Aquaculture Market Size, Share & Industry Analysis, By Product Type (Food Fish, Algae, and Others), By Culture Environment (Freshwater, Brackish Water, and Marine), By Form (Fresh and Chilled, Frozen, Prepared and Preserved, and Others), By Distribution Channel (B2B and B2C), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

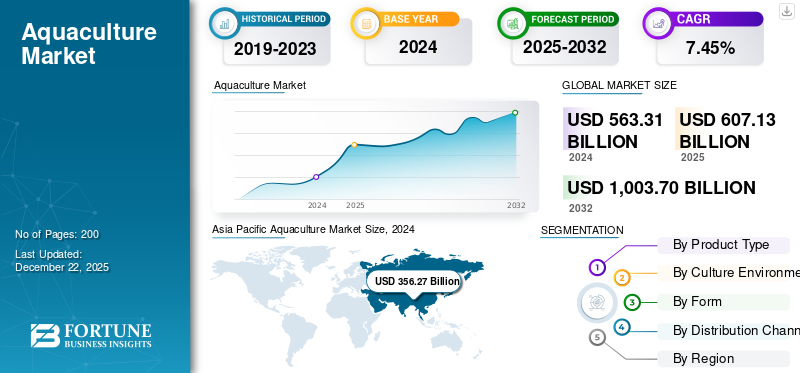

The global aquaculture market size was valued at USD 563.31 billion in 2024. The market is projected to grow from USD 607.13 billion in 2025 to USD 1,003.70 billion by 2032, exhibiting a CAGR of 7.45% during the forecast period. Asia Pacific dominated the aquaculture market with a market share of 63.25% in 2024.

Major players in the market include Thai Union Group PCL, MOWI ASA, Maruha Nichiro Corporation, Cooke Aquaculture Inc., and SalMar ASA.

Aquaculture is a method of breeding, rearing, and harvesting various fish species, shellfish, and other aquatic plants. The global market has been fueled by growing sustainability concerns, rising demand for seafood, as well as technological advancements in fish farming practices. Moreover, with increasing food consumption and an ever-growing global population, aquaculture has emerged as a prominent solution for meeting the global demand for protein.

Aquaculture Market Snapshot & Highlights

Market Size & Forecast:

- 2024 Market Size: USD 563.31 billion

- 2025 Market Size: USD 607.13 billion

- 2032 Forecast Market Size: USD 1,003.70 billion

- CAGR: 7.45% from 2025–2032

Market Share & Segmentation:

- Asia Pacific dominated the aquaculture market with a 63.25% share in 2024, driven by rising demand for high-quality animal protein and high per capita seafood consumption, particularly in China.

- By product type, the food fish segment held the largest market share due to its high nutritional quality and strong consumer preference for white meat.

- By distribution channel, the B2C segment led the market in 2024, with supermarkets and hypermarkets being key drivers due to their wide product selection, convenience, and competitive pricing.

Key Regional Highlights:

- Asia Pacific: Leads the global market, emerging as the epicenter of the industry. China is the largest market, characterized by huge annual seafood consumption and significant imports.

- North America: A growing market fueled by strong consumer demand for protein-rich foods (like salmon and shrimp) rich in omega-3, a shift away from red meat, and government policies aimed at reducing seafood import reliance.

- Europe: A major market driven by rising consumer awareness of healthy nutrition and a growing demand for premium-quality seafood. Norway is the region's largest producer, focusing on species like Atlantic Salmon.

- South America: A developing market with strong potential, fueled by a rising demand for both artisanal and industrial aquaculture, as well as an increasing preference for processed and canned seafood products.

MARKET DYNAMICS

Market Drivers

Increase in Government Support and Funding to Drive Market Growth

Government funding and subsidies have been playing a powerful role in fostering responsible practices that benefit both the environment and the communities that depend on aquaculture. Such initiatives have played a vital role in developing and developed nations, enabling adoption of sustainable practices and driving innovation in the sector. India, Indonesia, Thailand, Vietnam, and others provide strong examples of the diverse roles government subsidies have been playing in aquaculture, owing to their multiple approaches, including financing the development of advanced technology in developed economies to stimulating sustainable development and ecosystem rebuilding in developing economies, and through the help of international agencies. For instance, in June 2025, in India, the Bihar government announced financial help for fish farmers under the Chief Minister’s Pond Fisheries Development Scheme for 2025-26. Under this scheme, the farmers would get a 50 to 70% subsidy depending on their category. The scheme has helped farmers become self-sufficient in fish production and improve their income.

