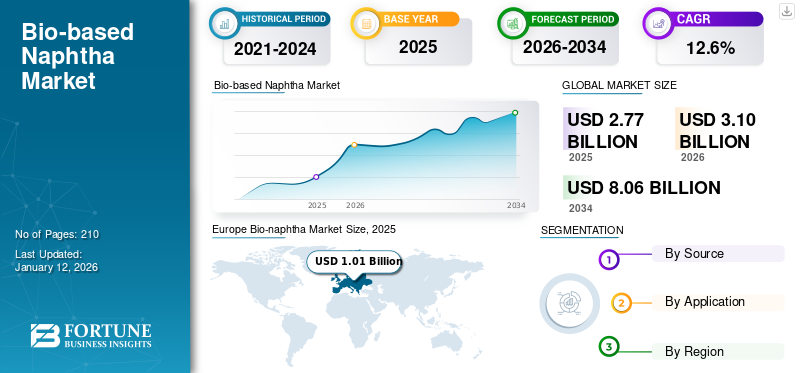

Bio-naphtha Market Size, Share & Industry Analysis, By Source (Biomass, Vegetable Oil, and Others), By Application (Petrochemicals, Gasoline, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global Bio-naphtha market size was valued at USD 2.77 billion in 2025 and is projected to grow from USD 3.10 billion in 2026 to USD 8.06 billion by 2034 at a CAGR of 12.6% during the forecast period of 2026-2034. Europe dominated the Bio-naphtha market with a market share of 37% in 2025.

Bio-naphtha is a liquid hydrocarbon mixture derived from renewable sources such as vegetable oils, waste animal fats, forestry residues, used cooking oils, and other organic waste materials. It is primarily a byproduct of second-generation hydrotreated vegetable oil (HVO) processes used to produce renewable diesel and sustainable aviation fuel (SAF), and can be obtained through methods such as Fischer-Tropsch conversion or hydrotreating.

Increasing demand for sustainable fuel and petrochemical alternatives is propelling the market growth. This growth is fueled by the need for renewable, low-carbon solutions in various industries, including transportation, chemicals, and energy. UPM Biofuels, Chevron, Mitsui Chemicals, and Neste Oil Corporation are the key players operating in the market.

Bio-naphtha Market Trends

Growing Demand for Renewable Fuels to Boost Market Growth

The rising demand for renewable fuels is expected to boost the global bio-naphtha market growth. As countries and industries shift toward more sustainable energy solutions, bio-naphtha, produced from biomass sources, is gaining attention for its potential to reduce greenhouse gas emissions and dependence on fossil fuels. This trend is driven by stricter regulations on carbon emissions, increasing awareness of environmental issues, and advancements in production technologies. With various applications in transportation and petrochemical industries, the market is likely to expand as companies invest in cleaner alternatives to traditional naphtha.

Download Free sample to learn more about this report.

Market Dynamics

Market Drivers

Environmental Concerns and Sustainability to Boost Market Growth

The increasing consumer demand for sustainable products and corporate sustainability commitments are prompting industries such as chemicals, automotive, and packaging to integrate products into their supply chains as part of their sustainable strategies.

Additionally, the growing awareness of climate change and the need to meet international climate commitments, such as those outlined in the Paris Agreement, are incentivizing stakeholders to transition from fossil-based to bio-based feedstocks, further bolstering the growth of the market.

Market Restraints

High Production Costs are Restraining Market Growth

High production costs are indeed a significant barrier to the growth of the market, making it less competitive with conventional naphtha. This cost disparity is primarily due to the expense of raw materials, specialized technology, and the complexities of large-scale bio-refinery operations.

These elevated costs can hinder competitiveness against conventional fossil fuels and limit widespread adoption. Efforts to innovate production processes and increase efficiency may help mitigate these financial barriers and encourage growth in the market.

Market Opportunities

Regulatory Support and Incentives will Create Significant Growth Opportunities

Stringent environmental regulations and incentives promoting demand for bio-based solutions, such as the EU's Renewable Energy Directive (RED II) and the U.S. EPA's Renewable Fuel Standard (RFS), are accelerating product adoption.

The EU Green Deal and Renewable Energy Directive (RED II) introduce sub-targets for renewable feedstocks in petrochemicals and obligate a significant growth in RFNBO (Renewable Fuels of Non-Biological Origin) share in final energy demand by 2030, directly enlarging the addressable market. Additionally, the U.S. EPA’s Renewable Fuel Standard (RFS) and the new 45Z Clean Fuel Production Credit effectively cut the current cost gap with fossil naphtha, triggering a wave of refinery retrofits and co-processing projects.

