Roofing Materials Market Size, Share & Industry Analysis, By Material (Bituminous, Tile, Metal, Elastomeric, and Others), By End-use Industry (Residential, Non-Residential, and Industrial), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

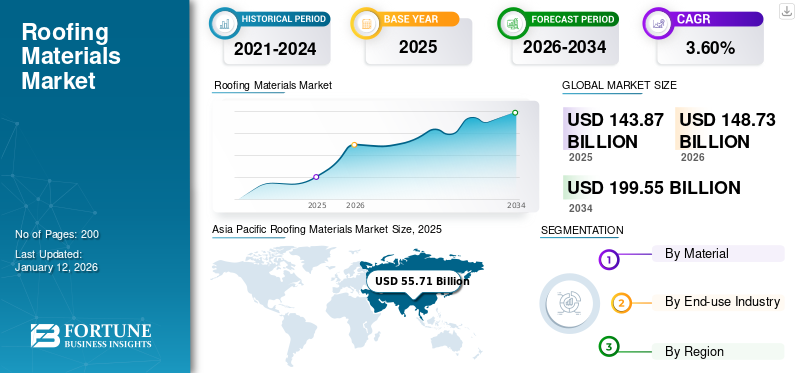

The global roofing materials market size was valued at USD 143.87 billion in 2025 and is market is projected to grow from USD 148.73 billion in 2026 to USD 199.55 billion by 2034, exhibiting a CAGR of 3.60% during the forecast period. Asia Pacific dominated the roofing materials market with a market share of 55.71 % in 2025. Moreover, the roofing materials market size in the U.S. is projected to grow significantly, reaching an estimated value of USD 34.77 billion by 2032, driven by construction industry expansion and notable shift towards eco-friendly and green roofing materials.

Roofing materials are the outermost layers of a building’s roof used to construct or repair a roof. The roof is a vital part of a house that offers protection against climatic conditions and natural elements. The exterior layer of a roof varies according to the available material and the complexity of the supporting structure. Roofing materials vary from natural products, such as slates and thatches, to commercially available products, such as bituminous tiles and plastic roofs. Rising investments in the development and renovation of commercial and residential buildings are anticipated to drive the roofing materials market growth.

The global pandemic and lockdown restrictions imposed by various governments caused major disruption in the entire construction materials supply chain. Additionally, companies suffered from labor scarcity, both skilled and unskilled, resulting in massive losses. Contractors working in the roofing sector had to adopt additional safety measures and follow COVID-19 protocols to safeguard their employees.

GLOBAL ROOFING MATERIALS MARKET OVERVIEW

Market Size & Forecast:

- 2025 Market Size: USD 143.87 billion

- 2026 Market Size: USD 148.73 billion

- 2034 Forecast Market Size: USD 199.55 billion

- CAGR: 3.60% from 2026–2034

Market Share:

- Asia Pacific led the market in 2025 with a 55.71 % share.

- By material, bituminous held the largest share due to cost-effectiveness and wide residential use.

- Metal roofing is gaining traction due to superior fire resistance and durability, especially in wildfire-prone areas.

- By end-use, the residential segment dominated in 2024, supported by population growth and infrastructure push.

- The non-residential segment is projected to hold a 33.7% share in 2024, backed by investments in social infrastructure.

Key Country Highlights:

- United States: Roofing materials market expected to reach USD 34.77 billion by 2032 due to construction industry growth and shift to green roofing solutions.

- China: Non-residential sector anticipated to hold 37.2% market share in 2024 amid robust infrastructure expansion.

- India: Government initiatives targeting 29.5 million homes by March 2024 fueling residential roofing demand.

- United Kingdom: National housing targets to combat shortages are boosting residential roofing usage.

- Middle East & Africa: Rising construction in Kenya, Nigeria, and the Gulf states propels regional demand.

