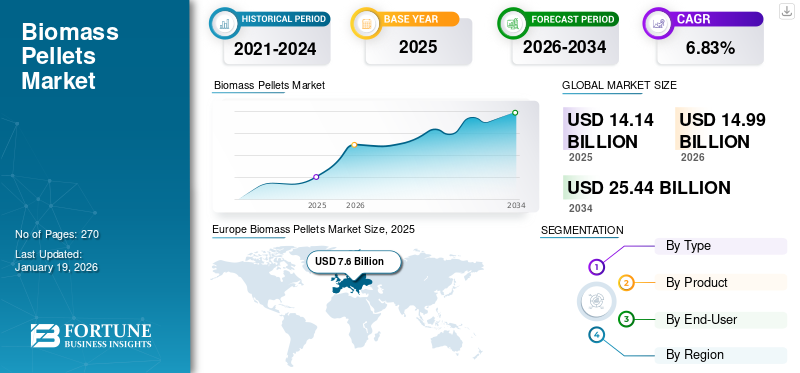

Biomass Pellets Market Size, Share & Industry Analysis By Type (Wood Pellets, Agricultural Residue Pellets, Industrial Waste Pellets, and Others), By Product (Torrefied and Non-torrefied), By End-User (Industrial, Transportation, Residential, Commercial, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global biomass pellets market size was valued at USD 14.14 billion in 2025. The market is projected to grow from USD 14.99 billion in 2026 to USD 25.44 billion by 2034, exhibiting a CAGR of 6.83% during the forecast period. Europe dominated the market with a share of 31.54% in 2025.

Biomass pellets are small, cylindrical fuel sources that are made from compressed organic matter such as wood, agricultural residues, food waste energy crops, or plant-based materials. These pellets have gained huge popularity across different countries as they offer a renewable, sustainable, and efficient alternative to the fossil fuels used in industrial processes, heating, electricity generation, along with residential and commercial sectors. Further, the market share is driven by its ability to reduce the carbon footprint as these pellets do not release carbon dioxide, which mitigates climate change. Hence, the pellets help reduce the demand for oil, coal, and natural gas, which are major contributors to greenhouse gases.

The market growth is driven by its ability to offer energy efficiency, owing to the high energy density of pellets and their ability to burn more efficiently compared to raw biomass, leading to better heat output and reduced fuel consumption. Biomass pellets are a popular choice for residential and commercial heating systems owing to their higher energy efficiency and relatively low emissions. Furthermore, the pellets are uniformly shaped, which makes them easier to store, transport, and handle compared to bulky or irregularly shaped biomass.

Enviva Inc. is the world's leading producer of industrial wood pellets, a renewable energy source derived from biomass. The company converts wood fiber into wood pellets, which are then shipped to customers, primarily in Europe and Asia, as a replacement for fossil fuels. Enviva's business model focuses on offering a sustainable alternative to coal and other fossil fuels, contributing to global decarbonization efforts.

MARKET DYNAMICS

MARKET DRIVERS

Growing Demand for Sustainable and Renewable Energy Sources Drives the Market Growth

Biomass pellets are widely known for their sustainability and growing awareness regarding climate change and concerns over air and water pollution from fossil fuels, coal fired power plants drives the biomass pellet market demand. The renewable energy sources, such as biomass pellets, produce little to no greenhouse gas emissions, which is crucial for mitigating climate change. Governments across several countries are focusing on transitioning to renewable sources to reduce carbon emissions and combat climate change.

For instance, in July 2024, the Ministry of New and Renewable Energy announced enhanced financial incentives for biomass pellet manufacturing to promote cleaner air quality and green energy sources. Under this incentive scheme, the Central Financial Assistance (CFA), which is a component of the National Bioenergy Programme, will provide USD 25,610 (INR 21.0 lakhs) for each metric tonne per hour (MTPH) to non-torrefied pellet manufacturing facilities, with a maximum limit of USD 128,049 (INR 105 lakhs) for each project.

