Concrete Admixtures Market Size, Share & Industry Analysis, By Type (Water Reducing Admixtures, Accelerating Admixtures, Water Proofing Admixtures, Retarding Admixtures, Air Entraining Admixtures, and Others), By Application (Residential, Infrastructure, Commercial, and Industrial), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

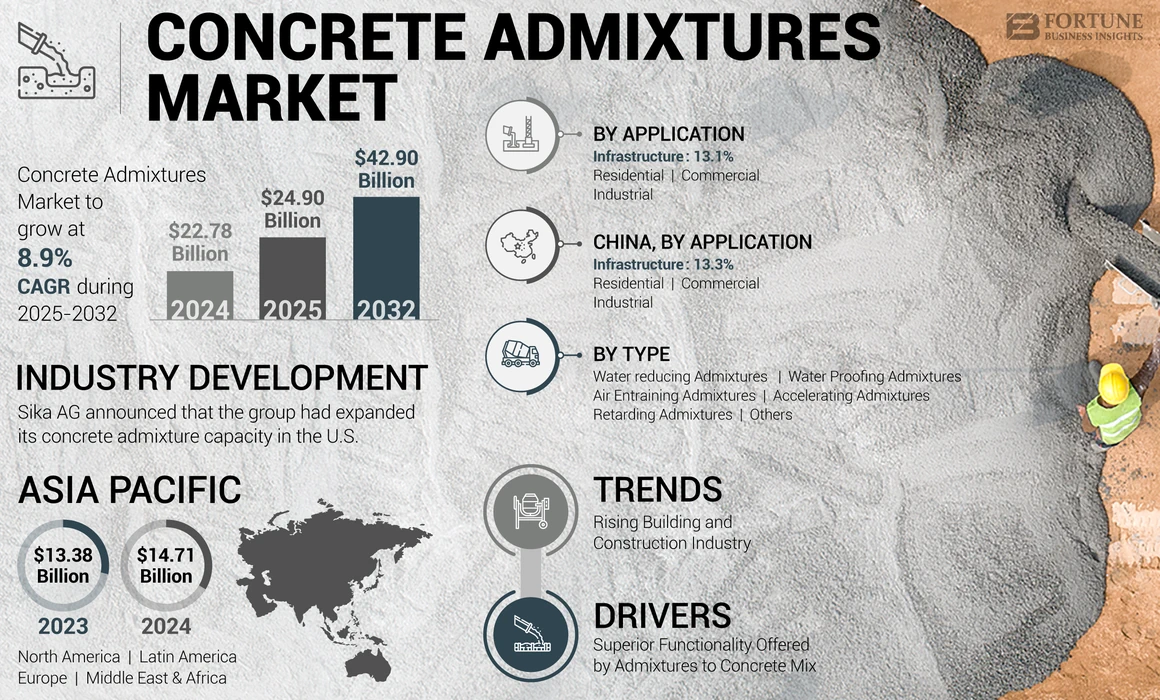

The global concrete admixtures market size was valued at USD 22.78 billion in 2024. The market is projected to grow from USD 24.90 billion in 2025 to USD 42.90 billion by 2032, exhibiting a CAGR of 8.9% during the forecast period. Asia Pacific dominated the concrete admixtures market with a market share of 64.57% in 2024. Moreover, the concrete admixtures in the U.S. is projected to grow significantly, reaching an estimated value of USD 3.08 billion by 2032, driven by the momentum towards high performance concrete.

Concrete admixtures are the mixtures of additives used in making different kinds of concrete, including pre-cast concrete, sprayed concrete, and ultra-high performance concrete to enhance their structural properties, such as durability, strength, enhanced modular ratio, and improved unit weight. These properties can be achieved by the various kind of admixtures, including water-reducing admixtures, accelerating admixtures, waterproofing admixtures, retarding admixtures, and air-entraining admixtures.

The rapid growth of the construction industry, coupled with growing contractors' preference to adapt these admixtures to enhance concrete performance and reduce material waste, is expected to boost the demand for concrete admixtures in the coming years.

The pandemic impacted the ongoing R&D activities to improve the development of concrete admixtures, which caused financial loss to the key operating players in the market. This failed the new construction chemicals launched in the market, such as concrete admixtures, additives, and reinforced fibers, as the key end-users were not operating and were not familiar with these products. Thus, all these factors created short-term challenges for the global market.

However, after the novel coronavirus pandemic, key players and contractors started to store building materials, such as aggregates, cement, additives, and admixture, to avoid a shortage of raw materials in case of the re-occupation of the lockdown. This has created an untapped opportunity for manufacturers across the globe.

