Chemical Licensing Market Size, Share & Industry Analysis, By Type (C2 Derivatives, C1 Derivatives, C3 Derivatives, C4 Derivatives, and Others), By End-use Industry (Petrochemicals, Oil & Gas, Inorganic Chemicals, Agrochemicals, Organic Chemicals, Pharmaceuticals, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

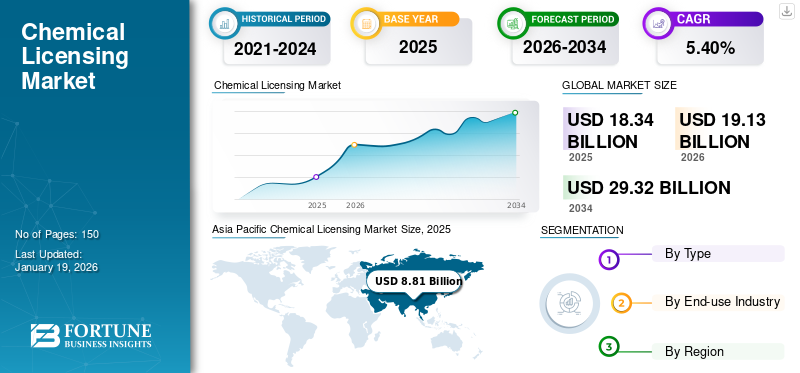

The global chemical licensing market size was valued at USD 18.34 billion in 2025. It is projected to grow from USD 19.13 billion in 2026 to USD 29.32 billion by 2034 at a CAGR of 5.40% during the 2026-2034 forecast period. Asia Pacific dominated the chemical licensing market with a market share of 48% in 2025.

Chemical licensing involves the transfer of intellectual property rights and proprietary technologies from a licensor to a licensee, enabling the licensee to utilize these technologies for production and development. Licenses typically cover a range of chemical processes, including those for producing fuels, lubricants, and specialty chemicals. The agreements often include provisions for royalties, which are payments made by the licensee to the licensor based on a percentage of sales or a fixed fee per unit produced using the licensed technology.

Technical assistance from the licensor to the licensee is commonly provided, including training, technical support, and access to proprietary know-how to ensure effective implementation. Performance guarantees are also included to ensure that the licensed technology meets certain performance standards, providing assurance to the licensee and mitigating risks. This chemical licensing model allows companies to access advanced technologies without the need for independent development, thereby enhancing their production capabilities and market competitiveness.

Exxon Mobil Corporation, BASF SE, Dow Inc., LyondellBasell Industries Holdings B.V., Mitsubishi Chemical Corporation, and Chevron Phillips Chemical Company LLC are the key players operating in the market.

GLOBAL CHEMICAL LICENSING MARKET TAKEAWAYS

Market Size & Forecast:

- 2025 Market Size: USD 18.34 billion

- 2026 Market Size: USD 19.13 billion

- 2034 Forecast Market Size: USD 29.32 billion

- CAGR: 5.40% from 2026–2034

Market Share:

- Asia Pacific led in 2025 with a 48% share, rising from USD 8.81 billion in 2025 to USD 9.22 billion in 2026.

- By type: C2 derivatives dominated due to their cost-effectiveness and wide industrial applications.

- By end-use: Petrochemicals segment led, supported by demand for efficient and sustainable production technologies.

Key Country Highlights:

- China: Major contributor with rapid industrialization and strong demand for licensed petrochemical technologies.

- India: Increasing adoption of sustainable chemical processes and licensing collaborations.

- U.S.: Focus on innovation, digitalization, and green chemistry driving licensing demand.

- Germany: Regulatory compliance and R&D strength supporting eco-friendly licensed technologies.

- Japan: Growing emphasis on advanced and energy-efficient chemical manufacturing.

