Bitumen Additives Market Size, Share & Industry Analysis, By Type (Modifier, Anti-Strip & Adhesion Promoters, Bitumen Emulsifiers {Cationic, Anionic, and Non-ionic}, Fiber Additives, Warm Mix Additives, and Others), By Application (Road Construction, Roofing, Paints & Coatings, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

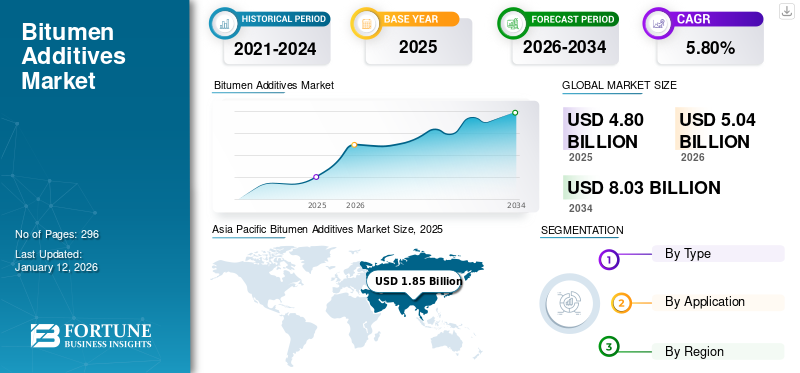

The global bitumen additives market size was valued at USD 4.8 billion in 2025. The market is projected to grow from USD 5.04 billion in 2026 to USD 8.03 billion by 2034, exhibiting a CAGR of 5.80% during the forecast period. Asia Pacific dominated the bitumen additives market with a market share of 39% in 2025.

Bitumen additives are substances added to bitumen, a viscous black material commonly used in road construction and roofing, to enhance its performance and durability. Bitumen itself has limitations, particularly in extreme weather conditions, where it can become brittle in cold temperatures and soft in hot conditions. The primary purpose of these additives is to improve the physical and chemical properties of bitumen, enabling better performance, longevity, and adaptability to varying environmental conditions.

Bitumen additives are essential in modern infrastructure projects, ensuring that roads and other surfaces withstand harsh conditions, offer longer service lives, and contribute to energy efficiency and sustainability in construction practices. They address specific challenges, such as weather-induced stress, traffic loads, and environmental concerns, ultimately improving the quality and sustainability of asphalt mixtures. A few of the major players in the market include Cargill, Incorporated, Evonik, BASF SE, Inc., Honeywell International Inc., and Arkema, among others. The growing focus on the sustainability and performance of additives has been shaping the research and development investments of these players in the market.

GLOBAL BITUMEN ADDITIVES MARKET SNAPSHOT & HIGHLIGHTS

Market Size:

- 2025 Value: USD 4.8 billion

- 2026 Value: USD 5.04 billion

- 2034 Forecast Value: USD 8.03 billion

- CAGR: 5.80% from 2026–2034

Market Share:

- Asia Pacific held the largest share at 39% in 2025, valued at USD 1.29 billion

- By type, the modifier segment dominated in 2023 due to its use in high-traffic and extreme weather conditions

- By application, road construction accounted for an 86.6% share in 2023

Key Country Highlights:

- China & India: Lead Asia Pacific growth through major investments in roads and infrastructure

- U.S.: Market supported by aging infrastructure upgrades and demand for warm mix asphalt

- Germany, U.K., France: Demand driven by EU green construction and renovation goals

- Brazil: Only 12% of roads paved, offering significant market potential

- Saudi Arabia & South Africa: Demand rising due to road durability needs under harsh climates

MARKET DYNAMICS

MARKET DRIVERS

Infrastructure Development and Urbanization to Aid Market Growth

Urbanization is one of the most significant socio-economic trends of the 21st century. Many people are moving to cities across the globe in search of better economic opportunities, healthcare, education, and living conditions. According to the United Nations, approximately 68% of the world’s population will live in urban areas by 2050, up from 55% in 2018. This massive migration to urban centers puts immense pressure on existing infrastructure, leading to a surge in demand for new roads, highways, bridges, and transport systems.

