Body Armor Market Size, Share & Industry Analysis, By Application (Air Force, Army, and Navy), By Material (Soft Armor, Hard Armor, Concealed Vest, Full Body Tactical Armor, Bulletproof Military Vest, and Others), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

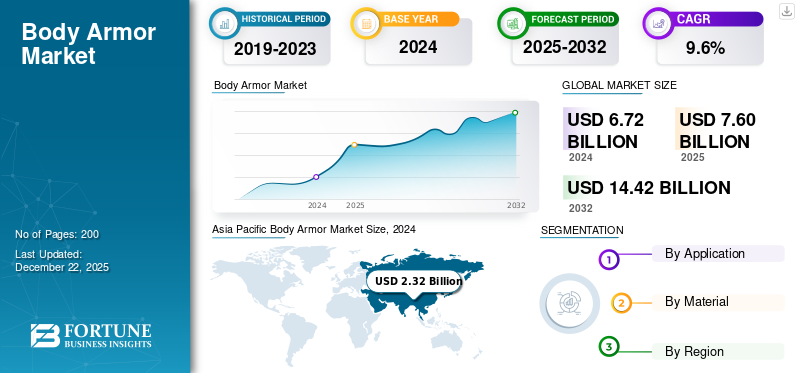

The global body armor market size was valued at USD 6.72 billion in 2024. The market is projected to grow from USD 7.60 billion in 2025 to USD 14.42 billion by 2032, exhibiting a CAGR of 9.6% during the forecast period. Asia Pacific dominated the body armor market with a market share of 34.52% in 2024.

Body armor, used by the military, is protective clothing worn by soldiers to protect them from all the threats that they face while they are involved in battle, including bullets, shrapnel, and other projectiles. Such a form of armor has made enormous progress over recent years. It is produced through newer materials and technologies in an effort to enhance safety as well as mobility during reconnaissance. Military body armor continues to evolve with shifting threats since its aim is to balance safety as well as ensure flexibility during operation.

The majority of market share is led by top players such as BAE Systems plc, Point Blank Enterprises Inc., Armor Express, and Honeywell International Inc. The growing number of terrorist missions and brutal crimes across the globe has contributed to increased demand for body armor. Soldiers, police officers, and individuals need high quality body armor to protect themselves against ballistic attacks as security issues become increasingly accumulating. Additionally, some nations are concentrating on military modernization, which entails buying new body armor solutions. Modernization is to equip soldiers with new-generation protective body armor that is light, boosts agility, and offers better protection. These factors are major contributors to the body armor market growth.

MARKET DYNAMICS

MARKET DRIVERS

Military Modernization Programs to Lead Substantial Market Growth

Military modernization programs are ambitious efforts to transform military forces to defeat evolving security challenges and achieve strategic advantage. The programs are intended for equipment modernization, expanding operational capability, and adaptation to multi-domain operations on land, air, sea, space, and cyberspace. For example, the U.S. modernization plan of the Army has six priorities: future long-range precision fires, next-generation combat vehicles, future vertical lift, missile and air defense, advanced networks, and soldier lethality. Indian modernization, too, has the same agenda of building defense preparedness, speeding acquisition, and creating a healthy defense industrial base. These initiatives leverage cutting-edge technology, including hypersonic missiles and artificial intelligence, and find a balance between cost and viability.

MARKET RESTRAINTS

High Cost and Regulatory Compliance Issues to Limit Market Expansion

The hefty cost of body armor arises from the incorporation of cutting-edge materials such as Kevlar, Dyneema, and ceramic composites. They provide quality ballistic protection but are costly to manufacture. The R&D costs associated with lightweight and long-duration designs also add to their manufacturing costs, rendering adoption costly in most instances, particularly for organizations in low-budget areas or small organizations.

Furthermore, compliance with regulations is also a major constraint, as body armor has to comply with rigorous standards that differ by country and region. The manufacturing cost of this item is high in terms of testing, certification, and compliance, which can deter market entry and innovation.

