Blockchain Identity Management Market Size, Share & Industry Analysis, By Component (Software and Services), By Network Insights (Permissioned and Permissionless), By Provider Type (Application Provider, Middleware Provider, and Infrastructure Provider), By Enterprise Type (Large Enterprises and Small & Medium Enterprises), By Vertical (BFSI, Energy & Utilities, Government, Healthcare & Life Sciences, Manufacturing, Telecom, Media & Entertainment, Retail, E-Commerce & Consumer Goods, Logistic & Transportation, and Others) and Regional Forecast, 2026 – 2034

BLOCKCHAIN IDENTITY MANAGEMENT MARKET SIZE AND FUTURE OUTLOOK

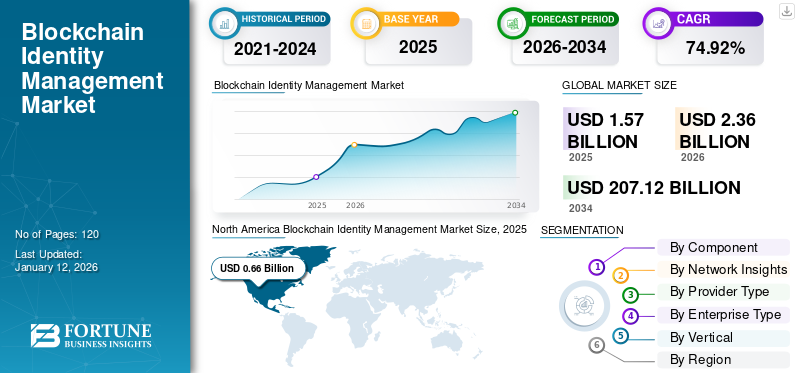

The global blockchain identity management market size was valued at USD 1.57 billion in 2025 and is projected to grow from 2.36 billion in 2026 to USD 207.12 billion by 2034, exhibiting a CAGR of 74.92% during the forecast period. North America dominated the market with a share of 42.21% in 2025.

Blockchain identity management employs blockchain technology to oversee and protect digital identities which allows individuals to manage their data and authenticate their identities safely and transparently without depending on a central authority. Each identity is linked to a unique cryptographic key, ensuring that it cannot be forged or altered without permission.

This system allows privacy-oriented verification, such as verifying the age without disclosing the birthdate and removes the threat of extensive data breaches due to the absence of a central database to target.

Market players such as Bitfury, DockLabs, Microsoft, and IBM are continuously developing more advanced and secured blockchain identity management platform in order to maintain their share in this competitive market.

IMPACT OF RECIPROCAL TARIFF RATES

Recent Tariff Rates to Hamper Market Growth

The new round of U.S. tariffs, which includes a substantial 104% tax (April 9th 2025), on imports from China, will impact the dominance of key market players by restricting their influence and hindering the expansion of open-source platforms. For instance,

- Indian or Israeli vendors can take advantage of the gap in Asia or the MENA region if the U.S. implements tariffs on Chinese AI and blockchain companies

Additionally, increased uncertainty and higher operational costs are likely to reduce investment in blockchain identity startups.

BLOCKCHAIN IDENTITY MANAGEMENT MARKET TRENDS

Use of Non-Fungible Tokens to be a Key Trend in the Market

NFTs, or non-fungible tokens, are emerging as a special use case for blockchain identity management solutions. The use of NFTs—unique digital assets stored on the blockchain—to represent and authenticate people is being investigated. It can store metadata such as personal identifiers (hashed or encrypted for privacy), certifications (diplomas and licenses), membership credentials (DAO access and subscriptions), and reputation scores (DeFI and social media). Additionally, recent collaborations in the industry also support this trend. For instance,

- In June 2024, Fiat24, Swiss fintech, collaborated with Web3 wallet ONTO to offer NFT-powered digital banking. This integration allows users to manage both digital and traditional assets securely, with decentralized identity (DID) systems enabling privacy and control over personal data.

Soulbound Tokens (SBTs) which is a type of non-transferable NFT can also prevent identity token trading, thereby enhancing trust and authenticity in identity management systems.

MARKET DYNAMICS

Market Drivers

Rise in Identity Theft to Enhance Market Progress

The global surge in identity fraud is forcing governments, businesses, and consumers to seek unhackable, tamper proof identity solutions, creating new opportunities for blockchain identity management market. Traditional security systems are proving increasingly inadequate against complicated cyber threats.

Download Free sample to learn more about this report.

The above graph highlights the rise in number of identity theft and fraud reports in U.S. In order to curb this growing issue, the U.S. government can adopt the blockchain identity technologies.

