Cocoa Butter Alternatives Market Size, Share & Industry Analysis, By Type (Cocoa Butter Substitutes, Cocoa Butter Equivalent, and Cocoa Butter Replacers), By Application (Bakery, Confectionery, Dairy and Frozen Desserts, Beverages, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

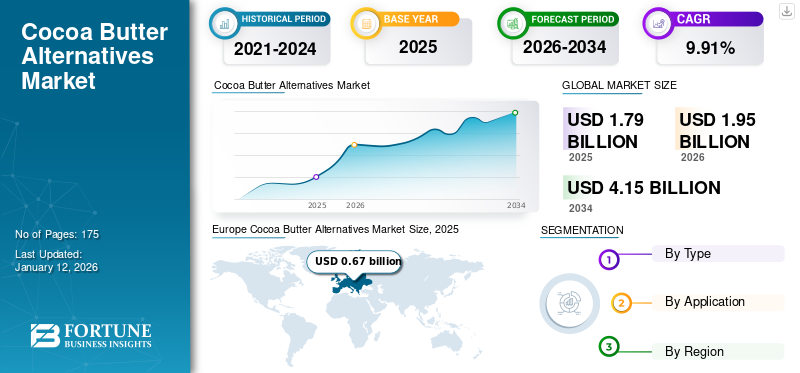

The global cocoa butter alternatives market size was valued at USD 1.79 billion in 2025 and is projected to grow from USD 1.95 billion in 2026 to USD 4.15 billion by 2034, exhibiting a CAGR of 9.91% during the forecast period. Europe dominated the cocoa butter alternatives market with a market share of 37.27% in 2025.

Cocoa Butter Alternatives (CBAs) are specialty fats made from coconut oil, shea butter, palm kernel oil, and palm oil. It has the same texture and melting point as cocoa butter, which enables recipe flexibility. Thus, they are designed to replace cocoa butter in chocolate production or for other applications, mainly due to their cost, availability, or dietary requirements.

The market is experiencing significant growth, and one of the primary factors driving this trend is the rising price of conventional cocoa butter. As the cost of cocoa butter increases, manufacturers and food & beverage producers are actively seeking cost-effective alternatives that can provide similar functional and sensory properties without the hefty price tag. The significant rise in cocoa prices is caused by the demand-supply gap owing to the high consumption of cocoa beans, climate change, the Russia-Ukraine war, and the resultant rising cocoa bean prices. Major companies such as Fuji Oil Holdings, Cargill Inc., AAK AB, Barry Callebaut AG, and Musim Mas Group are prominent players operating in the market.

Cocoa Butter Alternatives Market Snapshot & Highlights

Market Size & Forecast

- 2025 Market Size: USD 1.79 billion

- 2026 Market Size: USD 1.95 billion

- 2034 Forecast Market Size: USD 4.15 billion

- CAGR: 9.91% from 2026–2034

Market Share

- Europe led the cocoa butter alternatives market with a 37.27% share in 2025, driven by demand for plant-based, cost-effective, and sustainable ingredients in chocolate and bakery products.

- By type, Cocoa Butter Equivalent (CBE) held the largest share, due to its high compatibility, melting properties, and wide use in confectionery and dairy.

- By application, confectionery was the dominant segment, as CBAs help stabilize costs amid soaring cocoa prices while maintaining chocolate quality.

Key Country Highlights

- United States: Rising cocoa prices and evolving consumer demand drive CBE use in chocolate, cookies, and frozen desserts; strong support from key players like Cargill and Bunge Loders Croklaan.

- India: Local manufacturers like Manorama Industries expanding CBE production to meet domestic and global demand.

- Germany & France: Major importers and innovators in shea- and palm-based CBAs; supportive EU regulations permit 5% CBA use in chocolate.

- China & Japan: Rising demand for Western confectionery and functional fats fuels market growth.

- Nigeria: Investment partnerships aim to double cocoa output, which could impact long-term CBA substitution trends.

Market Dynamics

Market Drivers

Increasing Cocoa Butter Prices are Strongly Influencing Market Growth

Cocoa butter is derived from cocoa beans and is one of the essential ingredients used in the chocolate and confectionery industry. In recent years, the price of cocoa beans has been increasing significantly due to less production, a decline in yield, adverse climate conditions, and others. The spread of diseases such as black pod disease in key cocoa-producing areas is affecting crop production and resulting in low cocoa yield. Therefore, the price of cocoa butter is increasing significantly in the global market.

