Chlorine Market Size, Share & Industry Analysis, By Application (PVC, Organic Chemicals, Inorganic Chemicals, Water Treatment, and Others) and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

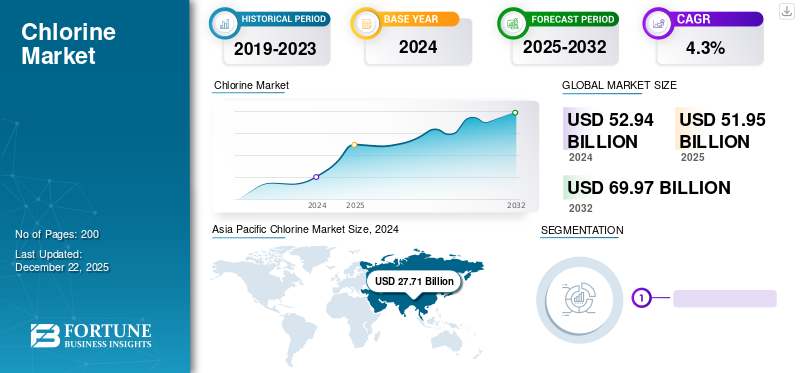

The global chlorine market size was USD 51.95 billion in 2025 and is projected to grow from USD 54.13 billion in 2026 to USD 76.12 billion by 2034 at a CAGR of 4.3% during the period 2026-2034. Asia Pacific dominated the chlorine market with a market share of 51% in 2025.

Chlorine is a greenish-yellow, reactive gas widely used in industries such as water treatment, paper and pulp, polyvinyl chloride (PVC) production, and pharmaceuticals. It is mainly produced through the electrolysis of brine and is valued for its strong disinfectant and oxidizing properties. A key driver of market growth is the increasing demand for PVC, particularly in the construction and automotive industries. As global urbanization and infrastructure development expand, especially in emerging economies, the need for chlorine-based PVC materials is anticipated to grow. This trend is expected to significantly contribute to the rising consumption of the product across various industrial applications, driving market growth in tandem.

Olin Corporation, Westlake Chemical, INEOS, and Occidental Petroleum are the key players operating in the market.

CHLORINE MARKET TRENDS

Shifting Trend Toward Greener Production to Reshape Market Expansion

The market is transitioning toward greener production methods by embracing membrane cell technology, which is more energy-efficient and environmentally sustainable compared to traditional mercury or diaphragm processes. This shift aligns with global environmental regulations and the increasing demand for compliance with sustainability standards. Green chemistry initiatives focus on minimizing hazardous by-products, optimizing resource use, and reducing emissions through advanced monitoring and closed-loop systems. Driven by regulatory pressures and sustainability goals, this trend allows producers to reduce their environmental impact while enhancing operational efficiency. Adopting green chemistry is becoming essential for maintaining competitiveness in a market that increasingly values sustainable and responsible industrial practices.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Rising PVC Demand to Fuel Market Growth

The increasing global demand for polyvinyl chloride is a major trend propelling product consumption. PVC is a chlorine-based thermoplastic widely used in construction for pipes, window frames, flooring, and roofing due to its durability, cost-effectiveness, and corrosion resistance. As urbanization accelerates in emerging markets such as India, China, and Southeast Asia, large-scale investments in infrastructure, housing, and public utilities are boosting PVC usage. In addition to this, the automotive and packaging sectors are adopting lightweight and recyclable PVC materials to improve fuel efficiency and reduce environmental impact. Since the product is a key raw material in PVC production, used in the synthesis of vinyl chloride monomer, rising PVC demand directly contributes to sustained product consumption across the globe. This reinforces its critical role in industrial value chains and continues to drive market growth in tandem.

MARKET RESTRAINTS

Health Hazards and Environmental Risks Associated with the Product to Restrain Market Growth

Chlorine’s toxic and corrosive nature poses serious health and environmental risks, making its handling, storage, and transportation subject to strict regulations. Accidental leaks can cause severe health issues, while industrial use can lead to harmful byproducts. These byproducts are linked to long-term ecological damage and potential human health risks. Environmental and safety risks significantly limit the growth of product usage, particularly in regions with strict environmental regulations and public scrutiny. Consequently, industries are either adopting costly safety measures or shifting to alternative chemicals, thereby limiting market expansion. This growing focus on environmental and health risks is likely to act as a major deterrent to chlorine market growth.

