Asia Air Conditioner Market Size, Share & Industry Analysis, By Product (Central, Split, Window, Ducted, Portable, and Others), By Technology (Automatic and Manual), By Application (Residential and Commercial), By Distribution Channel (Online and Offline), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

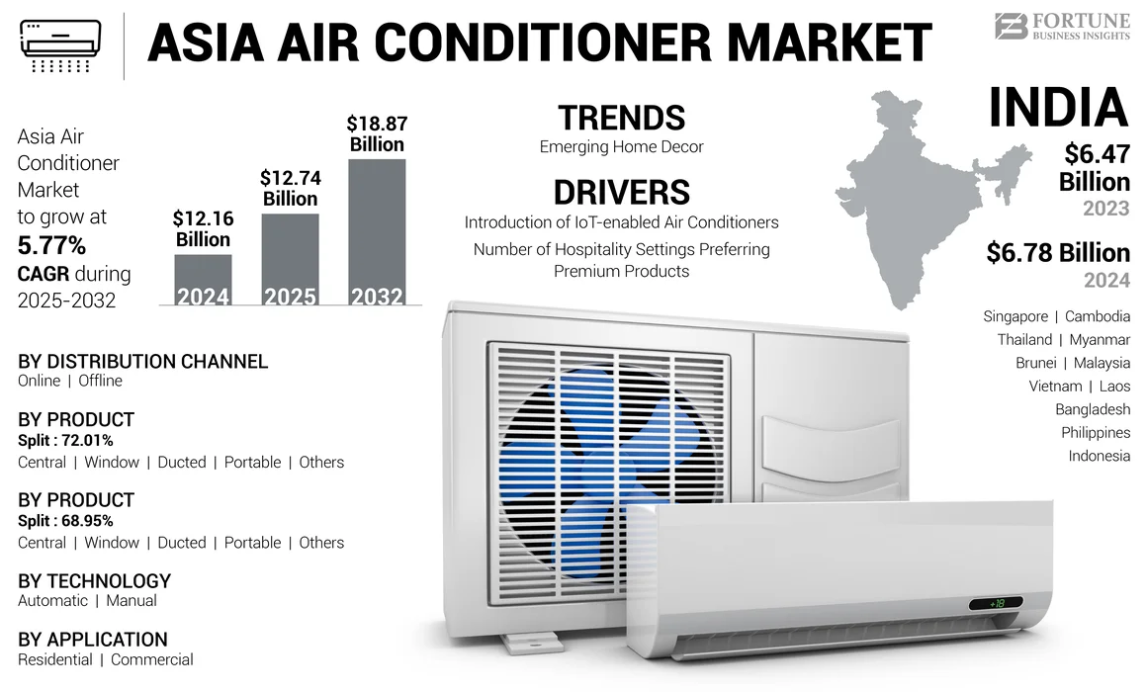

The Asia air conditioner market size was valued at USD 12.16 billion in 2024. The market is projected to grow from USD 12.74 billion in 2025 to USD 18.87 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 5.77% over the forecast period.

Air conditioners are crucial components of daily life, enabling households to maintain adequate room temperature for comfortable living. The growing real estate sector is a critical aspect, which is fueling the product demand across Asia. Newer constructions of residential and commercial buildings require efficient cooling systems, increasing the installation rate of energy-efficient air conditioners. In addition, the growing trend of appliance replacement among existing households will increase the installation rate of newer products in these settings. Furthermore, rising purchases and consumers’ emphasis on energy efficiency and environmentally friendly products create newer air conditioner market growth avenues.

- According to the International Energy Agency (IEA), air conditioning unit penetration is higher among households in Southeast Asian countries, including Singapore and Vietnam, compared to the global average of 37.4%.

- Below are the household product penetration rates across various Asian countries in 2023:

- Indonesia – 13.2%

- Japan – 89.5%

- Philippines – 13.9%

- Singapore – 77.5%

- Thailand – 35.8%

- Vietnam – 41.1%

- Other Southeast Asian countries – 30.3%

- World – 37.4%

The market is characterized by an extremely competitive business environment with a large number of domestic and international players operating in the market. The dominant international market players are Samsung Electronics Co., Ltd., GREE ELECTRIC APPLIANCES, INC., and Hitachi Ltd., and domestic players are Voltas Limited and Blue Star.