Developing regions, such as Asia, Latin America, and Africa, are leading the way in infrastructure development. Governments in countries, such as China, India, Brazil, and Indonesia are heavily investing in road infrastructure to support economic growth. For instance, China’s Belt and Road Initiative (BRI) involves the construction of thousands of kilometers of roads, railways, and ports across Asia, Europe, and Africa. This initiative alone has a massive impact on the market, as road construction projects require durable asphalt with improved performance properties.

- Asia Pacific witnessed a bitumen additives market growth from USD 1.90 Million in 2022 to USD 1.78 Million in 2023.

In addition to new infrastructure projects, there is a growing need to maintain and modernize existing road networks, particularly in developed countries, such as the U.S. and across Europe. Many roads in these regions were built decades ago and are now deteriorating under the pressure of increased traffic and harsher environmental conditions. In the U.S., the American Society of Civil Engineers (ASCE) estimates that 43% of the country’s roads are in poor or mediocre condition, necessitating substantial repair and reconstruction efforts. Modernizing existing infrastructure to meet the demands of electric and autonomous vehicles also requires road surfaces that can handle new types of loads, further boosting the demand for these additives and driving the market growth.

Download Free sample to learn more about this report.

MARKET RESTRAINTS

Volatility in Raw Material Prices May Hamper Market Growth

Many bitumen additives, including polymer modifiers, anti-stripping agents, and emulsifiers, are petrochemical-based. The price of crude oil significantly impacts the cost of these additives, given their reliance on petrochemical byproducts, such as styrene-butadiene-styrene (SBS) or ethylene-vinyl acetate (EVA), which are common modifiers in asphalt. The global crude oil market is highly volatile due to geopolitical tensions, fluctuations in supply and demand, OPEC decisions, and economic uncertainties. For example, conflicts in major oil-producing regions, such as the Middle East, or sanctions on major oil exporters can cause significant supply disruptions, leading to sharp increases in crude oil prices. This volatility affects the pricing of petroleum-derived bitumen and the additives associated with its modification. When oil prices rise sharply, the cost of producing bitumen and additives, such as polymers, can also increase, which makes infrastructure projects more expensive. Governments and private contractors may then reduce or delay projects, directly impacting demand for these additives.

MARKET OPPORTUNITIES

Identification of Emerging Markets and Sectors to Open New Avenues for Market Growth

Identifying emerging markets and sectors presents significant investment opportunities for stakeholders in the market, particularly in developing countries. Rapid urbanization and industrial growth in these regions are driving substantial demand for infrastructure development, including roads, highways, and urban projects. As governments in developing nations allocate increased budgets for infrastructure modernization, the demand for durable and cost-effective construction materials, including bitumen additives, is expected to rise. Emerging sectors, such as renewable energy, smart cities, and sustainable infrastructure, offer untapped potential. For instance, the push for environmentally friendly construction materials aligns with the growing adoption of advanced bitumen additives, such as warm mix asphalt modifiers and bio-based alternatives.

Additionally, the rise of public-private partnerships (PPPs) in infrastructure development in developing economies creates a fertile ground for innovation and investment in these economies. Investors can also capitalize on opportunities in rural road connectivity and urban expansion projects, which often receive significant government support. Tailored solutions that address local challenges, such as extreme weather or limited technical expertise, can further enhance market penetration. By focusing on these high-growth segments and forming strategic alliances with local entities, investors can not only generate attractive returns but also contribute to sustainable infrastructure development in emerging economies.

MARKET CHALLENGES

Limited Awareness about the Product May Hamper Market Growth

Limited knowledge and awareness of advanced bitumen additives in certain regions pose significant challenges to market penetration and adoption. In many developing economies, construction professionals and policymakers often rely on traditional materials and methods due to familiarity, cost concerns, and lack of exposure to modern alternatives. This reluctance to transition is due to a limited understanding of the long-term benefits of advanced additives, such as enhanced durability, reduced maintenance costs, and environmental advantages. In addition to this, inadequate training and technical expertise among local contractors and engineers prevent the effective application of these innovative solutions, further hindering their acceptance. To address this gap, targeted education and awareness initiatives are crucial. Manufacturers and industry stakeholders must collaborate with governments, construction associations, and academic institutions to promote the benefits of advanced bitumen additives. Workshops, training programs, and demonstration projects can highlight their performance advantages, lifecycle cost savings, and compliance with evolving environmental regulations. Furthermore, sharing success stories from regions where advanced additives have improved infrastructure resilience can help build trust and demand, driving market growth.