Roofing Materials Market Trends

Increasing Demand for Bituminous Roofing to Augment Market Growth

Bituminous is affordable compared to other common roofing materials. In bituminous, shingles & plates are commonly used. Bituminous shingles are a cost-effective roofing alternative and provide excellent protection. Available in a vast array of colors and designs, it is easy to find a choice to complement the design of the building and improve its appeal. The bituminous shingles are coated with asphalt and covered with colored mineral granules that help protect the shingles from the elements. Bituminous shingles are available in different thicknesses or grades; roofing lasts 25 to 30 years, depending on the local climate and how well it is maintained. Bituminous is a durable building material adapting to most environmental conditions and can withstand harsh weather conditions, including strong winds, without wear and tear.

- Asia Pacific witnessed a roofing materials market growth from USD 51.83 billion in 2023 to USD 53.71 billion in 2024.

However, wind resistance scores are measured from the lowest (Class D) to the highest (Class H). Bituminous shingles can meet the Class H grade, which stands against winds up to 150 mph, with proper installation and support from fasteners and bonds. Instead of absorbing solar heat, it reflects bituminous shingles. As a result, buildings can stay cool without relying on a heating and cooling system. Shingles made from bituminous have an effective resistance level of 1-4, making them suitable for inclement weather conditions, such as hail storms. Bituminous shingles retain a fire classification of class A, thereby reducing accidents in case of a disaster.

Download Free sample to learn more about this report.

Roofing Materials Market Growth Factors

Excellent Fire Resistant Property of Metal Roofing to Drive Industry Growth

Metal roofing is expected to expand rapidly due to increasing cases of wildfires. Metal roofing is an excellent fire-resistant roofing choice, which many have used to adapt to modern fire codes and fireproof their buildings. It can be produced using copper, aluminum, stainless steel, and zinc and is available in two forms, panels & shingles. The most common cost-effective metals among them are galvanized steel and aluminum.

Metal roofing is a durable material that lasts longer than other materials. It captures the sun's UV rays and keeps the building cooler during summer. The metal roofing adds extra insulation to the building, maintaining steady temperatures during the winter and summer. Metal roofing sales are on the rise in commercial construction and residential remodeling. Experienced building architects and property owners have embraced metal roofing as one of the roofing industry's most durable solutions. Metal roofing weighs less compared to bituminous shingles roofing or tiles. Similar to other roofing materials, it does not stress the building’s structure due to its strength, durability, flame resistance, and low maintenance.

Growing Construction Industry to Drive Roofing Materials Market Share

The global construction industry is the largest consumer of raw materials. The industry is projected to expand due to growth in residential, non-residential, and infrastructure projects. Europe’s construction market is increasing due to residential, non-residential, and civil engineering sectors.

Roof is an important building structure, providing protection and enhancing appeal. A roof structure consists of different materials interconnected to weatherproof and waterproof buildings from rain, heat, snow, and other elements. Roofing materials differ depending on roof form, position, environment, and commercial or residential use. Bituminous shingles are common as they are relatively inexpensive and have a good lifespan for residential use. Metal, EPDM, and built-up roofs are widely used in commercial construction, where flat roofs are more common. Thus, the growing construction industry is driving the demand of the market. However, the widespread pandemic affected construction and detained market growth.

RESTRAINING FACTORS

Higher Price of Roofing Materials to Hinder Market Growth

A massive investment of time, electricity, and money is involved in resurfacing worn-out roofs. Climatic conditions may affect product quality. For example, certain materials lack properties to withstand extreme heat and ultraviolet radiation from sunlight, though they easily succumb to prolonged freeze-thaw cycles. Shingles made from bituminous can be weakened if built during freezing temperatures. Since they are not as high quality as other materials, they are vulnerable to wind lifting and can quickly break at varying temperatures. The initial cost of metal roofing is typically higher than that of other materials.

