Commercial HVAC System Market Size, Share & Industry Analysis, By Product Type (Heating Equipment {Boilers, Heat Pumps, Furnaces, and Unit Heaters}, Cooling Equipment {Unitary AC, VRF Systems, Chillers, Room AC, & Coolers and Cooling Towers}, and Ventilation Equipment {Air-Handling Units, Air Filters & Purifiers, & Ventilation Fans}), By Capacity (Up to 10 Tons, 10 to 25 Tons, & Above 25 Tons), By Application (Office Buildings, Retail Spaces, Hospitality, Healthcare, Education, Transportation & Public Venues, and Government & Institutional Buildings), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

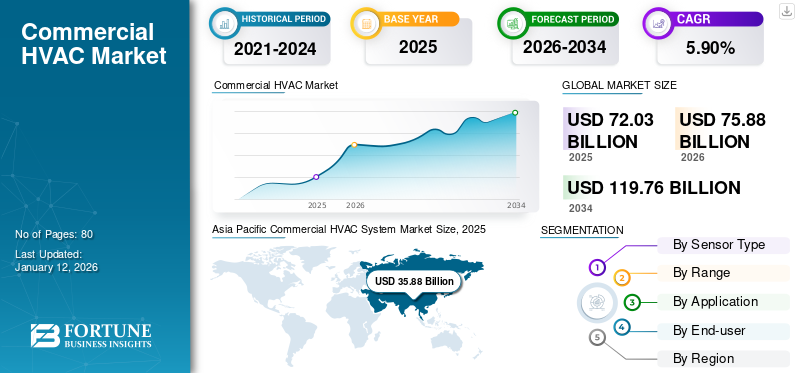

The global commercial HVAC system market size was valued at USD 72.03 billion in 2025 and is projected to grow from USD 75.88 billion in 2026 to USD 119.76 billion by 2034, exhibiting a CAGR of 5.90% during the forecast period. Asia Pacific dominated the commercial HVAC system market with a market share of 49.80% in 2025.

Commercial HVAC systems are used to control ventilation, heating and air conditioning of large buildings including hospitals, shopping centers, offices, and others. It regulates humidity, temperature and airflow, offering comfortable, safe, and healthy indoor environment.

The market is growing rapidly due to growing demand for energy efficient solutions, surging in construction products majorly across urban areas, and improvements in smart technologies that focus on enhanced indoor air quality.

Few prominent players operating in the market are Daikin Industries, Ltd., Carrier Global Corporation, Trane Technologies, Lennox International, Inc., Nortek, Panasonic Holdings Corp., and others.

MARKET DYNAMICS

Market Drivers

Rapid Urbanization & Commercial Real Estate Drives the Market Development

Growing urbanization and commercial real estate is driving the global commercial HVAC system market growth. This has surged the construction of commercial buildings including retail spaces, offices, hospitals, and others. Such infrastructures require sophisticated ventilation, heating and air conditioning systems which safeguards individual’s comfort and health. Moreover, a significant part of global population is shifting in urban settings, leading to a growth in commercial infrastructures and fueling the market growth.

Additionally, the development of smart city projects across developing economies are also fueling large-scale demand for advanced, energy-efficient HVAC installations. For instance, according to the Indian Press Information Bureau (PIB.gov), as of May 2025, a total of 7,555 smart city projects in India (94% of the total 8,067 projects) have been completed. Additionally, 512 projects are in the advanced stages of implementation. Such factors boost the market expansion globally.

Market Restraints

High Initial Investment and Installation Costs Hampers the Market Growth

Commercial HVAC systems demand higher initial investments and installation expenses, especially for advanced VRF and chiller systems, creating limitations, particularly for smaller businesses. Economic insecurity with growing interest rates also restricts the adoption of commercial HVAC products as it could delay or cut down the investments in these products. Additionally, lack of skilled workforce, complex regulatory landscape, and dynamic energy standards could also deter the overall market development.

Market Opportunities

Increasing Number of Last-Mile Delivery Solutions Offers Lucrative Growth Opportunities

Surging consumer demand for faster deliveries are allowing logistics firms to adopt advanced last-mile delivery solutions. This has pushed companies to invest in urban distribution and micro-fulfillment centers, demanding compact and energy efficient HVAC equipment for humidity monitoring, ventilation and maintaining indoor air quality.

