Automotive Transmission Market Size, Share & Industry Analysis, By Vehicle Type (Passenger Vehicles (Class A, Class B, Class C, Class D, Class E, Class M, and SUV), Light Commercial Vehicles, and Heavy Commercial Vehicles), By Engine Type (ICE, Hybrid, and BEV), By Transmission Type (Manual Transmission (MT), Intelligent Manual Transmission (IMT), Automated Manual Transmission (AMT), Automatic Transmission (AT), Continuously Variable Transmission (CVT), and Dual Clutch Transmission (DCT)) and Regional Forecast, 2026-2034

Automotive Transmission Market Current & Forecast Market Size

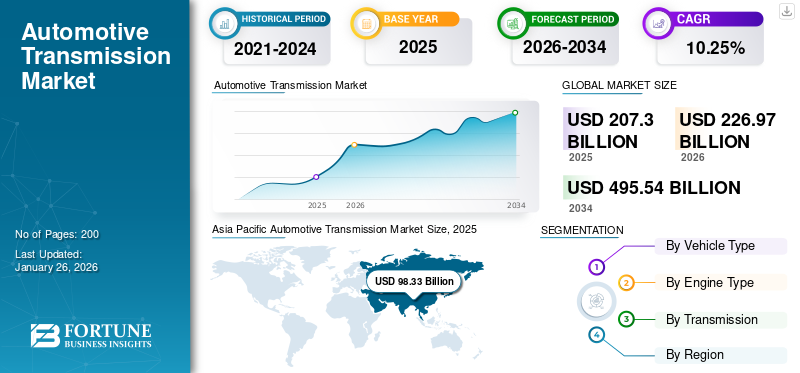

The global automotive transmission market size was valued at USD 207.30 billion in 2025. The market is projected to grow from USD 226.97 billion in 2026 to USD 495.54 billion by 2034, exhibiting a CAGR of 10.25% during the forecast period. Asia Pacific dominated the global market with a share of 47.43% in 2025.

Automotive transmission is a system that transmits power from a vehicle's engine to its wheels, enabling speed variation and torque conversion. Advanced variants including continuously variable transmissions (CVT) shift gears, and automatic transmissions and dual-clutch transmissions (DCT) optimize fuel efficiency and performance. Modern transmissions integrate electronic control units (ECUs) for smoother gear shifts, while electric vehicles (EVs) use single-speed transmissions due to high torque at low speeds. Transmission systems are critical for vehicle dynamics, impacting acceleration, fuel economy, and drivability.

Download Free sample to learn more about this report.

Global Automotive Transmission Market Overview

Market Size:

- 2025 Value: USD 207.30 billion

- 2026 Value: USD 226.97 billion

- 2034 Forecast Value: USD 495.54 billion, with a CAGR of 10.25% from 2026–2034

Market Share:

- Asia Pacific was the largest regional market, with revenue of USD 98.33 billion in 2025, driven by high levels of vehicle production and increasing adoption of automatic and CVT transmissions

- Europe and North America also hold significant shares, supported by established automotive industries and rising electrification trends.

- Leading players in the market include ZF Friedrichshafen (Germany), Aisin Seiki (Japan), BorgWarner (USA), JATCO (Japan), and Getrag (Germany)

Industry Trends:

- Rapid electrification of transmission systems, with the emergence of lightweight, efficient e-transmissions designed for electric vehicles

- Automatic transmissions (AT) continue to dominate, supplemented by growth in CVT, DCT, and AMT segments, catering to rising demand for fuel efficiency and smooth performance

- Diversification of transmission types to include single-speed gearboxes, especially in EVs, and multi-speed variants in high-performance models like Porsche Taycan and Tesla Cybertruck

Driving Factors:

- Strong demand for fuel-efficient vehicles and compliance with stringent emission regulations is driving adoption of advanced transmission systems

- Growth in vehicle electrification, especially in Asia Pacific, necessitates development and deployment of EV-compatible transmission architectures

- Increasing consumer preference for automatic and dual-clutch transmissions for comfort, performance, and efficiency

- Disruption from COVID-19, semiconductor shortages, and supply chain localization are accelerating innovation and investment in modular, localized transmission solutions

Rising demand for fuel-efficient vehicles, stricter emission norms, and advancements in transmission technologies drive the market. Major players in the market include ZF Friedrichshafen (Germany), a leader in 9-speed automatic transmissions, Aisin Seiki (Japan), known for hybrid vehicle transmissions, and BorgWarner (U.S.), specializing in DCT and all-wheel-drive systems. JATCO (Japan) dominates the CVT segment, while Getrag (Germany) supplies high-performance manual and DCT units to sports car manufacturers. Emerging trends include electrification-compatible transmissions and lightweight materials to improve efficiency. The market is also growing in emerging economies, where automakers are localizing production to reduce costs.

