Bacterial Vaccines Market Size, Share & Industry Analysis, By Type (Recombinant/Conjugate/Subunit, Inactivated, Live Attenuated, Toxoid, and Others), By Route of Administration (Parenteral and Oral), By Age Group (Pediatrics and Adults), By Indication (Meningococcal Disease, Pneumococcal Disease, Diphtheria/Tetanus/Pertussis, and Others), By Distribution Channel (Hospital & Retail Pharmacies, Government Suppliers, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

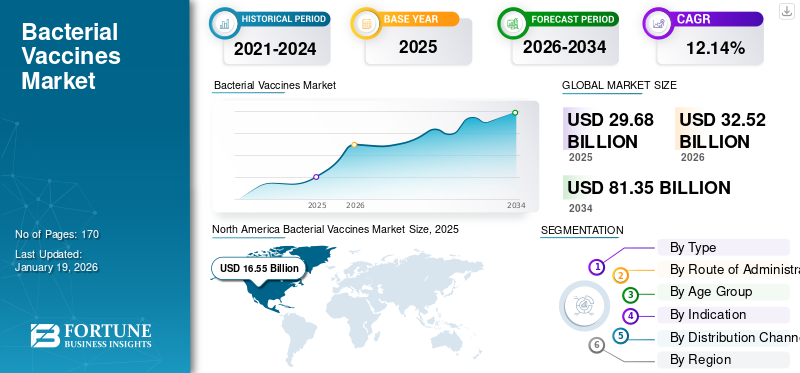

The global bacterial vaccines market size was valued at USD 29.68 billion in 2025. The market is projected to be worth USD 32.52 billion in 2026 and reach USD 81.35 billion by 2034, exhibiting a CAGR of 12.14% during the forecast period. North America dominated the bacterial vaccines market with a market share of 40.97% in 2025.

Bacterial vaccines refer to the type of vaccines that provide protection against bacterial infections. This vaccine works by stimulating the body's immune system to recognize and fight bacterial pathogens to prevent or reduce the severity of infection.

The market has experienced significant transformation and growth in recent years. This growth is driven by some factors, such as the rising global incidence of bacterial infections, increase in government efforts and high research and development initiatives. Additionally, rising awareness about the vaccine's role in preventing bacterial diseases also supports market growth. Sanofi, GSK plc., and Merck & Co., Inc. are some of the leading companies operating in the market.

Moreover, through bacterial vaccines, scientists can develop novel therapies for drug delivery, which propel the market growth in the future.

- For instance, according to the data published by ecancer in August 2024, targeted bacterial vaccines help in cancer treatment by training the body’s immune system to recognize and attack cancer cells.

MARKET DYNAMICS

MARKET DRIVERS

Rise in Incidence of Bacterial Diseases Boost Market Growth

The market growth is driven by the rise in incidence of bacterial diseases, such as diphtheria, tetanus, pertussis, pneumococcal disease, and others. This rise increases the demand for more effective bacterial vaccines. Additionally, the rise in population density and migration patterns contributed to the spread of bacterial infections, further supporting the growth of the market. With a high number of cases, awareness regarding preventive measures among people is also increasing, which further raises the adoption rate of bacterial vaccines and supports market growth.

- For instance, according to the data published by ReAct in December 2022, the global burden of bacterial diseases is increasing. In 2019, approximately 7.7 million deaths around the world were linked to infections caused by 33 types of bacteria.

MARKET RESTRAINTS

Regulatory Hurdles May Hamper Market Growth

The regulatory hurdles may lower the bacterial vaccines market growth. Bacterial vaccines require multi-phase clinical trials and long approval timelines, often spanning 10 to 15 years, which cost millions of dollars per vaccine. Additionally, regulatory standards differ significantly across countries, which increases the complexity of global approvals. Moreover, some manufacturers in emerging economies still face hurdles in maintaining WHO prequalification or GMP standards, which limits their access to global tenders and lower the market growth.

- According to the data published in June 2025, Centers for Disease Control and Prevention (CDC) updated vaccine price list, the private sector cost per dosage of Meningococcal (Groups A, B, C, W, and Y-135) vaccine is USD 189.35. These fixed price ranges may lower the profit, which hampers the market growth.

MARKET OPPORTUNITIES

Rise in Antimicrobial Resistance (AMR) Offer Lucrative Opportunities for Bacterial Vaccines Market

Vaccines are important in the fighting against antimicrobial resistance (AMR), helping to reduce the need for antibiotics and slow the emergence of drug-resistant pathogens. The rise in antimicrobial resistance may increase the market growth in the future. Antimicrobial resistance (AMR) highlights the urgent need for bacterial vaccines, as they reduce the reliance on antibiotics leading to decrease the need for antibiotic treatment. More than 70% of major bacterial strains exhibit antibiotic resistance, bacterial vaccines are a preventive solution to limit infections before antibiotics are needed. Global bodies such as CARB-X fund over 30% of their portfolio for bacterial vaccine development. This rise in antimicrobial resistance leads to increased healthcare spending.