MARKET OPPORTUNITIES

Increasing Demand for Modular Armor Systems among Civilians to Positively Impact Market Growth

Modular body armor systems offer flexibility and versatility, which is why they are becoming increasingly popular among civilians seeking personal safety. These systems allow users to customize their gear to address specific threats by combining lightweight designs with high-performance ballistic protection. The growing demand for personal protection, especially among preppers, outdoorsmen, and private security professionals, has fueled the trend toward concealable and modular armor. Online shopping websites also enhance convenience by offering features for personalization and transparent pricing policies, which encourage usage among security-conscious consumers.

Additionally, growing spending on defense throughout the globe is one of the key drivers for growth in the body armor industry. Nations are investing in advanced protective gear for their military personnel to address new security challenges. For example, the U.S. spent a record USD 842 billion for its FY2024 defense budget, focusing significant resources on next-generation body armor systems. This investment enables the production of lightweight, durable, and technologically advanced solutions, such as modular scalable vests and ballistic plates, which improve soldier survivability and mission success. NATO member countries are also increasing their defense budgets to enhance military modernization initiatives, counter strategic rivals, and better protect their personnel.

Body Armor Market Overview & Key Metrics

Market Size & Forecast

- 2024 Market Size: USD 6.72 billion

- 2025 Market Size: USD 7.60 billion

- 2032 Forecast Market Size: USD 14.42 billion

- CAGR: 9.6% from 2025–2032

Market Share

- North America dominated the body armor market in 2024, driven by high defense budgets (USD 842 billion FY2024 in the U.S.), extensive soldier protection programs, and increasing civilian demand for personal protective gear amid rising security threats.

- By material, bulletproof military vests accounted for the largest market share in 2024, fueled by advancements in lightweight ballistic fabrics like Kevlar and Dyneema, and their wide adoption in military and law enforcement applications.

Key Country Highlights

- United States: Military modernization programs and extensive R&D investments in next-generation modular and scalable body armor systems, such as the U.S. Army’s MSV Gen-II, continue to propel demand.

- India: Rapid defense procurement and indigenous manufacturing initiatives are boosting the adoption of advanced body armor to address regional security challenges.

- China: Expansion of defense budgets and local production capabilities supports significant demand for full-body tactical armor and ballistic plates.

- Europe: NATO modernization and increasing geopolitical tensions in Eastern Europe are driving investment in lightweight, modular body armor systems for both military and police forces.

BODY ARMOR MARKET TRENDS

Battlefield Operational Requirement Evolution Driving the Material and Design Innovation in Body Armor

Battlefield-Driven Material & Design Shifts: The Russia-Ukraine War’s drone-artillery dominance, which is causing 40% of combat injuries from micro-shrapnel, directly catalyzed three innovations:

- Hybrid ceramic-polyethylene plates, such as RMA 1192, Plasan Sasa Nano, replaced steel for 15% higher multi-hit resilience.

- Smart armor (BAE’s sensor-embedded plates) emerged for real-time damage assessment amid electronic warfare saturation.

- Shear-thickening fluid liners (Sioen X-FIPV) reduced blunt trauma by 30% in urban trench warfare.

Geopolitical Supply Chain Realignment: Sanctions crippling Russian/Belarusian raw material exports such as, aramid fibers, triggered industrial restructuring:

- Production reshoring to NATO states, such as Teijin, shifted 50% of Twaron output from Poland to the Netherlands.

- Dual-use crossover accelerated Safariland’s Tegris police tech, (militarized for 360° coverage).

- India’s MKU captured 20% of Asia-Pacific contracts as export controls blocked Chinese composites.

- Asia Pacific witnessed body armor market growth from USD 2 Billion in 2023 to USD 2.32 Billion in 2024.

Download Free sample to learn more about this report.

Impact of Russia-Ukraine War

Supply Chain Realignments and Market Entry of New Players are Propelling Market Growth

The rising demand for body armor in war impacted countries have facilitated the manufacturers to look for better and effective supply chain options. The companies are seeking location based suppliers to meet the growing demand of body armor. The dependence on few vendors is causing delay in production and also increases the dependency on specific vendors. Thus, new players are seeking to establish contracts and agreements with the leading players.

