Cardiology Positron Emission Tomography Scan Market Size, Share & Industry Analysis, By Source of Payment (Public and Private Health Insurance/Out-of-pocket), By Service Provider (Hospitals, Diagnostic Centers, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

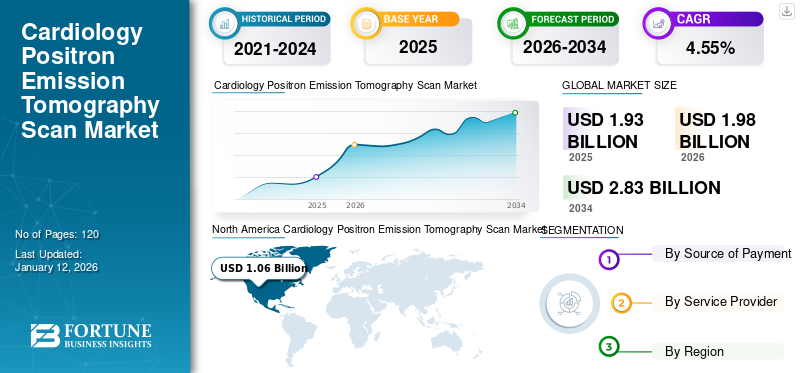

The global cardiology positron emission tomography scan market size was valued at USD 1.93 billion in 2025. The market is projected to grow from USD 1.98 billion in 2026 to USD 2.83 billion by 2034, exhibiting a CAGR of 4.55% during the forecast period. North America dominated the cardiology positron emission tomography scan market with a market share of 10.73% in 2025.

Cardiac Positron Emission Tomography (PET) is a non-invasive cardiac imaging procedure performed for visualization and comprehensive analysis of biological processes within the heart. The technology operates on radioactive tracers to assess various aspects of heart function, including metabolism, myocardial perfusion, inflammation, and viability. In addition, cardiac PET imaging is also performed by healthcare professionals for diagnosing Coronary Artery Disease (CAD) and evaluating damage caused by heart attacks. The scan also aids in preoperative planning for surgical procedures, including bypass surgeries.

The growth of the global cardiology positron emission tomography scan market is expected to be driven by the extensive technological advancements in radiopharmaceuticals, the introduction of new products, a rising prevalence of cardiac conditions, growing geriatric population, and increasing preference for non-invasive diagnostic procedures.

- For instance, in September 2024, GE HealthCare received FDA approval for Flyrcado (flurpiridaz F 18) injection. The newly introduced injection is a Positron Emission Tomography Myocardial Perfusion Imaging (PET MPI) agent specially developed for the diagnosis of Coronary Artery Disease (CAD).

Key players in the market include Sonic Healthcare Limited, Apex Radiology, and Alliance Medical. These companies are focused on implementing various organic and inorganic growth strategies to expand their market share globally.

Global Cardiology Positron Emission Tomography Scan Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 1.93 billion

- 2026 Market Size: USD 1.98 billion

- 2034 Forecast Market Size: USD 2.83 billion

- CAGR: 4.55% from 2026–2034

Market Share:

- North America dominated the cardiology positron emission tomography scan market with a 10.73% share in 2025, driven by rising cardiac disease prevalence, continuous product launches, and a robust healthcare infrastructure supporting advanced diagnostics.

- By service provider, Hospitals are expected to retain the largest market share owing to their comprehensive facilities, skilled professionals, and ability to handle complex cardiac procedures with advanced imaging systems.

Key Country Highlights:

- United States: Market growth is driven by the increasing adoption of advanced PET/CT systems in hospitals and diagnostic centers, supported by continual technological innovations and rising focus on precision cardiac imaging.

- Europe: The market is witnessing significant growth due to strategic investments in digital diagnostic infrastructure and collaborative initiatives aimed at improving diagnostic turnaround times.

- China: Rising awareness about advanced imaging techniques and increasing collaborations between global and local players for radiotracer production are key factors propelling market growth.

- Japan: Technological advancements in PET imaging systems and partnerships for local manufacturing of radiopharmaceuticals are driving the demand for cardiology PET scans.

MARKET DYNAMICS

Market Drivers

Technological Advancements to Accelerate Market Growth

Heavy investments by market players in the development of technologically advanced imaging instruments are positively driving market growth. The demand for these advanced devices is exponentially growing due to their enhanced capabilities in providing a comprehensive understanding of heart function and cardiovascular diseases. Moreover, these technological improvements contribute significantly to faster disease diagnosis, enhanced patient comfort, and efficient workflows.