MARKET DYNAMICS

Market Drivers

Manufacturers’ Introduction of IoT-enabled Air Conditioners to Favor Market Growth

Continual provision of connected IoT and inverter technology-based indoor cooling and their consistent product promotional efforts favor product demand among households and commercial settings across Asia. In addition, increasing consumers’ accessibility to smartphone-connected devices featuring voice control, human sensors, air-quality filtering, and cloud storage features will boost the Asia air conditioner market growth. In April 2024, Toshiba Corporation launched Toshiba HAORI as an aesthetic, residential air conditioning system for Singaporean homeowners. The device is compatible with digital features, including Smart Voice Control, Google Home Assistant, Amazon Alexa, and Wi-Fi connectivity to the new Toshiba Home AC Control app.

Besides, manufacturers are focusing on energy efficiency and sustainability measures implementation in their business practices, supporting the sustainability development of the Asia air conditioner industry.

Growing Number of Hospitality Settings Preferring Premium Products to Accelerate Product Revenues

Increasing infrastructural facilities related to luxury hospitality settings and tourism facilities are preferring IoT technology-based products. This is anticipated to uplift travelers’ lodging experience, favoring product revenues across the region. In addition, emerging hotel construction and tourism sectors support the product demand in these settings. According to the Asian Development Bank (ADB), as of 2022, the number of construction-completed accommodation rooms in Indonesia, Thailand, and Vietnam reached 788,500, 777,400, and 780,000, respectively. In addition, increasing demand for smart home security solutions, including bedroom activity monitoring and emergency systems among motels & hotels in Thailand, Singapore, and the Philippines, are accelerating product sales.

Market Restraints

Frequent Maintenance Requirements to Hinder Market Growth

The higher number of Southeast Asian households utilizing energy-consuming, obsolete technology-based products frequently require cleaning filters, checking refrigerant levels, servicing motors, and other maintenance services. Higher costs of repair and maintenance of space cooling devices have limited their demand among middle-income household groups. In addition, surging electricity costs due to the usage of less energy-efficient home appliances restrain product demand among households in the region.

Market Opportunities

Increasing Retail Presence of Key Companies to Provide Market Opportunities

The increasing retail presence of key companies in the Asia air conditioning market is providing significant opportunities for market expansion in the urban areas of Southeast Asian countries. Prominent manufacturers, including Voltas Limited, Samsung Electronics Co. Ltd., and others, are expanding their retail presence, which makes it easier for consumers to access a wide range of products. Increasing product availability at retail outlets, including large electronics retailers and department stores, supports the product installation rate across the region. In December 2024, Japanese home appliances manufacturer Daikin Industries, Ltd. announced its plan to invest USD 117.68 million (INR 1,000 Cr.) to set up Southeast Asia’s largest space cooling appliances manufacturing facility in Andhra Pradesh, India. The facility is spanning across 75 acres.

Market Challenges

Uncertain Spare Part Prices to Disrupt the Asian Market Supply Chain

Southeast Asian manufacturing facilities mainly source raw material supplies from semiconductor manufacturer companies, including Japan, South Korea, China, and the U.S. Higher transportation costs, limited availability, and uncertain prices of raw material supplies pose challenges to the South East Asian manufacturing facilities which are managing procurement costs from the air conditioner category.

Download Free sample to learn more about this report.

Asia Air Conditioner Market Trends

Emerging Home Décor Trend Leading to Upscale Product Replacement Rate

The emerging trend of home decoration and renovation increases the consumer necessities of existing home appliances with smart products, creating newer air conditioner market growth avenues. Appliances with modern & sleek designs and classic colors are widely opted among Thai and Singaporean households. The growing trend of installing smart space cooling devices of various colors and patterns that match the living room décor accelerates product sales across the region.

Impact of COVID-19

Limited operations of the modern trade and electronic brand stores due to lockdown restrictions by the governmental authorities during the COVID-19 pandemic significantly impacted the product demand across many countries in Asia. In addition, a shortage of key electronic components, including environmentally friendly refrigerants, temperature sensors, and displays, due to the disruption of the industry supply chain hampered the product revenue growth across many countries in Asia.

SEGMENTATION ANALYSIS

By Product

Efficacy in Targeted Cooling Results in Split Air Conditioner Segment to Lead the Market

Based on product, the market is segmented into central, split, window, ducted, portable, and others.

Split air conditioners are installed in various configurations, allowing for targeted cooling in specific rooms or zones. This targeted cooling flexibility is beneficial for homes with large or irregular layouts. The split segment held a majority market share in 2024 due to the higher efficacy of the split air conditioning devices in targeted cooling. The split segment is slated to excel at the fastest growing rate during the forecast period of 2025-2032.

Rising demand for air conditioners of affordable and portable categories among single-person and dual-person households favors the portable segment, which is attaining the second fastest growth rate during the forecast period of 2025-2032.