Segmentation Analysis

By Application

Increasing Demand for Sophisticated Protection Drives Army Segment

Based on application, the market is classified into army, air force, and navy.

The army segment accounted for a dominating market share and is expected to grow at the highest CAGR in the forthcoming years. Body armor growth in military uses is inspired by the enhanced requirement for protecting soldiers during conflict and military actions. Geopolitical tensions, border conflicts, and terrorism have created a requirement for sophisticated protection equipment to defend personnel in aggressive environments. Advanced armies are pouring money into modular, scalable, and lightweight body armor systems to improve mobility without compromising ballistic protection. For example, agreements such as the U.S. Army's Modular Scalable Vest (MSV) Gen-II illustrate attempts to supply soldiers with adjustable equipment for versatile threats. Besides, developments in materials such as composite ceramics and UHMWPE provide durability and comfort with increasing adoption levels.

The air force segment is expected to witness steady growth in the forecast period. Applications of body armor in the Air Force are expanding due to the unique operational demands of troops in air combat and ground support missions. Pilots and aircrew require light armor that can comfortably fit flight suits without affecting mobility but providing shrapnel and ballistic protection. Asymmetric conflict and advanced missile technology have elevated demands for additional protective gear for airbase missions or rescue missions. Governments are choosing to invest in modular systems designed to address the requirements of air forces, such as lightweight ballistic vests that allow mobility while offering protection. Advancements in technology, such as smart armor, also drive market growth.

By Material

Innovation in Material and Design in Ballistic Fabrics Propels Bulletproof Military Vest’s Growth

Based on material, the market is segmented into soft armor, hard armor, concealed vest, full body tactical armor, bulletproof military vest, and others.

The bulletproof military vest segment accounted for the larger share of the market in 2024. The development of light, flexible, and impact-absorbing ballistic fabrics such as Kevlar, Dyneema, and Ultra-High-Molecular-Weight Polyethylene (UHMWPE) fabric has set up bulletproof fabric technology. Technologies enable enhanced protection from bullets and shrapnel without added body weight. Graphene and metal nanofiber technology also enhance multi-hit capacity and energy absorption. Governments and enterprises are investing huge amounts of money to develop vests with a mid-point level of protection, mobility, and comfort, which are appropriate for the armed forces and law enforcement agencies and are also for civilian purposes. Lightweight solutions have an increasingly large market as the threats to security increase across the board.

Full body tactical armor is projected to continue to account for a considerable share of the market and is expected to grow at the highest CAGR in the forthcoming years. Materials for full body armor are witnessing growth as demand has increased for all-encompassing protection against various threats, such as explosives, high-caliber bullets, and sharp objects. High-tech ceramics, composite plates, and hybrid materials are being used in full body armor designs to resist extreme impacts while keeping the wearer comfortable. Modular designs enable customization for particular operating requirements, which suits military units conducting high-threat missions. Also, intelligent textiles infused with sensors for real-time threat detection are becoming popular. Increasing defense expenditures and geopolitical tensions fuel the demand for full body armor in global military uses.

Body Armor Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, and the rest of the world.

North America

Asia Pacific Body Armor Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominates the global market with a major share. North American body armor development is driven by huge defense expenditure, particularly in the U.S., which spent USD 842 billion FY2024 on upgrading the military. Soldier Protection Systems and Extremity Protection programs focus on future-generation armor technologies. Furthermore, growing civilian demand for protection equipment as a threat to security increases drives market growth.

Europe

Europe is the second-largest market for body armor. The prevalence of major market players and rising investments from the government in the region will fuel growth in the forthcoming years. Europe's body armor industry is being driven by increasing geopolitics in Eastern Europe and NATO military modernization. Defense allocations' highest priorities are light and modular body armor systems to enhance mobility and defense. Protective gear is also substantially invested in by police to deal with terror and civil unrest.