For instance, according to the World Economic Forum, last-mile deliveries have surged in large part due to the significant increase in e-commerce, with sales reaching USD 5.8 trillion in 2023 and expected to increase by 39% by 2027.

Additionally, growing of temperature sensitive last mile deliveries including pharmaceuticals, grocery and cold-chain logistics also demands HVAC units, transport refrigeration, and chillers. These factors create potential growth opportunities for the market.

COMMERCIAL HVAC SYSTEM MARKET TRENDS

Integration of AI, IoT, and Predictive Maintenance Has Emerged as a Prominent Market Trend

Advancements in technologies including artificial intelligence, Internet of Things (IoT), and predictive analytics boosts the overall market development. Smart commercial HVAC systems use IoT sensors to track different parameters such as humidity temperature, pressure, and energy consumption.

Additionally, AI-driven analytics recognize inadequacies, predict component wear (compressors, filters, motors), and suggest maintenance prior to its occurrence. This also results in lower maintenance expenses (up to 20–30%), reduced downtime, and longer lifespan of the equipment. One such key example includes Johnson Controls’ AI-enabled “OpenBlue” platform and Trane’s “Symbio” smart controllers, which are widely deployed in smart commercial buildings, highlighting the industry’s growth momentum.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Product Type

Growth of Retrofits Across Aging Infrastructures Boosts Heating Equipment Segment Growth

Based on the product type, the market is segmented into heating equipment, cooling equipment and ventilation equipment. Heating equipment is further sub-segmented into boilers, heat pumps, furnaces, and unit heaters, cooling equipment into unitary air conditioners, VRF Systems, chillers, room air conditioner, and coolers and cooling towers, and ventilation equipment into air-handling units, air filters, air purifiers, ventilation fans, and others.

The heating equipment segment is projected to dominate the commercial HVAC system market, accounting for 47.72% of the global market share in 2026. This dominance is attributed to the growing use of furnaces, boilers, and heat pumps across cold-climate commercial facilities. This may include healthcare institutions, office complexes, and educational buildings. Additionally, the growth of retrofits in different aging building stock as well as government incentives for energy-efficient heating technologies also boosts the segment’s dominance.

Ventilation equipment segment is expected to grow with a highest CAGR over the forecast period. This is due to growing investments in high-efficiency air handling units (AHUs), energy recovery ventilators (ERVs), and HEPA filtration by schools, hospitals, airports, and office complexes/buildings. Additionally, different standards including WELL Building Standard, ASHRAE 62.1 and IGBC focus on ideal ventilation for occupant’s health and comfort, thus boosting the demand for different ventilation equipment.

By Capacity

Growing Demand for 10 To 25 Tons from Medium Sized Commercial Facilities to Drive the Segment Growth

The market is divided into Up to 10 tons, 10 to 25 tons, and above 25 tons, based on capacity.

Among these, the 10 to 25 tons segment dominated the market with a revenue share of USD 45.34 billion in 2024. It is also expected to grow with highest growth rate during the forecast period. This growth is attributed to its increased demand from medium-sized commercial facilities such as schools, office buildings, mid-sized hospitals, retail stores, and restaurants. This capacity range balances the load needed and efficiency, thus making it highly suitable for zoned heating or cooling and modular installation. The 10 to 25 tons capacity segment is expected to lead the market, contributing 66.76% globally in 2026.

Additionally, the rapid shift of companies toward sustainability upgrades, electrification of HVAC, and replacement cycles also augments the segment’s expansion. The growing number of green building projects emphasizing medium capacity and modular HVAC for energy-efficient zoning contributes to the segment’s growth.

Additionally, the above 25 tons’ segment is growing substantially, due to its growing need from large scale complexes including airports, corporate buildings, shopping malls, data centers, and hospitals. These infrastructures demand high capacity systems that aids in efficient cooling and heading due to higher footfall and equipment loads.

By Application

To know how our report can help streamline your business, Speak to Analyst

Expansion of Corporate Real Estate Augments the Office Buildings & Corporate Campuses Segment Growth

Based on the application, the market is divided into office buildings & corporate campuses, retail spaces, hospitality, healthcare, education, transportation & public venues, government & institutional buildings, and others.

