Biotech Ingredients Market Size, Share & Industry Analysis, By Source (Microbial, Plant-based, and Animal-based), By Application (Pharmaceuticals, Food and Beverages, Personal Care & Cosmetics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

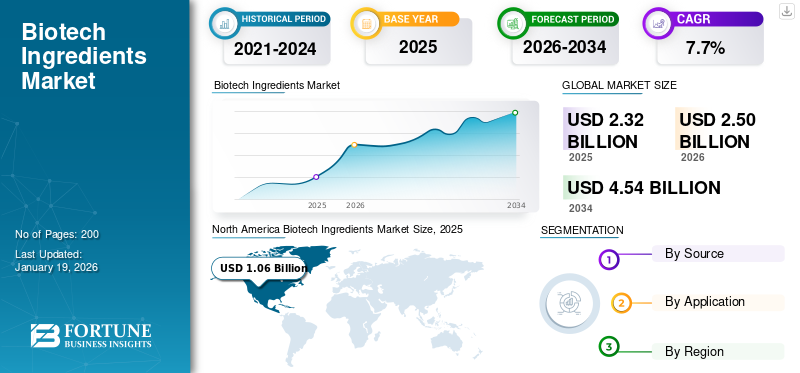

The global biotech ingredients market size was valued at USD 2.32 billion in 2025 and is projected to grow from USD 2.5 billion in 2026 to USD 4.54 billion by 2034 at a CAGR of 7.7% during the forecast period (2026-2034). North America dominated the biotech ingredients market with a market share of 45% in 2025.

Biotech ingredients refer to substances produced using biotechnological processes such as fermentation, genetic engineering, cell culture, and enzymatic synthesis. These ingredients are derived from natural sources such as microorganisms, plants, or animal cells and are used across various industries, including pharmaceuticals, cosmetics, food & beverages, and agriculture. Unlike traditional ingredients that often require chemical synthesis or extraction from limited natural resources, biotech ingredients are sustainable, consistent in quality, and can be tailored for specific functionalities. Examples include bio-based enzymes, peptides, amino acids, vitamins, probiotics, and active pharmaceutical ingredients (APIs).

The market is witnessing significant growth, driven by increasing demand for sustainable and natural alternatives, rising awareness around health and well-being, and advancements in biotechnology. In the pharmaceutical industry, biotech APIs are increasingly being used in the development of biologics for the treatment of chronic diseases such as cancer, diabetes, and autoimmune disorders. In the cosmetic sector, consumers are shifting toward biotech-based active ingredients that are safer and more effective, such as hyaluronic acid produced via microbial fermentation. In the food and beverage sector, enzymes and probiotics manufactured through biotechnology enhance nutrition, shelf-life, and taste.

The rising need for green manufacturing processes, supportive government regulations promoting bio-based products, and growing R&D investments in synthetic biology fermentation technologies are driving market growth.

The COVID-19 pandemic profoundly reshaped the global market, and its long-lasting effects are still unfolding. Demand for vaccine and monoclonal antibody-related active pharmaceutical ingredients (APIs) surged as governments rapidly expanded biopharma capacity, accelerating regulatory approvals and supply chain investments. However, logistical disruption, lockdowns, and raw materials shortages created short-term imbalances that pressured manufacturers to diversify geographically.

Givaudan, Codex-ing Biotech Ingredients, Covalo, dsm-firmenich, and Abel are the key players operating in the market.

GLOBAL BIOTECH INGREDIENTS MARKET TAKEAWAYS

Market Size & Forecast:

- 2025 Market Size: USD 2.32 billion

- 2026 Market Size: USD 2.5 billion

- 2034 Forecast Market Size: USD 4.54 billion

- CAGR: 7.7% from 2026–2034

Market Share:

- North America led in 2025 with a 45% share, rising from USD 2.32 billion in 2026 to USD 2.5 billion in 2026.

- By type: Animal-based ingredients dominated due to high bioavailability and pharmaceutical applications.