Growing Consumer Inclination Toward Protein-Rich Foods to Drive Market Growth

The seafood consumption across the globe has increased over the past years. The rising disposable incomes in developing countries, such as India, China, Brazil, and South Africa, and the growing health consciousness of consumers in developed countries have contributed to this increase in seafood consumption. Protein products are sought after by consumers who want to maintain healthy bones and joints, boost their immune systems, and increase muscle strength and tone while staying energized throughout the day. Consumers are becoming more aware of the link between protein and health, particularly the benefits of protein for weight loss and sports nutrition. They are seeking products that will suit their nutritional and dietary demands, fueling the global aquaculture market growth.

Market Restraints

High Infrastructure Costs and Investments to Impede Market Growth

Establishing an aquaculture farm is capital-intensive because of the requirement for high-technology infrastructure, specialized machinery, and trained personnel. Maintenance costs, energy, and feed can also impact profitability. However, ongoing technological advancements in technology and feed efficiency could cut these expenses in the long run. Moreover, fish escapes have been one of the prominent challenges in the industry. Fish escapes are financially damaging to players operating in the market. The companies must either invest in strong insurance coverage or better practices to prevent escapes, imposing high costs and affecting profitability.

Market Opportunities

Technological Advancements in the Industry to Provide Opportunity for Market Growth

Aquaculture is the fastest-growing seafood production activity, and technological development can bring more transparency to seafood products. For instance, Asian farms have traditionally adopted integrated rice-aquaculture farming, where freshwater fish are reared in the flooded rice cultivation fields. Modern technology opens up more integrated systems options, maximizing farmers’ revenue from existing land areas, including technologies such as automation, data analytics, recirculating aquaculture systems (RAS), biosecure facilities, and others.

Aquaculture Market Trends

Growing Focus on Sustainability and Eco-Friendly Practices to Shape the Industry

With the global rise in food demand and wild fisheries stretched to their limits, the adoption of sustainable practices has become essential to food security and economic growth, along with reducing greenhouse gas emissions and limiting environmental damage. Sustainable practices would further help to reduce the pressure on wild fish stocks and provide alternative seafood, thus preventing damage to essential habitats such as coral reefs and mangroves and safeguarding marine biodiversity. Players operating in the market have also been adopting sustainable sources, further impacting the market growth. For instance, in December 2024, HydroNeo, a Thailand-based aquaculture technology company, partnered with shrimp welfare experts, FAI Farms, to sustainably and ethically produce shrimp.

Download Free sample to learn more about this report.

Impact of Tariffs

Tariffs, taxes on imports, may profoundly affect the aquaculture sector, with special consideration for nations dependent on seafood exports. Tariffs could directly affect the price of imported aquaculture products, causing consumers in the importing nation to pay more. Exporters in the concerned nations are pressured to bear the tariff expense or transfer it to consumers, with diminished profit margins. Tariffs may also lead to delays in shipments and uncertainty in the market, which is detrimental to the timely delivery of products. Long-lasting tariff disputes can harm trade relations between nations, impacting long-term economic stability.

SEGMENTATION ANALYSIS

By Product Type

Nutritional Quality and High Preference Leads to the Dominance of Fish

On the basis of product type, the market is segmented into food fish, algae, and others.

The food fish segment held the largest global aquaculture market share in 2024. Fish is the most widely consumed product because of its nutritional quality and rising consumer demand for white meat.

The algae segment is expected to grow significantly in the forecast period. Algae play an important role in aquaculture, acting as a valuable feed supplement and contributing to water quality management. They are also gaining popularity as a sustainable option for aquaculture feed compared to conventional fishmeal and fish oil.

By Culture Environment

Less Initial Investment and Simple Infrastructure Aids in Freshwater Segment’s Highest Market Proportion

On the basis of culture environment, the market is segmented into freshwater, brackish water, and marine.

The freshwater segment held the largest global aquaculture market share in 2024. Freshwater aquaculture is relatively cheap and appealing to small-scale farmers compared to other culture environments. Moreover, it generally requires less initial investment and simpler infrastructure, fueling its adoption in the industry. Fish species such as carp, tilapia, and catfish thrive under controlled conditions and are resistant to diseases, making freshwater aquaculture management considerably simpler.

The marine segment is expected to grow significantly in the forecast period. Marine water environments offer ample nutrients naturally, promoting the rapid growth of species such as shrimp, oysters, and salmon. Moreover, marine fish species exhibit greater demand and fetch higher market prices, making them an ideal option for larger commercial operations.

By Form

Fresh and Chilled Segment accounts for Highest Share Due to Strong Consumer Preference and Superior Quality

Based on form, the market is segmented into fresh and chilled, frozen, prepared and preserved, and others.