GLOBAL CONCRETE ADMIXTURES MARKET SNAPSHOT & HIGHLIGHTS

Market Size & Forecast:

- 2024 Market Size: USD 22.78 billion

- 2025 Market Size: USD 24.90 billion

- 2032 Forecast Market Size: USD 42.90 billion

- CAGR: 8.9% from 2025–2032

Market Share:

- Asia Pacific led the global concrete admixtures market in 2024 with a commanding share of 64.57%, driven by rapid infrastructure expansion and urbanization across China, India, and Southeast Asia. The region saw an increase from USD 13.38 billion in 2023 to USD 14.71 billion in 2024.

- By type, water reducing admixtures held the largest share in 2024 due to their ability to enhance concrete strength, durability, and workability.

- By application, the residential segment dominated the market in 2024, supported by rising single-family housing demand and improving credit access. The infrastructure segment is projected to hold a 13.1% share in 2024.

Key Country Highlights:

- China: Infrastructure segment expected to hold a 13.3% market share in 2024, driven by expansive government investments in smart cities and transport systems.

- United States: Market projected to reach USD 3.08 billion by 2032, fueled by demand for high-performance concrete and ongoing infrastructure renewal programs.

- India: Witnessing robust demand from both residential and infrastructure sectors due to urban migration and housing initiatives.

- Germany: Emphasis on sustainable construction materials is driving adoption of low-VOC admixtures across commercial and industrial applications.

- Brazil & Mexico: Government-backed infrastructure development and growing consumer construction demand are boosting market growth.

- Saudi Arabia & UAE: Mega construction initiatives, including NEOM and Vision 2030 projects, are creating significant opportunities for admixture applications.

Concrete Admixtures Market Trends

Rising Building and Construction Industry to Present Lucrative Opportunities

Concrete admixtures are increasingly used in residential constructions to enhance the original properties of the concrete, achieve higher engineering specifications, minimize conditions contributing to the failure of specialized designs, and reduce the overall construction cost. This, in turn, is contributing to the growth of the building and construction industry. Additionally, developing countries in Asia Pacific are home to around 60% of the world's population. People in countries, such as China, India, and some ASEAN countries have witnessed significant improvement in their living standards and purchasing power over the past few decades. Improved spending ability coupled with the untapped regional construction industry is likely to prompt the initiation of new infrastructure and construction projects during the forecast period, presenting lucrative opportunities for the market. Asia Pacific witnessed a concrete admixtures market growth from USD 13.38 billion in 2023 to USD 14.71 billion in 2024.

Download Free sample to learn more about this report.

Concrete Admixtures Market Growth Factors

Superior Functionality Offered by Admixtures to Concrete Mix Drives Market Growth

Various factors contribute to the growth of concrete admixtures market such as increased construction activities, emphasis on infrastructural development, growing urbanization, and growing demand for advanced and high performance concrete with improved properties.

Concrete admixtures are natural or synthetic chemicals that are used as concrete additives during the mixing process or just before the process of mixing to enhance specific properties or impart desired properties to the concrete mix. Depending upon their application and functionality, they are grouped as water-reducing, accelerating, waterproofing, and retarding admixtures. The use of these admixtures enables the preparation of concrete with extended workability and high-strength development with better setting characteristics. Admixtures improve the durability of concrete structures by increasing resistance to chemical environment, enhancing resistance to freeze-thaw cycles, and reducing permeability which further leads to longer life and reduced need for maintenance and replacement. This also aligns with sustainability principles by extending the life of infrastructure. Additionally, the application enables greater relative dispersibility and slump protection, uniform distribution of ingredients of concrete mix, imparting a desired rheology to the concrete mixture.

Moreover, the water-to-cement ratio is the crucial factor determining the strength and durability of the concrete. Apart from that, the fluidity and rheology of concrete play an important role in determining the strength of the concrete by affecting the porosity of the concrete. In this aspect, different concrete admixtures, such as water-reducing admixtures, provide excellent functionality with a reduction of water content by around 15% to 30%. It not only reduces water content but also integrates water reduction, shrinkage, reinforcement, and environmental protection. It has emerged as an ideal mixture for preparing high-performance and high-strength concrete. Hence, such beneficial factors of the product are expected to augment the concrete admixtures market growth during the forecast period.

Moreover, environmental concerns coupled with sustainable construction practices influence the adoption of concrete admixtures. These admixtures reduce carbon emissions and improve the overall sustainability of the concrete. The replacement of one portion of cement by SCMs, such as admixtures, contributes to the reduction of carbon footprints in the concrete production process.