Window conditioners can fit better into windows and are suitable for smaller living environments. Lower upfront and electricity costs associated with such products are increasing their demand among household settings, driving segmental growth at the third fastest-growing rate during the forecast period of 2025-2032.

Advantages of central conditioners include filtering & circulating the air, removing dust, allergens, and pollutants, and enhancing indoor air quality. This is accelerating central segmental growth at the fourth fastest-growing rate across the region.

Increasing consumers’ accessibility to ducted space coolers of modern and sleek designs drives ducted segmental revenue growth at the sixth fastest growth rate across the region.

Others segment covering the market analysis on through-the-wall conditioners and vertical package conditioners is slated to grow at the fifth fastest growing rate during 2025-2032.

To know how our report can help streamline your business, Speak to Analyst

By Technology

Cost Effectiveness of Analog Technology-based Products Result in Manual Segment’s Dominance

Based on technology, the market is bifurcated into automatic and manual.

Significant household penetration of affordable air conditioning systems featuring analog interfaces, buttons, and dials resulted in the manual segment holding a majority of the Asia air conditioner market share in 2024.

Rising demand for smart air conditioning systems featuring advanced filtration systems and automatic temperature control settings accelerates automatic segmental revenue growth at the fastest rate.

By Application

Significant Product Installation among Households Result in Residential Segment to Lead Market

Based on application, the market is bifurcated into residential and commercial.

The significant installation rate of compact-sized air conditioning units among densely populated household areas in Thailand, Malaysia, Indonesia, and India resulted in the residential segment holding a major market share in 2024. In addition, the rising demand for smart housing facilities in Singapore, Vietnam, and India favors the segment growth.

Growing hospitality and restaurant infrastructural facilities preferring installing central air conditioning units are driving commercial segmental growth.

By Distribution Channel

Offline Segment Led the Market Due to Easy Accessibility of Products

By distribution channel, the market is bifurcated into online and offline.

While shopping at specialty electronic shops and supermarkets, consumers gain better insights about the product knowledge and features in person from the sales representative. This aspect mainly enables consumers to shop for products from offline stores, resulting in the offline segment exhibiting a major market share in 2024.

The rising adoption of online shopping for household electronics goods with Lazada, Shopee Pte. Ltd., and other online retailers’ provision of discounted products accelerates online segmental growth.

Asia Air Conditioner Market Country Outlook

Geographically, the Asian market report includes a market analysis of the various countries, including Vietnam, Laos, Cambodia, Thailand, Myanmar, Singapore, Malaysia, Indonesia, Philippines, Brunei, India, and Bangladesh.

India

The Indian market size reached USD 6.78 billion in 2024. Emerging electronic manufacturing industries and collaborations between electronics brands are fostering innovation and improving product visibility in the Indian market. A rising number of brands, including Daikin, Voltas, and Samsung, are implementing joint venturing and co-branding initiatives to increase their product reach and market position across India, supporting the development of the Indian market during 2025-2032. In December 2024, Daikin Industries, Ltd. established a joint venturing agreement with Rechi Precision Co., Ltd., a Taiwanese global compressor business, to strengthen its manufacturing capabilities of home cooling products, including air conditioning units, in India.

To know how our report can help streamline your business, Speak to Analyst

Indonesia

Increasing internet access in Indonesia is significantly boosting the market growth of consumer electronics products. E-commerce allows consumers to explore a wider variety of space-cooling products compared to the product stock available in physical stores. This diversity encourages consumers to try new brands and products, thus expanding the overall market.

Vietnam

Vietnamese consumers are becoming more environmentally conscious, prompting manufacturers to develop space-cooling appliances that align with sustainability goals. This trend is reinforced by government initiatives, promoting eco-friendly practices and regulations that encourage the use of sustainable materials. For instance, in 2024, the Vietnam Chamber of Commerce and Industry (VCCI) launched the Sustainable Business Assessment Programme aimed at evaluating and recognizing business performance across three key dimensions: economic, social, and environmental. This initiative marks the ninth consecutive year of the program, which has evolved to help businesses transition from traditional models to more sustainable practices.

Rest of Asia

Majorly, the Asian market in the rest of the Asian region is concentrated in countries including Thailand, the Philippines, and Malaysia. Government’s strict regulations on the production and import of energy-efficient products support the sustainable product demand in these countries.