MARKET CHALLENGES

Complexity of Bacteria May Limit Market Growth

The major challenging factor in the bacterial vaccines market growth is the complexity of its products. Bacteria is a very complex organism as compared to viruses, so it is more difficult to target. Due to its complexity, for the development of bacterial vaccines, high investment in research and development is required, which may hinder market growth.

- For instance, according to the data published in May 2022, Vaccines, a medical journal, bacteria are a complex organism as it possesses different types of antigens whose immunogenic potential is unknown. It is unclear which antigen can elicit a protective and long-lasting immune response.

BACTERIAL VACCINES MARKET TRENDS

Development of Thermostable Vaccines is a Significant Bacterial Vaccines Market Trends

In recent years, pharmaceutical companies have shifted their focus to developing innovative vaccines for life-threatening diseases using advanced technologies. A major trend in the market is the development of thermostable vaccines, such as SPVX02, which can stay stable in extreme temperatures from 20°C to +40°C. This innovation reduces the dependency on cold-chain logistics, and it is expected to enter the market by 2027. Additionally, there is a rising demand for thermostable vaccines in pediatric conjugate vaccines targeting pneumococcal, Hib, and pertussis infections. The development of thermostable vaccines is a cost-effective solution for emerging economies where suppliers face logistic problems, such as cold chain management, and others.

- For instance, in April 2025, Stablepharma initiated a human trial for SPVX02, the world’s first fridge free (thermostable) bacterial vaccine.

- Also, according to the data published by the journal The Expert Review of Vaccines, in June 2021, the key market players are highly investing in the R&D for the development of thermostable vaccines.

Download Free sample to learn more about this report.

Segmentation Analysis

By Type

Efficacy and Long-term Protection Bolsters Dominance of Recombinant/Conjugate/Subunit Segment

On the basis of type, the market is segmented into recombinant/conjugate/subunit, inactivated, live attenuated, toxoid, and others.

In 2024, the recombinant/conjugate/subunit segment dominated the bacterial vaccines market with the highest share. The segment is expected to hold its leading position throughout the forecast period. This dominance is due to these types of bacterial vaccines having the ability to elicit an appropriate immune response and provide long-term protection. Additionally, its simplified large-scale manufacturing is responsible for higher production, sales, and demand, which further supports market growth. Also, increasing regulatory approvals for this type of vaccines also boost the segment’s growth.

- For instance, in March 2025, Merck received approval for CAPVAXIVE, a conjugate vaccine from the European Commission (EC). This vaccine is used in the prevention of invasive pneumococcal disease and pneumococcal pneumonia.

On the other hand, the inactivated segment is the second largest segment and is projected to witness a strong growth rate over the forecast period. In recent years, the inactivated segment gained prominence due to their stability and ability to be used in immunocompromised individuals. The growth of the segment is attributed to a robust pipeline of products for various bacterial diseases. Additionally, the increasing R&D investment and advancements in technology further propelled the segment growth.

By Route of Administration

High Efficacy and Product Launches Propel Growth of Parenteral Segment

Based on route of administration, the market is divided into oral and parenteral.

The parenteral segment held the highest market share in 2024 as most bacterial vaccines are based on the parenteral route of administration. Parenteral route has high efficacy as the drugs bypass the liver's first-pass metabolism, allowing the body to easily absorb the drug. Additionally, other factors, such as the quick onset of action and government support, such as vaccination drives, along with new product launches and robust pipeline of products support the market’s growth.

- For instance, in October 2024, Valneva SE and LimmaTech Biologics AG received fast-track designation from the U.S. FDA for Shigella4V (S4V), an injectable vaccine used to treat shigellosis caused by the Gram-negative Shigella bacteria.

The oral segment held a significant share of the market and is anticipated to depict the fastest growth during the forecast period. This growth is attributed to key players paying attention to oral vaccines due to their advantages, such as better safety and ease of administration. Additionally, as compared to the parenteral vaccines, oral vaccines are cost-effective, which further raises its adoption rate.

By Age Group

Rise in Birth Cohort and Increased Vaccination Initiatives Push Pediatrics Segment

On the basis of age group, the market is classified into adults and pediatrics segments.

The pediatric segment held the major bacterial vaccines market share in 2024 owing to an increase in the birth cohort globally and a rise in pediatric vaccination initiatives to prevent bacterial diseases. This is expected to increase the demand for pediatric vaccines globally, which drives the segment growth.

