Chemical/Gas Sterilizers Market Size, Share & Industry Analysis, By Product Type (Hydrogen Peroxide Sterilizers, Ethylene Oxide Sterilizers, Nitrogen Dioxide Sterilizers, and Others), By End-user (Hospital & Specialty Clinics, Pharmaceutical & Medical Device Manufacturers, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

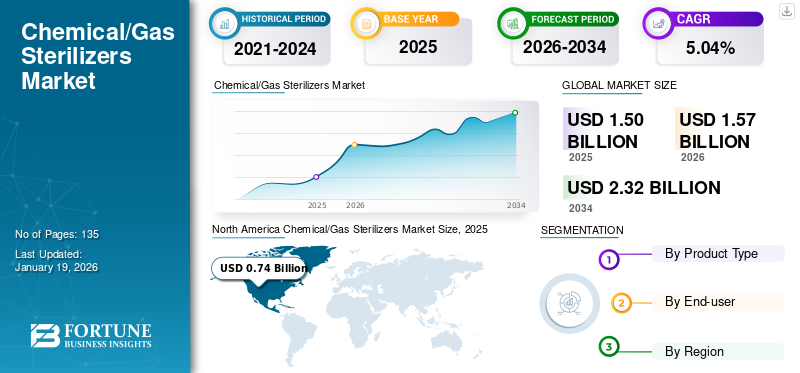

The global chemical/gas sterilizers market size was valued at USD 1.50 billion in 2025. The market is projected to grow from USD 1.57 billion in 2026 to USD 2.32 billion by 2034, exhibiting a CAGR of 5.04% during the forecast period. North America dominated the chemical/gas sterilizers market with a market share of 49.25% in 2025.

Chemical/gas sterilizers use chemical agents in gaseous form to eliminate or deactivate all forms of microbial life, including bacteria, viruses, and spores, from materials, particularly those that are heat-sensitive. These sterilizer products are used to disinfect and sterilize various items, including medical equipment and supplies.

The growing burden of hospital-acquired infections (HAIs) is fueling the adoption of sterilization equipment within healthcare facilities to mitigate the spread further. This encourages key players to launch new products, which is expected to contribute to the market growth.

Major companies in the market include Steris, Getinge, and others. These companies are focusing on new product development and strategic alliances to expand their market share.

MARKET DYNAMICS

Market Drivers

Increasing Number of Surgeries to Drive the Demand for Sterilization Equipment

Chemical/gas sterilizers are essential to ensure the safety of patients and healthcare professionals by effectively eliminating pathogenic microorganisms from surgical tools and devices. As a result, the increasing volume of surgical procedures globally propels the demand for sterilization equipment within the healthcare sector.

- For instance, according to the data published by the British Association of Aesthetic Plastic Surgeons (BAAPS) in April 2025, 27,462 cosmetic surgical procedures were performed in the U.K. in 2024.

The growing burden of hospital-acquired infections (HAIs) is also prompting healthcare facilities to maintain stringent infection control standards. Moreover, the rise in minimally invasive surgeries and complex procedures necessitates the use of specialized, reusable surgical instruments that require rigorous sterilization. This trend is expected to fuel the global chemical/gas sterilizers market growth.

Market Restraints

Lack of Skilled Workforce in Emerging Countries May Limit Market Expansion

Although the adoption of chemical/gas sterilizers in healthcare facilities has increased due to a significant number of product launches in the past few years, the scarcity of skilled personnel capable of operating these devices in emerging countries poses a significant barrier.

- For instance, as per the data provided by the Australian Government in February 2025, there were only 4,800 sterilization technicians in Australia in 2024.

The lack of a skilled workforce for sterilization can lead to inappropriate sterilization practices. In many sterilization cases, the medical device's Instruction For Use (IFU) manual is not followed properly, resulting in inappropriate sterilization. Such lapses may result in an increased burden of hospital-associated infections among patients treated with these devices. In such cases, the usage of chemical/gas sterilizers can be limited, which is anticipated to hinder market growth.

Market Opportunities

Increasing Product Launches by Key Players to Increase the Device Penetration Globally

In recent years, the significant burden of hospital-acquired infections has prompted key players to expand their product availability in the global market with new launches and advanced features.

- For instance, in April 2022, Andersen Sterilizers introduced Anprolene AN75, an ethylene oxide sterilizer, in the global market. This launch marked the most significant upgrade to the Anprolene system since its introduction in the 1960s.

Moreover, prominent players are also expanding their production capacity to fulfill the growing demand for effective sterilization. They are also focusing on strategic initiatives such as collaborations and acquisitions to expand their product reach and strengthen their position worldwide. These initiatives may create lucrative growth opportunities for the market in the forthcoming years.