According to the International Cocoa Organization, the average price of cocoa beans has increased from USD 2,540.99 per ton in January 2023 to USD 10,709.30 per ton in January 2025. Thus, the price of cocoa beans has increased by nearly 321.46% from 2023 to 2025. It has raised significant concern among chocolate, confectionery, and dairy & frozen dessert manufacturers across the globe and forced them to adopt alternative products. Cocoa butter alternatives are designed to mimic the functionalities of cocoa butter, making it ideal to replace cocoa butter to some extent and maintain stability in production costs. Increasing confectionery, bakery, and frozen food manufacturers' focus on incorporating CBAs in their products, which further contributes to the global cocoa butter alternatives market growth.

Regulatory Approvals and Adoption of CBAs in Wider Food Application is Likely to Propel Market Growth

Regulatory approvals play a vital role in fostering increased demand for food ingredients. Recently, regulatory associations such as the FDA, European Commission, and FSSAI have allowed the use of CBAs in chocolate, confectionery, bakery, and beverage products. However, they frame specific guidelines and restrictions on the use of CBAs in food applications. Cocoa butter alternatives allow manufacturers to create a wider range of confectionery products, which include different textures, flavors, and nutritional profiles. Furthermore, it assists manufacturers in maintaining profitability by reducing raw material costs, especially cocoa butter.

Regional regulators such as the EU Commission, FSSAI, and others permit up to 5% replacement of cocoa butter with certain vegetable fats. Furthermore, in Europe, the regulations allow manufacturers to use CBAs while still labeling products as "chocolate" under Directive 2000/36/EC. Such flexibility and support will allow manufacturers to participate in innovation activities. Therefore, the industry is witnessing a demand for such products. Increasing regulatory acceptance in the market is expected to contribute significantly in the coming years.

Market Restraints

Key Players’ Improvement in Cocoa Production Paired with Technical Challenges Hampers Market Growth

Amid rising cocoa butter prices, companies are actively reframing their strategies to achieve a more sustainable way of chocolate production. They are collaborating with farmers from key cocoa-producing countries such as Ghana and Côte d’Ivoire by investing sufficient funds in community development projects, providing training on modern farming techniques, and improving access to resources such as fertilizers or disease-resistant crops. Focusing on developing long-term partnerships with farmers will help to source quality raw materials at a reasonable price.

They are focusing on mitigating supply chain issues which will help to acquire raw materials at a stable price. They are also concentrating on mitigating supply chain issues which will help to acquire raw materials at a stable price. Suppose chocolate companies are procuring cocoa beans at a lower price range. In that case, companies may not opt for substitute products such as CBR, CBS, and CBE. It may adversely affect the market growth in the upcoming years. For instance, in February 2025, Johnvents Group (Johnvents), an agribusiness and manufacturing conglomerate, British International Investment (BII), and the U.K.’s Development Finance Institution (DFI), partnered to invest nearly USD 40.5 million to improve the production of cocoa in Nigeria. The partnership of these two companies is aimed at increasing production from 13,000 to 30,000 metric tons per year.

Market Opportunities

Expansion of Cocoa Butter Alternatives into Cosmetics, Pharmaceutical, and Personal Care Industries to Present Growth Opportunities

The global market for substitutes for cocoa butter has been experiencing growth due to increasing demand from the pharmaceuticals, cosmetics, and personal care markets. Such markets demand natural and cost-effective substitutes for cocoa butter, which are predominantly sourced from shea butter, coconut oil, and other sources. Furthermore, these substitutes play a vital role in pharmaceutical products, as they provide an appropriate base for the delivery of medication.

Market Challenges

Price Volatility Coupled with Sourcing and Environmental Concerns to Pose a Challenge for Market Growth

The price of raw materials such as shea butter, palm oil, and other fats used as cocoa butter replacements can fluctuate, which may be significantly affected by factors such as geopolitical events, weather, and supply & demand disparities. Moreover, the use of palm oil in cocoa butter substitutes highlights issues about deforestation and biodiversity implications, further raising concerns over sustainable sourcing practices.

