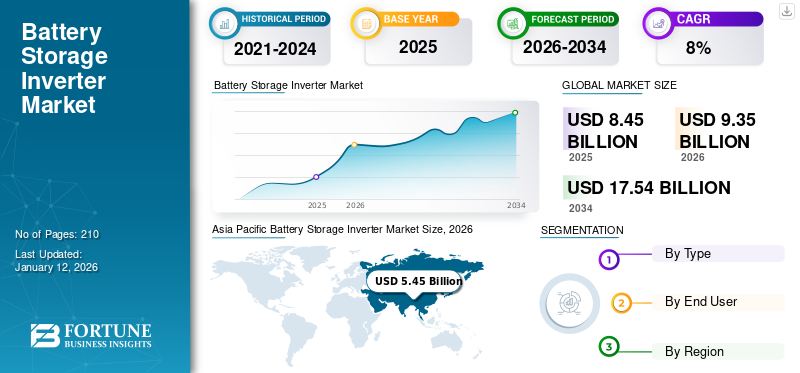

Battery Storage Inverter Market Size, Share & Industry Analysis, By Type (Single Phase Electric Power and Three Phase Electric Power), By End User (Residential, Commercial & Industrial, and Utility), and Regional Forecast, 2026-2034

Battery Storage Inverter Market Size and Future Outlook

The global battery storage inverter market size was valued at USD 8.45 billion in 2025 and is projected to grow from USD 9.35 billion in 2026 to USD 17.54 billion by 2034, exhibiting a CAGR of 8.18% during the forecast period. Asia Pacific dominated the battery storage inverter industry with a market share of 57.84% in 2025

A battery storage inverter is an important component in renewable energy systems, facilitating the efficient management of stored electrical energy. It serves a dual purpose: converting direct current electricity stored in batteries into alternating current for use in homes and businesses and vice versa, allowing the system to store excess energy produced by sources, such as solar panels or wind turbines. This conversion is essential for integrating stored energy into the power grid or using it during peak demand periods.

Hitachi is one of the leasing inverter manufacturing companies for battery storage. The PQstorITM and PQstorITM R3 inverters are compact, efficient, and modular solutions for Battery Energy Storage Systems (BESS), suitable for small to medium industrial, commercial, and renewable energy applications. Their flexible design allows easy integration and customization to meet specific needs, while high-efficiency 3-level bi-directional technology ensures optimal energy storage. These inverters are compatible with second-life automotive batteries and comply with grid codes, such as EN 50549-10 (2022).

MARKET DYNAMICS

MARKET DRIVERS

Rising Adoption of Renewable Energy is Driving the Market Expansion

The rising carbon emissions have inclined the globe to move toward renewable energy as a sustainable approach. The governments of the countries have made stringent regulations for limiting carbon emissions and set targets for increasing the share of renewable energy in the energy mix in the coming years. The increasing reliance on intermittent renewable energy sources, such as solar and wind, requires efficient storage systems. Battery storage inverters help manage and stabilize the energy generated, making them essential for integrating renewables into the grid. In 2023, renewable energy accounted for about 24.1% of the European Union’s final energy use, marking a one-percentage-point increase from 2022, largely driven by strong growth in solar power. A slight reduction in non-renewable energy consumption also supported this increase. To meet the EU’s new 2030 target of 42.5%, renewable energy deployment will need to more than double compared to the past decade, requiring a major transformation of Europe’s energy system, further supporting the global battery storage inverter market growth.

Favorable Government Policies and Incentives to Lead Market Surge

Recognizing the importance of clean energy for economic, environmental, and energy security reasons, many governments have introduced policies that encourage investments in renewable energy and energy storage systems. These measures include tax incentives, subsidies, grants, and favorable regulatory frameworks aimed at reducing the financial burden and risks associated with deploying renewable and battery storage solutions. For instance, China has set its 2024 renewable power subsidy at USD 1 billion, according to the finance ministry. The subsidies for 2024 allocate around USD 277 million for solar power, about USD 485 billion for wind energy, and the rest for other renewable sources. This type of financial support makes it more attractive for residential, commercial, and utility-scale investors to adopt battery storage inverters, which are essential for converting and managing energy between renewable sources and the grid. Thus, the strong support by the governments of the countries is expected to boost the demand for battery storage inverters.