As governments increasingly focus on sustainability and reducing carbon emissions, there are efforts to promote alternative fuels such as bionaphtha. This shift is likely to drive investment and innovation in the sector, making it a promising area for growth in the coming years.

Market Challenges

Limited Feedstock Availability is a Challenging Factor for Market Growth

The product manufacturing relies on sustainable and renewable resources, such as vegetable oils, animal fats, and algae, which face limitations in terms of supply and scalability. This scarcity directly impacts the cost-effectiveness and overall potential of the product as a substitute for conventional naphtha.

Research and development efforts are focused on exploring alternative feedstocks such as algae and waste materials. However, these technologies are still in early stages of development and may not be able to meet the demand at scale. Technological advancements are needed to improve the efficiency of converting these alternative feedstocks into products and to reduce production costs.

Trade Protectionism and Geopolitical Impact

Protectionist Policies and Trade Barriers to Restrict Market Growth

Trade protectionism and geopolitical instability can significantly impact the market by disrupting supply chains, increasing price volatility, and influencing trade policies. Protectionist measures, such as tariffs, can distort trade flows and create uncertainty, while geopolitical events can lead to supply chain disruptions and affect the availability and cost of raw materials.

Geopolitical events such as wars, political instability, or natural disasters can disrupt the supply of raw materials needed for bionaphtha production, leading to price fluctuations and supply shortages.

Research and Development (R&D) Trends

Integration of AI and IoT for Process Optimization to Create Opportunities for Market Growth

The market is experiencing significant growth due to increasing demand for sustainable products, advancements in bio-refinery technologies, and expanding end-use applications. R&D trends focus on enhancing feedstock diversity, improving refining technologies, and integrating market products with other biofuels.

The integration of AI and IoT for process optimization is enhancing operational efficiency and reducing production costs. Advancements in biotechnology and chemical engineering are leading to more efficient production methods, improved yields, and reduced environmental impact.

Segmentation Analysis

By Source

Vegetable Oil Segment Dominates Market Due to Its Versatility in Various Applications

On the basis of source, the market is segmented into biomass, vegetable oil, and others.

The vegetable oil segment accounted for the dominant global Bio-naphtha market share of 84.19% in 2026. Vegetable oil-derived naphtha can be used in the production of bio-based plastics, chemicals, and as a gasoline blending component, making it a versatile feedstock. This segment focuses on oils derived from plants such as soybeans, rapeseed, palm oil, and others. These oils are converted into bio-naphtha through various chemical processes, offering a sustainable alternative to fossil-based naphtha.

The biomass segment is set to register notable growth during the forecast period. This category includes a wide range of organic matter from plants, such as agricultural residues, energy crops, and forestry residues. These materials are processed to extract the necessary components for product production.

The others segment is also expected to register a positive growth during the forecast period. Animal fat, used cooking oils, algae, and microbial oils are considered in this segment.

By Application

Petrochemicals Segment Dominated Market Due to Its Use as a Sustainable Feedstock In Numerous Applications

On the basis of application, the market is segmented into petrochemicals, gasoline, and others.

The petrochemicals segment is anticipated to hold a dominant market share of 89.68% in 2026.. The petrochemical sector is a major consumer of product due to its use as a sustainable feedstock in producing plastics, synthetic rubber, and other chemical derivatives.

The gasoline segment is expected to register notable growth during the forecast period. The product can be blended with gasoline to create a biofuel blend, reducing reliance on fossil fuels.

Other applications attributed positive growth in the study period. Bio Benzene and Bio Phenol are considered in this segment. The increasing demand for sustainable and renewable alternatives to traditional fossil-based products drives the market growth.

To know how our report can help streamline your business, Speak to Analyst

Bio-naphtha Market Regional Outlook

By region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Europe

Europe Bio-naphtha Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The Europe market was valued at USD 1.01 billion in 2025. The strong emphasis on carbon neutrality and stringent emission norms is driving demand for products in the region. Government initiatives aimed at improving sustainable facilities further contribute to market expansion in this region.