The COVID 19 pandemic disrupted supply chains, halted production, and reduced vehicle sales, leading to a temporary decline in transmission demand. However, the shift toward personal mobility post-lockdowns boosted demand for fuel-efficient automatic transmissions. The semiconductor shortage further impacted electronically controlled transmissions, delaying deliveries. Meanwhile, EV adoption accelerated, prompting manufacturers including ZF and Aisin to invest in e-transmission systems. The crisis also pushed automakers to localize supply chains, reducing import dependency. In the long term, the market will recover, with hybrid and EV-compatible transmissions gaining importance.

Automotive Transmission Market Trends

Electrification and Integration of Transmission Systems with Electric Drivetrains is Emerging Market Trend

A transformative trend in the market is the rapid integration of transmission systems with electric drivetrains, as automakers shift from traditional multi-speed gearboxes to compact, efficient e-transmissions tailored for electric vehicles (EVs). Unlike internal combustion engines, EVs require dedicated transmissions that maximize efficiency, torque delivery, and range while minimizing weight and complexity.

Leading manufacturers are revolutionizing with dedicated e-axles and multi-speed EV transmissions to enhance performance. For example, ZF Friedrichshafen’s 2024 eDrive 2-speed transmission improves highway efficiency by 15% in EVs including the Jeep Wagoneer S. Similarly, BorgWarner’s integrated eGearDrive, used in Lucid Air, combines motor, inverter, and transmission into a single unit, reducing energy loss. Startups such as XTRONIC are developing 3-speed EV transmissions for high-performance applications, while Porsche’s Taycan continues to showcase the benefits of 2-speed gearboxes in electric sports cars.

Government regulations are accelerating this shift. The EU’s 2035 ICE ban and China’s New Energy Vehicle (NEV) mandates push automakers to adopt e-transmission technologies. Meanwhile, California’s Advanced Clean Cars II rule incentivizes lightweight, efficient drivetrains. As EV adoption raises, the market moves toward modular, scalable e-transmission systems, blurring the lines between transmissions and electric motors. For instance, Toyota filed patent 2024 for a hybridized e-CVT for its next-gen EVs. Mercedes has also implemented a strategy, developing a 2-speed e-axle for its 2025 EQG electric G-Class. This evolution highlights how transmission technology adapts to the EV era, merging with electrified powertrains for optimal performance. This trend ensures transmission manufacturers remain vital in the future of electrified automotive.

MARKET DYNAMICS

Market Drivers

Increasing Consumer and Regulatory Demand for Fuel-Efficient and Environmentally Friendly Vehicles Enhances the Product Demand

With stricter emission standards such as Euro 7, China’s CN6, and the U.S. CAFE regulations, automakers must adopt advanced transmission technologies that optimize engine performance while reducing fuel consumption and CO₂ emissions. Automatic transmissions (ATs), particularly ongoing variable transmissions CVT and dual-clutch transmissions (DCTs), are gaining traction due to their superior efficiency compared to traditional manual transmissions. For example, Toyota’s 2024 Corolla Hybrid uses an e-CVT that enhances fuel economy by 15-20%, while Volkswagen’s latest DSG (DCT) in the 2024 Golf GTI improves acceleration and reduces emissions. Similarly, Honda’s 2025 Accord Hybrid integrates an intelligent multi-mode drive (i-MMD) transmission, automatically switching between electric and hybrid modes for optimal efficiency.