CHEMICAL LICENSING MARKET TRENDS

Innovations in Chemical Manufacturing to Encourage Adoption of Licensed Technologies

Green chemistry is transforming chemical manufacturing by integrating sustainability into licensed technologies. These innovations aim to reduce waste, optimize energy use, and utilize renewable resources, offering safer alternatives to traditional methods. For instance, enzymatic catalysis and bio-based synthesis provide low-impact solutions that lower costs and meet regulations while appealing to consumer demand for eco-friendly products.

- Asia Pacific witnessed a growth from USD 8.81 billion in 2025 to USD 8.81 billion in 2026.

Digitalization also plays a key role in enhancing the effectiveness of licensed technologies. AI, machine learning, and automation improve process accuracy and speed up research and development. Tools such as predictive modeling and IoT monitoring offer real-time insights for better decision-making and safety. As the industry prioritizes efficiency and innovation, technologies that combine green chemistry with digital capabilities are vital for boosting competitiveness and expanding market reach.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Regulatory Compliance and Environmental Standards to Aid Market Growth

Stricter government regulations aimed at reducing pollution are driving the chemical companies to adopt licensed technologies that comply with the standards. These technologies incorporate cleaner production methods, waste reduction, and resource efficiency, helping firms avoid penalties and align with sustainability goals. Initiatives, including the circular economy and carbon reduction targets, further boost the demand for these solutions.

Environmental standards encourage the adoption of licensed technologies by promoting sustainability. Agreements such as the Paris Accord motivate businesses to implement eco-friendly processes. Licensed technologies, for those using renewable feedstocks or energy-efficient methods, provide a competitive edge by minimizing environmental impact. By leveraging these innovations, companies can meet regulations, enhance their eco-friendly image, and tap into growing green markets, making such technologies essential for industry growth.

MARKET RESTRAINTS

Licensing agreements Often Require Substantial Upfront Investments that May Hinder the Market

Licensing agreements in the chemical technology sector often require substantial upfront investments that can hinder the chemical licensing market growth. The costs associated with obtaining licensing rights, including fees and due diligence, may pose significant financial barriers, particularly for smaller firms. Additionally, adapting the licensed technology to specific production processes typically demands more investments in infrastructure and skilled personnel, increasing overall costs. Compliance with regulatory standards adds further financial strain and can delay product market entry, discouraging potential licensees.

Moreover, dependence on licensors for updates and support may stifle innovation, as companies might be less inclined to invest in their own development. In summary, while chemical licensing can provide access to advanced technologies, the high upfront costs can limit innovation and overall growth in the market.

MARKET OPPORTUNITIES

Increasing Focus on Sustainability Creates Market Opportunities for Licensed Technologies

The growing emphasis on sustainability is transforming the chemical industry by licensing innovative technologies that improve environmental performance. Companies are leveraging licensed solutions, including advanced catalysis and green chemistry, to comply with strict regulations and stand out in a market increasingly focused on eco-friendliness. Collaborations between research institutions and industry are enhancing innovation and operational efficiency.

Additionally, investing in these licensed technologies often leads to significant cost savings by reducing waste and energy consumption. This global exchange of best practices ensures regulatory compliance and enhances brand reputation among consumers and investors. As sustainability becomes integral to corporate strategies, chemical licensing is a vital tool for companies seeking to drive growth and create a greener future.

MARKET CHALLENGES

Significant Hurdles Rooted in IP Protection and Regulatory Compliance May Create a Market Challenge

Chemical innovations require significant R&D investments, making strong Intellectual Property (IP) frameworks essential for protecting proprietary processes and formulas. Licensing agreements must balance granting access to licensees while preventing unauthorized modifications. Transnational deals face challenges due to varying patent laws and regulations across jurisdictions. Compliance with safety and environmental standards, including REACH (Europe) or TSCA (U.S.), adds complexity, requiring licensors to frequently update contracts based on regulatory changes.