Durable, slate, concrete, and clay tiles can be broken if they have a strong effect, such as falling tree branches or even walking pressure. Repairs can be costly when needed. Roofing materials' durability comes with a higher repair cost and maintenance, as shakes and shingles of untreated wood require high maintenance. The amount of natural resources and electricity used, and toxicity caused by emissions should be considered while manufacturing roofing materials. These materials are made from scarce or ecologically-sensitive materials.

Roofing Materials Market Segmentation Analysis

By Material Analysis

Bituminous Material to be Leading Segment Due to Wide Usage in Residential Construction

In terms of material, the market is segmented into bituminous, tile, metal, elastomeric, and others.

The bituminous segment accounted for a major share of the market in 2024 and is likely to maintain its dominance during the forecast period. Shingles made from bituminous are preferred for residential roofing due to their cost-effectiveness and easy installation. These shingles may be reinforced with fiberglass or synthetic materials without altering the shingle’s appearance.

Tiles made of clay and concrete display texture that enhances the visual aesthetics of a building. Tiles of flat, ribbed clay are extremely durable and heavy and, thus, are advised to be mounted. Concrete tiles are heavy and flexible compared to real clay.

The tile material segment is projected to dominate the market with a share of 34.86% in 2026. Metal roofs are immune to severe weather. Metal roofs in aluminum, copper, stainless steel, and zinc are available in two forms, panels and shingles. Properly mounted metal roofing can last as long as the building, seal off the water, withstand high winds, and shed snow easily.

Elastomeric roofing material is made from synthetic rubber or plastic material that is specifically designed to withstand the harsh weather conditions. It is a highly durable and flexible material that can stretch and contract with changes in temperature and weather patterns, making it a popular choice for commercial and industrial buildings as well as residential homes.

One of the most significant benefits of elastomeric roofing material is its resistance to damage from UV rays and other types of weathering. This type of material can withstand prolonged exposure to sunlight without cracking or fading, making it ideal for areas that get exposed to intense heat and sunlight. Additionally, elastomeric material is highly resistant to water damage, which makes it an excellent choice for areas with heavy rainfall or snow.

By End-use Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Residential Segment to Account for the Major Market Share Due to Rise in Infrastructure Projects

In terms of end-use industry, the market is segmented into residential, non-residential, and industrial.

The residential end-use industry segment is expected to lead the market, accounting for 47.03% of the total market share in 2026 and is estimated to register a significant growth rate during the forecast period. The segment’s growth is attributed to a rise in policy and institutional support for building housing infrastructure in emerging economies. Residential roofing demand is growing due to the rising population and preference for single-family housing structures. In addition, ease of credit access and low-interest rates play an important role in the overall demand for residential structures.

- The non-residential segment is expected to hold a 33.7% share in 2024.

The investment to construct and renovate social infrastructures, such as hospitals, educational buildings, government offices, and correction facilities, is anticipated to fuel the non-residential construction sector.

REGIONAL INSIGHTS

Asia Pacific Roofing Materials Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

The Asia Pacific roofing materials market size was valued at USD 53.71 billion in 2024. In Asia Pacific, the high product demand is due to the rise in the construction sector, including new construction and renovation activities. The increase in industrial operations, especially in China and India, coupled with a growing population and rising disposable incomes, has increased demand for construction and building activities, thus boosting the industry growth in the region. Residential construction is India's leading segment of the construction industry. The Indian government has set a target of 29.5 million houses by March 2024, which is expected to significantly impact the regional market. The Japan market is valued at USD 5.96 billion by 2026, the China market is valued at USD 31.9 billion by 2026, and the India market is valued at USD 10.54 billion by 2026. The Japan market is valued at USD 5.96 billion by 2026, the China market is valued at USD 31.9 billion by 2026, and the India market is valued at USD 10.54 billion by 2026.

- In China, the non-residential segment is estimated to hold a 37.2% market share in 2024.

To know how our report can help streamline your business, Speak to Analyst

North America

The North America market growth is owed to its increasing re-roofing project activities for commercial, industrial, and residential projects in the U.S. The rise in construction activities of residential and commercial projects in the U.S. and Canada, along with infrastructure spending by the government for construction projects, is anticipated to drive market growth. The U.S. market is valued at USD 27.65 billion by 2026.