The fresh and chilled segment leads in the global market. The fresh and chilled segment is witnessing a strong demand compared to other forms, owing to consumer preference for fresh and high-quality seafood. This preference is driven by flavor and health attributes. In addition, fresh products contain high-quality nutrients, which are lost during processing.

The prepared and preserved segment is also witnessing substantial growth in the market, due to the hectic lifestyle and the rise in demand for convenience products. Preservation methods such as drying, canning, and salting help extend the product lifecycle by inhibiting microbial growth. The consumption of processed products has also been increasing, due to their affordability and abundance, with several variants posing a way for the market's momentum.

By Distribution Channel

To know how our report can help streamline your business, Speak to Analyst

B2C Segment accounts for Highest Market Share Due to Convenience and Wide Product Availability

Based on distribution channel, the market is segmented into B2B and B2C.

The B2C segment dominates the global aquaculture market share. The B2C segment comprises supermarkets/hypermarkets, convenience stores, online retail stores, and others. Fresh, canned, and frozen seafood distribution largely relies on chain supermarkets and other physical stores, owing to the wide product selection, convenience, and ability to offer competitive pricing. In addition, supermarkets/hypermarkets have quick-freezing options, which help sustain the fresh products for longer. Thus, consumers are highly inclined toward purchasing such products from the retail channels, attributed to the surety of their overall quality.

The B2B segment comprises food processing companies and restaurants that purchase large quantities of seafood for further processing, distribution, or sale to consumers.

Aquaculture Market Regional Outlook

Geographically, the global market report covers analysis across North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Aquaculture Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominates the global aquaculture market. The region has emerged as an epicenter of the global aquaculture industry. According to the Food and Agriculture Organization (FAO), in 2024, the Asia Pacific reported 167.1 million tons of global fisheries and aquaculture production. The Asian aquaculture production and processing are growing at a fast pace, attributed to the rising demand for high-quality animal protein. Moreover, in low-developed nations, individuals are largely seeking protein-enriched products, which offer some opportunities for the market players to tap into these economies. China is the largest market for the aquaculture industry, with huge annual seafood consumption and imports from leading seafood-producing countries such as Russia, India, Ecuador, Canada, Vietnam, and others. Species such as shrimps, lobsters, frozen pollock, crabs, frozen cod, and squid are the most important imported seafood in the Chinese market. The high per capita fish and seafood consumption and the presence of a well-organized seafood industry are crucial factors driving the market within the region.

North America

North America continues to make a relatively small contribution to the global aquaculture market. The region is anticipated to grow at a healthy pace due to the growing demand for protein rich food, improved economic affordability, and evolving preferences for incorporating seafood in various cuisines. These factors will also help increase the production and consumption rate of seafood products. The Atlantic fishing grounds contribute to over half of the world's total seafood production, including lobster, mackerel, haddock, and cod. Shrimps and shellfish are harvested mainly in the equatorial regions. Thus, Atlantic fishing fulfills the growing needs of the population as well as seafood needs from industries by providing tons of seafood for use.

Increased health consciousness and preference for seafood rich in omega-3 from salmon, shrimp, and oysters, are fueling market expansion in the U.S. as consumers shift away from red meat. Moreover, U.S. government policies (e.g., NOAA’s Sea Grant, funding for R&D and infrastructure) and market efforts to reduce seafood import reliance further promote both sector growth and resilience.

Europe

Europe has been one of the major markets for seafood in the world, primarily due to the rising awareness about healthy nutrition among consumers as well as the growing demand for premium-quality seafood. According to the European Market Observatory for Fisheries and Aquaculture (EUMOFA), in 2022, in Europe, household spending on fishery and aquaculture products surged by nearly 11% compared to 2021. In the past decade, a massive shift has been witnessed in consumer preferences, due to the surging population, improved aquaculture production, and growing demand for high-value-added products, fueling the growth of the aquaculture market. Norway is known to be the largest aquaculture producer within the region. The country is dominated by finfish production, with Atlantic Salmon and Rainbow trout being key species.

South America

The South America region is not very keen on consuming seafood. With the evolution, the region is also observing a high demand for artisanal fishing and artisanal aquaculture, apart from the industrial fishing, which paves the way for the market to prosper. Moreover, the Latin America market is expected to witness a surging demand for different types of seafood items, such as canned seafood, attributed to the growing demand for processed proteinaceous seafood products. The consumption of fish and other seafood is not only essential due to its proven health benefits, but also due to its positive impact on the environment. Numerous factors, such as eating habits, cultural patterns, socio-demographic factors, place of residence (coast/continent), and the changing consumer attitudes toward food and nutrition, influence the seafood consumption in the region.

