Cerium Market Size, Share & Industry Analysis, By Type (Cerium Oxide, Cerium Metal, Cerium Fluoride, Cerium Nitrate, Cerium Hydrate, and Others), By Application (Glass, Catalysts, Alloys, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

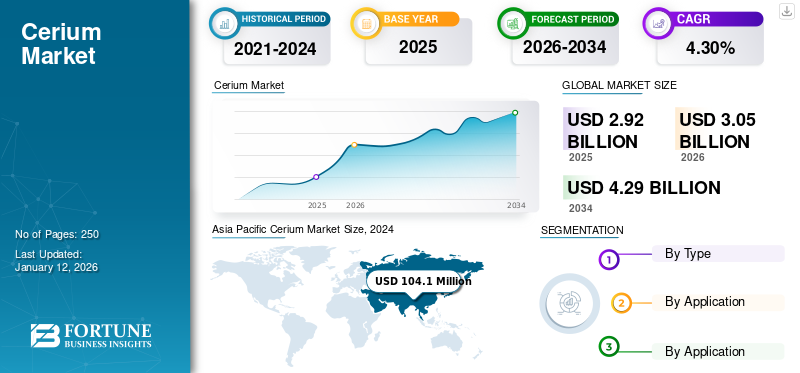

The global cerium market size was valued at USD 2.92 billion in 2025 and is projected to grow from USD 3.05 billion in 2026 to USD 4.29 billion by 2034, exhibiting a CAGR of 4.30% during the forecast period. Asia Pacific dominated the cerium market with a market share of 72.34% in 2024.

Cerium (Ce) is a soft, silvery-white rare earth metal and the most abundant among the lanthanides, widely used in catalysts, glass polishing, metallurgy, and alloys underscoring its significance in the global market. The growth is driven by increasing product demand in automotive catalytic converters, consumer electronics, and renewable energy applications. The expansion of the electric vehicle market, rising adoption of cerium-based polishing powders in the glass industry, and advancements in cerium oxide nanoparticles for biomedical and industrial applications are further fueling demand. Additionally, the shift toward cleaner energy solutions and stringent environmental regulations promoting the use of rare earth-based catalysts are creating significant market growth opportunities.

Key players in the market include The Shepherd Chemical Company, Avalon Advanced Materials, IREL, Canada Rare Earth Corporation, and Lynas Corporation.

GLOBAL CERIUM MARKET OVERVIEW

Market Size & Forecast:

- 2025 Market Size: USD 2.92 billion

- 2026 Market Size: USD 3.05.8 billion

- 2034 Forecast Market Size: USD 4.29 billion

- CAGR: 4.30% from 2026–2034

Market Share:

- Asia Pacific dominated the market in 2024 with a 72.34% share, rising from USD 97.1 million in 2023 to USD 104.1 million in 2024.

- By type, cerium oxide led the market due to high usage in catalysts, polishing, and renewable energy applications.

- By application, glass held the largest share in 2024 owing to demand in polishing, decolorization, and UV-blocking glass.

- The catalyst segment is growing with the increased adoption of Ce-based converters for vehicle emission control.

Key Country Highlights:

- China: Largest producer, driven by high consumption in electronics, catalysts, and metallurgy; accounted for nearly half of Asia Pacific’s market in 2024.

- United States: Investing in domestic rare earth mining to reduce reliance on China; demand rising from EVs and emission regulations.

- Japan & South Korea: Strong electronics and renewable energy sectors supporting steady cerium demand.

- Europe: Strict emissions laws and growing EV production fuel demand for Ce-based catalysts.

- Middle East & Africa: Moderate growth supported by clean energy adoption and industrial expansion.

MARKET DYNAMICS

CERIUM MARKET TRENDS

Growing Product Adoption in Electronics Industry to Drive Market Growth

Use of product is increasing with rising demand for smart consumer electronics. The phosphorescent properties of cerium plays a vital role in phosphors manufacturing used in electronic displays. It is extensively used to polish surfaces such as liquid crystal displays, display panels, and glass display panels. Additionally, rising application of product in carbon-arc lighting used in the motion picture industry is expected to surge demand. Further, rising product demand as permanent magnet in applications such as batteries, and optical electronics, will fuel the market growth. Asia Pacific witnessed a cerium market growth from USD 97.1 billion in 2023 to USD 104.1 billion in 2024.

MARKET DRIVERS

Advancements in Cerium-Based Nanocatalysts for Sustainable Energy Solutions to Fuel Market Growth

The product growth in catalysts is driven by increasing environmental regulations that mandate lower vehicle emissions, boosting the demand for cerium-based catalytic converters in the automotive industry. Cerium oxide is widely used in three-way catalysts (TWCs) to enhance fuel combustion efficiency and reduce harmful emissions such as CO, NOx, and hydrocarbons. The rising adoption of electric and hybrid vehicles, which still require catalytic converters for certain engine types, continues to support demand. Additionally, product plays a crucial role in industrial catalysts, such as in petroleum refining and hydrogen production. Advancements in Ce-based nanocatalysts for sustainable energy solutions are also contributing to market expansion. Moreover, increasing product demand in manufacturing phosphors for electronic displays due to the growing consumer electronics industry will drive cerium market growth.