MARKET RESTRAINTS

High Initial Costs to Constrain Market Expansion

The initial costs, including not only the inverters themselves but also the associated energy storage systems, installation, and integration with existing infrastructure, present a significant challenge for the adoption of battery storage inverters. For residential and small commercial users, these expenses can be prohibitive, making the return on investment less attractive in the short term compared to conventional energy solutions. The high costs stem from several factors: the use of advanced technology, the need for high-quality components to ensure reliability and efficiency, and the incorporation of complex power electronics for grid compatibility. Additionally, the price of lithium-ion batteries, while decreasing over the years, still contributes to the substantial upfront expenses of complete energy storage solutions. Hence, the high cost associated with the installation of battery storage solutions is expected to hinder market development.

MARKET OPPORTUNITIES

Ongoing Grid Modernization is Expected to Offer Lucrative Opportunities for the Market

Modernizing power grids involves integrating advanced technologies that enhance their efficiency and flexibility to handle the increasing influx of renewable energy sources. Traditional power grids were designed for one-way energy flow from centralized plants to consumers, so they face challenges accommodating variable and decentralized renewable sources, such as solar and wind. For instance, in December 2019, the Bundesnetzagentur, Germany, approved the 2019-2030 Grid Development Plan, which details the grid expansion and optimization needed to meet Germany's climate targets by 2030.

Battery storage inverters play a crucial role in this transformation, enabling the bidirectional flow of energy and supporting the dynamic balance of supply and demand. They convert and manage stored energy, ensuring that renewable power is efficiently used and stored when production exceeds consumption. During periods of low renewable energy generation, inverters discharge stored energy back into the grid to maintain stability and prevent outages.

MARKET CHALLENGES

Fluctuating Power Inputs by Renewable Energies Hinder Market Development

Fluctuating power inputs from solar and wind energy arise from their dependence on environmental conditions, such as sunlight availability and wind speed, which can change rapidly and unpredictably. These fluctuations result in variable DC outputs from renewable energy systems, posing a challenge for inverters tasked with converting this variable DC power into stable AC power suitable for the grid or end-users. The instability can manifest as voltage fluctuations, frequency deviations, or even power outages if not properly managed.

Moreover, integrating this fluctuating power into the grid complicates grid stability. The grid operates on precise voltage and frequency levels, and any disruption can cause harmonic distortion, such as anomalies in the waveform that reduce power quality and efficiency. These distortions might lead to overheating, reduced lifespan of electrical equipment, and even failure of sensitive devices. Thus, the fluctuation in the supply of power from renewable sources is expected to hinder the growth of the market in the coming years.

BATTERY STORAGE INVERTER MARKET TRENDS

Growing Traction Toward Energy Independence is One of the Key Trends in the Market

Energy Independence enables individuals, businesses, and nations to reduce reliance on external energy sources and centralized grids for regions prone to grid instability or in remote locations where connecting to the main power grid is not feasible. By using battery storage inverters, energy generated from renewable sources, such as solar and wind, can be stored and used as needed, allowing for greater self-sufficiency in power supply. For instance, in March 2024, Jaguar Land Rover (JLR) announced plans to build and install renewable energy projects to meet over 25% of its U.K. electricity needs. These off-grid projects will generate nearly 120 MW at peak capacity, enough to power 44,500 homes annually. Moreover, on a larger scale, the widespread adoption of battery storage systems helps countries reduce dependency on imported fossil fuels, enhance energy security, and strengthen resilience against energy price volatility, simultaneously increasing the sales of battery storage inverters.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The outbreak of COVID-19 created significant challenges for the battery storage inverter market by disrupting supply chains, manufacturing processes, and project timelines. Factory closures, shipping delays, and labor shortages slowed the production and delivery of battery storage inverters, affecting the availability and cost of key components. Additionally, many renewable energy projects, particularly large-scale storage installations, faced delays or cancellations due to financial uncertainty and shifting priorities during the pandemic.

