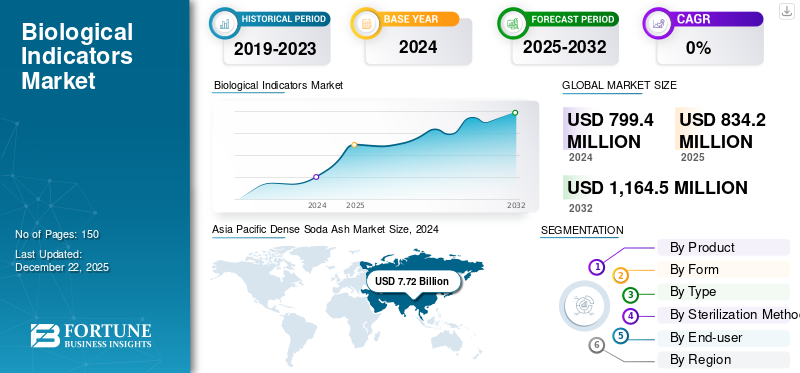

Biological Indicators Market Size, Share & Industry Analysis, By Product (Steam Biological Indicators, Hydrogen Peroxide Biological Indicators, and Others), By Form (Self-contained Vials, Indicator Strips, and Others), By Type (Traditional Biological Indicators and Rapid Biological Indicators), By Sterilization Method (Steam Sterilization, Hydrogen Peroxide Sterilization, Ethylene Oxide Sterilization, and Others), By End-user (Hospital & Clinics, Pharmaceutical & Medical Device Manufacturers, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global biological indicators market size was valued at USD 834.2 million in 2025. The market is projected to grow from USD 871.49 million in 2026 to USD 1296.47 million by 2034, exhibiting a CAGR of 5.09% during the forecast period. North America dominated the biological indicators market with a market share of 49.02% in 2025.

Biological indicators contain viable microorganisms that provide a defined resistance to a specific sterilization process. They help monitor whether the conditions were met to kill a specified number of microorganisms for a given sterilization process. These indicators are widely used in steam sterilization and hydrogen peroxide sterilization.

Market growth is driven by an increasing number of hospital-acquired infection cases and the increasing launch of biological indicators for sterility assurance processes. For example, in May 2020, Getinge introduced a new range of consumables for sterile reprocessing. Getinge Assured Superfast 20 biological indicator speeds up the ability of the Central Sterile Supply Department (CSSD) to release loads safely. This helps ensure that the sterile instruments are available at the right place and time, improving patient care and operational workflows.

Furthermore, the market comprises several small and mid-size companies such as STERIS, Getinge, Solventum, Tuttnauer, and Propper Manufacturing Co., Inc. These key players are introducing new products in the global market and participating in medical conferences to create brand awareness among consumers.

MARKET DYNAMICS

Market Drivers

Growing Number of Hospital Admissions and Rising Cases of Hospital-acquired Infections to Support Market Growth

The increase in prevalence of chronic diseases leads to a rise in hospital admissions, which in turn has driven the use of medical devices, surgical instruments, and patient care equipment. To ensure proper sterilization, biological indicators are crucial for validating the efficiency of the sterilization process. As the number of hospital admissions increases, the chances of developing hospital-acquired infections also increase.

- For example, as per the data provided by the Australian Institute of Health and Welfare in May 2025, the number of hospitalizations in Australian hospitals increased from 11.1 million in 2019 to 12.6 million in 2024.

Additionally, the hospital-acquired infections (HAIs), including sepsis, urinary tract infections, and surgical site infections, are increasing globally. The increasing cases of HAIs have been fueling the demand for sterilization indicators, as these indicators play an important role in infection control in healthcare facilities.

- For instance, as per the data provided by the Government of Canada in June 2024, the number of hospital-acquired Clostridioides difficile infection cases increased from 3,643 in 2021 to 3,846 in 2022.

Therefore, the rising cases of hospital-acquired infections are a key factor propelling market growth, due to increasing demand for effective sterilization practices in healthcare settings.