MARKET RESTRAINTS

Limited Availability of Products due to Highly Dependence on China to Limit Market Expansion

The limited availability of product stems from its classification as a rare earth element. Although it is relatively abundant in the Earth's crust, it is rarely found in high concentrations and is difficult to extract economically. The primary product sources are rare earth minerals such as monazite and bastnäsite, which require complex extraction and refining processes that involve high energy consumption and chemical-intensive separation techniques. Furthermore, fluctuations in product supply, driven by geopolitical factors and mining regulations, pose challenges to consistent availability.

- One of the biggest constraints is the geographic concentration of cerium production, with China accounting for over 60-70% of the global rare earth supply. This creates supply chain vulnerabilities, as export restrictions, geopolitical tensions, or changes in China’s mining policies can significantly disrupt global availability. Other countries, including the U.S., Australia, and Canada, possess rare earth reserves which often lack the infrastructure or cost-effective refining capabilities needed to compete with China’s dominant position in the market.

MARKET OPPORTUNITIES

Growing Initiatives on Renewable Energy to Positively Impact Market Growth

Cerium is playing an increasingly important role in renewable energy technologies, particularly in solar cells, fuel cells, and energy storage systems. Its oxide is used in solid oxide fuel cells (SOFCs), where it enhances ionic conductivity and improves fuel efficiency, making it a valuable material for clean energy production. Additionally, product is being explored for next-generation lithium-ion and lithium-sulfur batteries, where it contributes to improved battery lifespan and thermal stability. In solar energy applications, cerium-doped glass is used to filter harmful ultraviolet rays, thereby increasing the durability and efficiency of photovoltaic panels.

Furthermore, ongoing research into oxide-based catalysts for water splitting and hydrogen production holds significant potential for advancing the transition to green hydrogen as a sustainable fuel source. As there is a global shift towards sustainable energy solutions, product’s unique chemical properties and versatility in energy applications positions it as a key material in advancing renewable energy technologies. This has also heightened the demand for Ce-based catalysts, particularly in automotive exhaust systems, to reduce harmful emissions.

MARKET CHALLENGES

Rising Environment Concerns to Challenge Market Expansion

The environmental impact of product mining and processing poses a threat to the market. Product mining and processing can lead to significant environmental impacts, including habitat destruction, water pollution, soil contamination, and the release of hazardous and radioactive pollutants. Such factors lead to a surge in the adoption of sustainable practices to mitigate ecological harm and reduce dependence on product manufacturing.

TRADE PROTECTIONISM

The U.S. and Europe are working to reduce reliance on China for critical minerals such as cerium, focusing on securing supply chains for clean energy and defense technologies by diversifying sources and promoting domestic production and recycling.

- The U.S. has initiated the Minerals Security Partnership with 13 other countries and the EU to foster collaboration on critical minerals.

- The European Union's toolkit has called for increasing production and recycling of critical minerals and building partnerships to facilitate trade and investment.

Download Free sample to learn more about this report.

Segmentation Analysis

By Type

Cerium Oxide Dominated the Market due to its Growing Usage in Various Industries

Based on type, the market is segmented into cerium oxide, cerium metal, cerium fluoride, cerium nitrate, cerium hydrate, and others.

Cerium oxide held the highest cerium market share in 2024 due to its widespread use in catalysts, polishing powders, and emerging nanotechnology applications. A key driver is the increasing demand for automotive catalytic converters, where CeO₂ enhances fuel combustion and reduces emissions. Additionally, cerium oxide is widely used in precision glass polishing for industries such as electronics, semiconductors, and optics, fueled by the growing demand for high-quality displays and advanced optical components. Its role in renewable energy is expanding, particularly in solid oxide fuel cells (SOFCs) and solar panels, as clean energy initiatives gain momentum.

The growth of cerium metal is primarily driven by its applications in metallurgy, electronics, and specialized alloys. This metal is a key component in mischmetal, an alloy used in lighter flints, steelmaking, and aluminum-magnesium alloys to improve strength and oxidation resistance. The increasing adoption of Ce-based intermetallic compounds in automotive and aerospace industries is fueling demand. Additionally, product’s use in rechargeable batteries and electronic components, particularly in phosphors for LED lighting and displays, supports market expansion. As industries seek lightweight, high-performance materials, cerium metal’s role in alloy development and electronic applications is expected to grow steadily.

By Application

Glass Segment to Dominate the Product Demand in Polishing and Decolorization

Based on application, the market is segmented into glass, catalysts, alloys, and others.

