China Artificial Intelligence Market Size, Share & Industry Analysis, By Component (Hardware, Software, & Services), By Deployment (On-premise & Cloud), By Enterprise Type (Large, Small & Medium-sized Enterprises), By Technology (Machine Learning, NLP, Computer Vision, Robotics & Automation, & Expert Systems), By Function (HR, Marketing & Sales, Product/Service Deployment, Service Operation, Risk, & Supply-chain Management), By Industry (Healthcare, Automotive, BFSI, Retail, Manufacturing, Agriculture, Government, IT & Telecom, Energy & Utilities, & Education), & Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

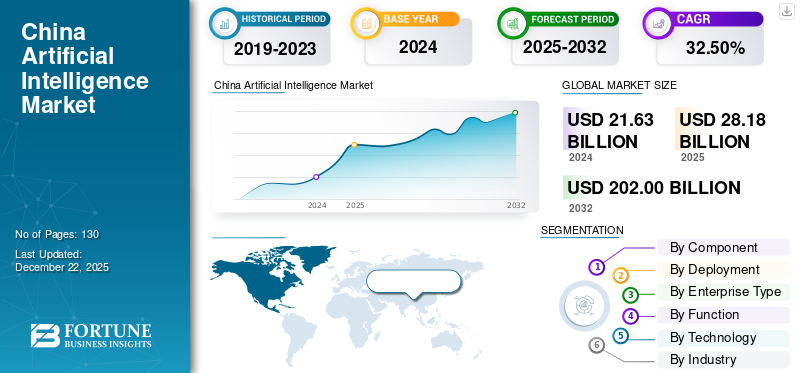

China artificial intelligence market size was valued at USD 21.63 billion in 2024. The market is projected to grow from USD 28.18 billion in 2025 to USD 202.00 billion by 2032, exhibiting a CAGR of 32.50% over the forecast period.

China’s artificial intelligence market is rapidly transforming into a global powerhouse driven by massive data availability, robust government support, and a vibrant tech ecosystem. Leveraging its strengths in large-scale deployment, digital infrastructure, and cutting-edge research, China is aggressively advancing AI applications across diverse sectors such as smart cities, healthcare, finance, and autonomous transportation. The synergy between leading tech giants, agile startups, and government-backed initiatives fuels innovation and accelerates commercialization. Focused on achieving technological self-reliance, China emphasizes AI models and hardware tailored to its unique market needs.

Impact of Generative AI

Generative AI is transforming the artificial intelligence landscape by enabling machines to create content such as text, images, music, and code with minimal human input. Its impact spans multiple industries, boosting creativity, automating content generation, and enhancing personalization in marketing, design, and customer service.

- According to Roland Berger, By February 2025, the number of generative AI users in China had surged to 250 million.

Impact of Reciprocal Tariffs

Reciprocal tariffs can raise the cost of importing AI hardware and software into China, slowing down development and increasing prices for AI companies. This may disrupt supply chains and push firms to focus more on domestic technology, but in the short term, innovation and growth could be hampered. For instance,

- A Chinese AI startup relying on imported sensors might face higher costs due to tariffs, forcing it to delay product launches or raise prices, which could limit its competitiveness and market expansion.

China Artificial Intelligence Market Trends

Rise in Smart Cities to be the Key Driver for Market Growth

One of the key trends shaping China's artificial intelligence market is the rapid rise of smart cities, becoming pivotal to the country’s urban innovation strategy. Smart cities leverage AI, IoT, and big data to achieve streamlined infrastructure, more efficient traffic management, modernized public services, and more robust security systems.

The strong nationwide push on digital urbanization has prioritized smart cities as significant engines for driving AI adoption, with initiatives that incorporate features of computer vision, predictive analytics, and real-time monitoring into daily city functions.

Key takeaways

- The China artificial intelligence market is projected to be worth USD 202.00 billion in 2032.

- In by component segmentation, Software accounted for around 49.4% of the China Artificial Intelligence Market in 2024.

- By deployment segmentation, Cloud is projected to grow at a CAGR of 34.6% in the forecast period.

- In the enterprise type segmentation, Large Enterprises accounted for around 63.8% of the market in 2024.

- By function segmentation, Risk is projected to grow at a CAGR of 35.3% in the forecast period.

- In the technology, Machine Learning accounted for around 41.4% of the market in 2024.

- By industry segmentation, Healthcare is projected to grow at a CAGR of 39.8% in the forecast period.