Market Restraints

Rise in Product Recalls to Impede Market Growth

Despite the increasing market players' focus on novel and innovative product launches, the voluntary recalls of certain sterilization biological indicators due to quality issues have limited their adoption in healthcare facilities. This further damages the brand reputation and leads to shifting consumer preference toward other products available in the market, thus hindering biological indicators market growth.

- For instance, in December 2023, Terragene initiated a voluntary recall for its Bionova PCD (PCD222C), a self-contained biological indicator, due to the discrepancy between the Food and Drug Administration (FDA) Cleared Indications for Use (IFU) and the actual IFU distributed with the products.

- In December 2022, STERIS recalled its VERIFY Dual Species Self-Contained Biological Indicator, 100 per box, item number: S3061, as the spores of G. stearothermophilus and B. atrophaeus were inconsistent and gave false-negative results, thus compromising product quality.

- Similarly, in May 2022, the U.S. Food and Drug Administration (FDA) recalled a few lots of Steris's Celerity biological indicator vials and Verify biological indicator strips for steam & hydrogen peroxide sterilization monitoring (distributed between 06/01/21-9/30/21, as the exposure to higher temperatures had impacted the product effectiveness.

Such product recalls damage the companies' reputation and erode customers' trust, impeding market growth.

Market Opportunities

Significant Growth in Pharmaceutical and Medical Device Manufacturing in Developing Nations Provides Lucrative Opportunities for Market Growth

Developing nations of Europe, Asia Pacific, and Latin America are witnessing significant growth in the pharmaceutical and medical devices sector. This growth is driven by increasing demand for medical devices and healthcare services in developing nations. Additionally, the increasing focus of pharmaceutical and medical device companies on expanding their manufacturing capacity is expected to create growth opportunities for the market.

- For example, in February 2024, Terumo Corporation announced the opening of a new medical device manufacturing facility at its Caguas, Puerto Rico, site. With the opening of the new facility, the company aimed to produce devices and technologies to improve patient care within healthcare settings.

Furthermore, the increasing awareness of effective sterilization among healthcare providers, including hospitals, clinics, and clinical laboratories, is anticipated to enhance the adoption of the sterilization process within healthcare facilities.

Market Challenges

High Cost of Biological Indicators and Availability of Alternatives to Limit Product Adoption

The availability of other sterilization validation indicators, such as chemical indicators and indicator tapes, may limit the adoption of biological indicators (BIs), thereby hindering market growth.

Chemical indicator strips are used to verify the successful sterilization of items, preventing the spread of germs. Many regulatory bodies mandate the use of chemical indicators for sterilization. Agencies such as the Food and Drug Administration (FDA), the Centers for Disease Control and Prevention (CDC), and the Occupational Safety and Health Administration (OSHA) in the U.S. have strict rules for medical devices. Moreover, the chemical indicators are more affordable than BIs, resulting in an increase in their adoption in low and middle-income countries with limited budgets for healthcare spending.

Furthermore, the high cost of sterilization indicators continues to limit their adoption in healthcare settings of low-income countries. For example, the cost of BI-O.K. self-contained biological indicators - 100 per box is USD 404.4. Additionally, the cost of a biological indicator, steam gravity displacement 24-hour readout 3M Attest 1261 100/box, 4 boxes/case is USD 1,099.0.

Download Free sample to learn more about this report.

BIOLOGICAL INDICATORS MARKET TRENDS

Rising Market Players’ Focus on New Product Launches to Fuel Industry Development

The high burden of hospital-acquired infections and the rise in the number of surgical procedures across the globe have been fueling the demand for effective sterilization practices. As a result, market players have been focusing on launching novel sterilization indicators that enhance sterilization processes.

- For example, in June 2025, Solventum launched its Attest Super Rapid Vaporized Hydrogen Peroxide (VH2O2) Clear Challenge Pack. The ready-to-use test systems integrate two previously FDA-cleared indicators: a biological indicator (BI) for confirming microbial neutralization, and a chemical indicator (CI) for verifying proper sterilizer function.