Additionally, aligning the strategic interests of licensors and licensees amidst evolving market demands, particularly toward sustainable practices, is crucial. This shift often leads to renegotiations of terms to accommodate eco-friendly technologies while maintaining IP value. Conflicts may arise over profit-sharing and operational control, particularly in industries including agrochemicals, where regional demand fluctuates. Transparent communication, adaptive licensing structures, and clear dispute-resolution mechanisms are essential for fostering long-term collaboration.

IMPACT OF COVID-19

The COVID-19 pandemic greatly affected the market. Lockdown measures and restricted movement have prolonged on-site audits and negotiations, complicating agreements. Cross-border projects have faced delays due to travel restrictions. Economically, the recession led to reduced financial resources for chemical companies, making them more cautious and prioritizing technologies with short payback periods. The pandemic also accelerated digital transformation, increasing interest in licensing digital technologies for smart manufacturing and industrial platforms. There was a heightened focus on health and safety, resulting in high demand for chemical licensing technologies related to biocidal materials and environmental protection, particularly in public spaces, for instance, hospitals and schools.

TRADE PROTECTIONISM AND GEOPOLITICAL IMPACT

Recently, trade protectionism and geopolitical shifts have challenged chemical licensing. Increased tariffs, stricter export controls, and complex trade policies hinder the cross-border flow of technologies. For instance, the U.S.-China trade war has raised costs for chemical firms, discouraging international technology licensing. Geopolitical tensions can disrupt supply chains and limit access to essential materials, impacting licensing. Changes in trade policies, such as tariffs and export restrictions, further affect chemical trade, increasing costs and altering competitiveness in global markets. Consequently, chemical companies must navigate complex trade compliance to avoid regulatory risks.

RESEARCH AND DEVELOPMENT (R&D) TRENDS

In the post-pandemic era, R&D trends in chemical licensing show several key characteristics. Digitalization is a major focus, with companies utilizing AI and machine learning to optimize material discovery and enhance collaboration through digital platforms. Additionally, R&D investments are diversifying into areas including renewable energy, bio-based chemicals, and electronic chemicals, particularly as the global energy transition accelerates. Collaboration has deepened as companies work with universities and institutions to tackle complex challenges, with licensing playing a crucial role in accessing external technologies. Lastly, R&D localization is becoming more important, driven by trade protectionism and geopolitical shifts, leading companies to enhance their independent innovation capabilities and increase local technology licensing.

SEGMENTATION ANALYSIS

By Type

C2 Derivatives Segment Dominated Due to Its Cost-Effectiveness and Use in a Wide Range of Applications

Based on type, the market is classified into C2 derivatives, C1 derivatives, C3 derivatives, C4 derivatives, and others.

The C2 derivatives segment held a dominant share of 37.27% the global market in 2026 and is estimated to record a significant annual growth rate during the forecast period. C2 derivatives primarily refer to organic compounds derived from ethylene, such as ethanol, ethylene oxide, vinyl acetate, etc. These derivatives have extensive applications in industries such as plastics, synthetic fibers, synthetic rubber, solvents, and pharmaceuticals, driving robust demand for related chemical technologies. C2 derivatives are derived from ethylene, one of the most important basic chemical raw materials, with a stable supply and relatively low costs. Chemical technologies related to C2 derivatives can help licensees reduce production costs and improve economic benefits, making them highly appealing in the market.

The C1 derivatives segment holds a substantial share of the market. These derivatives primarily refer to organic compounds derived from single-carbon molecules such as methane, methanol, methyl chloride, formaldehyde, and chloromethane. These derivatives find extensive applications in industries such as plastics, pharmaceuticals, synthetic fibers, and electronics, driving robust demand for related chemical technologies.

By End-use Industry

To know how our report can help streamline your business, Speak to Analyst

Continuous Development of New Petrochemical Processes Boosted Segment Growth

By end-use industry, the market is segmented into petrochemicals, oil & gas, inorganic chemicals, agrochemicals, organic chemicals, pharmaceuticals, & others.