Electric vehicles (EVs) are also reshaping the transmission landscape. While most EVs use single-speed gearboxes, high-performance models including the Porsche Taycan and Audi e-tron GT employ multi-speed transmissions to enhance speed and range. Tesla’s upcoming "Plaid" powertrain is rumored to feature an innovative 2-speed transmission for better highway competence. Manufacturers are advancing heavily in R&D to meet these demands. ZF Friedrichshafen launched its next-gen 8-speed automatic transmission in 2024, reducing fuel consumption by 10% in ICE vehicles. Aisin Seiki introduced a modular hybrid transmission compatible with multiple powertrains, which Lexus and Toyota adopted. BorgWarner uncovered an 800V e-transmission for EVs, set to debut in Lucid Motors’ 2025 models.

End-user trends and government policies are implementing suitable strategies, and fleet operator companies such as Uber and Lyft are prioritizing hybrid and automatic-transmission vehicles to lower operational costs. This focus on fuel efficiency, emissions compliance, and electrification safeguards sustained automotive transmission market growth, with innovations centered on hybridization, lightweight materials, and smart shifting technologies.

Market Restraints

Declining Demand for Traditional Transmissions Due to Increasing Adoption of EVs

One of the most significant challenges faced by market is the accelerating shift toward electric vehicles (EVs), which is reducing demand for conventional multi-speed transmissions. Unlike internal combustion engine (ICE) vehicles that require complex gearboxes, most EVs utilize single-speed transmissions due to electric motors' wide torque range and high efficiency at various speeds. This trend is disrupting the traditional transmission industry, as EVs account for a growing share of vehicle sales 18% in 2024, up from just 4% in 2020.

Leading suppliers including ZF Friedrichshafen and Aisin Seiki, which previously dominated the 8- and 10-speed automatic transmission market, are now forced to pivot toward e-drive systems. For instance, ZF announced in 2024 that it will phase out production of certain ICE transmissions by 2027, redirecting investments into EV-compatible 2-speed gearboxes and integrated drive units. Similarly, Jatco, a major CVT supplier for Nissan, has seen a 30% decline in orders as Nissan accelerates its EV transition, including the 2024 Ariya SUV, which uses a single-speed reducer.

While developed markets rapidly adopt EVs, price-sensitive regions including India and Southeast Asia still rely on manual and low-cost automatic transmissions. However, government policies are shifting across the countries. India’s FAME-III scheme (2025) prioritizes EV subsidies, pushing automakers including Tata Motors to reduce investments in new ICE transmissions. Meanwhile, China’s 2035 ICE ban has led Geely and BYD to discontinue certain DCT models in favor of dedicated EV platforms.

The rise of EVs is also reducing the transmission repair and replacement market, as EVs require minimal transmission maintenance. Companies including BorgWarner are acquiring e-motor and power electronics firms to offset declining transmission revenues, while independent garages face obsolescence without EV retraining. The decline of ICE vehicles is unavoidable, forcing transmission manufacturers to reinvent their product lines or risk irrelevance. While some companies including ZF and Aisin, are adapting with hybrid and multi-speed EV transmissions, others struggle to keep pace with the electric revolution. This restraint underscores the need for strategic diversification in the evolving automotive landscape.

Market Opportunities

Integration of Smart Bushings with IoT and Sensor Technology can be a Transformative Opportunity for the Market

While most Electric Vehicles (EVs) currently use single-speed transmissions, there is a growing market opportunity for innovative multi-speed transmissions designed to enhance next-generation EVs' efficiency, range, and performance. This trend is particularly noticeable in high-performance electric cars, heavy-duty electric trucks, and off-road EVs, where multi-speed gearboxes can optimize torque delivery and energy consumption at varying speeds.

Luxury and sports EV manufacturers are ground-breaking multi-speed transmissions to overcome the limitations of single-speed systems. For example, Porsche’s 2-speed transmission in the Taycan improves acceleration and top speed while reducing motor strain. Rimac’s Nevera hypercar utilizes a complex multi-ratio system to efficiently maximize its 1,914 hp output. The commercial vehicle segment presents significant growth potential. Daimler Truck’s ePowertrain division is developing a 3-speed transmission for its electric long-haul trucks to improve highway efficiency. Rivian’s electric adventure vehicles use dual-motor setups with gear reducers for improved off-road capability.

