analysis of the market and focuses on crucial aspects such as leading companies, types, and applications. Further, it provides quantitative data in terms of value, market analysis, research methodology for market data, and insights into market trends. It highlights vital industry developments and the competitive landscape. In addition to the factors mentioned above, the report encompasses various factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 5.30% from 2026 to 2034 |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 4.52 billion in 2025 and is projected to record a valuation of USD 7.19 billion by 2034.

Recording a CAGR of 5.30%, the market is slated to exhibit steady growth during the forecast period of 2026-2034.

In 2025, the phosphorus segment led the market by type.

Growing product demand from various industries globally is a key factor driving market growth.

Dow Chemicals, BASF SE, Ecolab Inc., Kemira Oyg, and ACURO ORGANICS LIMITED are the major players in the global market.

U.S. dominated the market in terms of share of USD 1.65 billion in 2025.

The growing demand for water treatment worldwide and rising technological innovations are anticipated to boost the consumption of the product.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us