RESTRAINING FACTORS

Stringent Government Regulations On Construction Materials to Limit Market Growth

Implementation of stringent environmental regulations by governments on construction materials across nations is expected to have a negative impact on the market. Raw materials for chemical admixtures are mainly sourced from petrochemical products, which further leads to increasing environmental damage along with petrochemical resource consumption.

The increasing environmental issues and rising expectations from the public toward reducing pollution levels have forced several countries to introduce a new set of rules and regulations in the construction industry. Nowadays, many consumers are becoming increasingly aware and concerned about environmental health. These factors led governments from many countries to establish methodologies to monitor the adverse effects of pollution caused by chemical manufacturing industries in collaboration with the private sector and international organizations. Hence, such factors are expected to hinder the market growth.

Concrete Admixtures Market Segmentation Analysis

By Type Analysis

Water Reducing Admixtures Segment Accounted for the Larger Share Due to its Characteristics

Based on type, the market is segmented into water reducing admixtures, accelerating admixtures, water proofing admixtures, retarding admixtures, air entraining admixtures, and others.

The water reducing admixtures segment held the highest concrete admixtures market share in 2024. Water-reducing admixtures are also known as plasticizers and help to maintain an adequate proportion of water in the concrete mixture, which helps in enhancing the strength and durability of the concrete. Hence, growing product innovation coupled with increasing its adoption in the construction industry as it enhances bonds between concrete and steel while preventing cracking, honeycombing, segregation, and bleeding will fuel the segment's growth.

The air entraining mixture segment is growing at a rapid pace owing to the growth of the concrete admixture product consumption in the building and construction industry. These admixtures improve the properties of the concrete by forming non-coalescing air bubbles throughout the mixture and help to enhance its workability.

Retarding admixtures are also called retarders and are mainly used in high-temperature zones where concrete settles quickly. These admixtures reduce the hydration rate of cement in the initial stages and enhance the initial setting time of the concrete.

The growing demand for waterproofing admixtures to make the hardened concrete structure impermeable to water and prevent the dampness of the concrete surface will drive segment growth in the coming years.

Accelerating admixtures find their expanding demand from residential and infrastructure building and construction projects. These admixtures are mainly used for reducing the initial setting time of the concrete and improving the earlier hardening of the concrete, which plays an important role in determining the strength of the concrete; hence, they are widely used in crucial infrastructure developments.

Other segments of admixtures include pozzolanic admixtures, gas-forming admixtures, air-detraining admixtures, and alkali-aggregate expansion-inhibiting admixtures. The use of these admixtures mainly depends on the purpose of the building and construction project for which concrete is used. For instance, pozzolanic admixtures are used to prepare dense mixtures for water-retaining structures, including dams and reservoirs.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Residential Segment Dominated the Market Owing to Growing Preference for Single-Family Housing Structures

Based on the application, the market is segmented into residential, infrastructure, commercial, and industrial.

In the global market, the residential segment accounted for the largest share in 2024. The rising population and growing preference for single-family housing structures are the factors driving the growth of residential constructions. This is expected to positively impact the concrete admixture demand for residential applications during the forecast period. In addition, ease of credit access and interest rates in the market play an important role in the overall demand for residential housing structures, indirectly influencing the market's growth.

The infrastructure segment is the fastest-growing application owing to rising public and private investments in infrastructure projects, including hospitals, educational buildings, government offices, correction facilities, roads, reservoirs, and dams. Moreover, rising industrialization in developing countries across the globe is anticipated to play a key role in driving the demand for concrete admixture applications in the industrial building and construction market. The growth of the service sector in developing countries, leading to increased demand for commercial building constructions, is anticipated to play a key role in driving the commercial segment. The infrastructure segment is expected to hold a 13.1% share in 2024.

REGIONAL INSIGHTS

The market is analyzed across North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Asia Pacific Concrete Admixtures Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific accounted for the largest market share and the market was valued at USD 14.71 billion in 2024. In this region, demand for concrete admixtures is expanding due to the continuously growing building & construction sector, which includes new construction and renovation activities. Rising infrastructure investment is leading due to an increase in industrial operations, especially in China and India, further propelling the growth of the construction and building industry and boosting product demand.

- In China, the Infrastructure segment is estimated to hold a 13.3% market share in 2024.

To know how our report can help streamline your business, Speak to Analyst

North America

North America and Europe are growing at a significant rate in the global market. High lending rates and increasing construction costs have affected the new commercial constructions in these regions. However, the market in North America and Europe is anticipated to gain momentum from the rising household formations and strong housing markets. Governments’ initiatives to support the building and construction industry and consumer demand for larger houses are the factors driving the market growth in regions.