Market Challenges

High Cost of Chemical/Gas Sterilizers to Hinder Market Growth

In most scenarios, the installation of chemical/gas sterilizers can be quite costly. Hydrogen peroxide sterilizers, particularly hydrogen peroxide plasma sterilizers, often come with high initial purchase prices and can also involve expensive maintenance contracts due to the corrosive nature of the sterilant.

- For instance, according to the research article published by the West China Hospital/West China School of Nursing, Sichuan University, in April 2024, hydrogen peroxide low-temperature plasma sterilization is most expensive, followed by ethylene oxide sterilization.

Such high expenses are not feasible for small private healthcare facilities, research institutions, or pharmaceutical companies operating under budget constraints. This financial barrier can hamper adoption in resource- constrained settings, hindering market growth in the coming years.

Chemical/Gas Sterilizers Market Trends

Shift in Preference Toward the Adoption of Nitrogen Dioxide Sterilization

In the field of chemical/gas sterilization, the healthcare industry substantially relies on ethylene oxide sterilization. However, certain limitations are associated with this sterilizer, such as it may pose health risks due to the carcinogenic potential of EtO emissions and involves a lengthy process, impacting operational efficiency.

In response to these challenges, there is a noticeable shift in market preferences toward alternative chemical/gas sterilization products, such as nitrogen dioxide and other chemical or gas-based sterilization methods, which generally offer higher efficiency.

Therefore, to fulfill the increasing demand for alternative options for ethylene oxide sterilizers, market players have been increasing their focus on expanding the availability of other chemical or gas-based sterilizers, increasing their market availability.

- For instance, in April 2024, Noxilizer, Inc. announced the opening of a new manufacturing facility in the U.S. dedicated to the manufacture of its nitrogen dioxide sterilization equipment.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The market witnessed positive growth during the COVID-19 pandemic due to increased demand for sterilization and disinfection in healthcare facilities to prevent the spread of infections. Moreover, certain initiatives were taken by the government and healthcare organizations due to strict protocols for disinfecting tools and equipment in healthcare facilities. This boosted the sales of sterilizers, including chemical/gas sterilizers, contributing to market growth.

The market witnessed significant growth in 2021 and 2022, and this upward trend is expected to continue to grow further due to the rising number of surgical procedures, necessitating a sterilization process for surgical equipment.

Segmentation Analysis

By Product Type

Hydrogen Peroxide Sterilizers Led the Market due to Strong Recommendations by Regulatory Authorities

Based on product type, the market is segmented into hydrogen peroxide sterilizers, ethylene oxide sterilizers, nitrogen dioxide sterilizers, and others.

The hydrogen peroxide sterilizers segment held the largest chemical/gas sterilizers market share in 2024. This dominance is attributed to strong recommendations by regulatory authorities for hydrogen peroxide sterilization for medical device companies. These endorsements are anticipated to stimulate key players to launch more advanced sterilization devices.

- For instance, in January 2024, the U.S. FDA announced consideration of vaporized hydrogen peroxide (VH2O2) as an established method for sterilization of medical devices.

The ethylene oxide sterilizers segment accounted for the second-largest share of the global market in 2024. The growth is attributable to their widespread usage in healthcare due to their effectiveness in sterilizing a broad range of heat-sensitive medical devices and equipment without damaging the materials of the medical devices.

By End-user

Hospitals & Specialty Clinics Dominated Due to Rising Cases of HAIs in These Settings

Based on end-user, the market is segmented into hospital & specialty clinics, pharmaceutical & medical device manufacturers, and others.

The hospital & specialty clinic segment held a dominating share in 2024. This dominance is attributed to the growing incidence of hospital-acquired infections in hospital patients undergoing surgeries, which has increased the demand for sterilizers to effectively sterilize medical devices in these settings.

- For instance, according to the data published by the European Centre for Disease Prevention and Control (ECDC) in May 2024, a point prevalence survey conducted across European hospitals from 2022 to 2023 revealed that around 7.1% of hospital patients were infected with at least 1 HAI.

The pharmaceutical & medical device manufacturers segment accounted for the second-largest global market share in 2024. The increasing expenditure by pharmaceutical and medical device companies on research and development activities, and the stringent regulatory requirements for sterilization of pharmaceutical products and medical devices. These factors are expected to increase the adoption of chemical/gas sterilizers in these facilities, thereby supporting the segment’s growth during the projection period.