- By end-use: Pharmaceuticals held the largest share, driven by chronic disease therapies and biologics.

Key Country Highlights:

- U.S.: Strong demand for sustainable biotech ingredients in pharma and cosmetics.

- China: Rapid R&D growth and government support boost bio-based production.

- India: Investments in biotechnology and biomanufacturing drive market expansion.

- Europe: Stringent regulations and sustainable product demand enhance adoption.

- Brazil: Expanding pharma sector and natural ingredient use support growth.

Biotech Ingredients Market Trends

Technological Innovation to Boost Market Growth

Advancements in biotechnology, such as recombinant DNA technology, synthetic biology, and CRISPR gene editing, have significantly enhanced the production efficiency, purity, and scalability of active ingredients used in pharmaceuticals, cosmetics, and the food industry. These innovations enable the creation of highly targeted and sustainable ingredients, reducing dependency on traditional chemical synthesis and animal-derived sources. For instance, precision fermentation allows for the bio-manufacture of complex molecules such as vitamins, fragrances, and enzymes in controlled environments, minimizing waste and carbon footprints. Additionally, continuous progress in bioprocessing techniques, including cell-free synthesis and biocatalysis, contributes to faster development timelines and cost-effective production. Artificial intelligence and machine learning are also increasingly integrated into biotech R&D to predict protein structures, optimize gene sequences, and streamline discovery processes. North America witnessed a growth from USD 0.91 billion in 2023 to USD 0.98 billion in 2024.

Download Free sample to learn more about this report.

Market Dynamics

Market Drivers

Rising Demand for Sustainable and Clean-Label Ingredients to Drive Market Growth

The rising demand for sustainable and clean-label ingredients across various industries, such as food & beverages, cosmetics, and pharmaceuticals, drives the biotech ingredients market growth. Consumers increasingly prioritize health, environmental impact, and product transparency, pushing manufacturers to replace synthetic additives with bio-based, naturally derived alternatives. They are produced through environmentally friendly processes such as microbial fermentation, enzymatic synthesis, and cell culture, which further boost their demand. These methods often result in lower carbon emissions, reduced water usage, and decreased reliance on petrochemicals, offering a more sustainable solution for ingredient production. In the food industry, clean-label trends encourage the use of biotech-derived flavors, enzymes, and preservatives that meet consumers' expectations of recognizable and minimally processed components. Similarly, biotech ingredients such as plant stem cells, microbial-derived peptides, and hyaluronic acid are gaining traction in cosmetics due to their safety, efficacy, and eco-conscious sourcing.

Market Restraints

High R&D and Production Costs Limit Market Growth

Biotech ingredients, crucial to the pharmaceutical, cosmetic, and food industries, often require extensive scientific research, rigorous clinical trials, and advanced biotechnological processes before reaching commercialization. Developing new biotech ingredients involves high capital investment in sophisticated lab infrastructure, skilled personnel, and long development timelines that can span several years. These expenses place a significant financial burden on manufacturers that lack the funding capacity of large multinationals. Moreover, the complexity of regulatory approvals for pharmaceutical biotech products adds another layer of time and cost, as companies must comply with stringent global standards such as FDA or EMA requirements. In addition, production processes such as fermentation, cell culture, or genetic engineering often require specialized equipment and a controlled environment, further escalating operation costs. The scalability of these technologies can also be limited, making mass production cost-intensive and less economically viable compared to traditional chemical synthesis.

Market Opportunities

Expansion of Biosimilars, Monoclonal Antibodies, and Advanced Therapies to Create Significant Growth Opportunities

A major wave of patent expirations on high-value biologics such as Humira, Herceptin, and Remicade has opened the door to biosimilar development, enabling cost-effective alternatives that maintain therapeutic equivalence. This enhanced access to biologic treatments compels manufacturers to scale up production of core biotech ingredients such as recombinant proteins and cell culture media to meet heightened demand. Monoclonal antibodies remain the dominant segment due to their broad application in oncology and autoimmune diseases. The urgency to control drug costs and burdened healthcare budgets reinforces the adoption of mAb biosimilars, boosting ingredient assumption. Moreover, advanced therapies including cell and gene therapies, CAR-T, and antibody-drug conjugates are gaining momentum, supported by favourable regulated pathways, breakthrough designations, and substantial R&D investments worldwide in the U.S., China, and Europe.