- For instance, in June 2024, Siemens Healthineers announced the launch of its new PET/CT scanner, Biograph Trinion. The newly introduced product offers optimal user and patient experience along with AI-powered workflow. Moreover, the machine also incorporates an integrated patient camera, allowing healthcare professionals to communicate with and monitor patients during the scan.

Technologically advanced scanners also assist in articulating personalized treatment strategies, which leads to improved patient outcomes. Alongside these developments in radiopharmaceuticals coupled with the growing prevalence of cardiovascular conditions are expected to create a favorable environment for market growth during the forecast period.

Market Restraints

Lack of Skilled Professionals Coupled with High Cost May Deter Market Growth

The shortage of skilled workforce in nuclear medicine is one of the prominent factors restraining market growth. Cardiac PET scans need a team of expert professionals, including a physician with training in nuclear interpretation, a nuclear technologist, and registered nurses.

Additionally, the high cost of PET scan machines is also projected to hamper market growth. This expense can be substantial for smaller healthcare facilities and providers in developing countries.

- For instance, according to the data published by Block Imaging, the average cost of a PET/CT scanner ranges from USD 225,000 to USD 750,000.

Trade Protectionism

Trade protectionism, including import tariffs, local manufacturing requirements, and regulatory standards, can hinder the global distribution of PET imaging technology. In certain regions, these measures increase the costs of advanced imaging systems and delay their adoption in healthcare facilities. These challenges are particularly pronounced in emerging markets, where healthcare budgets are more limited.

Market Opportunities

Rising Demand for Advanced Imaging Systems with Improved Workflows

Continual technological advancements coupled with the rising burden of cardiac patients are expected to create a favorable environment for the global cardiology positron emission tomography scan market during the forecast period. Advanced imaging systems provide in-detail analysis with shorter turnaround time, enabling better and faster care for patients.

Additionally, companies are increasingly focusing on partnerships and collaborations to develop advanced imaging systems that meet the demand for novel imaging technologies. The development of such innovative products is expected to positively impact cardiology positron emission tomography scan market growth.

- For instance, in February 2024, IONETIX, one of the prominent players in isotope manufacturing and cyclotron technology, entered into a strategic partnership with Provision Diagnostic Imaging. The duo will focus on providing cutting-edge imaging procedures with shorter turnaround times.

Market Challenges

Constrained Availability of Radiotracers to Hamper Market Growth

Radiotracer availability is one of the prominent challenges for the growth of the cardiology PET scan market. Some of the prominent radiotracers require an on-site radiochemistry unit and cyclotron due to their short half-life. Such conditions are not feasible for most healthcare institutions. These operational challenges are expected to hamper market growth.

- For instance, in October 2024, NHS announced a severe shortage of radioisotopes, which caused delays in treatment and diagnostic procedures. Authorities confirmed that this shortage has led to substantial disruptions in patient care.

Moreover, supply chain disruptions, regulatory inspections, and maintenance downtime can further intensify availability issues, leading to scheduling delays and underutilization of expensive imaging systems.

Cardiology Positron Emission Tomography Scan Market Trends

Rising Demand for Hybrid Imaging Systems to Amplify Product Demand

The cardiac PET scan market is witnessing a substantial shift toward the growing adoption of hybrid imaging systems, especially PET/CT and PET/MRI technologies. These systems are capable of providing high-quality functional and anatomical resolutions. Such a high resolution facility allows precise assessment of coronary flow reserve and myocardial perfusion.

- For instance, in July 2024, Positron Corporation announced the introduction of its new PET & PET-CT imaging system, NeuSight PET-CT, in the U.S. and North American markets. The new technology provides superior diagnostic precision, operational efficiency, and patient comfort in nuclear cardiology procedures.

Moreover, recent advances in artificial intelligence, coupled with software development, are expected to achieve superior accuracy in cardiac imaging. In addition, the integration of automation modules is also projected to positively impact market growth.

Download Free sample to learn more about this report.

Impact of COVID-19

The COVID-19 pandemic substantially disrupted the cardiology positron emission tomography scan market market dynamics, leading to a considerable decline in the number of cardiac procedures and testing. In addition, the reallocation of healthcare resources toward pandemic management significantly hindered market growth. Moreover, global lockdown, traveling restrictions, and supply chain disturbance further compounded these challenges during the pandemic.