When personal information is stored in a centralized system, they become single point of failure, if breached, they can expose large amounts of sensitive information. On the other hand, blockchain technology operates through a distributed ledger, where each piece of identity data is cryptographically secured and stores across a network of nodes.

Market Restraints

Public Trust and Perception Issues Restrain Blockchain Identity Adoption

Public skepticism and misunderstanding remain major barriers to widespread adoption of blockchain identify solutions, as many people continue to associate blockchain only with volatile cryptocurrencies (such as Bitcoin) rather than with secure identity solutions.

Additionally, tech company’s failures in the field of crypto market have further eroded consumer trust, causing hesitation toward the adoption of blockchain identity solutions. For instance,

- According to Treasury Committee, approximately 85 %of cryptocurrency companies that submitted applications to the Financial Conduct Authority (FCA) in 2023 failed to fulfill the essential criteria for registration under its regulations concerning anti-money laundering and the prevention of terrorist financing.

Market Opportunities

Rising Government Initiatives Creates Lucrative Market Opportunities

Governments worldwide are launching state-backed digital identity systems to provide enhanced security, digitize citizen services, and tackle fraud risks, with blockchain emerging as the foundational technology due to its tamper-proof verification capabilities. For instance,

- In January 2025, MYEG and MyDigital ID Solutions launched the MyDigital ID Superapp, a blockchain-based platform to enhance Malaysia’s digital identity and fight online fraud.

Government initiatives acts as the single accelerator for blockchain identity by mandating its adoption, fund infrastructure development, and setting global standards.

SEGMENTATION ANALYSIS

By Component Insights

Rising Demand for Consulting and Advisory Services to Boost Service Segment Progress

Based on component, the market is categorized as software and service.

The service segment is expected to hold the highest share and register the highest CAGR, driven by the need for specialized expertise in the implementation, customization, and integration of blockchain identity solutions with existing systems (e.g., current IAM, government databases, and enterprise platforms). Additionally, it also provides consulting and advisory services to guide organizations comply with regulatory frameworks (e.g., GDPR, KYC, AML) and adopt identity standards (DIDs and SSI). This segment dominated the market in 2026 with the share of 58.02%.

The software segment will experience a stable CAGR as identity management solutions requires continuous monitoring, updates, and improvements rather than being a one-time implementation.

By Network Insights

Advanced Security Features Boosts the Permissioned Network Segment Growth

Based on network insights, the market is categorized into permissioned and permissionless.

The permissioned segment is expected to hold the highest share of 71.28% in 2026 and is expected to grow at the highest CAGR of 86.40% during the forecast period (2025-2032) as it provides privacy and data control for selective visibility (e.g. only regulators can access full KYC details) and provides higher performance compared to permissionless network (e.g. 1K + TPS vs public chains (~15 TPS)). Enterprises and governments prefer permissioned blockchains as they offer better control, regulatory compliance, and risk mitigation.

Permissionless network is expected to grow with a significant CAGR as it helps to verify identity without exposing data (e.g. age without revealing DOB) and no central authority can control or alter personal identities.

By Provider Type Insights

Pre-built Solution Boosts the Application Provider Segment Growth

Based on provider type, the market is categorized into application provider, middleware provider, and infrastructure provider.

Application provider is anticipated to hold the highest market share of 73.89% in 2026, as it offers ready-to-use identity solutions which eliminates the need for enterprises to build systems from scratch. Applications such as Jumio & Onfido provides pre-built KYC solutions for banks and fintechs, while ProCredEx provides blockchain-based patient ID management. These solutions also ensure seamless integration with existing systems. For instance, IBM Verify Credentials integrated with existing IAM (Identity & Access Management) solutions.

Infrastructure provider is expected to grow at the highest CAGR of 87.00% during the forecast period (2025-2032), due to rising demand for self-sovereign identity (SSI). SSI requires decentralized infrastructure (no central authority), which only infrastructure providers can supply. For instance, the Sovrin Network (built on Hyperledger Indy) powers SSI for governments such as British Columbia.

By Enterprise Type Insights

Small & Medium Enterprises Segment Leads due to Focused Solutions Offered

Based on enterprise type, the market is categorized into small & medium enterprises and large enterprises.

Small & medium enterprises hold the highest share in the market as it provides laser-focus solutions that address specific market gaps. They also provide vertical-specific offerings such as in healthcare. For instance,

- ProCredEX streamlines medical verification processes with blockchain by reducing processing from 3 months to 72 hours.