Office buildings & corporate campuses segment held the highest market share in 2024 with a revenue share of USD 22.37 billion. The segment is also expected to grow with a highest CAGR over the forecast period. This growth is due to expanding corporate real estate and energy-efficient retrofits. Additionally, its long term growth owing to the corporate ESG commitments, net-zero goals, and IAQ-focused retrofits contributes to the segment’s dominance.

On the other hand, retail spaces segment holds a substantial market share. This is due to the growing demand for improved customer experiences and energy efficiency across retail spaces such as supermarkets, shopping malls, and departmental stores.

COMMERCIAL HVAC SYSTEM MARKET REGIONAL OUTLOOK

Geographically the market is segmented into North America, Europe, Asia Pacific, Latin America and Middle East & Africa.

North America

Asia Pacific Commercial HVAC System Market Size, 2025 (USD Billion) To get more information on the regional analysis of this market, Download Free sample

The North America commercial HVAC system market is growing substantially due to increase in demand for energy efficient solutions by large infrastructures. Additionally, strict government standards and green building policies including LEED certification also pushes businesses to adopt advanced HVAC systems. The U.S. leads the North American market with an expected revenue share of USD 17.38 billion in 2025.

Europe

The European market is substantially growing and likely to contribute to a revenue share of USD 10.01 billion in 2025. This is attributed to the growing focus of governments on sustainability and energy efficiency. This is also supported by various EU regulations including Energy Performance of Buildings Directive (EPBD). The UK market reaching USD 1.55 billion by 2026 and the Germany market reaching USD 2.98 billion by 2026.

Asia Pacific

Asia Pacific dominates the market with a revenue share of USD 35.88 billion in 2025. The region is also predicted to expand with largest CAGR over the forecast period. This regional growth is due to growing number of construction projects associated with office buildings, metro stations, airports, shopping malls, and hospitality facilities across China, India, Southeast Asia, and Japan. The Japan market reaching USD 9.29 billion by 2026, the China market reaching USD 16.01 billion by 2026, and the India market reaching USD 7.00 billion by 2026.

According to Airports Council International, authorities are planning to fund around USD 240 billion during 2025 to 2035 in infrastructure expansion and modernization of airports in Asia Pacific & Middle East. This will increase the demand for large HVAC systems across terminals, passenger halls, lounges, air-conditioning, ventilation, and other components.

Additionally, government and authorities are focusing on ventilation and filtration systems in airports, offices, and healthcare facilities. This increases the demand for AHUs, ERVs, and HEPA solutions. For instance, according to Asian Development Bank (ADB), USD 1.7 trillion annual infrastructure investment is predicted across Asia Pacific until 2030, where a substantial portion will be linked to commercial buildings that require HVAC installations.

Latin America and Middle East & Africa

The markets of Latin America and Middle East & Africa are growing with an expected share of USD 1.66 billion and USD 3.18 billion respectively in 2025 due to rapid urbanization, infrastructure development, dynamic climate conditions, energy efficiency regulations and economic investments by different countries. GCC countries are predicted to have a market share of USD 2.07 billion by 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Growing Focus of Key Players on Innovation and New Launches Leads to their Dominating Market Positions

The global commercial HVAC industry is highly fragmented with different market players operating in the market. These include Gree Electric Appliances Inc., Nortek, Panasonic Holdings Corp., Rheem Manufacturing Co., Acumatica, Inc., MIDEA Group Co. Ltd., and others. These companies implement different strategic initiatives including new launches, mergers, acquisitions, and investment in new technologies to sustain the market competition.

LIST OF KEY COMMERCIAL HVAC SYSTEM COMPANIES PROFILED

- Daikin Industries, Ltd. (Japan)

- Carrier Global Corporation (U.S.)

- Trane Technologies (U.S.)

- Johnson Controls International plc (Ireland)

- Mitsubishi Electric Corporation (Japan)

- Lennox International, Inc. (U.S.)

- Gree Electric Appliances Inc.(China)

- Nortek (U.S.)

- Panasonic Holdings Corp. (Japan)

- Rheem Manufacturing Co. (U.S.)