Middle East & Africa

The aquaculture industry in the Middle East & Africa is mainly driven by the rising per capita seafood consumption, increasing demand for imported seafood products, and the emergence of specialty seafood restaurants. Seafood consumption in Eastern Africa has increased due to the region’s population growth and rising health consciousness among consumers. The demand for sustainably sourced seafood is rising in the region owing to its numerous health benefits and convenience. Consumers are seeking other sources of meat products, such as fish, shrimp, lobster, crab, and other seafood products, over traditional ones, including chicken, beef, mutton, and others.

Seafood consumption in the GCC countries (Saudi Arabia, Oman, Kuwait, Bahrain, UAE, and Qatar) has increased over the last few years. According to fisheries statistics published by the Food and Agriculture Organization (FAO) in 2022, there is a strong and growing demand for seafood in the Middle East.

COMPETITIVE LANDSCAPE

Key Industry Players

Focus on Investment Strategies by Key Players to Support Market Growth

The global aquaculture market is consolidated and has intensified in recent years due to the escalated demand for health-imparting foods, which are wholesome and safe for consumption, and a growing focus on sustainability. Seafood is also an increasingly important source of protein to feed the growing population and thus requires investments to address global food security concerns. Players in the market have been capitalizing on this demand and growing emphasis on strategic investments.

- For instance, in June 2023, Australis Aquaculture, LLC, an aquaculture company, and the Asian Development Bank (ADB) invested USD 15 million to offer climate-resilient, ocean-based barramundi and seaweed aquaculture in Vietnam. The investment would also expand Australia’s Aquaculture’s operations at Van Phong Bay and a second regional production hub in southern Vietnam.

Some prominent players in the market include Thai Union Group PCL, MOWI ASA, Maruha Nichiro Corporation, Cooke Aquaculture Inc., and SalMar ASA.

Key Players in the Aquaculture Market

|

Rank |

Company Name |

|

1 |

Thai Union Group PCL |

|

2 |

MOWI ASA |

|

3 |

Maruha Nichiro Corporation |

|

4 |

Cooke Aquaculture Inc. |

|

5 |

SalMar ASA |

List of Key Aquaculture Companies Profiled in the Report

- Nireus SA, Ltd. (Greece)

- Thai Union Group PCL (Thailand)

- MOWI ASA (Norway)

- Cermaq Group AS (Norway)

- SalMar ASA (Norway)

- Norway Royal Salmon ASA (Norway)

- Maruha Nichiro Corporation (Japan)

- Kyokuyo Co., Ltd. (Japan)

- Stoly Sea Farm SA (Spain)

- Cooke Aquaculture Inc. (Canada)

KEY INDUSTRY DEVELOPMENTS

- June 2025: Australis Aquaculture, one of the leaders in sustainable ocean-farmed barramundi, constructed a new state-of-the-art processing facility in Vietnam. The new facility would significantly enhance productivity and its operations' sustainability, efficiency, and quality.

- May 2025: Corboin N.V., a Dutch food and bio-chemicals company, partnered with Sustainable Shrimp Partnership (SSP) as an associate member, focusing on its commitment to responsible aquaculture and helping advance SSP’s vision of a cleaner, more sustainable shrimp industry.

- March 2025: Aquaconnect, a seafood company, entered into aquaculture biological research and production with an investment of USD 4.5 million.

- February 2025: The Uttar Pradesh government transformed its fisheries sector with a USD 466.77 million investment from the UAE’s Aqua Bridge Group. The investment is one of the largest foreign investments in India’s aquaculture industry.

- October 2022: Indian Immunologicals Limited, a subsidiary of the National Dairy Development Board, forayed into the aquaculture health segment with the launch of its products, including vaccines, and would serve the growing need in farmed shrimp and fish in the country.

REPORT COVERAGE

The global aquaculture market report analyzes the market in depth and highlights crucial aspects such as market trends, dynamics, prominent companies, and distribution channels. Besides this, the market statistics report also provides insights into the market analysis and highlights significant industry developments.

To gain extensive insights into the market, Download for Customization

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 7.45% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

|

|

By Culture Environment

|

|

|

By Form

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value was USD 563.31 billion in 2024 and is anticipated to reach USD 1,003.70 billion by 2032.

At a CAGR of 7.45%, the global market will exhibit steady growth over the forecast period.

By distribution channel, the B2C segment leads the market.

Asia Pacific held the largest market share in 2024.

The growing consumer inclination toward protein-rich foods is driving market growth.

Thai Union Group PCL, MOWI ASA, Maruha Nichiro Corporation, Cooke Aquaculture Inc., and SalMar ASA are the leading companies in the market.

A growing focus on sustainability and eco-friendly practices is shaping the industry.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us