The petrochemicals segment accounted for the largest global chemical licensing market share of 31% globally in 2026. Petrochemical companies depend on advanced process technologies to enhance efficiency, reduce costs, and comply with environmental regulations. The ongoing development of new petrochemical processes and the modernization of existing facilities further stimulate the demand for technology licensing in this segment. Chemical companies leverage licensing in bulk organic chemicals and petrochemicals to generate revenue from process innovations. As the chemical industry advances, the demand for chemical licenses in the petrochemical segment is expected to rise.

The oil & gas segment holds a substantial share as it encompasses a wide range of technologies, such as GTC Vorro's sulfur removal and sulfur management technologies for upstream wellhead treatment, midstream central processing treatment, and downstream refining processes, including fluid catalytic cracking (FCC) gasoline, and ultra-low sulfur diesel (ULSD). The continuous innovation in the oil & gas industry driven by growing licensing demand is the primary factor contributing to the market growth. The Inorganic Chemicals segment is expected to hold a 9.2% share in 2024.

CHEMICAL LICENSING MARKET REGIONAL OUTLOOK

The market is categorized into regions across North America, Asia Pacific, Europe, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Chemical Licensing Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific held the dominant share in the market in 2024, driven by rapid industrialization and infrastructure development in China, Japan, and South Korea. China accounted for the largest market share in 2024, valued at USD 8.43 billion. The rise of the middle class and increasing industrialization propel the need for advanced chemical processes and materials. Collaborative partnerships between local firms and multinational corporations are common as businesses seek to leverage established technologies to enhance production capabilities. However, challenges such as intellectual property protection and regulatory compliance vary significantly across countries in this diverse region, which can impact the ease of technology transfer and licensing agreements. The Japan market is expected to attain USD 0.81 billion by 2026, the China market is anticipated to grow to USD 5.67 billion by 2026, and the India market is set to reach USD 0.71 billion by 2026.

- In China, the Agrochemicals segment is estimated to hold a 8.5% market share in 2024.

To know how our report can help streamline your business, Speak to Analyst

North America

In North America, the chemical licensing landscape is characterized by a strong emphasis on innovation and sustainability. The region benefits from a robust research and development infrastructure, with significant investment in green chemistry and advanced manufacturing processes.

The U.S. is the leading country in the region. The presence of major chemical companies and a collaborative environment among academic institutions, industry players, and government bodies fosters an atmosphere ripe for technology transfer in the country. This trend is bolstered by stringent environmental regulations in the country that push for cleaner technologies, making licensing arrangements increasingly vital for companies aiming to remain competitive while adhering to regulatory standards. The U.S. market is estimated to reach USD 4.07 billion by 2026.

Europe

Europe's chemical licensing landscape is highly advanced, marked by a focus on sustainability, the circular economy, and regulatory compliance. The European Union’s stringent environmental regulations, alongside the Green Deal initiative, drive innovation in chemical processes, leading to a surge in the commercialization of sustainable technologies. Companies are increasingly entering licensing agreements to share innovations, particularly in areas such as bioplastics, renewable feedstocks, and energy-efficient processes. The strong presence of research institutions and industry consortia in Europe facilitates knowledge exchange and collaborative R&D efforts, enhancing the attractiveness of licensing arrangements. The UK market is projected to reach USD 0.29 billion by 2026, and the Germany market is forecast to reach USD 1.32 billion by 2026.

Latin America

In Latin America, the market is gradually evolving, influenced by both local needs and global trends. The region's rich natural resources present chemical production and innovation opportunities, particularly in agriculture and biofuels. Moreover, local companies are increasingly looking to form partnerships with international firms to gain access to advanced technologies and improve their market competitiveness. The emphasis on sustainable practices, especially in agriculture, is beginning to drive interest in licensing arrangements that focus on environmentally friendly technologies.