- Acumatica, Inc. (U.S.)

- MIDEA Group Co. Ltd. (China)

KEY INDUSTRY DEVELOPMENTS

- September 2025- Mitsubishi Electric Corporation has announced the upcoming shipment of its latest Compact DIPIPM (Dual In-line Package Intelligent Power Module) series, designed for use in consumer and industrial applications such as packaged air conditioners and heat pump.

- July 2025- Midea launches new business “Midea Building Technologies” to enter commercial building air conditioning market in Thailand. It aims to build air conditioning factory with production capacity of 6 units per year in Rayong, highlighting energy-saving technology to respond to the growing demand for HVAC market, supporting the economy and generating jobs in the country.

- June 2025- The National HVAC collective Ambient Enterprises announced the launch of its representative firm, Nevada Systems Group (NSG), based in Las Vegas, Nevada. Nevada Systems Group will serve the dynamic Las Vegas market and surrounding areas, specializing in applied HVAC sales and solutions.

- February 2025- Bosch Group received the Competition Commission of India’s (CCI) approval for its USD 8 billion acquisition of Johnson Controls International’s (JCI) residential and light commercial heating, ventilation, and air-conditioning (HVAC) sbusiness.

- October 2024- Johnson Controls-Hitachi Air Conditioning Singapore has launched its VG and S Series centrifugal chillers that provide commercial customers in Singapore with highly energy efficient cooling systems and solutions. Both the VG and S Series use environmentally friendly R1234ze ultra-low global warming potential (GWP <1) refrigerant, aiding to further decrease greenhouse gas emissions.

REPORT COVERAGE

The global report provides a detailed analysis of the market and focuses on key aspects such as prominent companies, deployment modes, types, and end users of the product. Besides this, it offers insights into the commercial HVAC system market trends and highlights key industry developments and market share analysis for key companies. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Growth Rate |

CAGR of 5.90% from 2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type · Heating Equipment o Boilers o Heat Pumps o Furnaces o Unit Heaters · Cooling Equipment o Unitary Air Conditioners o VRF Systems o Chillers o Room Air Conditioner o Coolers and Cooling Towers · Ventilation Equipment o Air-Handling Units o Air Filters o Air Purifiers o Ventilation Fans o Others (Humidifiers, etc.) |

|

By Capacity · Up to 10 Tons · 10 to 25 Tons · Above 25 Tons |

|

|

By Application · Office Buildings & Corporate Campuses · Retail Spaces · Hospitality · Healthcare · Education · Transportation & Public Venues · Government & Institutional Buildings · Others |

|

|

By Region · North America (By Product type, Capacity, Application and Country/Sub-region) o U.S. (By Product type) o Canada (By Product type) · Europe (By Product type, Capacity, Application and Country/Sub-region) o U.K. (By Product type ) o Germany (By Product type ) o France (By Product type ) o Italy (By product type) o Spain (By product type) o Scandinavia (By product type) o Rest of Europe (By product type) · Asia Pacific (By Deployment Type, End-User, and Country/Sub-region) o China (By product type) o Japan (By product type) o India (By product type) o Australia (By product type) o Southeast Asia (By product type) o Rest of Asia Pacific (By product type) · Latin America (By Deployment, Type, End-User, and Country/Sub-region) o Argentina (By product type) o Brazil (By product type) o Rest of Latin America (By product type) · Middle East & Africa (By Deployment, Type, End-User, and Country/Sub-region) o GCC (By product type) o South Africa (By product type) · Rest of the Middle East & Africa (By product type ) |

Frequently Asked Questions

The global commercial HVAC system market size was valued at USD 72.03 billion in 2025 and is projected to grow from USD 75.88 billion in 2026 to USD 119.76 billion by 2034, exhibiting a CAGR of 5.90%

The market is expected to exhibit steady growth at a CAGR of 5.90% during the forecast period.

Rapid urbanization & commercial real estate growth drives the market growth.

Daikin Industries, Ltd., Daikin Industries, Ltd., Trane Technologies, and Johnson Controls International plc are some of the top players in the market.

The Asia Pacific region held the largest market share.

North America was valued at USD 33.93 billion in 2025.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us