Automotive Wheel Rims Market Size, Share & Industry Analysis, By Vehicle Type (Passenger Cars and Commercial Vehicles), By Material (Alloy, Steel, and Carbon Fiber), By Sales Channel (OEM and Aftermarket), and Regional Forecasts, 2026-2034

KEY MARKET INSIGHTS

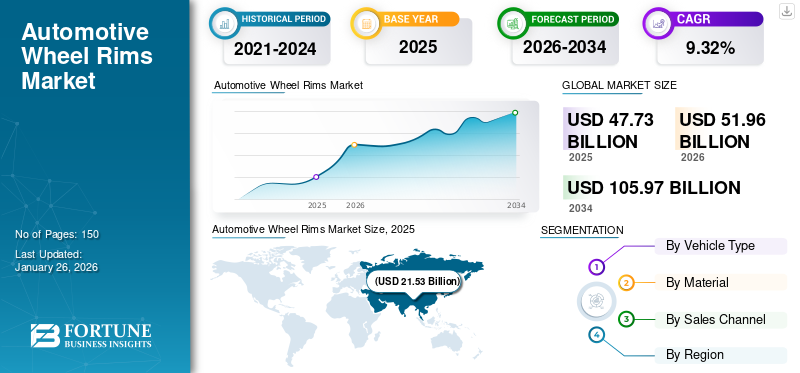

The global automotive wheel rims market size was valued at USD 47.73 billion in 2025 and is projected to grow from USD 51.96 billion in 2026 to USD 105.97 billion by 2034, exhibiting a CAGR of 9.32% during the forecast period. Asia Pacific dominated the global market with a share of 45.10% in 2025.

As the demand for high-power and efficient automobiles increases, so does the adoption of lightweight automotive wheel rims. Wheel rims play a crucial role in improving the driving experience; for instance, lightweight wheel rims enhance the vehicle's power-to-weight ratio, improving ride quality and performance. Moreover, well-built wheel rims improve the vehicle's stability, enabling the wheel to perform accurate rolling, braking, and other critical operations.

Rims improve not only the performance but also the vehicle's aesthetics. The wide range of automotive wheel rims with diverse designs and coatings in the market will enhance the vehicle's aesthetics. Therefore, the growing popularity of new vehicles among various age groups drives the global market growth. Most automotive rims are manufactured using conventional materials such as alloys and steel.

However, automotive wheel rims manufactured from advanced materials such as carbon fiber, which has various favorable properties including high tensile strength, thermal & chemical resistance, lightweight, stiffness, and others, have been witnessing surging adoption in high-performance automotive such as sports cars. The COVID-19 pandemic has negatively impacted this market. Dropped automotive sales and halted transportation activities worldwide, suppressed the sales of automotive wheel rims in both Original Equipment Manufacturers (OEM) & aftermarket.

Automotive Wheel Rims Market Trends

Demand for Lightweight Wheels for Lightweight Vehicles to Drive the Market Growth

As gasoline prices continue fluctuating, automakers have been vigorously improving the miles per gallon to target consumers with budget limits. Hence, the companies are highly focused on improving the fuel economy rating. Therefore, the ongoing trend among vehicle manufacturers to provide improved miles per gallon efficiency by lowering the overall weight of the automobile is one of the major factors driving the automotive wheel rims market growth.

To do so, the manufacturers are adopting metals such as aluminum alloys to manufacture auto parts, including wheel rims to reduce the vehicle's overall weight further. Additionally, advanced vehicles such as EVs are already hefty owing to the weight of lithium-ion battery packs. Therefore, automakers’ preference to use these lightweight materials in the new generation automobiles to improve energy efficiency and travel range will likely accelerate the market growth in the coming years.

Download Free sample to learn more about this report.

Automotive Wheel Rims Market Growth Factors

Surging Automotive Production & Sales to Drive Market Growth

Increasing automotive production and sales worldwide is primarily driving the growth of this market. The market for automobiles is expected to grow significantly owing to increasing focus of manufacturers toward the introduction of EV models. Furthermore, rising consumer awareness toward environment and helping toward carbon neutrality is motivating car buyers to switch toward EVs, leading to higher sales of vehicle than before. Automotive production has been witnessing consistent growth post-pandemic. Therefore, these rising automotive production activities influence OEMs' demand for automotive rims.

Moreover, growth in automotive sales driven by factors such as the rising popularity of personal transportation coupled with the increasing disposable income and standard of living among the populace residing in emerging economies are expected to boost the market growth in years to come.