In addition, for torrefied pellet manufacturing facilities, the funding will be set at USD 51,220 (INR 42.0 lakhs) per MTPH, capped at USD 256,098 (INR 210 lakhs) per project or 30% of the capital cost for the plant and machinery of a 1 MTPH facility, depending on which amount is lower for both components. These factors are driving the biomass pellets market growth.

Biomass Pellets Promote Circular Economy & Help in Waste Diversion Driving Market Expansion

Pellets made from organic waste material help in waste diversion, which would otherwise end up in landfills or be burned, causing pollution. Hence, utilizing waste materials reduces the amount of waste that needs to be disposed of in landfills, minimizing the environmental impact linked with landfills. These pellets help in the circular economy by transforming waste into a valuable energy source that reduces the reliance on fossil fuels.

The combustion of biomass pellets leads to cleaner air and replaces the need for burning wood or coal, which releases harmful pollutants. Further, these pellets promote a decentralized energy model as they are produced locally, empowering communities and providing affordable and sustainable energy solutions. For instance, according to Servoday Plants & Equipment Limited, the estimated electricity generation potential in India from biomass pellets is anticipated to reach 244 TWh by 2030, which will account for approximately 6% of total power production.

MARKET RESTRAINTS

Excessive Investment in Biomass Pellet Manufacturing Set-up to Hamper the Market Growth

Setting up of biomass pellet manufacturing plant requires significant capital investment, which includes the cost of land, machinery, and infrastructure. In addition, a huge investment is needed for developing infrastructure for the transportation and storage of biomass pellets. In addition, the machinery used for biomass pellet production, such as dryers, pelletizing machines, hammer mills, and others, requires a high upfront investment.

The raw biomass, such as wood, straw, agricultural residues, and others, requires proper drying, uniform blending, and size reduction, which adds to the overall feedstock handling, storage, and processing cost. These aspects are anticipated to hamper the biomass pellets market growth in the coming years.

MARKET OPPORTUNITIES

Increased Pellet Production, Consumption, and Import-Export to Generate Excellent Opportunities for Market Growth

The production, import-export, and consumption of biomass pellets are rising globally owing to a growing focus on sustainability. As stated by the Food and Agriculture Organization (FAO) of the United Nations, in 2022, the production of wood pellets in the European Union (EU) was around 20.3 million tonnes. Further, the import of wood pellets in the European Union in 2022 was 5.89 million tonnes and the export accounted for 1.48 million tonnes.

During the same year, the consumption of wood pellets was 24.80 million tonnes. These statistics indicate a significant rise in the number of biomass pellet plants and their capacity, which is anticipated to generate excellent opportunities for companies operating in the biomass pellets industry. As stated by Enviva, the leading wood pellets producer, the estimated demand for wood pellets in Germany was around 20%, followed by the U.K. with 18%, Japan accounting for 15%, South Korea 15%, followed by other countries.

MARKET CHALLENGES

High Raw Material Cost and Logistical Hurdles Present Challenges for Emerging Industry Players

The companies operating in the industry face significant challenges owing to fluctuating raw material costs & supply. Further, the logistical hurdles linked with transportation & storage, and the need to maintain consistent quality standards add up to the cost. The lack of standardized equipment and conversion technologies hinders the production capacity and quality of biomass pellet production, which creates a barrier for smaller companies.

The cost of biomass pellets is perceived higher as they are more expensive than fossil fuels, owing to the higher cost of transportation, storage, and handling. Further, limited consumer awareness regarding the adoption of these pellets as a viable source of energy presents challenges for market players.

BIOMASS PELLETS MARKET TRENDS

Advancements in Technology to Boost Pellet Production Processes

Advancements in biomass pellet production technologies with the use of artificial intelligence (AI) and automation to enhance the efficiency, reduce cost, and improve the product quality of pellets are the recent trends in the market. The use of AI and automation can enhance the pellet production process, such as drying, compression, and cooling, with the help of sensors. Further, the use of AI helps in monitoring the critical parameters such as moisture content, temperature, and humidity to maintain the optimal conditions. These real-time control minimizes the errors, improve the product consistency, and reduce the risk of equipment failure.