Europe

In the U.K., the government has set a goal to provide annual residential homes to address the acute housing shortage. Thus, the increasing emphasis on housing construction activities is projected to surge the demand in Europe.

The growth of the market in Latin America is due to increased industrialization. The demand for heavy roofing materials brought more new building materials, such as cast iron, steel, and glass, with which architects and engineers rearranged the concept of function, size, and form due to the impact of the industrial revolution.

In the Middle East & Africa, roofing materials demand is majorly driven by the rapid growth of the residential building sector in Kenya, Nigeria, Egypt, and Ethiopia. In addition, the ongoing construction boom in Qatar, Saudi Arabia, and UAE creates considerable demand for the market.

List of Key Companies in Roofing Materials Market

Key Players Blend Effective Strategies, Acquisition, and New Product Launch to Boost Market Stance

The market is substantially fragmented. Key players include Owens Corning, GAF, and Carlisle Companies Inc., among others. Industry players compete primarily based on the price and application characteristics of the product. Most global companies have integrated raw material production and sales activities to maintain product quality and expand regional influence.

In addition, these firms have built a robust network of certified roofing contractors to ensure the quality of the roof installation to expand their client base. Major market players depend on backward integration to preserve quality and control production costs.

LIST OF KEY COMPANIES PROFILED:

- Owens Corning (U.S.)

- CertainTeed Corporation (U.S.)

- Atlas Roofing Corporation (U.S.)

- BMI Group (U.K.)

- Johns Manville (U.S.)

- IKO Industries Ltd. (U.S.)

- GAF (U.S.)

- TAMKO Building Products, Inc. (U.S.)

- Carlisle Companies Incorporated (U.S.)

- Firestone Building Products Company, LLC (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- January 2022 - Owens Corning acquired Natural Polymers LLC, a company that specializes in the manufacturing of spray polyurethane foam insulation for building and construction applications.

- February 2022 - Johns Manville, a Berkshire Hathaway company, announced two new products for bituminous roofing systems to help improve productivity on the roof.

- February 2022 - Carlisle Companies Incorporated acquired MBTechnology, Inc. (MBT). This acquisition will expand CWT’s modified bitumen roofing offerings and provide additional capacity for roofing underlayment.

- December 2021 - Cornerstone Building Brands, Inc. completed the acquisition of Union Corrugating Company Holdings, Inc., a provider of metal roofing, roofing components, and accessories. This acquisition will expand Cornerstone Building Brands’ solutions offerings to customers in the growing residential metal roofing market.

- January 2021 - ProVia launched a metal roofing product line that combines the luxury and beauty of slate or cedar shakes with the durability and longevity of a galvanized, highly-engineered steel roof system.

REPORT COVERAGE

The research report thoroughly examines key factors such as major firms, goods, and services. It also provides market trends, competitive landscape, and highlights important industry advancements. The study includes different variables that have contributed to the market's growth in recent years and the factors listed above. It examines the industry's newest market dynamics and opportunities and historical data and revenue growth estimates at the global, regional, and country levels.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 3.60% from 2026 to 2034 |

|

Unit |

Value (USD Billion), Volume (Million Square Meters) |

|

Segmentation |

By Material

|

|

By End-use Industry

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 139.33 billion in 2024 and is projected to reach USD 185.92 billion by 2032.

In 2025, the Asia Pacific market size was valued at USD 55.71 billion.

The market will exhibit a CAGR of 3.60% during the forecast period of 2026-2034.

The bituminous segment is expected to lead the market during the forecast period.

The growing construction industry and infrastructure spending are factors driving the market.

Owens Corning, GAF, and Carlisle Companies Inc. are major players in the global market.

Asia Pacific dominated the market in terms of share in 2025.

The increasing demand for bituminous roofing due to its wide application usage in residential and commercial construction projects aids the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us