MARKET OPPORTUNITIES

Rising Investments in Water and Wastewater Treatment to Create Market Growth Opportunities

Growing investments in water and wastewater treatment are significantly driving product demand worldwide. As urban populations expand and concerns over waterborne diseases rise, governments, particularly in emerging economies, are prioritizing clean water access and sanitation. The product’s effectiveness as a disinfectant makes it essential in municipal water treatment systems. Stricter global regulations, including those set by the WHO, are further supporting its use. In addition to this, industries are increasingly required to treat wastewater before discharge, boosting the product’s role in industrial applications. Large-scale initiatives in countries such as India and China are accelerating this trend, positioning water treatment infrastructure as a key driver of chlorine market growth.

MARKET CHALLENGES

Regulatory Compliance to Increase Operational Cost Posing Challenges to Market Growth

The product’s hazardous nature has led to increasingly strict regulations, especially in regions such as North America and Europe. Compliance with frameworks such as REACH and EPA standards requires significant investment in safety systems, emission controls, and specialized infrastructure. These measures increase operational costs and often delay project approvals or expansions. In addition to this, environmental scrutiny is intensifying as sustainability becomes a priority, further raising the compliance cost on producers and users. This stringent regulatory environment challenges profitability, limits flexibility, and creates high entry barriers for new players, thereby restricting market growth.

SEGMENTATION ANALYSIS

By Application

To know how our report can help streamline your business, Speak to Analyst

Organic Chemicals Segment to Dominate the Market due to Rising Demand for Crop Protection Chemicals

Based on application, the market is segmented into PVC, organic chemicals, inorganic chemicals, water treatment, and others.

The organic chemicals segment is representing 41.55% of the total market share in 2026. In organic chemical synthesis, the product plays a critical role as a reactant in producing intermediates for pharmaceuticals, agrochemicals, and solvents. The rising demand for medicines and crop protection chemicals, particularly in developing economies, drives product consumption. Chlorine enables complex reactions essential for manufacturing high-value chemicals. As specialty chemical innovation advances, the product’s role in enabling diverse synthetic chemical production ensures its continued demand in this application segment.

The PVC segment is anticipated to witness prominent growth during the forecast period. The product’s demand in PVC production is primarily driven by global infrastructure growth and urbanization. PVC, a key material in construction, relies on the product in its production process and is widely used in piping, window frames, and electrical wiring due to its durability and cost-efficiency. Rapid development in emerging markets, especially in Asia, is accelerating demand for affordable construction materials. In addition to this, PVC's expanding use in sectors such as automotive and packaging contributes to stable product consumption, reinforcing its importance in supporting infrastructure and industrial development.

CHLORINE MARKET REGIONAL OUTLOOK

By region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Chlorine Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific (APAC) region dominated the market with a size of USD 26.24 billion in 2025. Product demand in the region is primarily driven by rapid urbanization and rising PVC consumption. Countries such as China and India are experiencing strong construction and infrastructure growth, requiring large volumes of chlorine-based PVC for pipes, fittings, and building materials. In addition, industrialization and the growing expansion of chemical manufacturing further boost product usage. Water treatment industries’ needs are also increasing with expanding urban populations. These factors, combined with government-led development initiatives, make Asia Pacific a growing market globally, with both industrial and infrastructure sectors contributing significantly to demand. China market valued at USD 10.53 billion by 2026, and the India market valued at USD 0.83 billion by 2026. Japan market value at USD 7.9 billion by 2026

To know how our report can help streamline your business, Speak to Analyst

North America

In North America, product demand is fueled by strict environmental regulations and the pressing need to upgrade aging water infrastructure. The U.S. EPA mandates chlorine use for disinfecting public water supplies, reinforcing its continued importance in municipal and industrial water treatment. While regulatory compliance adds operational pressure, chlorine remains essential for maintaining water quality and hygiene standards. Infrastructure investments and environmental safety requirements ensure steady demand for the product in both public and private sectors, driving market growth in tandem.

Europe

Europe’s chlorine demand is sustained by its critical role in the production of industrial chemicals, pharmaceuticals, and agrochemicals. Chlorine-based intermediates are essential for manufacturing various compounds used across healthcare, agriculture, and specialty industries. Despite strict environmental policies, the region continues to rely on the product for its irreplaceable role in these sectors. European companies are increasingly adopting sustainable production technologies and closed-loop systems to align with the EU’s green initiatives. Thus, innovation in cleaner chemical processing and continued demand for product-based derivatives prompt a stable demand across the region. Germany market is valued at USD 2.08 billion by 2026.