Key players are investing heavily, for instance, ZF’s EVplus 2-speed transmission (2024) reduces energy loss by 15% in urban delivery vehicles. BorgWarner’s integrated eGearDrive combines motor and transmission for medium-duty EVs. Dana’s electric axle transmissions power Amazon’s Rivian EDV vans. Mercedes-AMG is strategically developing a performance-focused multi-speed unit for its 2026 electric AMG models. The evolution to multi-speed EV transmissions represents a multi-billion-dollar opportunity, mainly in premium and commercial segments. As EV adoption grows beyond passenger cars, transmission manufacturers who innovate in lightweight, compact, and effectual gear systems will lead this emerging market.

Segmentation Analysis

By Vehicle Type

Widespread Popularity and Versatility of Passenger Cars Leads to Their Dominance

Based on vehicle type segments the market into passenger cars, LCVs, and HCVs.

The passenger vehicle segment holds the largest share of the automotive transmission market, driven by strong demand for SUVs and Class C (compact) vehicles due to their widespread popularity and versatility, accounting for a 72.97% market share in 2026. SUVs, in particular, are driving growth, as they increasingly adopt advanced automatic transmissions (ATs) and dual-clutch transmissions (DCTs) for improved performance and fuel efficiency. For example, Toyota RAV4 and Hyundai Tucson utilize 8-speed ATs and DCTs, enhancing drivability and meeting stricter emission norms. Class B (subcompact) and Class M (multi-purpose) vehicles are also significant, especially in emerging markets including India and Southeast Asia, where cost-effective AMTs and CVTs are preferred. Meanwhile, Class E (executive) and Class D (mid-size) vehicles often feature premium DCTs and ATs, as seen in the BMW 5 Series and the Mercedes E-Class. The fastest-growing sub-segment is SUVs, spurred by urbanization and off-road trends, with transmissions including Jeep’s 4xe hybrid DCT and Land Rover’s 8-speed AT.

Light commercial vehicles (LCVs), such as the Ford Transit, increasingly adopt AMTs and electrified transmissions for cost efficiency. In contrast, heavy commercial vehicles (HCVs) rely on automated manuals (e.g., Volvo I-Shift) and emerging e-axles for electric trucks (e.g., Tesla Semi). The rise in e-commerce logistics and last-mile delivery services fuels the growth of the light commercial vehicle (LCV) segment. Models including the Ford Transit and the Tata Ace increasingly use automated and hybrid transmissions to balance load capacity and fuel economy.

However, smaller in volume, heavy commercial vehicles (HCVs) rely on robust manual and automated manual transmissions (AMTs), with companies including Volvo and Daimler integrating intelligent shifting systems for long-haul efficiency. HCV showcase considerable market growth.

By Engine Type

ICE Segment Led due to Soaring Popularity and Infrastructure Availability in Passenger Cars

The market is segmented, by engine type, into ICE, HEV, and BEV.

The internal combustion engine (ICE) segment holds the largest share of the market, as traditional gasoline and diesel vehicles continue to dominate global fleets, accounting for a 71.73% market share in 2026. Due to its inherent advantages, this demand surge is linked to its increasing popularity in passenger cars and light commercial vehicles. Initially tailored for internal combustion engine (ICE) vehicles to optimize engine efficiency and power-to-speed ratios, this technology has developed considerably, contributing to ICE's greater market share than other engine types.

Battery electric vehicles (BEVs) are the fastest growing and primarily use single-speed transmissions, but high-performance and commercial EVs are adopting 2- and 3-speed gearboxes to enhance efficiency. Examples include Porsche Taycan’s 2-speed transmission and Tesla’s rumored multi-speed Cybertruck gearbox.

Hybrid transmissions have a significant growth rate and are bridging the gap between ICE and full electrification. Toyota’s Hybrid Synergy Drive and Honda’s e: HEV systems use e-CVTs and power-split devices to optimize fuel efficiency, with models including the Toyota Prius and Honda Accord Hybrid leading adoption. The shift toward hybrids and BEVs is reshaping transmission demand, with manufacturers including ZF and Aisin investing in integrated e-drive units. This transition supports the market’s evolution toward sustainable mobility.

By Transmission Type

To know how our report can help streamline your business, Speak to Analyst

Significant Vibration-Damping and Comfort Offered by the Automatic Transmission (AT) Contribute to the Segmental Dominance

Based on transmission type, the market is segmented into Manual Transmission (MT), Intelligent Manual Transmission (IMT), Automated Manual Transmission (AMT), Automatic Transmission (AT), Continuously Variable Transmission (CVT), and Dual Clutch Transmission (DCT).