COMPETITIVE LANDSCAPE

Key Market Players

Robust Manufacturing Capability to Enable Key Players to Dominate Asian Market

Leading players operating in the market, including Voltas Limited, Samsung Electronics Co., Ltd., Hitachi, Ltd., GREE ELECTRIC APPLIANCES, INC., and DAIKIN INDUSTRIES, Ltd., operate with a robust space cooling appliances manufacturing and a diverse customer base located across India, Malaysia, Vietnam, Indonesia, and Thailand. These companies focus on expanding their manufacturing capacity to build their market positions across the Asian region. For instance, in November 2022, Japanese home appliances manufacturer Daikin Industries, Ltd. announced its plan to invest USD 711 million in building the manufacturing capacity of air conditioners in India and Southeast Asia. The company is planning to produce around 1.5 million home space cooling systems through such facilities annually.

The competitive landscape of the market provides valuable insights into various competitors. It includes detailed profiles of various companies operating in the market, highlighting their business models and strategic initiatives and examining the financial health of these companies, including revenue generation and overall financial performance. The report also details the investments made by companies in research and development, indicating their commitment to service innovation and improvements.

Major Players in the Asia Air Conditioner Market

To know how our report can help streamline your business, Speak to Analyst

Asia air conditioner market is competitive with the presence of leading companies, including Voltas Limited, Samsung Electronics Co., Ltd., Hitachi, Ltd., GREE ELECTRIC APPLIANCES, INC., and DAIKIN INDUSTRIES, Ltd. in the market. These top 5 players account for 25.86% of the market share in 2024.

List of Key Asia Air Conditioner Companies Profiled

- Voltas Limited (India)

- GREE ELECTRIC APPLIANCES, INC.ss (China)

- DAIKIN INDUSTRIES, Ltd. (Japan)

- LG Electronics Inc. (South Korea)

- Panasonic Corporation (Japan)

- Samsung Electronics Co., Ltd. (South Korea)

- Hitachi, Ltd. (Japan)

- Midea Group (China)

- Mitsubishi Electric Corporation (Japan)

- Concepcion-Carrier Air Conditioning Company (CCAC) (U.S.)

KEY INDUSTRY DEVELOPMENTS

- December 2024 – HOSHIZAKI CORPORATION signed to acquire a 51% stake in ASIA REFRIGERATION INDUSTRY JOINT STOCK COMPANY’s ARICO, an air conditioning and electrical construction services company to build production and distribution capabilities of space cooling devices in Vietnam.

- December 2024 - Japanese home appliances manufacturer Daikin Industries, Ltd. announced its plan to invest USD 117.68 million (INR 1,000 Cr.) to set up Southeast Asia’s largest space cooling appliances manufacturing facility in Andhra Pradesh, India. The facility is spanning across 75 acres.

- September 2024 – Haier Smart Home Co. Ltd. announced its plan to invest USD 304.70 million (10 billion THB) to establish its first space cooling appliances manufacturing facility in Thailand. This 324,000 sq. m. facility is situated in WHA Eastern Seaboard Industrial Estate 3 (WHA ESIE 3), Chonburi province, Thailand.

- November 2023 - ZERO, an innovator of air conditioning systems, established a collaboration agreement with Midea Group and TCL to jointly conduct R&D activities and develop newer products for Southeast Asian consumers.

- October 2023 - ECM Technologies, an HVAC efficiency and energy conservation solution provider, established a strategic partnership with AC Wise to increase its air conditioning product reach in Southeast Asia.

Investment Analysis and Opportunities

The Asia air conditioner market research report provides comprehensive investment analysis, insights, and opportunities aimed at providing actionable guidelines to investors and business leaders about the market. The report highlights the various opportunities and trends that have the potential for investments, including R&D activities, new product launches, partnerships & expansion, mergers & acquisitions, and joint venturing.

REPORT COVERAGE

The Asia air conditioner market report analysis includes in-depth market-related information, and it highlights crucial aspects such as prominent companies, product types, product technology, application, and distribution channel analysis areas. Besides this, the research report on the air conditioner market outlook provides insights into the market trends and highlights significant industry developments.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 5.77% from 2025 to 2032 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Product

|

|

By Technology

|

|

|

By Application

|

|

|

By Distribution Channel

|

|

|

By Country

|

Frequently Asked Questions

Fortune Business Insights says that the Asian market was USD 12.74 billion in 2025 and is anticipated to reach USD 18.87 billion by 2032.

In 2024, the market value stood at USD 12.16 billion.

The market forecasted to grow at a CAGR of 5.77% during 2025-2032.

By product, the split segment led the market in 2024.

Manufacturers introduction of IoT-enabled space conditioning systems to favor market growth.

Voltas Limited, Samsung Electronics Co., Ltd., Hitachi, Ltd., GREE ELECTRIC APPLIANCES, INC., and DAIKIN INDUSTRIES, Ltd. are the leading companies operating in the Asian market.

India dominated the Asian market in 2024.

The increasing retail presence of key companies is set to create newer market growth opportunities.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us