BITUMEN ADDITIVES MARKET TRENDS

Technological Advancements in Additive Formulations and Road Construction to Boost Market Growth

Polymer-modified bitumen has become one of the most widely used forms of modified asphalt due to its superior mechanical properties compared to conventional bitumen. Polymer-modified bitumen enhances the flexibility, elasticity, and resistance to deformation of asphalt, making it ideal for roads subject to heavy traffic and extreme weather conditions. The continued development of new polymer additives is driving the growth of the market as manufacturers explore innovative ways to improve the performance of bitumen for a variety of applications. Recent advancements in polymer-modified bitumen technology include the introduction of reactive elastomeric terpolymers. These new polymers offer improved bonding between bitumen and aggregates, making roads more durable and less susceptible to cracking and potholes. They also provide enhanced performance in regions with extreme climates, where roads must endure both hot and cold temperatures.

In addition to this, nanotechnology is another emerging trend in the market. By incorporating nanomaterials into bitumen, researchers can significantly improve the performance of asphalt in terms of durability, resistance to moisture damage, and overall lifespan. Nanomaterials, such as nano-silica, carbon nanotubes, and graphene, are being studied for their potential to improve the mechanical properties of bitumen at the molecular level.

Furthermore, Warm Mix Asphalt technology is gaining popularity as a sustainable alternative to traditional Hot Mix Asphalt. Warm Mix Asphalt allows asphalt to be mixed and applied at lower temperatures, reducing energy consumption and emissions during the construction process. This technology is particularly appealing in regions with strict environmental regulations, as it helps reduce greenhouse gas emissions and VOCs. As the demand for sustainable construction practices grows, the adoption of warm mix asphalt technology and the additives required for it is expected to increase, driving bitumen additives market growth.

IMPACT OF COVID-19

The COVID-19 pandemic had a significant impact on the market, disrupting supply chains, halting construction activities, and creating economic uncertainty. Lockdowns and transportation restrictions caused material shortages and operational delays, while reduced infrastructure investment led to a sharp decline in demand. Construction projects were postponed or canceled, particularly in developing regions, further dampening the demand. Manufacturers also faced workforce challenges, with many plants operating at reduced capacity or shutting down temporarily. However, the market has shown resilience and a steady recovery. Government stimulus packages and increased investment in infrastructure projects have driven demand for these additives, particularly in road construction and maintenance. The resumption of delayed construction activities, coupled with a growing focus on sustainability, has accelerated the adoption of innovative and eco-friendly additives, such as warm mix asphalt and bio-based modifiers. With continued investment in resilient infrastructure, the demand is anticipated to witness sustained growth in the post-pandemic era, driving market growth.

TRADE PROTECTIONISM AND GEOPOLITICAL IMPACT

International trade policies between major economies significantly impact raw material prices and the final cost of products in the market. Tariffs, import/export restrictions, and geopolitical tensions can disrupt the supply chain for key raw materials, such as polymers, emulsifiers, and other chemical additives, many of which are sourced globally. For instance, trade disputes between major economies can lead to increased tariffs on raw material imports, driving up production costs for manufacturers. Similarly, non-tariff barriers, such as stringent regulatory requirements or quotas, may limit the availability of essential inputs, causing price volatility and supply shortages.

To mitigate these impacts, businesses in the market need to diversify their supply chains, explore alternative sources of raw materials, and engage in active policy monitoring. Strategic partnerships and advocacy for balanced trade policies can also help stabilize prices and ensure consistent access to raw materials, enabling sustainable growth in the global market.