North America

North America is a significant player in the market, with strong government support and advanced technological infrastructure contributing to its growth. The U.S. held the largest revenue share within North America in 2024, fueled by demand from the petrochemicals and other sectors. The UK market size reached USD 0.74 billion in 2026. In Germany, the market size reached USD 0.36 billion in 2026, whereas Japan recorded a market size of USD 0.21 billion during the same year.

Asia Pacific

Asia Pacific is also a positive contributor to the market. This region is experiencing rapid growth, fueled by industrial expansion, digital transformation, and strong government support. China, Indonesia, Singapore, and India are major markets in this region, with rising domestic demand and manufacturing strength. The China Bio-naphtha market was valued at USD 0.08 billion in 2026, and the India market reached USD 0.03 billion in 2026.

Middle East & Africa and Latin America

Latin America is seeing increased adoption of bionaphtha, driven by abundant biomass resources and supportive regulatory frameworks. Also, the Middle East & Africa region is exploring bio-naphtha as a diversification strategy, with growing investments in infrastructure and technology.

Competitive Landscape

Key Market Players

Leading Companies Implement Expansion Growth Tactic to Uphold Their Supremacy in Market

In terms of the competitive landscape, the market signifies the existence of developing and established companies. Key players in the market include UPM Biofuels, Chevron, Mitsui Chemicals, and Neste Oil Corporation. These companies possess substantial production capabilities and manufacture products for industry-specific applications. They are also increasing their manufacturing capacity and sales and distribution network across the globe.

List of Top Bio-naphtha Companies Profiled

- UPM Biofuels (Finland)

- Montana Renewables LLC (U.S.)

- TOPSOE (Denmark)

- Chevron (U.S.)

- Mitsui Chemicals (Japan)

- Eni S.p.A. (Italy)

- TotalEnergies (France)

- Neste Oil Corporation (Finland)

- OMV Group (Austria)

KEY INDUSTRY DEVELOPMENTS

- December 2024: BASF and INOCAS partnered to develop a sustainable supply of Macaúba oil in Brazil, with a focus on its use in bio-naphtha production. This initiative will involve scaling up INOCAS's Macaúba cultivation program and providing BASF with both kernel and pulp oils. The pulp oil will be used to produce bio-naphtha, which can be transformed into various products, including polymers, solvents, detergents, and fuels. Commercial volumes of the kernel oil are expected by 2025, with a regular supply of pulp oil for bio-naphtha production starting in 2027.

- July 2024: Mitsubishi Corporation and Neste partnered to increase the availability of bio-naphtha in Japan, encouraging its adoption by Japanese downstream companies. This collaboration aims to facilitate the transition from conventional petroleum naphtha to bio-naphtha in the production of various petrochemical products such as plastics and chemicals.

REPORT COVERAGE

The report provides a detailed analysis of the market. It focuses on key aspects, such as leading companies, types, compositions used to produce products, and applications. Besides this, it offers insights into the market and current industry trends and highlights key industry developments. In addition to the factors mentioned above, it encompasses several factors contributing to the market's growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) and Volume (Kiloton) |

|

Growth Rate |

CAGR of 12.6% from 2026 to 2034 |

|

Segmentation |

By Source · Biomass · Vegetable Oil · Others |

|

By Application · Petrochemicals · Gasoline · Others |

|

|

By Region · North America (By Source, By Application, By Country) o U.S. (By Application) o Canada (By Application) · Europe (By Source, By Application, By Country) o Germany (By Application) o France (By Application) o Italy (By Application) o Spain (By Application) o Rest of Europe (By Application) · Asia Pacific (By Source, By Application, By Country) o China (By Application) o Indonesia (By Application) o Singapore (By Application) o India (By Application) o Rest of Asia Pacific (By Application) · Latin America (By Source, By Application, By Country) o Brazil (By Application) o Argentina (By Application) o Rest of Latin America (By Application) · Middle East & Africa (By Source, By Application, By Country) o South Africa (By Application) o Rest of Middle East & Africa (By Application) |

Frequently Asked Questions

The global Bio-naphtha Market was valued at USD 2.77 billion in 2025 and increased to USD 3.10 billion in 2026, with the market projected to reach USD 8.06 billion by 2034

In 2025, the Europe market value stood at USD 1.01 billion.

Recording a CAGR of 12.6%, the market will exhibit steady growth during the forecast period of 2026-2034.

In 2026, Petrochemicals was the leading segment in the market by application.

Environmental concerns and sustainability are driving market growth.

Europe is poised to capture the highest market share during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us