Market Challenges

Regulatory Complexity May Hurdle Market Expansion

Regulatory frameworks vary widely across regions, with agencies such as the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), and various national authorities setting different approval standards, testing protocols, and documentation requirements. This lack of harmonization creates uncertainty for manufacturers, leading to extended product development cycles, increased compliance costs, and delays in market entry. Additionally, newer biotech innovations such as those derived from synthetic biology or genetically engineered microbes often face heightened scrutiny due to biosafety risks and public perception issues. Furthermore, frequent updates to guidelines on labeling, traceability, and environmental impact demand continuous adaptation from manufacturers.

Trade Protectionism and Geopolitical Impact

Trade protectionism and geopolitical tensions are significantly reshaping the global market, constraining growth while triggering strategic realignments. Recent U.S. tariffs, including baselines of 10% on imports and higher country-specific duties, have been announced and are expected to expand to pharmaceuticals and biotech ingredients. These measures disrupt established supply chains and increase costs. Many biotech firms rely heavily on APIs and biologics sourced from China (~80-90%), Europe, and India, making them vulnerable to sudden tariff escalations, customs delays, and export controls. The geopolitical rivalry between the U.S. and China has accelerated efforts to decouple critical biotech processes such as gene-editing, vaccines, and biology drug manufacturing from Chinese supply chains. While this promotes reshoring initiatives, it also exacerbates fragmentation and increases regulatory complexity. Meanwhile, non-tariff barriers such as stringent GMO labeling and approval regimes in Europe and Japan continue to hinder ingredient trade independence.

Research And Development (R&D) Trends

New advances in synthetic biology, precision fermentation, genetic engineering, and machine learning are enabling the creation of novel enzymes, peptides, proteins, and high-purity bioactives with greater efficiency. AI-driven strain optimization and process modeling, for example, have raised fermentation yield by up to 20%, slashing development cycles and production costs. Companies are also embedding green chemistry principles into their design pipelines, using renewable feedstocks and pursuing carbon-neutral production. This shift is being spurred by pressure from regulators and consumers favoring clean-label, naturally derived ingredients.

Segmentation Analysis

By Source

Animal-based Segment Dominated the Market Owing to its Increasing Use in Pharmaceuticals Applications

Based on source, the market is classified into microbial, plant-based, and animal-based.

The animal-based segment held the largest biotech ingredients market share in 2024 and is expected to experience substantial growth, driven by its high bioavailability and efficacy in pharmaceutical, nutraceutical, and cosmetic applications. Ingredients such as collagen, gelatin, and hormones are derived from animal tissues and offer proven functionality in drug delivery, wound healing, and anti-aging products.

The rising veganism, clean-label preference, and sustainability awareness drive the growth of the plant-based segment. They are widely used in functional foods, supplements, and cosmetics, offering natural antioxidants, phytochemicals, and bioactive compounds such as flavonoids and terpenes. Biotechnology has enhanced the extraction efficiency and bioavailability of these plant compounds through enzyme engineering and fermentation.

The microbial segment is projected to contributing 46.00% globally in 2026, experience significant growth in the coming years. The growth of the segment is driven by the rapid advancement in metabolic engineering and CRISPR-based gene editing, which enhances yield and specificity. Microbial production also supports sustainability goals by reducing dependency on animals or plant biomass, enabling precision manufacturing in controlled environments.

By Application

To know how our report can help streamline your business, Speak to Analyst

Pharmaceuticals Segment Dominates the Market Due to Increasing Incidence of Chronic Diseases

In terms of application, the market is segmented into pharmaceuticals, food and beverages, personal care & cosmetics, and others.