CHEMICAL/GAS STERILIZERS MARKET REGIONAL OUTLOOK

Based on the region, the market is studied across North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America to Dominate Global Market Owing to High Incidence of Diabetes

North America

North America Chemical/Gas Sterilizers Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 0.74 billion in 2025 and USD 0.77 billion in 2026. The growing focus of market players on participating in medical conferences to create awareness about their sterilizers is increasing the product’s penetration rate in the region, which is anticipated to drive market growth.

In the U.S., the surge in hospital surgeries is driving the demand for sterilization of medical devices, thereby contributing to the usage of chemical/gas sterilizers in the country.

- For instance, according to the article published by the NCBI in September 2020, around 40.0 to 50.0 million surgeries were performed in the U.S. each year.

Europe

Europe held the second-largest share in 2024, attributed to key players focused on launching new chemical/gas sterilizers in the region, making it accessible to regional healthcare facilities.

- For instance, in November 2020, SOLSTEO introduced its latest ethylene oxide sterilizer in France.

Asia Pacific

Asia Pacific is expected to showcase the highest CAGR during the forecast period. Prominent market players are expanding manufacturing facilities in emerging countries of the region, such as India. The high incidence of HAIs in this region is also encouraging key players to invest in local production.

- For instance, in April 2025, Steris announced its plans to establish a state-of-the-art manufacturing facility in the Southern states of India, including Kerala, Telangana, Karnataka, and Tamil Nadu.

Latin America and Middle East & Africa

The Latin America and Middle East & Africa chemical/gas sterilizers market accounted for a lower market share in 2024. However, increasing initiatives to prevent HAIs in these regions are expected to increase the demand for chemical/gas sterilizers. Moreover, the increased number of endoscopy procedures performed in hospitals and clinics, which require sterilized endoscopes and related products, is an important factor driving the growth of the segment throughout the forecast period.

- For instance, in August 2024, Kuwait Hospital in Sharjah, an Emirates Health Services (EHS) facility, announced that it had performed around 782 endoscopic procedures in the first half of 2024.

COMPETITIVE LANDSCAPE

Key Market Players

Strong Focus on Increasing Product Reach and Involvement in Strategic Alliances May Boost the Market Share of Key Players

STERIS and Getinge accounted for the largest global chemical/gas sterilizers market in 2024. There largest share can attributed to strong focus on expanding their worldwide manufacturing facilities and product reach.

Furthermore, other market players such as Andersen Sterilizers, and Noxilizer Inc., are focusing on new product launches and strategic alliances to increase their market reach and enhance brand reputation. These initiatives are expected to help these companies boost their market share.

LIST OF KEY Chemical/Gas Sterilizers COMPANIES PROFILED

- STERIS (U.S.)

- Getinge (Sweden)

- ASP (Fortive) (India)

- ERNA Medical (Turkey)

- Andersen Sterilizers (U.S.)

- Noxilizer Inc. (U.S.)

- Stryker (U.S.)

- DE LAMA S.P.A. (Italy)

KEY INDUSTRY DEVELOPMENTS

- June 2024 – Getinge introduced the vaporized hydrogen peroxide (VH2O2) low-temp sterilizer Poladus 150 for sterilizing heat-sensitive surgical instruments.

- June 2024 – Getinge attended the ACHEMA 2024 medical conference in Frankfurt, Germany. During the event, the company showcased its sterilizers to create consumer awareness and enhance its brand image in the global market.

- April 2020 – Stryker received an emergency use authorization (EUA) for using Sterizone VP4 Sterilizer to decontaminate N95 respirators used by healthcare personnel.

- April 2020– STERIS announced that it had received the U.S. Food and Drug Administration (FDA) approval for its product, STERIS VHP LTS-V low-temperature sterilizer.

- April 2019 – Fortive acquired the ASP business from Ethicon, Inc. for around USD 2.7 billion to enter into the business of sterilization equipment.

REPORT COVERAGE

The research report provides a detailed market analysis and focuses on key aspects, such as major companies, competitive landscape, product type, and end-user. Additionally, it covers market dynamics and insights into the latest market trends and highlights key industry developments. Furthermore, the report covers several factors contributing to the market's growth in the past few years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.04% from 2026-2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Product Type

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 1.50 billion in 2025 and is projected to record a valuation of USD 2.32 billion by 2034.

In 2025, the North America market value stood at USD 0.74 billion.

The market will exhibit a steady CAGR of 5.04% during the forecast period (2026-2034).

By product type, the hydrogen peroxide sterilizers segment led the market.

The rising burden of hospital-acquired infections (HAI) worldwide and the rising surgical procedures are the key factors driving market growth.

STERIS and Getinge are the major players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us