Increasing Demand for Customized Wheel Rims to Fuel Market Growth

Customizing wheel rim is one of the economical ways to improve vehicle aesthetics. Therefore, consumers' increasing demand for customized wheel rims for a unique and stylish look is a prominent market driving factor. Car enthusiast exhibit the inclination toward upgrading their vehicle for aesthetics and attractive styling purposes. Various car manufactures are including multiple rim styles for their vehicle models to allow consumers to choose the design and shapes of the rims according to their needs and preferences. Moreover, manufacturers focus on automotive wheel rims with various coatings for an elegant look to attract customers. Furthermore, the increasing number of social & racing events across developed economies is also influencing the populace to adopt stylist-customized wheel rims to improve the aesthetics of their cars specifically for the events.

RESTRAINING FACTORS

Volatility in Raw Material Prices to Hamper Market Growth

Raw material price fluctuation and supply shortage are significant factors hampering market growth. For instance, in September 2022, the Aluminium Association of India (AAI) informed the government of India regarding challenges faced by the non-power sector. AAI stated that companies are witnessing enormous material production, cost, and supply disruption due to plummeted coal supply to the non-power sector, including aluminum, steel, and cement. This volatility in raw material supply due to various factors may hamper the market growth.

Automotive Wheel Rims Market Segmentation Analysis

By Vehicle Type Analysis

Increasing Demand for Personal Transport to Boost Growth of Passenger Cars Segment

By vehicle type, the market is segmented into passenger cars and commercial vehicles.

The passenger cars segment held the largest market share of 64.79% in 2026 and is expected to dominate the market during the forecast period. The segment accounted for the largest share of global vehicle production. Moreover, increasing demand for personal transport and the growing popularity of new-generation automobiles, including connected cars and electric vehicles, fuel the demand for high-quality lightweight rims. Furthermore, improving the standard of living and disposable income in developing economies also influences the market's growth.

The commercial vehicles segment also accounted for a significant market share. Increasing transportation and logistics-related activities and the surging adoption of e-commerce are some of the factors driving the sales and production of commercial vehicles, further surging the demand for automotive rims. Furthermore, increasing last mile delivery operations and the expansion of e-commerce marketplaces are expected to further contribute to the demand for commercial vehicles, directly driving the demand for commercial vehicle wheel rims.

By Material Analysis

Increasing Demand for Advanced Materials for Rim Manufacturing to Drive Segment Growth

By material, the market is classified into alloy, steel, and carbon fiber.

The alloy segment dominated the market share of 81.01% in 2026 and is expected to continue its dominance over the forecast period. The growing popularity of aluminum alloys due to their appearance and lightweight drive market growth. Almost all automakers prefer to use aluminum alloy wheels in their automobile to improve the efficiency and performance of the vehicle. The carbon fiber segment is anticipated to witness the fastest growth during the forecast period. Increasing demand for advanced materials such as carbon fiber with lightweight and favorable properties for rim production for sports cars and high-performance vehicles is anticipated to drive segment growth.

The carbon fiber segment is expected to grow at the highest CAGR from 2025 to 2032. The heavy weight of the vehicle consumes more fuel, which, in turn, hampers the growth of the market. Key OEMs such as Mercedes and BMW have focused on adopting lightweight Carbon Fiber Reinforced Plastic (CFRP) wheel rims in most luxury and high-end vehicles to curb the excess fuel consumption in vehicles.

To know how our report can help streamline your business, Speak to Analyst

By Sales Channel Analysis

Increasing Demand for Aluminum Wheel Rims among OEMs to Drive Segment Growth

By sales channel, the market is categorized into aftermarket and OEM.

The OEM segment dominated the market share of 91.21% in 2026 and is likely to continue its command by 2034. The low replacement rate of wheel rims and continuous production of automobiles have concentrated the sales of these rims to OEMs. Moreover, automaker’s efforts on continuous innovation for improving performance, ride quality, and aesthetics are driving the adoption of these rims with various designs, coatings, advanced materials, and others, thereby boosting the segment growth in the coming years.

The aftermarket segment is expected to grow fastest due to consumer preference for installing customized wheel rims. The growing demand for customized passenger vehicles is expected to fuel the demand for aftermarket rims.

REGIONAL INSIGHTS

Rising Automotive Production in the Asia Pacific to Drive Market Growth

Region-wise, the market is categorized into North America, Europe, Asia Pacific, and the rest of the world.