While large enterprises take 18-24 months to implement new protocols, SMEs such as Spruce ID deployed W3C Verifiable Credentials across 50+ chains in under 6 months.

Large enterprises hold the highest CAGR as governments demand enterprise-grade solutions that small startups may struggle to deliver due to the complexity of global regulations. Additionally, while small startups are known for innovation, large corporations are better positioned to deploy solutions at scale. Large enterprises’ existing customer’s bases are also driving demand for new technologies such as blockchain-based identity management.

By Vertical Insights

Rising Regulatory Pressures Dominates the BFSI Segment Growth

Based on vertical, the market for is categorized into BFSI, energy & utilities, government, healthcare & life sciences, manufacturing, telecom, media & entertainment, retail, e-commerce & consumer goods, logistics and transportation and others.

BFSI is estimated to hold the market share of 24% in 2025, due to regulatory pressures, complex cross-border operations, and massive fraud losses that blockchain-based identity solutions can effectively address. For instance,

- According to KPMG, synthetic identity fraud caused banks a shocking USD 6 billion in costs.

To tackle identity theft fraud and risks, banks are increasingly partnering to implement blockchain identity solutions and to safeguard customers. For instance,

- In June 2024, Japan’s top banks- MUFG, Mizuho, and Sumitomo Mitsui launched a blockchain based digital identity system which allows users to securely store and share personal information on their phones.

Healthcare & life sciences is expected to grow at the highest CAGR of 87.80% during the forecast period (2025-2032), as blockchain identity helps to reshape patient identification, data, sharing and medical fraud prevention. For instance,

- In February 2025, Prenectis partnered with Humanity Protocol to integrate its CircleDNA service for blockchain-based identity verification, using DNA testing to issues secure Proof of Personhood credentials.

Additionally, the COVID-19 pandemic exposed critical vulnerabilities in traditional healthcare identity systems which creates a need for secure digital health credentials that blockchain technology can solve. For instance,

- During COVID-19 pandemic, a black market for fake COVID vaccine and test certificates exploded in U.K., with over 1200 vendors worldwide selling counterfeit NHS and CDC vaccine cards, and fake negative test certificates, for as little as USD 29.

To know how our report can help streamline your business, Speak to Analyst

BLOCKCHAIN IDENTITY MANAGEMENT MARKET REGIONAL OUTLOOK

Based on regional ground, the market is studied across North America, Asia Pacific, Europe, Middle East & Africa, and South America.

North America

North America held a majority blockchain identity management market share valued at USD 0.99 billion in 2026 and USD 0.66 billion in 2025, due to early adoption of technology and supportive government initiatives such as DHS (Department of Homeland Security) funding blockchain identity projects. For instance,

- In July 2024, U.S. Department of Homeland granted contracts to six startups to create digital credentials that might be utilized for international travel and various other applications.

The region also attracts the highest VC funding for blockchain startups, including those focused on identity management. Silicon Valley, New York, and Toronto are home for many blockchain identity management startups.

The market in the U.S. is also gaining momentum as industries prioritize secure, user-centric solutions to combat rising cyber threats and fragmented digital identity systems. The U.S. market is set to reach USD 0.69 billion in 2026.

North America Blockchain Identity Management Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

South America

South America is projected to grow with a considerable CAGR driven by the CBDC expansion, fraud reduction needs, rising startup ecosystem, and government digitization initiatives. For instance,

- In October 2023, Brazil announced the adoption of blockchain technology for its national digital ID system, starting with the states of Rio de Janeiro, Goias, and Parana.

Europe

Europe is the second-largest market, expected to hold the valuation of USD 0.49 billion in 2026, exhibiting a CAGR of 85.00% during the forecast period (2025-2032), due to the rising adoption of the technology across various industries. Banking and finance in the region use blockchain identity for KYC/AML compliances, while healthcare use it for secure patient ID management. The U.K. market is expanding, projected to be valued at USD 0.12 billion in 2026.

European Union initiatives further supports the adoption of blockchain identity technology. The aim of the EU is to safeguard citizens from digital identity theft and risks associated with it. For instance,

- In December 2024, Italy announced the launch of EU’s first Digital (EUDI Wallet) which is set for beta testing in Q1 2025.It will use Decentralized Identifiers (DIDS) and Verifiable Credentials (VCs) for secure, decentralized identity management.

Germany is estimated to capture the market share valued at USD 0.11 billion in 2026, while France is anticipated to reach a market value of USD 0.05 billion in 2025.