Cocoa Butter Alternatives Market Trends

New Product Launches and Base Expansion to Propel Industry Growth in the Near Future

The acceptance of cocoa butter alternatives such as CBE, CBS, and CBR across multiple food applications is emerging globally. Furthermore, the positive changes in the industrial environment to adopt new, innovative, and sustainable ingredients are additionally contributing to the adoption of vegetable fats and CBAs in confectionery and ice cream products. Key companies are emphasizing expanding their production capacity to meet upcoming industrial demand. Companies from developing countries such as China, Japan, India, South Korea, and Indonesia are actively investing in production expansion. Key industry players such as Manorama Industries, Usha Edible Oil, Musim Mass Group, and others easily access raw materials such as palm, palm kernel, kokum butter, and mango kernel for the production of CBAs.

For instance, in July 2024, Manorama Industries, one of the key Indian CBA manufacturers, opened its new production plant in Raipur, Chhattisgarh. The company aims to increase its total fractionation capacity to 40,000 tons per annum to meet the rising demand for Cocoa Butter Equivalents (CBE) from the chocolate, confectionery, and cosmetics industries.

Download Free sample to learn more about this report.

Impact of COVID-19

As the global lockdown and movement restrictions were implemented in early 2020, the suspension of the supply chains created significant challenges for the production, transportation, and distribution of cocoa butter alternative products. Many of these alternatives, such as shea butter, palm oil derivatives, and other plant-based fats, are obtained from regions that experience serious logistical disruptions.

Palm oil is mainly produced in Indonesia and Malaysia, where the outbreak of COVID-19 led to a lack of labor in plantations and processing units. Lockdown, travel restrictions, and health-related workforce deductions imposed by the government slowed down production and processing activities. The palm-based fat and low availability of shea butter increased their market prices, putting financial pressure on the manufacturers who rely on these materials. In addition to the disruption of the supply chain, demand fluctuations affected the product industry in many ways. The food industry, especially the chocolate and confectionery areas, observed changes in consumer behavior throughout the pandemic. Initially, as the lockdown was implemented, the demand for various food products, including chocolate and bakery products, increased, leading to CBA demand.

Segmentation Analysis

By Type

Cocoa Butter Equivalent Dominated Owing to their Compatibility and Flexibility

Based on type, the global market is categorized into cocoa butter substitutes, cocoa butter equivalent, and cocoa butter replacers.

The cocoa butter equivalent segment held the largest market share in 2024. It is traditionally developed to mimic the functional properties of cocoa butter closely. The Cocoa Butter Equivalent (CBE) is a versatile ingredient actively used in wider food applications, including bakery, fillings, chocolate, cookies, and dairy products. The solid fat content in fractionated palm stearin, shea butter, and fractionated palm kernel oil is much harder and has a melting point between 35 and 40°C. High flexibility and compatibility with various vegetable fats, and the high melting properties of CBE make it more beneficial for end-use applications.

Additionally, the segment’s growth is driven by growing product developments and launches under CBE categories that meet the end-use consumers' demand. Over the past decade, key players such as AAK AB, Musim Mas, Cargill Incorporated, Manorama Industries, and Fuji Oil have introduced advanced CBE products. Thus, it displays the highest growth potential of CBE products in the industry and is anticipated to exhibit the highest CAGR during the forecast period.

Cocoa Butter Substitute (CBS) is another prominent segment that held 50.23% of market share in 2026 and is anticipated to showcase a promising growth scenario during the forecast period. As compared to the cocoa butter equivalent, CBS is less expensive and has a softer profile. It melts at 30°C, serving as an effective fat replacer in biscuit filling creams or chocolate centers, where its rapid melting provides a pleasing cooling sensation in the mouth.

To know how our report can help streamline your business, Speak to Analyst

By Application

Confectionery Segment Led Due to a Surge in Demand for Chocolate and Confectionery Products

Based on application, the global market is categorized into bakery, confectionery, dairy and frozen desserts, beverages, and others.

The confectionery segment dominated the market in 2024 and is expected to grow at a CAGR of 9.51% during the forecast period (2025-2032) . Cocoa butter equivalents are largely used in chocolate and confectionery products, as they closely mimic cocoa butter’s functional properties. Confectionery manufacturers are incorporating CBS and CBE to maintain price stability, as surging cocoa butter prices have affected their price strategy.

Globally, the confectionery industry presented promising growth in 2024. According to the National Confectioners Association, 52-week sales of confectioneries ended in August 2024, reported USD 21.4 billion, USD 12.4 billion, and USD 4.5 billion of chocolate, candy, and gum & mints were respectively sold in the U.S. Increasing confectionery sector sales is likely to drive the ingredients demand in the upcoming years.