Middle East & Africa

The Middle East & Africa region is an emerging market, with a strong focus on oil & gas processing and petrochemicals. The region's vast natural resource base supports a thriving chemical industry, and nations are investing heavily in diversifying their economies. Licensing agreements can facilitate technology transfer that promotes more efficient and sustainable chemical processes, aligning with the region's goals of industrial growth while addressing environmental concerns. As the market matures, there is potential for increased collaboration with international firms seeking to leverage local expertise and resources.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Players Adopt Product Development Strategy to Maintain Their Dominance in Market

Exxon Mobil Corporation, BASF SE, Dow Inc., LyondellBasell Industries Holdings B.V., Mitsubishi Chemical Corporation, and Chevron Phillips Chemical Company LLC are the key players in the market. Major investments by companies are in developing additives that address evolving demands for sustainability and performance. Furthermore, the companies have formed partnerships to develop new products and gain competence. Partnerships with an emphasis on research & development by technology providers are the strategies the market players use to increase their presence globally and maintain their mark in the competition.

LIST OF KEY CHEMICAL LICENSING COMPANIES PROFILED

- Exxon Mobil Corporation (U.S.)

- BASF SE (Germany)

- Dow Inc. (U.S.)

- LyondellBasell Industries Holdings B.V. (Netherlands)

- Mitsubishi Chemical Corporation (Japan)

- Chevron Phillips Chemical Company LLC (U.S.)

- Johnson Matthey plc (U.K)

- Eastman Chemical Company (U.S.)

- Mitsui Chemicals, Inc. (Japan)

- Sumitomo Chemical Co., Ltd. (Japan)

KEY INDUSTRY DEVELOPMENTS

- May 2025 – Mitsubishi Chemical announced that its subsidiary, MU Ionic Solutions Corporation, had entered into a patent license agreement with CATL, granting CATL access to lithium-ion battery-related patents. The agreement centers on the next-generation cathode interfacial control MP1 Technology, with Mitsubishi Chemical licensing the patents to CATL.

- May 2025 – Himadri Speciality Chemical signed a technology licensing agreement with the Australian battery materials company Sicona, representing a step toward localizing advanced lithium-ion battery materials within India. The agreement provides Himadri with exclusive rights to utilize, commercialize, and produce Sicona's proprietary Silicon-Carbon (SiCx) anode technology in India.

- March 2025 – Mitsubishi Chemical Group (MCG Group) signed a licensing agreement with SNF Group for MCG Group's technology to produce N-vinylformamide (NVF). NVF is a raw material used in the production of functional polymers. Through this agreement, SNF will utilize the licensed manufacturing technology to begin commercial production of NVF.

- November 2024 – ExxonMobil entered into a licensing agreement with Neuvokas Corporation, producer of GatorBar, a leading GFRP composite rebar. ExxonMobil will have exclusive rights to sub-license Neuvokas' manufacturing process outside North America, helping to expand the global market for composite rebar in concrete reinforcement.

- April 2024 – KBR and Sumitomo Chemical formed an alliance, making KBR the exclusive licensing partner for Sumitomo's advanced propylene oxide by cumene (POC) technology. Propylene oxide is mainly used to produce polyurethanes, which are found in products such as foams, coatings, adhesives, and sealants for growing industries such as construction and automotive.

REPORT COVERAGE

The report provides a detailed analysis of the market. It focuses on key aspects, such as leading companies, type, and end-use industry. Besides this, it offers insights into the market and current industry trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors contributing to the market's growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 5.40% from 2026 to 2034 |

|

Segmentation

|

By Type

|

|

By End-use Industry

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 18.34 billion in 2025 and is projected to reach USD 29.32 billion by 2034.

Recording a CAGR of 5.40%, the market is slated to exhibit steady growth during the forecast period of 2026-2034.

By end-use industry, the petrochemicals segment led the market in 2025.

Asia Pacific held the highest market share of 48% in 2025.

Stricter government regulations and environmental standards are key factors driving market growth.

Innovations in chemical manufacturing, such as green chemistry and digitalization, are expected to drive product adoption.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us