The pharmaceuticals segment held the largest market share in 2026 with a share of 45.60% in 2026 and is expected to dominate the market during the forecast period. Biotech-derived APIs (active pharmaceutical ingredients), such as recombinant proteins, monoclonal antibodies, and vaccines, are favored for their efficacy and safety profiles. The increasing burden of chronic diseases such as diabetes, cancer, and autoimmune disorders necessitates biologic-based therapies.

The food and beverages segment is also experiencing favorable growth over the projected period. The growth of the segment is due to increasing consumer demand for natural, sustainable, and health-enhancing products. Enzymes, probiotics, flavor enhancers, and functional proteins derived from biotechnology offer clean-label alternatives to synthetic additives.

The personal care & cosmetics segment is also registering positive growth in the market due to increasing consumer awareness about sustainability, skin compatibility, and product efficacy. Biotechnologically derived peptides, hyaluronic acid, ceramides, and enzymes are widely used in anti-aging, hydration, and skin repair formulations. The food and beverages segment is expected to hold a 15.8% share in 2024.

Biotech Ingredients Market Regional Outlook

By region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Biotech Ingredients Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominates the market with a valuation of USD 1.06 billion in 2025 and USD 1.14 billion in 2026 and is projected to register the highest CAGR during the forecast period. Growth in the region is driven by increasing demand for sustainable and bio-based ingredients across various industries. The U.S dominates the North America market, particularly in the pharmaceutical and cosmetic sectors. Biotech ingredients, including enzymes, amino acids, peptides, and proteins, are gaining traction due to their ability to enhance product quality, improve sustainability, and meet consumer demand for natural and clean-label products. The U.S. market is projected to reach USD 0.9 billion by 2026.

- In U.S., the food and beverages segment is estimated to hold a 15.5% market share in 2024.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

The Asia Pacific market is witnessing rapid growth in the market, driven by increasing demand for bio-based products, rising investments in R&D, and supportive government policies. This growth is notable in countries such as China and India, which are making significant investments in biotechnology and biomanufacturing. The Japan market is projected to reach USD 0.05 billion by 2026, the China market is projected to reach USD 0.21 billion by 2026, and the India market is projected to reach USD 0.11 billion by 2026.

Europe

Europe is also a positive contributor to the market. Growth in the region is attributed to strong demand for sustainable products, stringent regulations on synthetic chemicals, and significant investments in research and development. This growth is further boosted by the increasing adoption of biologics in disease management, expanding product use across various industries such as pharmaceuticals, cosmetics, and food & beverages, and advancements in biotechnology itself. The UK market is projected to reach USD 0.11 billion by 2026, while the Germany market is projected to reach USD 0.26 billion by 2026.

Latin America

The market in the Latin America region is growing steadily, attributed to the expanding pharmaceutical manufacturing and rising demand for sustainable and natural ingredients in cosmetic and personal care. Countries such as Brazil, Mexico, and Argentina are witnessing consistent growth owing to the increasing focus on local biopharmaceutical production and government support for biotech R&D initiatives.

Middle East & Africa

The region is expected to witness positive growth during the study period, driven by the growing interest in sustainable and organic products, coupled with increasing awareness about the health benefits of bio-based ingredients, which is driving market growth.

Competitive Landscape

Key Market Players

Key Players are Adopting an Expansion Strategy to Maintain Their Dominance in the Market

In terms of the competitive landscape, the market is characterized by the presence of emerging and established companies. Givaudan, Codex-ing Biotech Ingredients, Covalo, dsm-firmenich, and Abel are the major players in this market. These companies possess substantial production capabilities and manufacture products for industry-specific applications. They are also expanding their global manufacturing capacity, sales, and distribution network.

List of Top Biotech Ingredients Companies

- Givaudan (Switzerland)

- Codex-ing Biotech Ingredients (U.S.)