- According to a survey conducted by the International Atomic Energy Agency in April 2020, the global market witnessed an estimated 64% decline in all types of cardiovascular testing from April 2019 to April 2020. The survey also highlighted that lower-income countries experienced an even greater reduction in cardiovascular testing during the period.

Segmentation Analysis

By Source of Payment

Growing Demand for Customized Patient Care Coupled with Rising Disposable Incomes Drives Private Health Insurance/Out-of-Pocket Segment’s Growth

Based on source of payment, the market is classified into public and private health insurance/out-of-pocket. The private health insurance/out-of-pocket segment captured the key cardiology positron emission tomography scan market share due to its benefits such as access to a wider range of service providers, more personalized treatment options, and a better patient experience. Unlike public insurers, there are no limitations on the range of conditions to be treated in healthcare facilities.

The public segment is likely to register marginal CAGR during the forecast period. Factors, such as insufficient reimbursement policies and operational difficulties are responsible for the slower growth of this segment. However, authorities are focusing on expanding its coverage by introducing new policies, which are likely to boost segment growth during the forecast period.

- For instance, in July 2025, the Centers for Medicare & Medicaid Services (CMS) announced a proposal to modify the Hospital Outpatient Prospective Payment System (HOPPS) and Medicare Physician Fee Schedule. This proposal includes recommendations to increase reimbursements for certain PET/CT procedure codes.

By Service Provider

Diagnostic Centers Segment to Display Fastest CAGR due to its Benefits

Based on service provider, the market is divided into hospitals, diagnostic centers, and others. The hospitals segment is projected to hold a substantial market share during the forecast period. Key factors such as trained personnel, availability of cutting-edge equipment, and ability of hospital resources to handle critical conditions are expected to positively impact segment growth.

- For instance, in February 2025, Princess Alexandra Hospital, Queensland, Australia, installed a novel PET/CT scanner costing USD 4 million to enhance diagnostics capabilities and improve workflow efficiency. Furthermore, the new system is capable of providing quicker scanning and image analysis, which is expected to drive increased adoption of cardiology PET/CT scanning procedures.

The diagnostic centers segment is projected to grow at the fastest CAGR owing to benefits such as shorter waiting times, easy accessibility, and cost-effectiveness. In addition, an increasing number of collaborations and partnerships with major companies are also estimated to have a positive impact on segment growth, as these partnerships will allow diagnostic centers to introduce technologically advanced products. For instance, in November 2024, Positron Corporation announced its strategic agreement with Upbeat Cardiology Solutions to supply its PET-CT instruments.

The others segment comprises cardiac centers, research & academic institutes, and cardiac centers. The segment is estimated to witness stagnant growth due to limited patient preference for other service providers and issues related to resource availability.

CARDIOLOGY POSITRON EMISSION TOMOGRAPHY SCAN MARKET REGIONAL OUTLOOK

By geography, the market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Cardiology Positron Emission Tomography Scan Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market in 2026 and stood at USD 1.13 billion. The market’s growth is driven by the rising incidence of cardiac conditions coupled with continual research & development activities for the launch of new products. According to data published by the CDC, around 1 in 20 adults above age 20 or 5% of the total population suffers from coronary artery disease. In addition, advanced healthcare infrastructure, coupled with increasing demand for precision diagnostics, is likely to accelerate market growth.

Certain factors, such as increasing demand for preventive care and robust healthcare infrastructure, are projected to have a positive impact on the growth of the U.S. cardiology positron emission tomography scan market.

Additionally, in Canada, the rising focus of healthcare providers to install instruments with enhanced capabilities is anticipated to accelerate market growth.

For instance, in January 2025, Initio Medical Group announced the purchase and install of an innovative GE HealthCare Omni Legend PET/CT system with advanced cardiac imaging capabilities, improving regional diagnostic and treatment capacities.

Europe

Europe held a substantial share of the cardiology PET scan market in 2024 owing to rising demand for technological advancements and the presence of leading companies in the region. Furthermore, collaborative initiatives by EU and healthcare authorities is also projected to accelerate market growth.

- For instance, in November 2021, the U.K. government allocated USD 334 million for the digitalization of diagnostic imaging services with an aim to reduce the total turnaround time for diagnostic procedures.