In addition, the predictive maintenance feature of AI algorithms helps in analyzing the data patterns before equipment failure can occur, offers proactive maintenance, reduces downtime, and minimizes production issues. The high-pressure pellet mills with advanced drying techniques enhance the pellet durability and energy density. The use of high-pressure feeders and improved drying techniques lowers the production cost and energy density of biomass pellets.

Download Free sample to learn more about this report.

IMPACT OF TARIFF ON THE GLOBAL BIOMASS PELLETS MARKET

The impact of tariffs on the biomass pellets industry will be significant, as it could increase the cost of imported goods, which can make these pellets expensive for consumers and businesses. Further, an increase in cost can impact the demand for biomass pellets and consumers may switch to cheaper alternatives. The consumers & businesses may switch to alternative energy sources such as natural gas or may seek pellets from countries with lower or no tariffs.

However, if the domestic pellet producers can meet the biomass pellet demand, the sale of pellets would increase due to reduced competition from the export markets. The impact of tariffs can be mitigated with the help of government policies and subsidies for the use of biomass & renewable energy production. Thus, the impact of tariffs on the biomass pellets industry is anticipated to be multifaceted globally.

SEGMENTATION ANALYSIS

By Type

Wood Pellets Dominates the Market Owing to their High Energy Density

Based on type, the market is segmented into wood pellets, agricultural residue pellets, industrial waste pellets, and others.

The wood pellets segment accounted for a dominant market with a share of 61.89% in 2026. These pellets are widely used as a biomass fuel owing to their high energy density, ease of handling, and environmental benefits. For instance, the wood pellets are denser compared to raw wood and require less space for storage & transportation. The low moisture content maximizes the heat output and lowers the ash residue. The consistent shape & size of wood pellets, with a uniform cylindrical shape, make them easy to handle, store, and transport. In addition, these pellets are widely used in residential heating systems such as pellet stoves and boilers and in the industrial sector for heat and power generation.

The agricultural pellets have gained significant popularity owing to their renewability, cost effectiveness as a fuel source, and efficiency. These agricultural pellets includes straw, stalks, and husks which are sustainable alternative compared to fossil fuels. The agricultural pellets have wide range of application in soil amendment, animal bedding, and heating for residential, commercial, and industrial uses.

The industrial waste pellets produced by various industrial byproducts and waste materials such as the waste generated from paper, textile, and construction sector are environment friendly and cost-effective fuel source when processed in the form of pellets.

The others segment comprises food waste, forestry waste, and untreated lumbar. By converting these waste residues into biomass pellets, the farmers can utilize resources effectively and contribute to cleaner environment.

To know how our report can help streamline your business, Speak to Analyst

By Product

Torrefied Dominates the Market Share Owing to their Increased Energy Efficiency & Improved Durability

Based on product, the market is classified into torrefied and non-torrefied.

Among these, the torrefied segment accounted for the dominant market accounting for 76.63% market share in 2026. Torrefied pellets offer higher energy density compared to non-torrefied biomass as they contain more energy per unit, which makes them a more efficient fuel source. The torrefaction process removes the moisture from biomass material, enhancing the stability of torrefied pellets and making them easier to transport. The lower moisture content reduces microbial growth and the risk of corrosion during storage & transport.

In addition, the durability of biomass pellets is enhanced owing to their increased resistance to mechanical stress, temperature changes, and water damage. This makes them less susceptible to degradation during handling, storage, and transportation. Furthermore, torrefied pellets produce lower greenhouse gas emissions compared to fossil fuels and release fewer pollutants such as nitrogen oxides and sulfur dioxide, which enhances their demand.

The non-torrefied segment is growing at a considerable rate owing to its wider availability and lower cost. These pellets have low energy density and high moisture content owing to which they are suitable for local use and small-scale heating applications.

By End-User

Industrial Segment Dominates the Market Due to Widespread Use in Power Generation and Industrial Heating Applications

Based on end-user, the market is subdivided into industrial, transportation, residential, commercial, and others.

Of these, the industrial segment accounted for the highest market share contributing 44.68% globally in 2026. Biomass pellets are widely used in the industrial sector for power generation and industrial heating applications. For instance, many power plants utilize biomass pellets as a fuel source for electricity generation. The use of these pellets for power generation helps in the transition toward renewable energy and reduces the dependence on fossil fuels. In the industrial heating sector, biomass pellets serve as a sustainable and viable alternative to traditional fossil fuels, contributing to a greener industrial sector.