Increasing Outsourcing of Sterilization Services to Boost Market Progress

The increasing outsourcing of sterilization services is emerging as a growing trend in the healthcare and medical device industries, driven by cost reduction and the need for specialized expertise. Several hospitals, pharmaceutical companies, and medical device manufacturers are increasingly turning to third-party sterilization service providers to handle their sterilization needs. This trend is expected to continue gaining momentum in the coming years, resulting in market growth.

- For instance, in March 2023, Servizi Italia Spa announced the inauguration of its first sterilization plant in São Paulo, Brazil. This facility provides steam sterilization services to São Paulo, Brazil, hospitals.

SEGMENTATION ANALYSIS

By Product

Steam Biological Indicators Led due to Growing Focus of Key Players on Launching Product

Based on the product, the market is divided into steam biological indicators, hydrogen peroxide biological indicators, and others.

The steam biological indicators segment dominated the global market in 2024 and is expected to grow at a moderate CAGR during the forecast period. The increasing market players' focus on the launch of biological indicators used in the steam sterilization process is one of the major factors driving the segment's growth.

- For instance, in December 2020, STERIS announced the global launch of Spordex self-contained biological indicator (SCBI) ampoules, designed to confirm sterilization of liquids in steam autoclave cycles.

The hydrogen peroxide biological indicators segment is expected to grow at the highest CAGR from 2025 to 2032, owing to increasing market players' focus on receiving regulatory approvals to launch novel sterilization indicators in the global market.

- For example, in January 2020, ASP (Fortive) received 510(k) clearance from the U.S. Food and Drug Administration (FDA) for a 15-minute time-to-result on the STERRAD VELOCITY biological indicator (BI)/process challenge device (PCD) for use in STERRAD systems. This product is used to monitor loads and assess process performance during vaporized hydrogen peroxide sterilization.

By Form

Self-Contained Vials Dominated as They Offer Fast, Visible, Consistent, and Reliable Results

Based on form, the market is divided into self-contained vials, indicator strips, and others.

The self-contained vials segment accounted for the dominant share of the market in 2024 and is projected to grow at the highest CAGR throughout the forecast period. Self-contained biological indicators (SCBIs) provide fast, visible, consistent, and reliable results that assure an effective sterilization process. These are some of the important factors responsible for a higher adoption rate of self-contained vials in both developed and developing economies due to their various benefits, thereby driving the segment’s growth. This, coupled with various novel and innovative product launches, will boost market growth during the forecast period.

The indicator strips segment held a moderate market share in 2024 and is projected to grow at a moderate CAGR throughout the forecast period. The segment's growth is mainly attributed to the increasing launch of indicator strips used to verify the effectiveness of sterilization processes in various healthcare settings.

By Type

Rapid Biological Indicators Led Market owing to Their Ability to Provide Faster Results Than Traditional Ones

Based on type, the market is segmented into traditional biological indicators and rapid biological indicators.

The rapid biological indicators segment dominated the market in 2024 and is expected to grow at the highest CAGR from 2025 to 2032. The segment's growth is mainly attributed to the fact that rapid biological indicators provide faster results than traditional ones. These indicators are designed with advanced technologies to provide a readout in minutes, making them highly suitable for time-sensitive healthcare settings such as hospitals and clinics. Their efficacy significantly reduces the waiting time for sterilization validation, improving clinical workflow.

The traditional biological indicators segment is expected to grow at a stagnant CAGR throughout the forecast period. The increasing prevalence of healthcare-associated infections (HAIs), strict regulatory requirements for sterilization monitoring, and the growing demand for reliable sterilization processes are major factors driving the segment’s growth.

By Sterilization Method

Steam Sterilization Methods Commanded Market Due to Their Rapid Adoption in Healthcare Facilities

In terms of sterilization method, the market is segmented into steam sterilization, hydrogen peroxide sterilization, ethylene oxide sterilization, and others.

The steam sterilization segment held a dominant global biological indicators market share in 2024 and is estimated to grow at the second-largest CAGR from 2025 to 2032. The dominance is primarily attributed to the rising adoption of steam sterilizers in healthcare facilities. For example, in June 2023, idsMED Taiwan installed Steelco steam sterilizers at the Ministry of Health and Welfare Taipei Hospital in New Taipei City, Taiwan, to enhance sterilization capabilities and ensure high standards of patient care and safety.