Asia Pacific

The cardiology PET scan market in Asia Pacific is expected to witness the highest CAGR during the forecast period. The market growth is attributed to rising awareness of advanced imaging systems, growing focus on personalized diagnostics, and heavy investments by market players and governments altogether.

- For instance, in February 2022, Nihon Medi-Physics and Cerveau Technologies, Inc. entered into a strategic manufacturing agreement where Cerveau will allow its partner to manufacture MK-6240, a PET radiotracer used for imaging.

Latin America

The market in Latin America is expected to grow at a considerable CAGR during the forecast period. Certain factors, such as the rising prevalence of cardiac conditions and growing investments by market players, are likely to boost market growth.

- According to research published by the International Journal of Medical Science and Clinical Research Studies in November 2023, an estimated 23% of the deaths were caused due to cardiovascular diseases.

Middle East & Africa

The Middle East & Africa region is anticipated to register a noteworthy CAGR during the forecast period. The growth of the region is primarily attributed to the increasing healthcare expenses, rising disposable incomes, and active government involvement in providing technologically advanced products.

- For instance, in June 2022, the Egypt-based Alameda Healthcare Group introduced a Centre of Excellence in Cardiac Sciences for special programs in heart-related conditions.

COMPETITIVE LANDSCAPE

Key Industry Players

Collaborative Product Development with the Incorporation of Advanced Technologies

The global market is dominated by key players such as Sonic Healthcare Limited, Apex Radiology, Siemens Healthcare Limited, and Novant Health, who together account for a majority portion of the market share in 2024.

The strong market position is attributed to its robust distribution network, focus on the development of cutting-edge PET technologies, strategic collaboration for product enhancements, and continual research & development.

- For instance, in June 2024, Siemens Healthcare Limited announced a new high-performance PET/CT scanner featuring a broad range of clinical applications. As per the company, the newly introduced system provides cutting-edge functionalities with low operational cost.

Other companies operating in the global market include Alliance Medical Limited, InHealth Group, Dignity Health. These companies are focusing on various strategic initiatives such as partnerships, collaborations, and others to improve their market presence.

LIST OF KEY CARDIOLOGY POSITRON EMISSION TOMOGRAPHY SCAN COMPANIES PROFILED

- RadNet, Inc. (U.S.)

- Sonic Healthcare Limited (Australia)

- Akumin Inc. (U.S.)

- Apex Radiology (Australia)

- Alliance Medical Limited (U.K.)

- Novant Health (U.S.)

- InHealth Group (U.K.)

- Dignity Health (U.S.)

- Concord Medical (China)

- Siemens Healthcare Limited (Germany)

- Mediworks (China)

KEY INDUSTRY DEVELOPMENTS

- April 2025: Southcoast Health, U.S., announced the launch of its imaging suites to offer advanced PET/CT scanning for neurology, cardiology, and cancer.

- March 2025: Positron Corporation raised USD 8 million through rounds of series funding to expand its footprints in the PET-CT market along with the introduction of new products.

- October 2024: Positron Corporation announced the launch of a PET-CT scanners rental program, offering attractive service packages on a monthly basis.

- April 2024: CDL Nuclear Technologies introduced its new mobile dedicated cardiac PET/CT trailer. This new facility allows access to state-of-the-art cardiac PET/CT imaging services to medical facilities as per their schedule.

- July 2022: Radialis Inc. received FDA approval for its Radialis PET Imager, a novel PET system featuring open-targeted imaging functionality.

REPORT COVERAGE

The global cardiology positron emission tomography scan market report provides market size and forecast by source of payment and service providers. It includes details on the market dynamics and emerging market trends. It offers information on the prevalence of various cardiac conditions in key regions, key industry developments, an overview of regulatory scenarios, and COVID-19's impact on the market. The report covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.55% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Source of Payment

|

|

By Service Provider

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 1.98 billion in 2026 and is projected to reach USD 2.83 billion by 2034.

In 2025, the market value stood at USD 1.09 billion.

The market is expected to exhibit a CAGR of 4.55% during the forecast period of 2026-2034.

The private health insurance/out-of-pocket segment led the market by source of payment.

The key factors driving the market are the increasing burden of cardiac conditions and technological advancements in diagnostic products.

Akumin Inc., Apex Radiology, Alliance Medical Limited, and Novant Health are the top players in the market.

North America held the largest share and dominated the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us