China Artificial Intelligence Growth Factors

Tremendous Data and Computational Assets to Boost Market Growth

With a huge population and widespread use of digital technology, China generates vast amounts of data, meaning there is great data for training AI models in language, vision, analytics and other domains. In addition to its data advantage, China has heavily invested in the high-performance computing infrastructure, including national supercomputing centres, which have large amounts of compute resource for the development of large-scale AI systems. As a result of this investment, China has amassed a significant advantage for accelerating both research and applications of AI in the real world.

China Artificial Intelligence Market Restraints

Regulatory Pressure and Content Control to Hinder the Market Growth

The China artificial intelligence market growth is characterized by strictly enforced government regulations that require compliance to political ideology and core socialist values. Developers must receive approvals from the state before the public or commercial use models, and results are monitored closely especially when a result relates to political ideology. For instance,

- China has implemented stringent regulations for AI, including new labeling requirements for AI-generated content, set to take effect on September 1st, 2025, to address the spread of misinformation.

Compliance requirements create challenges, additional development time, and limit the flexibility within generative AI models. Although compliance in order to maintain social order is important, compliance requirements can limit innovation and ultimately impact the global competitiveness of China's AI technologies.

China Artificial Intelligence Market Segmentation Analysis

By Component

Based on component, the market is divided into hardware, software, and services.

In the Chinese AI market, software is the majority segment, primarily due to the growing adoption of AI applications and services across industries. Enterprises are utilizing AI software primarily for data analytics, automation of workflows, and to engage with customers, which is solidifying software as the primary segment

The hardware segment is set to register the fastest growth over the coming years. This surge is driven by the expanding need for specialized AI chips, edge devices, and computing infrastructure that can handle the processing demands of advanced AI models, reflecting a growing focus on building robust physical foundations for AI development,

By Deployment

Based on deployment, the market is bifurcated into on-premise and cloud.

The cloud segment has the largest share, and the highest CAGR is expected to continue, as organizations prioritize agility, scale, and remote accessibility with their AI strategy. The organizations grow more reliant on cloud infrastructure as they are able to access models faster, integrate seamlessly with existing systems and leverage advanced tools without needing to make heavy capital investments. As digital transformation deepens in every industry, cloud is establishing itself as the foundation on which organizations prefer to develop their AI capabilities, reinforcing its current dominance and future growth in the market.

By Enterprise Type

Based on enterprise type, the market is segmented into large enterprises and SMEs.

SMEs are expected to have the fastest CAGR in China's AI marketplace due to the growing adoption of digital technology, affordable cloud AI services, and government support. As a result, SMEs are quickly and readily turning to AI to increase efficiency, customer engagement and competitiveness. The growth and expansion of Chinese SMEs with AI really highlights a broader phenomenon of AI democratization where advanced technology is no longer just available for only large companies.

Large enterprises currently hold the majority market share due to their heavy investment in AI infrastructure and new applications. Their early adoption of AI across leading industries keeps them in the front seat of innovation. They continue to push the envelope on the use of advanced AI to drive strategic advantage and operational efficiency.

By Function

Based on function, the market is segmented into human resources, marketing & sales, product/service deployment, service operation, risk, supply chain management, and others.

The service operation function currently has the major share in the China AI market, mainly due to the application areas in customer service, support, and user engagement. Businesses will increasingly use AI tools such as chatbots and virtual agents to increase response times, and now, with AI’s reduction of operational costs, businesses will also be on a cost-reducing missions.

The risk function is expected to experience the highest CAGR growth in the artificial intelligence market in China, prompted by increasing demand for AI-enabled, fraud detection tools, cybersecurity, and compliance monitoring. As the amount of data increases and threats become more complex, organizations will pay attention to intelligent risk management tools.

By Technology

Based on technology, the market is segmented into machine learning, natural language processing, computer vision, robotics and automation, and expert systems.

In the China artificial intelligence market, machine learning is the largest market segment and is also forecasted to have the highest CAGR during the forecast period. Machine learning's dominance is due to its widespread adoption across industries for different applications including predictive analytics, image and speech recognition, and recommendation engines. The key value of this technology is that it can learn over time by using data, and this is essential for businesses looking for smart automation and decision-making.

By Industry

Based on industry, the market is segmented into healthcare, automotive, retail, bfsi, manufacturing, agriculture, government and public sector, IT & telecom, energy and utilities, and education.

The BFSI (Banking, Financial Services, and Insurance) sector holds the largest China artificial intelligence market share, driven by early and extensive adoption of AI technologies in the sector. Financial institutions are leveraging AI for fraud detection, algorithmic trading, customer service automation, and risk management, significantly improving efficiency and security.

The healthcare sector, on the other hand, is expected to grow at the highest CAGR in the coming years. This growth is fueled by increasing demand for AI applications in diagnostics, medical imaging, predictive analytics, and personalized medicine.