Asia Pacific

Asia Pacific is projected to be the fastest-growing region, with a high CAGR in the forecast period. The region’s expansion is driven by increasing defense expenditures in China and India, owing to regional security concerns. Governments are also acting quickly to equip military personnel with body armor that incorporates cutting-edge technologies. Expansion in civilian markets as a result of urbanization and security concerns also propels the market.

Rest of the World

The market in the rest of the world is expected to witness considerable growth in the near future. The Latin American body armor market share is also expanding as a result of increasing crime and political unrest. Law enforcement agencies and security companies are investing in protective gear to counter rising violence. Spending by militaries of Brazil and Mexico on new body armor products is driving growth. The growth in the Middle East & Africa is being driven by sustained warfare and increased security threats. Governments are buying advanced body armor products to armor troops. Increasing application by private security companies and individuals working in high-risk environments also drives market growth.

COMPETITIVE LANDSCAPE

Key Industry Players

Continuous Development and Introduction of New Products by Key Companies Resulted in their Dominating Position

The market for body armor is competitive and dynamic with a mix of defense conglomerates as well as protection equipment specialists. Major players such as DuPont de Nemours Inc., Honeywell International Inc., BAE Systems plc, and 3M Company dominate the global body armor market with huge R&D capabilities and excellent connections with military as well as law enforcement agencies. They maintain their positions in the market by following strategic alliances, continuous research and development, and adherence to rigorous quality norms.

LIST OF KEY BODY ARMOR COMPANIES PROFILED

- 3M (U.S.)

- ArmorSource LLC (U.S.)

- BAE Systems (U.K.)

- DuPont (U.S.)

- Eagle Industries (U.S.)

- Gentex Corporation (U.S.)

- Honeywell International Inc. (U.S.)

- Armor Express (U.S.)

- Point Blank Enterprises Inc. (U.S.)

- Revision Military (U.S.)

KEY INDUSTRY DEVELOPMENTS

- August 2024: The British Military introduced a next-generation body armor designed for modern warfare. This modern kit aims to address emerging threats such as drones and laser detection while enhancing soldiers' situational awareness and decision-making capabilities.

- May 2024: Queensland-based defense contractor Craig International Ballistics announced a contract to supply body armor for the Australian Protection Drive. Valued at USD 19.7 million, the contract covers suits that provide protection for troops against low- and high-velocity shells and fragmentation effects.

- January 2024: DuPont and Point Blank Enterprises (PBE), a worldwide pioneer in protective solutions for military and law enforcement experts, announced an exclusive agreement to offer body armor made with Kevlar® EXO™ aramid fiber for state and local law enforcement departments in North America.

- April 2023: At the University of Skövde, Frida Nordling and Agnes Fryklind are working on their final project in the Product Design Engineering program. They are collaborating with a Swedish company to create a model of body armor designed specifically for women in the armed forces, as there is a growing demand for customized body protection among female users.

- April 2022: The Department of Campus Safety at York College of Pennsylvania is joining support efforts for Ukraine. The department is donating 8 pre-worn pieces of body armor to the FBI National Academy Class. The FBI National Academy is a leadership training program for senior law enforcement officials from around the country, and also includes international law enforcement leaders.

REPORT COVERAGE

The global body armor market analysis provides market size & forecast by all the segments included in the report. It includes details on market dynamics and market trends expected to drive market in the forecast period. It offers information on the key regions/countries, key industry developments, new product launches, details on partnerships, and mergers & acquisitions. The report covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 9.6% from 2025-2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Application

|

|

By Material

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 6.72 billion in 2024 and is projected to reach USD 14.42 billion by 2032.

The market is expected to exhibit a CAGR of 9.6% during the forecast period of 2025-2032.

The army segment led the market by application.

Military modernization programs are expected to lead to substantial growth.

Major companies operating in the market, such as Thermo Fisher Scientific Inc., Bruker, and Horiba, dominate the market.

Asia Pacific dominated the market in 2024 by holding the largest share.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us