The residential segment is anticipated to grow at a faster rate over the forecast period. In the residential sector, biomass pellets are used in pellet stoves and boilers that are designed for automated and efficient heating. The use of these pellets for residential application reduces the dependence on fossil fuels such as heating oil and natural gas.

In the commercial sector, biomass pellets are used for heating purpose in commercial buildings such as hospitals, buildings, warehouses, hospitals, and other sectors especially in colder regions.

The others segment includes the use of biomass pellets for animal bedding. These pellets are used in animal bedding application owing to their odor control, high absorbency, and ease of maintenance. Hence, these pellets can keep the animal environment dry and reduces the amount of bedding required. For instance, one bag of wood pellets has an ability to absorb upto 11 gallons of water.

BIOMASS PELLETS MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. Europe accounted for the highest biomass pellets market share

Europe

Europe Biomass Pellets Market Size, 2025 (USD Billion) To get more information on the regional analysis of this market, Download Free sample

Rise in Sustainability Initiatives Drives the Dominant Share of the Region

Europe accounted for the highest share of biomass pellets production and produced approximately 20 million tonnes of biomass wood pellets in 2023. Germany accounted for the highest wood pellet production, accounting for 3 million tonnes. The European Union (EU) promotes the use of biomass for energy transition. Further, the EU has established a Renewable Energy Directive, which includes renewable energy and bioenergy as sustainability initiatives. The European Green Deal promotes the use of bioenergy as a sustainable energy source with the aim of climate neutrality by 2050.The UK market is projected to reach USD 1.24 billion by 2026, while the Germany market is projected to reach USD 1.75 billion by 2026.

Germany

Germany is the largest wood pellet producer in Europe and a majority of the country's pellet production is EN Plus-certified, A1-grade quality. The majority of the wood pellets produced in Germany are consumed domestically for power generation. The presence of leading biomass pellet producers in Germany drives the pellet demand in this country. For instance, German Pellets GmbH, a well-established wood pellets manufacturer, focuses on enhancing the quality of wood pellets to make them a sustainable and cost-effective fuel. In addition, Wismar Pellets GmbH has a strong presence in Germany and Central Europe and offers a wide range of wood pellets.

Asia Pacific

Rise in Agricultural Waste Generation to Drive the Market Growth

Asia Pacific is another prominent region owing to an increase in the production of agricultural waste, which increases the demand for biomass pellets as it is a renewable source of energy derived from agricultural residues. As stated by the Indian Council of Agricultural Research, India generates around 350 million tonnes of agricultural waste, with a significant amount of paddy straw being discarded. Similarly, China has abundant agricultural residues that are being utilized for soil amendments, animal feed, and other industrial applications.The Japan market is projected to reach USD 0.22 billion by 2026, the China market is projected to reach USD 4.92 billion by 2026, and the India market is projected to reach USD 0.35 billion by 2026.

North America

Diverse Application of Biomass Pellets Drives Market Share

In North America, biomass pellets are being widely used for heating, electricity generation, and as transportation fuels. In addition, the government subsidies in this region encourage the adoption of these pellets for heating purposes. For instance, in the U.S., subsidies for biomass pellets are released by the Rural Energy for America Program (REAP), which supports rural renewable energy projects. Furthermore, there are state-level incentives and tax breaks, as well as policies promoting biomass co-firing in thermal power plants.The U.S. market is projected to reach USD 3.39 billion by 2026.

Rest of the World

Growing Awareness Regarding Decarbonization Drives Pellet Demand

The demand for biomass pellets in the rest of the world is driven by increasing pressure on several countries to meet their carbon emission targets. The pellets, when sourced sustainably, are considered a carbon-neutral energy source. Furthermore, the growing concerns over energy security and the rising cost of fossil fuels boost the adoption of biomass pellets across different countries.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Investments and Business Expansion Present Significant Growth Opportunities for Market Players

The market is undergoing significant advancements that present attractive investment opportunities for market players, owing to the growing demand for renewable energy and the government support for biomass-based initiatives. For instance, the Ministry of New and Renewable Energy, India, launched a program to support the setting up of biomass pellet manufacturing plants and to support biomass-based cogeneration projects in various industries in India.