The Automatic Transmission (AT) segment led the market with a share of 32.93% in 2026 and is poised to maintain its dominance with a higher CAGR during the forecast period. The largest market share can be attributed to the increasing demand for a smoother and hassle-free driving experience.

Following closely, the dual-clutch transmission (DCT) segment is expected to grow significantly. This growth is driven by major auto OEMs' continuous efforts to enhance vehicle drivability and fuel efficiency. These efforts include promoting DCT transmission technology for next-generation vehicles to improve fuel economy and decrease carbon emissions.

Continuously Variable Transmission (CVT), Intelligent Manual Transmission (IMT), Automated Manual Transmission (AMT), and Manual Transmission (MT) systems hold a significant market share and are expected to grow steadily. This growth is due to consumer preferences for various transmission systems that cater to individual needs. The diversification in transmission types caters to varying consumer preferences and regulatory needs, ensuring sustained market expansion.

AUTOMOTIVE TRANSMISSION MARKET REGIONAL OUTLOOK

Regionally, the market is categorized into North America, Europe, Asia Pacific, and the rest of the world.

Asia Pacific

Asia Pacific Automotive Transmission Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific region is experiencing dominance in the automotive transmission market due to the expanding automotive industry, particularly in China and India, with the market valued at USD 50.5 billion in 2025. Increased vehicle production and a shift toward automatic and CVT transmissions are key factors in the market growth. Furthermore, the development of electric vehicles is creating a need for specialized gearbox solutions tailored to EV powertrains. Asia Pacific is the largest production hub, led by Japan (Aisin CVTs), India (Maruti Suzuki AMTs), and China (BYD e-transmissions). Cost-effective AMTs dominate India (e.g., Tata Altroz), while China’s EV boom drives single-speed reducers (NIO, XPeng). Japan’s Toyota and Honda pioneer e-CVTs for hybrids (e.g., Prius). the region’s diverse demand—from budget AMTs to premium EV transmissions—fuels global supply chains. The Japan market is projected to reach USD 1.53 Billion by 2026, the China market is projected to reach USD 48.78 Billion by 2026, and the India market is projected to reach USD 3.77 Billion by 2026.

Europe

The European market is steadily growing, largely due to the transition toward electric vehicles and the demand for more efficient transmission systems to optimize EV performance. There's also a focus on reducing carbon emissions, which incentivizes the development of gearbox solutions that enhance vehicle efficiency and sustainability. The EU’s 2024 Battery Passport Regulation is pushing localized e-transmission production, with Mercedes-Benz developing 2-speed e-axles for EQG. Stellantis’s EMP2 platform integrates hybridized ATs for Peugeot and Opel, showcasing regional innovation. The UK market is projected to reach USD 7.82 Billion by 2026, while the Germany market is projected to reach USD 18.95 Billion by 2026.

North America

North America is witnessing significant market growth driven by technological advancements, increased vehicle production, and a growing consumer preference for vehicles with advanced transmission systems including automatic and dual-clutch transmissions. North America's market is driven by high demand for automatic transmissions (ATs) and performance-oriented drivetrains, particularly in trucks and SUVs. The U.S. dominates with 8- and 10-speed ATs. Recent regulatory pushes including the U.S. EPA’s 2027 Heavy-Duty Emission Standards are accelerating electrified transmissions for commercial vehicles. Tesla’s Cybertruck multi-speed gearbox and Rivian’s dual-motor e-axle highlight the shift toward EV-optimized transmissions. The U.S. market is projected to reach USD 8.82 Billion by 2026.

Rest of the World

The demand for reliable transmission systems in commercial vehicles, particularly those used in transportation and logistics, contributes to market expansion in the rest of the world. Moreover, adopting electric and hybrid vehicles drives the need for advanced gearbox technologies to support electrification initiatives. Latin America relies on flex-fuel ATs (e.g., VW Tiptronic in Brazil), while Africa’s used-car market sustains manual transmissions. The Middle East’s luxury SUV demand fuels high-torque ATs (e.g., Land Rover 8HP), and GCC’s EV targets are prompting e-transmission pilots (e.g., Lucid Air in Saudi Arabia).