Latin America

Latin America’s market is driven by the need to improve water quality and sanitation infrastructure. Many countries in the region face challenges in providing clean water, prompting government investments in municipal water treatment systems where chlorine is the preferred disinfectant. Countries such as Brazil and Mexico are prioritizing public health through water infrastructure upgrades, often supported by international funding. The product’s low cost and high effectiveness make it ideal for large-scale disinfection, supporting consistent demand. As urbanization grows and sanitation goals expand, the product will continue to play a vital role in addressing the region’s health and infrastructure needs.

Middle East & Africa

In the Middle East and Africa, product demand is rising due to industrial expansion and growing reliance on desalination. Countries such as Saudi Arabia and the UAE are investing in chemical and PVC production as part of economic diversification, increasing product use in manufacturing. In addition to this, the product is essential for microbial control in desalination plants that provide drinking water in arid regions. In Africa, urban growth and increasing water treatment projects are also boosting demand. Together, industrial growth and essential infrastructure needs are making this product a key component in regional development, driving market growth in tandem.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players Focus on Vertical Integration to Gain Competitive Edge

The global chlorine market is marked by moderate to high competition, dominated by major players such as Olin Corporation, Westlake Chemical, INEOS, and Occidental Petroleum. These companies compete primarily on cost efficiency, production scale, and regional presence. Since chlorine is a commodity with limited product differentiation, price competitiveness is intense. High fixed costs, regulatory pressures, and regional supply-demand gaps further influence market dynamics. Long-term contracts and vertical integration into downstream chlorine products give established players a strong edge, making market entry difficult for new firms. Overall, vertical integration and operational scale are key to maintaining competitiveness in the chlorine industry.

LIST OF KEY CHLORINE COMPANIES PROFILED

- Hanwha Solutions Chemical Divison (South Korea)

- Olin Corporation (U.S.)

- Covestro AG (Germany)

- AGC Inc. (Japan)

- BONDALTI (Portugal)

- Ercros S.A (Spain)

- INEOS (U.K.)

- KEM ONE (France)

- Occidental Petroleum Corporation (U.S.)

- Westlake Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS

- February 2023 - Covestro successfully commissioned a new chlorine plant in Tarragona, Spain, incorporating energy-efficient oxygen depolarized cathode technology. This facility is the first in the world to employ this specific technology and would reinforce Covestro’s European methylene diphenyl di-isocyanate production network.

- May 2022 - AGC is investing over 100 billion yen (USD 0.76 billion) to expand chlor-alkali production in Thailand, boosting output of caustic soda, VCM, and PVC at two manufacturing sites. The move is part of the company’s plan to meet the growing demand in the country.

REPORT COVERAGE

The global market report provides a detailed analysis of the market. It focuses on key aspects such as profiles of leading companies, product types, and leading applications of the product. Besides this, it offers insights into the analysis of key market trends and highlights key industry developments. In addition to the aforementioned factors, it encompasses several factors that have contributed to the growth of the market over recent years.

[eEFbKTQmHd]

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Volume (Kiloton); Value (USD Billion) |

|

Growth Rate |

CAGR of 4.3% during 2026-2034 |

|

Segmentation |

By Application · PVC · Organic Chemicals · Inorganic Chemicals · Water Treatment · Others |

|

By Region · North America (By Application and By Country) § U.S. (By Application) § Canada (By Application) · Europe (By Application, By Country) § Germany (By Application) § France (By Application) § Belgium (By Application) § Russia (By Application) § Rest of Europe (By Application) · Asia Pacific (By Application and By Country) § China (By Application) § India (By Application) § Japan (By Application) § South Korea (By Application) § Rest of Asia Pacific (By Application) · Latin America (By Application and By Country) § Brazil (By Application) § Mexico (By Application) § Rest of Latin America (By Application) · Middle East & Africa (By Application and By Country) § Saudi Arabia (By Application) § South Africa (By Application) § Rest of Middle East & Africa (By Application) |

Frequently Asked Questions

The Chlorine Market was valued at USD 51.95 billion in 2025 and increased to USD 54.13 billion in 2026, with the market projected to reach USD 76.12 billion by 2034.

In 2025, Asia Pacific stood at USD 26.24 billion.

Registering a CAGR of 4.3%, the market will exhibit steady growth during the forecast period (2026-2034).

The organic chemicals application is expected to lead this market during the forecast period.

Rising PVC demand across high-growth industries is a key factor driving market growth.

Olin Corporation, Westlake Chemical, INEOS, and Occidental Petroleum are the major players operating in the market.

Asia Pacific is likely to dominate the market in terms of share.

Rising Investment in water treatment is likely to drive the adoption of the product.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us