List of the Key Biomass Pellets Companies Profiled

- Enviva Inc. (U.S.)

- Drax Group plc (U.K.)

- Babcock & Wilcox Enterprises (U.S.)

- Graanul Invest (Estonia)

- Rentech, Inc. (U.S.)

- Sumitomo Corporation (Japan)

- Biopower Ltd (India)

- The Westervelt Company (U.S.)

- Green Circle Bio Energy, LLC (U.S.)

- Zilkha Biomass Energy (U.S.)

- Fram Renewable Fuels, LLC (U.S.)

KEY INDUSTRY DEVELOPMENTS

- June 2025- The Ministry of New and Renewable Energy (MNRE) revised the guidelines for the National Biomass Program from 2022 to 2027 (Phase-1). The key highlight of the revision includes the integration of technology to enable the use of Internet of Things (IoT) for quarterly data submissions or monitoring solutions instead of the existing data acquisition, project supervisory control, and remote monitoring systems.

- June 2025- The International Energy Agency (IEA) published the World Energy Investment Report that predicts a 13% rise in bioenergy investments in 2025, reaching a record high USD 16 billion, despite a slowdown in new capacity additions for liquid biofuels.

- January 2025- NTPC, India’s leading integrated power company, ordered 930,000 tonnes of biomass pellets for co-firing in power plants, which will aid in enhancing air quality, according to the power ministry. Additionally, NTPC is in the process of procuring another 2.5 million tonnes, with vendors invited to submit their bids by November 1, as mentioned.

- September 2024- Canadian renewable fuel company Woodland Biofuels announced a USD 1.35 billion investment at the Port of South Louisiana. The company utilizes waste biomass for the production of sustainable biofuel.

- August 2024- SDL Solutions, the leading company developing renewable energy sources, announced plans to double the capacity of its new wood pellet production line. The company holds diverse experience in site clearance, harvesting, and sawmill operations.

Investment Analysis and Opportunities

Biomass pellets present a favorable investment opportunity due to the growing demand for sustainable energy solutions and decarbonization initiatives. The market is anticipated to expand significantly, with these pellets offering cost savings and environmental benefits compared to fossil fuels.

- In September 2024, British electricity producer Drax (DRX.L) announced that it might allocate as much as USD 12.5 billion to the development of biomass power plants equipped with carbon capture and storage (BECCS) technology in the U.S. over the next ten years. Drax, responsible for approximately 6% of the U.K.'s electricity generation, stated that while it remains dedicated to the U.K., it also sees potential for its BECCS technology in the U.S.

- In August 2021, Mitsui & Co., Ltd. announced an investment of approx. USD 4.04 million in Punjab Renewable Energy Systems Private Limited (PRESPL), which is the leading Indian biomass-based energy company. This investment aims to align with creating a sustainable society for the expansion of the bioenergy business in India.

REPORT COVERAGE

The global market report provides a detailed market analysis. It focuses on key market aspects such as key players, various biomass pellet types, products, and their end-users. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the market growth in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.83% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type · Wood Pellets · Agricultural Residue Pellets · Industrial Waste Pellets · Others By Product · Torrefied · Non-torrefied By End-User · Industrial · Transportation · Residential · Commercial · Others |

|

By Region

|

Frequently Asked Questions

As per a study by Fortune Business Insights, the market size stood at USD 14.14 billion in 2025.

The market is likely to grow at a CAGR of 6.83% over the forecast period (2026-2034).

The wood pellet segment accounted for the leading share of the global market.

The Europe market size stood at USD 8.09 billion in 2025.

The growing demand for renewable energy resources and the need to reduce carbon emissions are driving the market expansion.

Some of the key players operating in the market are Enviva Inc., Drax Group plc, Babcock & Wilcox Enterprises, Graanul Invest, and others.

The global market size is expected to reach USD 25.44 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us