The hydrogen peroxide sterilization segment accounted for the second-largest market share in 2024 and is estimated to grow at the highest CAGR from 2025 to 2032. The increasing focus by regulatory authorities on creating awareness about the effectiveness of the hydrogen peroxide sterilization method to increase its adoption in healthcare facilities is one of the prominent factors driving segmental growth.

- For example, in January 2024, the U.S. Food and Drug Administration announced that it considered vaporized hydrogen peroxide (VHP) an established sterilization method for medical devices, recognizing VHP's long history of safety and effectiveness.

Moreover, the ethylene oxide sterilization segment is expected to grow at a negative CAGR during the forecast period. The negative growth of this segment is mainly attributed to the growing government initiatives toward limited use of ethylene oxide sterilization in healthcare facilities, as long-term exposure to ethylene oxide causes carcinogenic effects.

- For instance, in March 2024, the U.S. Environmental Protection Agency (EPA) published a rule restricting the use of the medical device sterilization agent ethylene oxide (EtO).

The others segment is anticipated to grow at a stagnant CAGR during the forecast period. The increasing market players' focus on expanding existing sterilization services facilities, including ionizing sterilization, is an important factor driving the segment’s growth.

- For example, in April 2024, STERIS announced the expansion of its existing Suzhou, China EO processing facility to include X-ray processing. In addition to the Suzhou, China facility, STERIS supports medical device manufacturing in Asia through its electron beam, ethylene oxide, gamma, and X-ray processing sterilization services in Malaysia and Thailand.

By End-user

Hospitals & Clinics Segment Dominated Market Due to the High Burden of Hospital-acquired Infections

In terms of end user, the market is segmented into hospitals & clinics, pharmaceutical & medical device manufacturers, and others.

The hospitals & clinics segment dominated the global market in 2024 and is expected to grow at the highest CAGR from 2025 to 2032. The increasing cases of hospital-acquired infections (HAIs), rising numbers of surgical procedures, and the expansion of hospitals equipped with advanced sterilization infrastructure are the key factors supporting the segment’s growth. According to data from the European Centre for Disease Prevention and Control (ECDC) published in May 2024, approximately 4.3 million patients in EU/EEA hospitals are affected by healthcare-associated infections annually.

The pharmaceutical & medical device manufacturers segment is anticipated to grow moderately during the forecast period. This growth is mainly due to increasing investments by pharmaceutical and medical device companies in research and development activities, combined with stringent regulatory requirements for sterilizing pharmaceutical products and medical devices.

- As per the data provided by the 2024 annual report of STERIS, the company invested around USD 103.7 million in research and development activities during the fiscal year 2024.

The others segment is expected to grow at a stagnant CAGR throughout the forecast period. The increasing utilization of biological indicators during the sterilization process by research institutes for research purposes is one of the important factors driving the segment’s growth.

BIOLOGICAL INDICATORS MARKET REGIONAL OUTLOOK

In terms of region, the global market can be divided into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Biological Indicators Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

The North America region accounted for a market size of USD 310.84 million in 2025, dominating the market with a 49.02% share. The market growth in this region was mainly attributed to the availability of advanced healthcare infrastructure and the presence of a large number of market players providing indicators for the sterilization process.

Additionally, the high burden of hospital-acquired infections in the U.S. increases the demand for sterilization products in healthcare centers, fueling the market's growth.

- For example, as per the data provided by the Centers for Disease Control and Prevention (CDC) in January 2024, around 30,100 central line-associated bloodstream infections (CLABSI) occur in intensive care units and wards in the U.S. every year.

Europe

Europe accounted for the second-largest share of the market in 2025 and is anticipated to grow at the second-largest CAGR during the forecast period. The increasing market players' focus on participating in medical conferences to create awareness about sterilization products among healthcare professionals is one of the important factors driving market growth across European nations.

- In January 2025, Tuttnauer participated in the IDS 2025 medical conference in Cologne, Germany. The company showcased its MO58 during the event and featured its infection control products.