- Covalo (Switzerland)

- dsm-firmenich. (Netherlands)

- Abel (Germany)

- Aesthetics Rx (Australia)

- Nikko Chemicals Co., Ltd. (Japan)

- Evonik Industries (Germany)

- Fermenta Biotech Limited (India)

- Titan Biotech. (India)

- Conagen, Inc. (U.S.)

- Advanced Biotech (U.S.)

- Merck KGaA (Germany)

KEY INDUSTRY DEVELOPMENTS

- May 2025: Astorg, a European private equity firm, announced that it signed a definitive agreement to acquire a majority stake in Solabia Group, a global biotechnology ingredient solutions provider, from TA Associates, a private equity firm, which will reinvest in the business. Astorg would partner with TA to support Solabia in executing its growth plan, which is focused on international expansion and product innovation, through a combination of organic initiatives and targeted M&A.

- April 2025: Amgen announced a USD 900 million expansion of its Ohio biotech manufacturing facility, becoming the latest in a string of drugmakers pledging to increase U.S. capacity amid under the Trump administration’s renewed threats of potential import tariffs.

- March 2025: Isobionics, a biotechnology brand of BASF Aroma Ingredients, launched two new natural ingredients on the flavor market. Isobionics Natural beta-Sinensal 20 and Isobionics Natural alpha-Humulene 90 are produced using an innovative cutting-edge fermentation process, making them a novelty in the flavor industry.

- January 2025: Biotech beauty company Debut released BeautyORB, an artificial intelligence (AI) tool designed to formulate bio-based ingredients for beauty and cosmetic products. The tool eliminates the need for labor-intensive research into rare plant ingredients and is set to create two biotech ingredients a year.

- November 2024: CABIO Biotech and Nourish Ingredients officially announced a milestone joint commercial agreement. Nourish Ingredients, an industry specializing in specialty fats and precision fermentation, is partnering in this international collaboration. The collaboration aimed to produce Tastilux, Nourish's flagship animal-free fat ingredient, at scale for the Asia-Pacific market.

- February 2024: Evonik launched Vecollage Fortify L, a new vegan collagen for the beauty and personal care market that is identical to collagen in the skin.

REPORT COVERAGE

The report provides a detailed analysis of the market. It focuses on key aspects, such as leading companies, end-use industries, and product applications. Besides this, it offers insights into the market and current industry trends and highlights key industry developments. In addition to the factors mentioned above, it encompasses several factors contributing to the market's growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 7.7% from 2026 to 2034 |

|

Segmentation |

By Source · Microbial · Plant-based · Animal-based |

|

By Application · Pharmaceuticals · Food and Beverages · Personal Care & Cosmetics · Others |

|

|

By Region · North America (By Source, By Application, and By Country) o U.S. (By Application) o Canada (By Application) · Europe (By Source, By Application, and By Country) o Germany (By Application) o France (By Application) o U.K. (By Application) o Italy (By Application) o Rest of Europe (By Application) · Asia Pacific (By Source, By Application, and By Country) o China (By Application) o India (By Application) o Japan (By Application) o South Korea (By Application) o Rest of Asia Pacific (By Application) · Latin America (By Source, By Application, and By Country) o Brazil (By Application) o Mexico (By Application) o Rest of Latin America (By Application) · Middle East & Africa (By Source, By Application, and By Country) o Saudi Arabia (By Application) o South Africa (By Application) o Rest of Middle East & Africa (By Application) |

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 2.5 billion in 2026 and is projected to record a valuation of USD 4.54 billion by 2034.

In 2025, the North America market value stood at USD 1.06 billion.

Recording a CAGR of 7.7%, the market will exhibit steady growth during the forecast period of 2026-2034.

In 2026, pharmaceuticals is the leading segment in the market by application.

Growing demand from the pharmaceutical industry is a key factor driving the growth of the market.

North America captures the highest market share.

Givaudan, Codex-ing Biotech Ingredients, Covalo, dsm-firmenich, and Abel are major players in the global markets.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us