SEGMENTATION ANALYSIS

By Type

Three Phase Electric Power Leads the Market Due to Its Suitability in Industrial-scale Energy Storage

The market is segmented by type into single phase electric power and three phase electric power.

Three phase electric power holds the major share in the market due to its ability to handle larger energy capacities, making it suitable for industrial-scale energy storage, commercial applications, and utility-scale projects. Three-phase systems are highly efficient and capable of managing the higher power loads required in these settings, supporting grid stability and renewable energy integration. The segment is foreseen to attain 58.07% of the market share in 2026.

Single phase electric power is the second leading segment due to its growing uses in residential applications with lower power requirements, such as small-scale solar installations and home energy storage systems. Additionally, the increasing adoption of residential solar power systems, rising interest in backup power for homes and small businesses, and government incentives for renewable energy in regions, such as the U.S. and Europe are also leading to the development of single-phase electric power in the market. This segment is expected to grow with a CAGR of 8.35% during the forecast period (2026-2034).

By End User

To know how our report can help streamline your business, Speak to Analyst

Rising Focus for Grid Stability and Renewable Energy Drives the Utility Sector

The market is segmented by end-user into residential, commercial & industrial, and utility.

Utility holds the largest battery storage inverter market share, influenced by regional grid needs and renewable energy projects. The rising focus on grid stability, renewable energy integration, frequency regulation, and peak demand management, supported by government and private investments in infrastructure, is also stimulating the expansion of the utility sector in the market. The segment is expected to gain 55.61% of the market share in 2026.

The residential sector is the fastest-growing segment in the market, owing to the increasing adoption of home solar and battery storage systems. The rising demand for energy independence and backup power solutions, government incentives and subsidies for renewable energy adoption, and technological advancements that make inverters more compact and efficient are supporting the expansion of the residential segment in the market.

BATTERY STORAGE INVERTER MARKET REGIONAL OUTLOOK

The market has been studied geographically across four main regions: North America, Europe, Asia Pacific, and the Rest of the World.

Asia Pacific

Asia Pacific Battery Storage Inverter Market Size, 2026 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Increasing Renewable Energy Penetration to Foster Market Growth in Asia Pacific

Asia Pacific dominated the market with a valuation of USD 4.35 billion in 2024 and USD 4.89 billion in 2025. The market in this region is the fastest growing, due to the fast-growing integration of renewable energy sources and battery energy systems. In 2022, Asia contributed about 65% of global renewable energy funding, which increased by 13% year-over-year to USD 532 billion. Investments in renewable energy in the Asia Pacific region are expected to double to USD 1.3 trillion by 2030, compared to the previous decade. Renewable energy integration is supported by the country's government's strong focus on reducing carbon emissions and reaching carbon neutrality in the coming years. Japan is anticipated to reach USD 1.08 billion in 2026, while South Korea market is estimated to be worth USD 0.38 billion in the same year.

China

Soaring Deployment of Solar and Wind Energy to Propel the Market in China

China is one of the leading countries in the region, witnessing rapid growth in the market owing to the high penetration of renewable energy, such as solar energy and offshore & onshore wind. Chinese energy investments remain strong, making up one-third of global clean energy investments and contributing significantly to its GDP growth. China aims to peak carbon emissions by 2030 and reach carbon neutrality by 2060, showing significant progress. In 2023, China installed as much solar PV as the entire world did in 2022, and wind energy additions increased by 66% year-over-year. Over the past five years, China added 11 GW of nuclear power, the largest increase by any country. China is forecasted to be valued at USD 3.34 billion in 2026.