The glass segment is expected to remain dominant during the forecast period, driven by its essential role in glass polishing, decolorization, and UV protection. Cerium oxide is widely used as a polishing agent for precision glass applications in industries such as electronics, semiconductors, optical lenses, and high-end automotive and architectural glass. The increasing demand for smartphones, tablets, and high-resolution display screens has significantly boosted the use of Ce-based polishing powders. Additionally, Ce compounds are used in glass manufacturing to remove impurities and enhance clarity, particularly in optical and specialized scientific glass. Furthermore, the rising use of Ce-doped glass in UV-blocking applications for eyewear, windows, and solar panels further supports market expansion.

The catalyst segment is growing due to its critical role in emission control technologies. Cerium oxide is a key component in automotive catalytic converters, where it enhances oxidation and reduces harmful emissions such as carbon monoxide, nitrogen oxides, and hydrocarbons. Stricter global environmental regulations aimed at lowering vehicle emissions have significantly increased the product demand in catalysts.

Cerium Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, and the Rest of the World.

Asia Pacific

Asia Pacific Cerium Market Size, 2024 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the global market, with China being the largest producer due to its extensive use in electronics, automotive, and catalyst production. The region's rapid industrialization, expanding automotive sector, and increasing electronics production are major growth drivers. China’s dominance in rare earth mining and refining ensures a steady supply for various applications, including catalysts, glass polishing, and metallurgy. Countries such as Japan, South Korea, and India are also expanding their product use in EVs, renewable energy technologies, and high-end manufacturing.

North America

The market in North America is growing due to the rising demand for rare earth elements in the automotive, electronics, and renewable energy sectors. The U.S. is investing in domestic rare earth mining and processing to reduce reliance on Chinese supply chains, boosting the regional market growth. The increasing adoption of electric vehicles (EVs) and stringent environmental regulations on emissions are further driving demand for Ce-based catalysts.

Europe

Europe’s market is driven by strong environmental regulations and the push for sustainable technologies. The region’s strict emission control policies have increased demand for Ce-based catalytic converters in the automotive industry. The rise of EV production and hydrogen fuel cells is also boosting product consumption in battery and energy applications.

Rest of the World

The market in the rest of the world, including Latin America and Middle East & Africa, is growing at a moderate pace. Increasing industrialization, infrastructure development, and the adoption of clean energy technologies are some key factors boosting product demand.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Companies’ Focus on Expanding their Operations to Reduce Reliance of Earth Metals On China

The market is highly competitive and is largely dominated by China, which controls most of the global rare earth supply through key players such as China Northern Rare Earth Group and Shenghe Resources. However, non-Chinese companies such as The Shepherd Chemical Company, Avalon Advanced Materials, IREL, Canada Rare Earth Corporation, and Lynas Corporation are expanding their operations to reduce dependence on China. Government policies, especially in the U.S. and Europe, are driving investments in domestic mining and recycling initiatives aimed at securing alternative supply chains. Technological advancements in catalysts, batteries, and nanotechnology are fueling competition, with companies increasingly focusing on innovation and sustainable sourcing. Furthermore, strategic mergers, acquisitions, and partnerships between mining firms and refiners are shaping the industry landscape. Rare earth recycling is emerging as a key competitive factor, offering an environmentally friendly solution to supply constraints and sustainability challenges.

LIST OF KEY CERIUM COMPANIES PROFILED

- The Shepherd Chemical Company (U.S.)

- Avalon Advanced Materials (Canada)

- IREL (India)

- Canada Rare Earth Corporation (Canada)

- Lynas Corporation (Australia)

- MITSUI MINING & SMELTING CO.,LTD. (Japan)

- Vizag chemical (India)

- Star Earth Minerals (India)

- Lobachemie (India)

- Gujarat Mineral Development Corporation Ltd. (India)

REPORT COVERAGE

The global market analysis provides market size & forecast by all the segments included in the report. It includes details on the market dynamics and market trends expected to drive the market in the forecast period. It offers information on the metals in key regions/countries, key industry developments, new product launches, details on partnerships, and mergers & acquisitions in key countries. The report covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.30% from 2026-2034 |

|

Unit |

Value (USD Million) and Volume (Kiloton) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 3.05billion in 2026 and is projected to reach USD 3.05 billion by 2034.

In 2024, the market value stood at USD 2.92 million.

The market is expected to exhibit a CAGR of 4.30% during the forecast period of 2026-2034.

The cerium oxide segment led the market by type.

Advancements in cerium-based nanocatalysts for sustainable energy solutions is the key driving factor for market growth.

The Shepherd Chemical Company, Avalon Advanced Materials, IREL, Canada Rare Earth Corporation, and Lynas Corporation are the top players in the market.

Asia Pacific dominated the market in 2025.

Growing preference for renewable energy to favor the product adoption.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us