COMPETITIVE LANDSCAPE

Key Industry Players

Innovation, Diverse Product Portfolio, Quality, and Reliability make ZF Friedrichshafen AG a Leading Player

ZF Friedrichshafen is the global leader in automotive transmissions and is renowned for its innovative, high-performance drivetrain solutions. Its dominance stems from pioneering technologies including the 8HP and 9HP automatic transmissions, widely adopted by luxury brands (BMW, Audi, Land Rover). ZF also leads in electrified transmissions, including e-drive systems for EVs (e.g., Jaguar I-Pace) and hybrid modules. Strategic acquisitions (e.g., WABCO for commercial vehicle tech) and heavy invest in research and development solidify its position. ZF’s modular transmission platforms cater to diverse segments from passenger cars to heavy trucks, ensuring adaptability amid industry shifts toward electrification.

Aisin, a Toyota Group subsidiary, ranks second with its best-selling CVTs (e.g., Toyota Corolla) and hybrid transmissions (e.g., Prius e-CVT). It surpasses in DCTs for performance models (Lexus IS) and e-axles for EVs (bZ4X). Aisin’s vertically integrated supply chain and OEM partnerships (Honda, Mazda) ensure market resilience. Recent breakthroughs include heat-resistant e-transmissions for high-performance EVs, reinforcing its competitive edge.

LIST OF KEY AUTOMOTIVE TRANSMISSION COMPANIES PROFILED

- ZF Friedrichshafen AG (Germany)

- Aisin Corporation (Japan)

- JATCO Ltd (Japan)

- BorgWarner Inc. (U.S.)

- Getrag (Magnus Powertrain) (Germany)

- Eaton Corporation (U.S.)

- Schaeffler Group (Germany)

- Hyundai Transys (South Korea)

- Dana Incorporated (U.S.)

- GKN Automotive (Dowlais Group) (U.K.)

KEY INDUSTRY DEVELOPMENTS

- June 2025: ZF India entered into a partnership agreement with an Indian commercial vehicle manufacturer to supply a large quantity of 9-speed transmissions designed for vehicles with over 300 horsepower, manual and automatic transmissions for trucks in the heavy-duty segment. The partnership involves ZF's EcoMid manual transmissions and EcoTronic Mid automatic transmissions, engineered for trucks weighing over 25 tonnes and operating in the 1300Nm torque segment. The transmissions will be manufactured at ZF's existing facility in Chakan, Pune, supporting the government's "Make in India" initiative.

- February 2025: Zenvo partners with Ricardo for transmission development of the hypercar Aurora.

- April 2024: Stellantis launched its new electrified dual-clutch transmission (eDCT) at the Mirafiori Automotive Park in Italy. The company also planned an approximately USD 267 million investment in the site and the Italian automotive industry to create the Mirafiori Automotive Park 2030.

- June 2023: Allison Transmission announced its expansion in Saudi Arabia and Qatar to strengthen its presence in the Middle East by partnering with both nations to equip 40 buses with its transmission technology. The buses feature a fully hydraulic automatic transmission without mechanical clutches, less wear and tear on all drivetrain parts, and fewer costly breakdowns and repairs.

- April 2023: Volkswagen AG announced that it would be introducing a manual transmission to the company’s newly launched GT Plus editions for Indian markets. The two models, Virtus GT Plus and Taigun GT Plus, will feature a 6-speed manual gearbox.

REPORT COVERAGE

The global automotive transmission market report provides detailed market analysis and focuses on key aspects such as leading companies, vehicle types, design, and technology. Besides this, the report offers insights into the latest market trends and highlights key industry developments. In addition to the abovementioned factors, the report encompasses several factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

| Estimated Year | 2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) & Volume (Thousand units) |

|

Segmentation |

By Vehicle Type

|

|

By Engine Type

|

|

|

By Transmission Type

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says the market will reach USD 495.54 billion by 2034.

The market is expected to grow at a CAGR of 10.25% during the forecast period.

Increasing consumer and regulatory demand for fuel-efficient and environmentally friendly vehicles enhances the transmission demand.

Asia Pacific led the market in 2025.

Asia Pacific dominated the global market with a share of 47.43% in 2025.

ZF, Aisin, BorgWarner, Getrag, and JATCO are a few of the leading market players operating in the industry.

Get 20% Free Customization

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us