Latin America

In Latin America, the availability of natural resources at relatively lower prices and favorable government policies have raised industrialization activities in the region. This, in turn, increased consumer expenditure positively, driving the growth of the building & construction industry. In a nutshell, factors such as rising commercial real estate investments, increasing consumer expenditure, and increased industrial activity are driving the admixture demand in the region.

Middle East & Africa

The market in the Middle East & Africa is anticipated to rise at a significant rate during the forecast period. The rising industrialization in South Africa and GCC countries plays a key role in driving the region’s growth in building and construction activities. The growing residential building sector in Egypt, Nigeria, Kenya, and Ethiopia is expected to drive the product demand in the Middle East & Africa.

KEY INDUSTRY PLAYERS

Expansion of Production Capacity and Development of Renewable Products to Provide Competitive Edge

The market is moderately fragmented. However, there are a few major players, including Sika AG, CEMEX S.A.B. de C.V., BASF SE, GCP Applied Technologies, and Mapei S.P.A., that hold considerable market share. These companies have significant production capabilities for admixtures and are investing in research and development for manufacturing renewable products. Other key players involved in the market are focusing on enhancing their manufacturing capacities to meet the rising demand in the market.

List of Top Concrete Admixtures Companies:

- Buildtech Products (India)

- Sika AG (Switzerland)

- RAZON ENGINEERING COMPANY PRIVATE LIMITED (India)

- Flowcrete Group Ltd. (U.K.)

- CEMEX S.A.B. de C.V. (Mexico)

- BASF SE (Germany)

- GCP Applied Technologies (U.S.)

- RPM International Inc. (U.S.)

- Fosroc International Inc. (UAE)

- Mapei S.P.A (Italy)

- CICO Technologies Ltd. (India)

- CHRYSO S.A.S (France)

- Master Builders Solutions (Canada)

KEY INDUSTRY DEVELOPMENTS:

- November 2023: Sika AG announced that the group had expanded its concrete admixture capacity in the U.S. The company continues to invest in its polymer production at its Sealy site in the U.S. state of Texas. Sika’s latest move marks its second polymer investment in the state of Texas in just five years. The company requires polymers for chemical building blocks that are needed to produce Sika ViscoCrete, a high-performance, resource-saving concrete admixture. The company initiated this expansion to meet the growing demand for its products in the U.S. and Canada.

- June 2023: Fosroc India launched a state-of-the-art Concrete Lab in Chennai that will provide advanced building material testing facilities to developers, contractors, and other construction professionals.

- April 2023: CHRYSO (Saint-Gobain Construction Chemicals) announced the development of a solution for the use of ultra-low carbon concrete based on the new admixture CHRYSO EnviroMix ULC 5500, specially designed for H-UKR type cement by Hoffmann Green Cement Technologies.

- May 2022: Tremco CPG India, a parent company of Flowcrete, opened a new manufacturing plant in Alwar, Rajasthan (India), to keep up with the growing demand for construction chemical products in South Asian countries. The new facility spans 50,000 sq. Ft and will produce highly specialized products, including powder, admixtures, waterproofing, and resin flooring systems. Tremco CPG India's new plant will aim to expand its presence in such an important and rapidly growing market.

- June 2021: Mapei, a leading company in supplying chemical products and solutions for the building industry, and Elettrondata, a leader in automation systems for the management, production, and control of ready-mix concrete plants, signed a multi-year partnership agreement to offer equipment and services for quality control, production and transport of ready-mix concrete.

REPORT COVERAGE

The research report provides both qualitative & quantitative insights on admixtures used in concrete manufacturing across the world. Quantitative insights include market sizing in terms of value (USD Billion) across each segment, sub-segment, and region profiled in the scope of the study. Also, it provides market analysis and growth rates of segments, sub-segments, and key counties across each region. Qualitative insight covers the elaborative analysis of key market drivers, restraints, growth opportunities, and industry trends related to the market. The competitive landscape section covers detailed company profiling of the key players operating in the industry.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

CAGR (2024-2032) |

CAGR of 8.9% from 2025-2032 |

|

Unit |

Value (USD Billion), Volume (Kiloton) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 22.78 billion in 2024 and is projected to reach USD 42.90 billion by 2032.

Growing at a CAGR of 8.9%, the market will exhibit steady growth over the forecast period.

The water reducing admixtures segment was the leading type in the market.

Superior functionality offered by admixtures to the concrete mix is driving the market growth.

Asia Pacific dominated the market share in 2024.

Sika AG, CEMEX S.A.B. de C.V., BASF SE, GCP Applied Technologies, and Mapei S.P.A are a few of the leading players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us