RESEARCH AND DEVELOPMENT (R&D) TRENDS

The growing focus on sustainability and energy-efficient production has significantly shaped research and development (R&D) in the market. With global efforts to reduce carbon emissions and meet environmental regulations, manufacturers are prioritizing the development of eco-friendly additives that improve infrastructure durability while minimizing environmental impact. This shift has led to innovations, such as bio-based modifiers, which utilize renewable resources, and warm mix asphalt additives, which reduce the energy required for asphalt mixing and lower greenhouse gas emissions. Additionally, the demand for energy-efficient production methods has driven R&D investments in technologies that optimize manufacturing processes and reduce waste. Advanced additives that enhance recycling capabilities for reclaimed asphalt pavement (RAP) have also gained traction, aligning with circular economy principles. Research is increasingly focusing on multi-functional additives that not only improve performance but also address challenges, such as climate resilience and lifecycle cost reduction.

SEGMENTATION ANALYSIS

By Type

Modifier Segment Dominated Owing to its Versatility in Pavement Construction

The market is classified by type into modifier, anti-strip & adhesion promoters, bitumen emulsifiers {cationic, anionic, and non-ionic}, fiber additives, warm mix additives, and others.

The modifier segment held the highest share of of 49.40% in 2026 and is estimated to record a significant growth rate during the forecast period. Demand for polymer modifiers is driven by the need for improved durability and flexibility in asphalt pavements, especially in high-traffic areas. As road infrastructure projects expand globally, these additives are essential for enhancing bitumen's resistance to cracking and deformation. Additionally, regions with extreme climates increasingly adopt modified bitumen to withstand temperature fluctuations, contributing to the steady demand for polymer and chemical modifiers.

Warm mix additives are seeing rising demand as they enable asphalt production at lower temperatures, reducing energy consumption and emissions. This aligns with global environmental goals and regulations, especially in North America and Europe, where sustainable construction practices are prioritized. These additives also improve worker safety by reducing fumes, making them popular for large-scale projects aimed at minimizing environmental impact while enhancing productivity.

By Application

To know how our report can help streamline your business, Speak to Analyst

Road Construction Accounted for Prominent Share Owing to Growing Usage of Products

Based on application, the market is segmented into road construction, roofing, paints & coatings, and others.

The road construction segment accounted for the largest global market share 86.71% globally in 2026. Demand for bitumen additives in road construction is driven by the need for durable, high-performance pavement that can withstand heavy traffic and extreme weather. Additives enhance properties, such as flexibility, moisture resistance, and longevity, making them essential for sustainable infrastructure development. Increasing government investments in highway projects and maintenance initiatives globally are further boosting the demand for these additives, driving market growth. The road construction segment is expected to hold an 86.6% share in 2023.

In roofing, bitumen additives are used to improve water resistance, UV protection, and thermal stability. Demand is growing due to increasing awareness of energy-efficient roofing solutions that provide longer-lasting, low-maintenance protection for buildings. Rising urbanization, along with the need for affordable and resilient roofing materials, particularly in developing regions, drives the demand for additives that enhance the performance and lifespan of bitumen-based roofing products.

BITUMEN ADDITIVES MARKET REGIONAL OUTLOOK

Regarding geography, the global market is segmented into North America, Europe, Southeast Asia, Asia Pacific, Latin America, and Middle East & Africa.

Asia Pacific

Asia Pacific Bitumen Additives Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific was valued at USD 1.78 billion in 2023 and captured the largest bitumen additives market share in 2023. It is anticipated to dominate during the forecast period. The region is witnessing rapid urbanization and infrastructure development, driving a strong demand for these additives. China and India, in particular, are investing heavily in road construction and urban infrastructure, necessitating the use of polymer modifiers and fiber additives for durable, high-traffic roads. The region also has extreme weather variations, which increases the demand for anti-strip and adhesion promoters. Growing construction activities in the residential and commercial sectors support the demand for roofing applications while increasing industrial growth fuels the need for coatings enhanced with bitumen additives. According to Oxford Economics, the Asia Pacific region will account for USD 2.5 trillion of growth in construction output between 2020 and 2030, up by over 50%. It will become a USD 7.4 trillion market by 2030.

The Japan market is projected to reach USD 0.05 billion by 2026, the China market is projected to reach USD 1.34 billion by 2026, and the India market is projected to reach USD 0.35 billion by 2026.