The dairy and frozen desserts segment is another leading segment, exhibiting the fastest growth rate of 9.76% during the forecast period 2025-2032. Specialty fats, especially cocoa butter alternatives, are cost-effective alternatives for many dairy products.

The bakery segment is estimated to capture a market share of 18% in 2025.

Cocoa Butter Alternatives Market Regional Outlook

On the basis of region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Europe

Europe Cocoa Butter Alternatives Market Size, 2025 (USD billion)

To get more information on the regional analysis of this market, Download Free sample

Europe dominated the global cocoa butter alternatives market share with a valuation of USD 0.67 billion in 2025 and USD 0.72 billion in 2026. Europe is known to have a strong potential for CBAs, such as shea butter, in food products. It is a cost-effective ingredient and a great cocoa butter alternative used in baked goods, pastries, and chocolates. The U.K. market continues to expand, projected to be valued at USD 0.06 billion in 2026. The growing demand for plant-based diets further drives demand for products. This region has a large bakery and confectionery industry, with rising demand for plant-based oils and fats. According to the European Union, the imports of plant-based oils and fats increased by 1.7% in volume to 470 thousand tons in 2023. The major markets for the product are Germany, France, the Netherlands, and the U.K. Furthermore, manufacturers in the region are shifting away from using palm oil as ethical and sustainable sourcing is becoming more important. Germany is anticipated to reach a market value of USD 0.11 billion in 2026 and France is projected to be valued at USD 28.83 million in 2025.

Asia Pacific

Asia Pacific is the second largest market with a valuation of USD 0.44 billion in 2026, exhibiting a CAGR of 9.99% during the forecast period (2025-2032). This region has been witnessing rapid growth owing to rising disposable incomes, changing dietary habits, and increasing urbanization. The growing popularity of Western-style confectionery products and the expanding middle-class population have led to increased consumption of baked goods and chocolates, thereby fueling the demand for CBAs in the region. The region boasts a warmer climate, which poses handling and logistical challenges for cocoa butter, further fueling the demand for CBAs. India is poised to be valued at USD 0.13 billion in 2026.

North America

North America is the third largest market with a market size of USD 0.37 billion in 2026. The chocolate industry in North America is continuously evolving as consumer preferences shift toward indulgent, sustainable, and affordable products. In the past couple of years, the price of cocoa butter has increased significantly. It has burdened confectionery industry players to find alternatives that offer the same rich texture and sensory experience without inflating costs. CBAs have emerged as a viable solution, providing flexibility in the production of confectioneries, cookies & ice creams while helping companies manage costs and meet the growing demand for eco-friendly products.

Key players from the American market, such as AAK AB, Cargill Inc., Blommer Chocolate Company, and Bunge Loders Croklaan, are collaborating with industry researchers and oil & fat manufacturers. It may offer new opportunities for companies in the upcoming years.

The U.S. is the leading market for CBAs in North America. The emerging confectionery industry, bakery & desserts sectors, and ice cream applications are significantly driving the demand for CBAs, especially CBE, in the country. Increased new product launches, technical innovation, and improved R&D activities will strengthen the market growth over the forecast period. For instance, in December 2020, Bunge Loders Croklaan, a subsidiary of Bunge Limited that specializes in producing & supplying plant-based specialty oils and fats, launched a shea-only Cocoa Butter Equivalent (CBE) – Karibon in the U.S. The U.S. market is anticipated to be valued at USD 0.33 billion in 2026.

Latin America

Latin America is known to be one of the largest producers of cocoa beans, exhibiting a valuation of USD 0.23 billion in 2026. However, the region faces significant challenges in cocoa cultivation. The majority of the producers in this region have low incomes and are vulnerable to climate change; in addition, the loss of biodiversity and low diversification make smallholders face limited access to niche markets. These challenges push manufacturers to opt for alternatives or replacers to traditional cocoa butter and further fuel the demand for cocoa butter alternatives such as shea butter. Moreover, the growth of the food and cosmetic industries in the region has further contributed to the demand for the product.

Middle East & Africa

Market growth in the region is emerging with potential in the coming years. The rising consumer awareness of sustainable and cost-effective ingredients and the growing food processing industry have been gradually contributing to the adoption of cocoa butter alternatives in the region. The UAE market is projected to reach a market value of USD 62.18 million in 2025.