List of Key Companies in the China Artificial Intelligence Market

China’s AI landscape is being shaped by a new generation of trailblazing companies that are driving large-scale innovation and accelerating real-world AI deployment. Moonshot AI is making headlines with its cutting-edge language models and rapid scaling capabilities, reflecting China’s push for foundational AI leadership. Baidu, a pioneer in AI research and commercialization, continues to lead in autonomous driving, voice recognition, and large-scale AI platforms such as Ernie Bot, which integrates seamlessly into China’s digital ecosystem. Baichuan is advancing open-source AI development, focusing on multi-modal and multi-language foundation models aimed at boosting enterprise-grade AI applications. MiniMax is gaining momentum with its emphasis on safe and scalable generative AI, offering models tailored for dynamic content creation, virtual assistants, and more. Together, these companies represent the driving force behind China’s ambition to lead the global AI race, supported by a unique blend of state policy, talent concentration, and commercial agility.

LIST OF KEY COMPANIES PROFILED

- Minimax (China)

- Moonshot AI (China)

- Baidu, Inc. (China)

- Tencent (China)

- AI (China)

- Baichuan AI (China)

- Bytedance (China)

- SenseTime (China)

- Alibaba Cloud (China)

- CloudWalk Technology Co., Ltd (China)

- Yitu Tech (China)

KEY INDUSTRY DEVELOPMENTS

- July 2025: China has launched the World AI Cooperation Organization to compete with the US in AI development, focusing on global governance and providing accessible, affordable AI solutions. The initiative aims to set international standards, support developing nations, and challenge US dominance in the AI market.

- March 2025: China’s National Development and Reform Commission has launched a state-backed venture capital fund focused on robotics and AI, aiming to raise USD 138 billion over 20 years.

REPORT COVERAGE

This report presents a detailed analysis of China’s rapidly expanding artificial intelligence market, highlighting its strategic integration of AI into national development goals. Backed by strong government policy, substantial funding, and a robust industrial base, China is positioning AI as a core pillar of its economic and technological leadership. The study examines the widespread deployment of AI across key sectors such as manufacturing, public services, defense, finance, and smart cities, with special focus on advancements in computer vision, natural language processing, and autonomous systems. China's AI ecosystem is characterized by powerful synergies between large tech giants, a dynamic startup scene, and state-supported research institutions.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 32.50% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component · Hardware · Processors (GPU, FPGA, ASIC and CPU) · Memory Systems · Storage Devices · Software · Services · AI Strategy Advisory/Consulting Services · System Integration and Deployment · AI Model Development · Process Automation and Optimization · AI Training · AI-powered Customer Experience · Support & Maintenance |

|

By Deployment · On-premise · Cloud · Public Cloud · Private Cloud · Hybrid Cloud |

|

|

By Enterprise Type · Large Enterprises · Small and Mid-sized Enterprises (SMEs) |

|

|

By Technology · Machine Learning · Supervised Learning · Unsupervised Learning · Reinforcement Learning · Natural Language Processing (NLP) · Speech Recognition · Text Analytics · Language Translation · Computer Vision · Image Recognition · Object Detection · Robotics and Automation · Expert Systems · Rule-based Expert System · Knowledge-based System |

|

|

By Function · Human Resources · Marketing & Sales · Product/Service Deployment · Service Operation · Risk · Supply-Chain Management · Others (Strategy and Corporate Finance) |

|

|

By Industry · Healthcare · Diagnostic AI · Clinical AI · Hospital Management System · Automotive · Autonomous Vehicle · AI in Mobility-as-a-Service · BFSI · Fraud Detection · Risk Management · Algorithmic Trading · Retail · Customer Analytics · AI-powered Marketing and Sales · Supply Chain Automation · Manufacturing · Predictive Maintenance · AI-driven Robotics and Automation · Agriculture · Smart Farming · Yield Monitoring and Optimization · Crop Disease Detection · Government and Public Sector · Smart City Initiatives · Law Enforcement AI · Disaster Management · IT & Telecom · Network Optimization · AI Chatbots · Intelligent Call Routing · Energy & Utilities · Grid Management · AI in Renewable Energy Management · Education · Adaptive Learning Platform · AI-assisted Learning Tools |

Frequently Asked Questions

Fortune Business Insights says that the China artificial intelligence market was worth USD 21.63 billion in 2024.

The market is expected to exhibit a CAGR of 32.50% during the forecast period.

By industry, the BFSI industry is set to lead the market.

Minimax, Moonshot AI, Baidu, and Tencent are the leading players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us