Asia Pacific

Automotive Wheel Rims Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 21.53 billion in 2025 and USD 24.26 billion in 2026. Increasing vehicle sales in China and India are expected to boost the market growth in the region. For instance, automotive sales in China are higher than in any other country globally. Moreover, supportive government regulations in China and the government's focus on banning outdated vehicles will further influence the demand for wheel rims in the region. Apart from conventional vehicles, Asia Pacific is also the hub for electric vehicles. China produces the most significant number of electric vehicles than any other country. Therefore, increasing demand for lightweight rims in these EVs will drive market growth. The Japan market is projected to reach USD 4.61 billion by 2026, the China market is projected to reach USD 11.59 billion by 2026, and the India market is projected to reach USD 3.39 billion by 2026.

North America

North America held the second-largest market share in 2024. North America is well known for its adoption and innovation in new technologies. Therefore, automotive manufacturers in North America are highly focused on adopting advanced lightweight materials for automotive parts. Similarly, increasing demand for aluminum alloy and carbon fiber rims in North America for high-performance vehicles is supporting the market growth in the region. Moreover, surging automotive production in the U.S. is also accelerating the market growth in the region. The U.S. market is projected to reach USD 9.71 billion by 2026.

Europe

Europe is anticipated to witness a substantial growth rate over the forecast period. The growth is mainly driven by the region's leading automakers' increasing demand for lightweight auto parts. For instance, key players such as Volkswagen, Mercedes-Benz, Renault, and others, are highly focused on adopting lightweight auto parts to enhance the performance of their new-generation automobiles. The rest of the world covers Latin America and the Middle East & Africa. The rapidly expanding automotive industry in these regions is anticipated to boost market growth. The UK market is projected to reach USD 0.6 billion by 2026, and the Germany market is projected to reach USD 3.3 billion by 2026.

List of Key Companies in Automotive Wheel Rims Market

Manufacturers Focus on Partnerships with Automakers to Drive Competition in Market

The market is significantly fragmented as several domestic & international automotive wheel rims players operate in it. Therefore, various leading manufacturers are partnering with leading automakers to supply their rims to OEMs. Moreover, these automakers are investing significantly in developing lightweight material-based automotive rims for future mobility solutions.

LIST OF KEY COMPANIES PROFILED:

- MAXION Wheels (U.S.)

- Steel Strips Wheels Ltd. (India)

- ESE Carbon (U.S.)

- Accuride Corporation (U.S.)

- Superior Industries International, Inc. (U.S.)

- Ronal Group (Switzerland)

- Trelleborg AB (Sweden)

- BORBET GmbH (Germany)

- Enkei International, Inc. (Japan)

- Alcoa Wheels (U.S.)

- CITIC Dicastal Co., Ltd. (China)

KEY INDUSTRY DEVELOPMENTS:

- February 2023 – Ford announced to provide carbon fiber wheels for its top-of-the-heap models, including GT Supercar, Mustang Shelby GT500, and Mustang Shelby GT350R. The company also stated that it would soon offer carbon fiber wheels in its lower-line performance-oriented models.

- September 2022 – Maxion Wheels, one of the leading wheel manufacturers, announced that its new manufacturing plant, in partnership with INCI Holdings, is ready to open in Turkey. The company stated that the new plant would be focused on manufacturing steel wheel rims for trucks.

- September 2022 – Maxion inci Wheel Group, a joint venture between Maxion Inci and Maxion Jantas, announced a strategic investment in Manisa OIP during the IAA Transportation fair.

- October 2020 – Auto component manufacturer Wheels India Ltd. announced that its new aluminum wheels’ plant would initially focus on serving overseas.

- September 2019 – Maxion Wheels and ZF Openmatics partnered on wheel connectivity solutions. This partnership is expected to be the world’s first fully-integrated wheel connectivity solution.

REPORT COVERAGE

The report provides detailed market analysis and focuses on key aspects such as leading companies, product types, vehicle types, design, and technology. Besides this, the report offers insight into the market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.32% from 2026 to 2034 |

|

Unit |

Value (USD Billion) & Volume (Thousands of Units) |

|

Segmentation |

By Vehicle Type

By Material

By Sales Channel

By Geography

|

Frequently Asked Questions

Fortune Business Insights say that the market was valued at USD 51.96 billion in 2026 and is projected to reach USD 105.97 billion by 2034.

The market is expected to register a CAGR of 9.32% during the forecast period (2026-2034).

Increasing demand for lightweight automotive parts to drive the market growth.

Asia Pacific dominated the global market with a share of 45.10% in 2025.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us