Asia Pacific

Asia Pacific held a moderate market share in 2025 and is anticipated to grow at the highest CAGR throughout the forecast period. The increasing market players' focus on new product launches is one of the main factors driving market growth in this region.

- For instance, in August 2021, ASP (Fortive) announced the launch of STERRAD VELOCITY biological indicator (bi)/process challenge device (PCD), with a 15-minute time to result in the Asia Pacific region.

Additionally, developing healthcare infrastructure for sterilization services across the Asia Pacific region further supplements market growth.

Latin America and Middle East & Africa

The market in Latin America and the Middle East & Africa is expected to grow steadily throughout the forecast period. The growth in these regions is mainly due to increasing market players' focus on creating awareness about sterilization products among medical professionals.

- For example, in January 2025, LISTER BIOMEDICAL CO., LTD. participated in Arab Health 2025, an event held in Dubai, UAE. During the event, the company was present at booth Z7.G10-02 and showcased its sterilization consumables to create awareness among healthcare professionals who visited the company's booth.

COMPETITIVE LANDSCAPE

Key Industry Players

Market Players Focus on Attending Medical Conferences to Create Brand Awareness among Consumers

The market is fragmented with the presence of several small and mid-sized companies. The market comprises key players, such as Solventum, STERIS, LISTER BIOMEDICAL CO., LTD., and ASP (Fortive). These companies hold a significant share of the market due to their strong focus on attending medical events to create product awareness among healthcare professionals.

- For example, in November 2024, LISTER BIOMEDICAL CO., LTD. participated in the 25th WFHSS Congress in Santiago, Chile. During the event, the company showcased its sterilization indicators to create product awareness among healthcare professionals.

Furthermore, other players in the market include Getinge, Tuttnauer, Terragene, and Propper Manufacturing Co., Inc. These companies have been focusing on new product launches to enhance their portfolio and expand their footprint in the global market.

List of Key Biological Indicator Companies Profiled

- STERIS (U.S.)

- Getinge (Sweden)

- ASP (Fortive) (U.S.)

- Solventum (U.S.)

- Terragene (Argentina)

- Mesa Labs, Inc. (U.S.)

- Tuttnauer (Netherlands)

- LISTER BIOMEDICAL CO., LTD (China)

- BEYA Medical Machine Equipments CO. (Turkey)

- Propper Manufacturing Co., Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- May 2025 - STERIS announced the opening of an ethylene oxide processing facility in Batu Kawan, Malaysia.

- November 2024 - Terragene announced its presence at the 25th WFHSS Congress in Santiago, Chile. The company showcased its sterilization consumables during the event to create product awareness among healthcare professionals.

- November 2023 - STERIS announced that its applied sterilization technologies (AST) business participated in the U.S. Food and Drug Administration (FDA) Radiation Sterilization Master File Pilot Program.

- October 2023 - Mesa Labs, Inc., a manufacturer of life science tools and critical quality control solutions, announced the acquisition of GKE-GmbH's sterilization indicators business and its accredited, independent testing lab, SAL GmbH.

- October 2020 - Propper Manufacturing Co., Inc. announced a new partnership with Medical Supply Company, a medical supply company to expand its sterilization product offerings in the European market.

REPORT COVERAGE

The global market analysis report provides a detailed competitive landscape and market insights. In addition to the global biological indicators market size, it covers regional analysis of different market segments, profiles of key market players, and market dynamics. Moreover, the market report encompasses several factors contributing to the market's growth over recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.09% from 2026-2034 |

|

Unit |

Value (USD million) |

|

Segmentation |

By Product

|

|

By Form

|

|

|

By Type

|

|

|

By Sterilization Method

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 871.49 million in 2025 and is projected to reach USD 1296.47 million by 2034.

In 2025, the market value in North America stood at USD 310.84 million.

The market will exhibit steady growth at a CAGR of 5.09% during the forecast period (2026-2034).

By product, the steam biological indicators segment led the market.

The increasing hospitalizations and growing prevalence of hospital-acquired infections are some of the important factors driving market growth.

Solventum, STERIS, ASP (Fortive), and Getinge are the top players operating in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us