- For instance, according to the data published by the World Health Organization (WHO), in July 2024, around 84.0% of infants worldwide received three doses of diphtheria-tetanus-pertussis (DTP3) vaccine (a bacterial vaccine) in 2023.

The adult segment also held a significant share of the market in 2024 fueled by the rise in prevalence of bacterial diseases worldwide, which increased the R&D activities for adult vaccines. Such research and development activities are expected to develop novel bacterial vaccines that support the segment’s growth.

By Indication

Strong Immunization Trends toward Pneumococcal Disease Boost Segment’s Dominance

Based on indication, the market is divided into meningococcal disease, pneumococcal disease, diphtheria/tetanus/pertussis, and others.

The pneumococcal disease segment dominated the market with a major market share in 2024 due to the rise in prevalence of pneumococcal diseases. Additionally, an increase in awareness to prevent this disease, government initiatives, and an aging population supports the bacterial vaccines market growth during the forecast period.

- For instance, according to the article published in January 2023, serological studies indicated that old individuals are at high risk of getting infected with pneumococcal pneumonia due to a decrease in adaptive immunity, i.e., T-cell responses.

The diphtheria/tetanus/pertussis also held a significant share of the market. The growth of the segment is attributed to the rise in the prevalence of diphtheria, tetanus, and pertussis diseases. Furthermore, the rise in bacterial vaccine launches by key market players to treat these diseases also supports the growth of the segment.

By Distribution Channel

Government Suppliers Focus on Sustainable Vaccine Supply Makes it a Preferred Distribution Channel

Based on distribution channel, the market is categorized into hospital & retail pharmacies, government suppliers, and others.

The government suppliers segment dominated the market growth with the largest share in 2024. This growth is attributed to the increasing focus of government suppliers, such as the Global Alliance for Vaccines and Immunization (GAVI) and the United Nations International Children's Emergency Fund (UNICEF), to achieve a sustainable supply of bacterial vaccines across the globe. Additionally, government initiatives, such as vaccination drives or campaigns, also support the market growth during the forecast period.

- For instance, according to the data published by the United Nations International Children's Emergency Fund (UNICEF) in May 2023, every year, two billion life-saving vaccines are delivered by UNICEF to protect children against bacterial diseases such as pneumonia,

On the other hand, the hospital & retail pharmacies segment is expected to witness considerable growth in upcoming years. The hospital and retail pharmacies ensure that vaccines are available enough to meet the demands of patients. This is expected to boost the segment growth during the forecast period.

BACTERIAL VACCINES MARKET REGIONAL OUTLOOK

By region, the market is divided into Europe, North America, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Bacterial Vaccines Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The North America region dominated the global market and generated a revenue of USD 16.55 billion in 2025. Key factors contributing to the regional dominance include the robust usage of vaccines and the increasing number of vaccination plans to prevent bacterial diseases in the region.

U.S.

In North America, the U.S. held the major share of the bacterial vaccine market in 2024. This growth is attributed to factors such as the rise in the prevalence of bacterial diseases, substantial investments in R&D, the strong presence of well-established as well as emerging entities, and a favorable regulatory environment support.

- For instance, in January 2024, Emergent BioSolutions Inc. secured an indefinite-delivery, indefinite-quantity (IDIQ) procurement contract to supply BioThrax with a maximum value of USD 235.8 million. It will used by all branches of the U.S. military as Pre-Exposure Prophylaxis (PrEP) for anthrax disease.

Europe

Europe is expected to witness significant growth in the upcoming years. The growth of the region is attributed to centralized vaccine procurement systems, government initiatives, such as vaccines awareness campaigns, and other factors. Additionally, the favorable regulatory frameworks and new product launches also support the market’s growth in this region. Germany, the U.K., and France invest significantly in national immunization programs leading to increase in regional growth.

- For instance, according to the data published by the World Health Organization, in July 2024, in Europe, the Haemophilus influenzae type b (Hib) vaccine coverage is 94%, as compared to the global coverage, which is estimated to be around 77%.

Asia Pacific

Asia Pacific is the fastest-growing region of the bacterial vaccines market with significant contribution from India and China. India’s Serum Institute and Bharat Biotech supply vaccines, including bacterial vaccines, globally. Additionally, government campaigns in Indonesia, Vietnam, and the Philippines are boosting the adoption rate of bacterial vaccines, leading to boost market growth.

The rise in government initiatives, such as immunization campaigns, coupled with increasing bacterial vaccine development and external funding support also helps to drive the market growth in this region.