North America

Increasing Construction Activities and Government Support for Renewable Energy to Push the Market in North America

North America is the second leading region in the market expected to hit USD 2.05 billion in 2026, exhibiting a CAGR of 8.30% during the forecast period (2025-2032), due to extensive residential, commercial, and utility-scale energy storage projects. The strong incentives and policies, such as tax credits supporting renewable energy adoption, a high rate of residential solar and backup energy solutions, and significant utility-scale projects aimed at grid stabilization, are pushing the growth of the market in the region. For instance, The "Made in Canada" strategy aligns with a global shift toward boosting domestic manufacturing and job creation, similar to policies, such as the U.S. Inflation Reduction Act. The refundable Investment Tax Credit (ITC) under this strategy offers a 30% tax write-off for renewable energy investments, incentivizing local production and reducing dependency on imports. This policy aims to stimulate economic growth, enhance energy security, and support the transition to clean energy by encouraging investment in homegrown renewable technologies through 2034.

U.S.

Stringent Government Initiatives for Carbon Emission Reduction to Drive the Product Demand in the U.S.

The U.S. has been experiencing significant growth in the market owing to the numerous government strategies to reduce carbon emissions and transition to a more sustainable energy system. Key initiatives, such as the Inflation Reduction Act, have introduced substantial incentives to boost the development and deployment of clean energy technologies, which include tax credits for solar and wind energy, investments in battery storage, and support for domestic production of renewable energy components. In September 2024, The U.S. government announced around USD 7.3 billion in clean energy investments under the Investing in America agenda, marking the largest rural electrification investment since the New Deal. This initiative aims to promote a prosperous future for rural communities by accelerating the shift to clean energy, keeping energy bills affordable, and creating new jobs and apprenticeships to support the American workforce. The U.S. market is poised to hold USD 2.01 billion in 2026.

Europe

Government Focus on Carbon Neutrality to Push Market Growth in Europe

Europe is the third leading region expected to grow with a valuation of USD 1.54 billion in 2026. The region also holds a notable share in the market owing to the growing demand for energy storage solutions that support the integration of renewable sources, such as solar and wind, into the grid. With policies, such as the European Green Deal and ambitious carbon neutrality targets, many European countries are incentivizing investments in energy storage systems. The U.K. market continues to grow, projected to reach a market value of USD 0.18 billion in 2026. In the first half of 2024, renewables accounted for 50% of public electricity generation in the EU, a milestone for the region. Eurelectric highlighted that 74% of power came from renewable and low-carbon sources, including nuclear, up from 68% in 2023. The association noted that the pace of decarbonization in Europe is unprecedented. This has spurred the adoption of advanced battery storage inverters that ensure efficient power conversion and grid stability. Germany is foreseen to gain USD 0.37 billion in 2026, while Italy is expected to stand at USD 0.23 billion in the same year.

Rest of the World

Surging Deployment of Renewable Energy to Positively Impact the Market in the Rest of the World

The rest of the world is the fourth leading region anticipated to attain USD 0.29 billion in 2026. Countries of the Middle East & Africa and Latin America, is showing positive growth in the market owing to the rise in the share of renewable energy in the energy mix. The growth in the deployment of solar and wind energy coupled with the battery energy storage system is expected to have a positive impact on the market in the region. Brazil is showing rapid growth in the region as it generated 91% of its electricity from clean sources in 2023, with hydropower making up 60%. Its share of wind and solar energy was 21%, higher than the global average of 13% and Argentina’s 12% but lower than Chile’s 32%.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Market Players are Launching New Products To Support Various Applications

Globally, Wind & Sun Ltd, ABB, Hitachi, Eaton, and KACO are some of the dominating players in the market. Hitachi, one of the leading companies, focuses on integrating advanced inverter solutions with battery energy storage systems (BESS) to support the growing demand for clean energy and grid stability. Hitachi has also been enhancing its product launches by improving inverter efficiency, scalability, and compatibility with renewable energy sources, such as solar and wind. Hitachi’s PQstorITM family of inverters is ideal for integration into Battery Energy Storage Systems (BESS) across a variety of applications. These inverters support small and medium-sized industrial installations, commercial buildings such as data centers, and Electric Vehicle (EV) charger infrastructure. They are also designed to enhance renewable energy integration. They can be used for the second-life application of automotive Li-Ion battery modules, making them versatile solutions for a wide range of energy storage needs.