Europe

In Europe, the demand for these additives is influenced by stringent environmental regulations and sustainability goals. The region has a strong focus on green construction practices, driving demand for warm mix additives and emulsifiers that reduce energy consumption. With an emphasis on high-quality infrastructure, polymer modifiers, and fiber additives are being widely used to improve road longevity. The roofing market also sees a demand for additives due to the need for energy-efficient, weather-sensitive solutions. Additionally, road recycling and maintenance initiatives across the EU are fueling the use of rejuvenators and other specialized additives. The EU aims to double renovation rates by 2030 and ensure this leads to better energy- and resource efficiency. This means that by 2030, 35 million buildings could be renovated, creating up to 160,000 new green jobs in the construction sector. The UK market is projected to reach USD 0.08 billion by 2026, while the Germany market is projected to reach USD 0.07 billion by 2026.

North America

Demand for bitumen additives in North America is driven by the need to maintain and upgrade aging road infrastructure. The U.S., in particular, has an extensive network of highways that require durability enhancements through polymer modification and anti-strip agents. Additionally, environmental regulations encourage the use of warm mix additives to reduce emissions during road construction. The roofing market is another significant driver, as energy-efficient, weather-resistant materials are increasingly becoming popular. With government infrastructure investments on the rise, the demand for these additives in North America is expected to grow, driving market growth during the forecast period. The construction industry is a major component of the U.S. economy. As of 2024, it accounts for approximately 4.5% of the country’s GDP. The U.S. market is projected to reach USD 0.95 billion by 2026.

Latin America

In Latin America, demand for bitumen additives is rising due to investments in infrastructure and road expansion projects. Countries, such as Brazil and Argentina are working to improve their road networks to support economic growth. The region’s diverse climate conditions increase the need for additives that provide moisture resistance and temperature stability. Additionally, the construction sector in the region is expanding, driving demand for these additives in roofing and waterproofing coatings. In terms of existing infrastructure, Brazil has more than 1.7 million kilometers of roads, of which only 213,500 km are paved (about 12% of the entire network), providing a huge potential for market growth.

Middle East & Africa

The Middle East & Africa region has a growing demand for bitumen additives due to infrastructure development and road construction projects, particularly in the GCC countries. Extreme weather conditions, such as high temperatures and sand abrasion, create a need for polymer modifiers and fiber additives to improve road durability. Additionally, urbanization and population growth drive demand for housing, driving market growth for roofing materials that provide weather resistance. Countries in Africa are also investing in road connectivity to support economic development, further fueling the demand for these additives to enhance performance under varying weather conditions. According to the Institute for Security Studies, in 2023, African countries received USD 21.7 billion in China’s Belt and Road Initiative deals, including investments in ports, railways, and renewable energy.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Market Players are Focusing on Advancing Their Product Portfolio

The market is fragmented with numerous global and regional key players, leading to intense competition. These key players often engage in price competition, R&D investments and marketing efforts to differentiate themselves. A few of the major players in the market include Cargill, Incorporated, Evonik, BASF SE, Inc., Honeywell International Inc., and Arkema, among others. Recently, companies are also investing in developing additives that address evolving demands for sustainability and performance.

LIST OF KEY BITUMEN ADDITIVES COMPANIES PROFILED

- Ingevity (U.S.)

- Arkema (France)

- Kao Corporation (Japan)

- Cargill, Incorporated (U.S.)

- Evonik (Germany)

- Zydex Group (India)

- Colas (U.S.)

- Ecolab (U.S.)

- BASF (Germany)

- Iterchimica SpA (Italy)

- Honeywell International Inc. (U.S.)

REPORT COVERAGE

The report provides a detailed analysis of the market. It focuses on key aspects, such as leading companies, types, and applications of the product. Besides this, it offers insights into the market and current industry trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors contributing to the market's growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) and Volume (Ton) |

|

Growth Rate |

CAGR of 5.80% from 2026 to 2034 |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 5.04 billion in 2026 and is projected to reach USD 8.03 billion by 2034.

Recording a CAGR of 5.80%, the market is slated to exhibit steady growth during the forecast period.

The road construction application segment led in 2025.

Infrastructure development and urbanization to aid the market growth.

Increasing demand for environmentally sustainable bitumen additives is anticipated to drive product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us