- For instance, in March 2024, Biological E Limited and the International Vaccine Institute (IVI) signed a technology license agreement to manufacture a simplified oral cholera vaccine (OCV-S) at Biological E Limited’s facilities.

Latin America and the Middle East & Africa

The Latin America and the Middle East & Africa regions held a comparatively lower market share in 2024. However, these regions are expected to grow in upcoming years. The immunization coverage supported by GAVI and UNICEF is rising in these regions. Nigeria, Egypt, and Kenya are among the leading countries investing in national immunization strategies. However, the infrastructure deficits and conflict zones limit the widespread access to bacterial vaccines. Oral and thermostable vaccines are expected to drive the growth of the market during the forecast period.

COMPETITIVE LANDSCAPE

Key Market Players

Strong Focus on R&D and Pipeline Candidates Boost Market Presence of Leading Companies

The global bacterial vaccines market is concentrated, with companies such as Sanofi, GSK plc. And Merck & Co., Inc. accounts for a significant share.

Sanofi is one of the leading players in the market and is actively involved in the development of bacterial vaccines. The company is actively engaged in the research and development, manufacturing, and marketing of bacterial vaccines. Additionally, the company's bacterial vaccine products include pertussis, Hib pediatric, meningitis, and endemic vaccines. Moreover, the company has a strong focus on various strategic initiatives, such as collaboration, acquisitions, and others, which make it a key market player. Sanofi is a leading player due to its global manufacturing and distribution network with focus on combination vaccines.

- For instance, in October 2023, Sanofi collaborated with Janssen Pharmaceuticals, Inc. to develop and commercialize the vaccine for extra-intestinal pathogenic E. coli (9-valent) developed by Janssen Pharmaceuticals, Inc., which was in Phase

Merck & Co. is another prominent player in the market. It strongly invests in research and development activities for the development of bacterial vaccines. Merck & Co., Inc. contributed to the discovery and development of novel vaccines to fight various bacterial diseases. The company’s human health bacterial vaccine products consist of preventive pediatric, adolescent and adult vaccines. The company’s growth is driven by a rise in incidence of antimicrobial resistance (AMR). Merck & Co. is strongly focused on stopping the increasing threat of AMR.

- For instance, in June 2024, Merck & Co., Inc. received the U.S. FDA approval for the Capvaxive pneumococcal vaccine to protect against certain types of pneumonia and other infections.

Other entities operating in the market include Bharat Biotech, GSK plc., and Emergent BioSolutions, Inc. These players are increasing investments in research activities for the development of innovative products and pipeline candidates, which support the companies’ share in the market.

LIST OF KEY BACTERIAL VACCINES COMPANIES PROFILED

- Sanofi (France)

- GSK plc. (U.K.)

- Merck & Co., Inc. (U.S.)

- Bharat Biotech (India)

- Pfizer Inc. (U.S.)

- Emergent BioSolutions, Inc. (U.S.)

- Serum Institute of India Pvt. Ltd. (India)

- BIO-MED (India)

KEY INDUSTRY DEVELOPMENTS

- March 2024: Pfizer Inc. received market authorization for its PREVENAR 20 from the European Commission (EC) to protect infants and children against pneumococcal disease.

- July 2023: EMERGENT received the U.S. FDA approval for its CYFENDUS (anthrax vaccine) for use in adults aged 18 through 65

- May 2023: Bavarian Nordic acquired the travel vaccine portfolio from EMERGENT, including two marketed vaccines, Vivotif and Vaxchora, for the prevention of typhoid fever and cholera, respectively.

- June 2022: Merck received approval from the U.S. FDA for VAXNEUVANCE, a conjugate vaccine used for the prevention of invasive pneumococcal disease in infants and children

- June 2021: Merck and Sanofi’s product VAXELIS, a first and only hexavalent (six-in-one) combination vaccine was made available in the U.S. It is indicated for active immunization and prevention of diphtheria, tetanus, pertussis, and hepatitis B.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 12.14% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Route of Administration

|

|

|

By Age Group

|

|

|

By Indication

|

|

|

By Distribution Channel

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 32.52 billion in 2026 and is projected to record a valuation of USD 81.35 billion by 2034.

In 2025, the market value stood at USD 16.55 billion.

The market is expected to exhibit a CAGR of 12.14% during the forecast period of 2026-2034.

The recombinant/conjugate/subunit segment led the market by type.

The key factors driving the market are the rise in prevalence of bacterial diseases and increase in research and development activities.

Sanofi, GSK plc. and Merck & Co., Inc. are the top players in the market.

North America dominated the bacterial vaccines market with a market share of 40.97% in 2025.

The rise in awareness and prevalence of bacterial diseases, and the rise in the demand for bacterial vaccines in developing markets are some of the factors that are expected to favor product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us