Wind & Sun Ltd, a U.K.-based renewable energy company, is also one of the leading companies in the market dedicated to advancing battery storage inverter technology to support energy independence and sustainability. The company offers a range of on-grid, off-grid, and hybrid inverters tailored for various applications. Their on-grid battery inverters efficiently store surplus energy for later use, ensuring energy availability during low generation or grid outages. For remote or standalone systems, their off-grid inverters deliver reliable AC power from battery banks. Wind & Sun also champions hybrid inverters, integrating solar energy management and battery storage in a single solution, designed to optimize energy use and enhance backup capabilities. Their efforts empower customers with efficient, adaptable energy solutions.

List of the Key Battery Storage Inverter Companies Profiled:

- ABB (Switzerland)

- Wind & Sun Ltd. (U.K.)

- Hitachi (Japan)

- TRIED (Italy)

- Eaton (Ireland)

- SMA Solar Technology AG (Germany)

- KACO (Germany)

- Robert Bosch GmbH (Germany)

- Ginlong Technologies (China)

- Zhicheng Champion (China)

- SUNGROW (China)

- Dynapower (U.S.)

KEY INDUSTRY DEVELOPMENTS:

In November 2024, Deye, a Chinese inverter manufacturer, launched a 2 kWh hybrid energy storage system (ESS) for residential and off-grid solar applications. The AE-F(S)2.0-2H2 system includes a microinverter, lithium iron phosphate (LFP) battery, and battery management system (BMS). It supports up to four expansion modules for a total storage capacity of 10 kWh. The system features multiple output ports to power different devices simultaneously. It includes two maximum power point trackers (MPPTs) with a high PV power input of 1,600 W, making it compatible with over 99% of photovoltaic panels for maximum flexibility.

In September 2024, EPC Power launched the M System, a new platform aimed at optimizing energy storage and solar plant design. This advanced solar inverter solution highlights EPC Power’s focus on high-quality, innovative products that meet the changing needs of renewable energy. The M System enables the smooth integration of battery and solar energy systems, reinforcing EPC Power's role in supporting reliable and profitable energy projects in the U.S. and globally.

In June 2023, Savant Systems, which recently acquired POMCube, launched its first home energy storage system, Savant Power Storage, with shipping starting in Q3 2023. The system features a scalable inverter and LFP battery, offering storage capacities from 12.5 kW to 125 kW or 20 kWh to 200 kWh. Its integrated software optimizes power source management, ensures high performance, and provides flexible load management for homes and businesses up to 800A.

In October 2023, FIMER announced the launch of a 5 MVA bidirectional converter (BDC) for large-scale grid-connected energy storage in India within the next two months, with commercial availability early next year. It will be the largest BDC produced in India. FIMER serves commercial, industrial, and utility-scale markets and operates a 10 GW factory in Bengaluru that produces central inverters, bidirectional converters, and microgrid inverters. Its 1 MVA BDC, PVS980-58BC, has already been used in projects in Modhera and by the Indian army in Leh, Ladakh.

In April 2023- Ginlong (Solis) Technologies announced the launch of its new S6 Advanced Power Hybrid Inverter, designed specifically for South Africa, at the Solar Show Africa 2023 in Johannesburg from April 25 to 26. The inverter features generator connection and control functions, making it an independent power center ideal for South African residential and commercial markets, where power outages are common.

REPORT COVERAGE

The global battery storage inverter market report delivers a detailed insight into the market and focuses on key aspects such as leading companies in Battery Storage Inverter. Besides, the report offers insights into the market trends & technology and highlights key industry developments. In addition to the factors above, the report encompasses several factors and challenges that contributed to the growth and downfall of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.18% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By End User

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 8.45 billion in 2025.

The market is likely to grow at a CAGR of 8.18% over the forecast period.

The utility segment leads the market.

The Asia Pacific market size stood at USD 4.89 billion in 2025.

The rising integration of renewable energy is the key factor driving market growth.

Some of the top players in the market are Wind & Sun Ltd, ABB, Hitachi, Eaton, and KACO.

The global market size is expected to reach USD 17.54 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us