Competitive Landscape

Growing Focus on New Product and Base Expansion Strategies to Attain Competitive Edge

Key Market Players

The global cocoa butter alternatives market is characterized as moderately fragmented, indicating a diverse competitive landscape with numerous players operating across various regions. The industry has grown with the efforts and dominance of established as well as a few small regional key players. Major companies such as Fuji Oil Holdings, Cargill Inc., AAK AB, Barry Callebaut AG, and Musim Mas Group face fierce competition from numerous smaller firms. The prominent players in the global market focus on two primary strategies: new product launches, followed by base expansion to expand their product lineup and strengthen their regional presence.

Get comprehensive study about this report by, Download free sample copy

Fuji Oil Holdings is one of the largest market players and holds a prominent share of the market. This company offers a wide range of alternative cocoa butter products, including Palmy MM7, Melano SP10N, and others, catering to various end-use industry players such as bakery, dairy, confectionery, frozen desserts, and others. Cargill Inc. has emerged as the second key player in the market by successfully positioning itself in the chocolate and chocolate ingredient manufacturing sector, which is increasingly popular among consumers seeking alternatives to cocoa butter. Barry Callebaut AG is another prominent player in the market. The company is one of the largest chocolate manufacturers across the globe, actively adopting new product development and R&D activities to improve alternative products for cocoa butter.

List of Key Cocoa Butter Alternative Companies Profiled

- Cargill, Incorporated (U.S.)

- Barry Callebaut AG (Switzerland)

- Fuji Oil Company, Ltd. (Japan)

- Olam International (Singapore)

- Bunge Ltd. (U.S.)

- AAK AB (Sweden)

- Wilmar International Ltd. (Singapore)

- Musim Mas Group (Singapore)

- Ariyan International Inc. (Canada)

- Manorama Industries Limited (India)

Key Industry Developments

- March 2025 – Fuji Oil Holdings, a major Japanese manufacturer of industrial chocolate and plant-based food solutions, launched cacao-free alternative chocolate in response to the rising cost of cocoa. This innovative product leverages Fuji Oil's expertise in vegetable oils and fats to create a sustainable and cost-effective chocolate substitute.

- October 2024 – “Döhler” announced a strategic partnership with “Nukoko,” the company behind the world’s first cocoa-free ‘bean-to-bar’ chocolate. This partnership is expected to enable both companies to scale Nukoko’s fermentation process to an industrial level by the end of 2025. Its cocoa-free chocolate is made possible through its patent-pending fermentation technology, which mimics traditional cocoa fermentation to create chocolate’s characteristic flavors from fava beans.

- July 2024 – Bunge introduced Coberine 206, a revolutionary shea-based Cocoa Butter Equivalent (CBE) designed to address key challenges in the soft chocolate and ganache market. The new product delivers an indulgent taste experience with a premium, soufflé-like texture, elevating soft chocolate creations.

- June 2024 – “Blommer Chocolate,” a subsidiary of Fuji Oil Holdings, launched “Elevate Chocolate Coatings.” The coatings are a product made with an ingredient as an alternative to traditional cocoa butter. Elevate’s coatings utilize Cocoa Butter Equivalent (CBE) technology and were formulated to integrate with cocoa butter.

- May 2023 – AAK introduced a plant-based compound called CEBES Choco 15, a Cocoa Butter Substitute (CBS) designed to enhance the cocoa content in chocolate formulations. This innovation addresses challenges such as bloom and sensory quality issues that arise when cocoa levels exceed 5% in traditional CBS formulations.

Report Coverage

The global cocoa butter alternatives market report analyzes the market in depth. It highlights crucial aspects such as prominent companies, market trends, market segmentation, competitive landscape, product types, distribution channels, and application usage areas. Besides this, it provides insights into the global demand for CBAs and highlights significant industry developments. In addition to the aspects mentioned earlier, it encompasses several factors contributing to the market growth over recent years.

To gain extensive insights into the market, Download for Customization

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.91% from 2026 to 2034 |

|

Unit |

Value (USD billion), Volume (Tons) |

|

Segmentation |

By Type

By Application

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 1.95 billion in 2026 and is anticipated to record a valuation of USD 4.15 billion by 2034.

The global market is projected to grow at a significant CAGR of 9.91% during the forecast period of 2026-2034.

By type, the cocoa butter equivalent segment dominated the market.

Increasing cocoa butter prices are likely to drive the global market.

Cargill Inc., Fuji Oil Company, Ltd., AAK AB, and Olam International are some of the leading players globally.

The U.S. dominated the global market in 2024.

New product launches and base expansion are the latest trends in the global market.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us