Middle East and Africa

The Middle East & Africa is the fourth leading region and is expected to hit USD 0.29 billion in 2026. The region is expected to grow at a steady CAGR driven by digitization efforts in GCC countries such as Digital Emirates ID, a blockchain based national IDs. In Africa, countries such as Rwanda is planning to integrate blockchain into e -government services to improve the security and accessibility of citizen data.

Asia Pacific

Asia Pacific is expected to hold the highest CAGR in the market and is anticipated to be valued at USD 0.47 billion in 2026, due to region’s massive digital economy, fintech dominance, and heightened fraud risk, creating a perfect wave for blockchain identity adoption. China is set to be worth USD 0.22 billion in 2026.

E-commerce giants such as Alibaba and Flipkart requires fraud-resistance KYC/AML system, further indicating strong demand for blockchain-based identity technology solutions. For instance,

- In May 2023, Certik partnered with Alibaba Cloud to enhance blockchain security for Web3 projects. This collaboration offers tools such as smart contract building, identity verification, and real-time vulnerability scanning.

India is estimated to capture the market share valued at USD 0.10 billion in 2026, while Japan is projected to be valued at USD 0.06 billion in the same year.

Competitive Landscape

KEY INDUSTRY PLAYERS

Key Market Players are Forging Strategic Alliances to Expand their Business

Market players are increasingly focusing on developing innovative products and services to meet the increasing demand for more secured identity platforms. Market players are implementing various business strategies, such as partnerships, mergers, and acquisitions, to expand their businesses across the world. IBM Corporation, Oracle, Microsoft, NEC, AWS, LeewayHertz, Tradle, Dock Labs and Ping Identity, among others, are the largest players in the market.

List of Blockchain Identity Management Companies Profiled:

- Bitfury (U.K.)

- Dock Labs AG (U.S.)

- Humanity Protocol (Hong Kong)

- Validated ID (Spain)

- Peer Ledger Inc. (Canada)

- Tradle (U.S.)

- IBM Corporation (U.S.)

- AWS (U.S.)

- Oracle (U.S.)

- Microsoft (U.S.)

- NEC (Japan)

- LeewayHertz (U.S.)

- Ping Identity (U.S.)

- Rapid Innovation (U.S.)

- Trinsic Technologies Inc. (U.S.)

…and more

KEY INDUSTRY DEVELOPMENTS:

- November 2024: Following validation approval, XRP Ledger enacted the Digital Identity (DID) Amendment via XLS-40. The amendment brings decentralized identity management to the XRP Ledger, enabling users to independently manage their digital identities.

- October 2024: Vechain, a blockchain platform, obtained a U.S. Patent (US 12,093,419 B2) for advanced identity verification techniques and tools design to handle user identity verification information.

- October 2024: Argentina introduced QuarkID, a blockchain-enabled digital identity solution aimed at improving security and privacy for its 3.6 million residents in Buenos Aires. It turned into the world’s inaugural government-supported decentralized identity system.

- September 2024: Frax Finance introduced Frax Name Service (FNS), an identity platform that enables users to register distinctive names on the Frax blockchain. Frax asserts that this service allows users to secure a name on the Frax blockchain, playing a crucial role in their broader effort to establish a fully decentralized finance (DeFi) ecosystem.

- August 2024: IDCHAIN, a blockchain-based digital identity management system, was introduced by Indonesian Internet Doman Name Manager (PANDI) with the goal of improving the security and protection of personal data. IDCHAIN facilitates the safe and decentralized management, security, and sharing of users' digital identities.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 74.92% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component, Network Insights, Provider Type, Enterprise Type, Vertical, and Region |

|

Segmentation |

By Component

By Network Insights

By Provider Type

By Enterprise Type

By Vertical

By Region

|

|

Companies Profiled in the Report |

Bitfury (U.K.), Dock Labs AG (U.S.), Humanity Protocol (Hong Kong), Validated ID (Spain), Peer Ledger Inc. (Canada), Tradle (U.S.), IBM Corporation (U.S.), AWS (U.S.), Oracle (U.S.), Microsoft (U.S.) and LeewayHertz (U.S.) |

Frequently Asked Questions

The market is projected to reach USD 207.12 billion by 2034.

In 2025, the market was valued at USD 1.57 billion.

The market is projected to grow at a CAGR of 74.92% during the forecast period.

The application provider holds the highest market share.

Rise in identity theft is a key factor driving market progress.

Microsoft, IBM Corporation, Dock Labs AG, Oracle, and LeewayHertz are the top players in the market.

North America holds the highest market share.

By vertical, healthcare & life science is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us