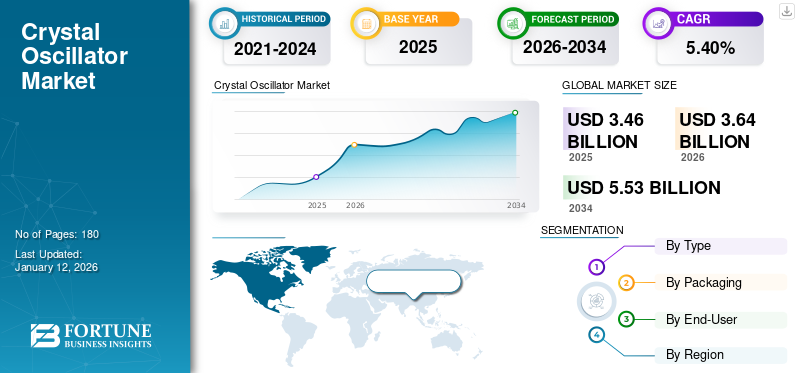

Crystal Oscillator Market Size, Share & Industry Analysis, By Type (Simple Packaged Crystal Oscillator (SPXO), Temperature-Compensated Crystal Oscillator (TCXO), Voltage-Controlled Crystal Oscillator (VCXO), Over-Controlled Crystal Oscillator (OCXO), and Others (Frequency-Controlled Crystal Oscillator (FCXO), etc.)), By Packaging (Surface Mounted (SMT/SMD) and Through-Hole), By End-user (Consumer Electronics, Telecommunications, Automotive, Industrial, Aerospace & Defense, Healthcare, and Others (Energy & Utilities, etc.), and Regional Forecast, 2026–2034

Crystal Oscillator Market Size and Future Outlook

The global crystal oscillator market size was valued at USD 3.46 billion in 2025 and is projected to grow from USD 3.64 billion in 2026 to USD 5.53 billion by 2034, exhibiting a CAGR of 5.40% during the forecast period. Asia Pacific dominated the crystal oscillator market with a market share of 46.90% in 2025.

A crystal oscillator is an electronic device that utilizes the mechanical resonance of a vibrating crystal (usually quartz) to produce a stable frequency signal. The frequency is employed to measure time (in clocks and watches), stabilize frequencies in radio transmitters and receivers, and deliver a stable clock signal for digital integrated circuits. The demand for these systems is gaining prominence fueled by electronic device’s need for precise timing and frequency control. The market for crystal oscillators has been witnessing consistent development due to growing demand in consumer electronics, telecommunications, automotive industry, and industrial applications.

Seiko Instruments, Texas Instruments, Murata Manufacturing, SiTime Corporation, CTS Corporation, Epson, and Q-Tech Corporation are constantly developing new products, consisting of low-power oscillators, high-frequency oscillators, and TCXO for a number of applications.

Impact of AI

AI Integration Enhances Oscillator Performance, Efficiency, and Demand in Advanced Applications

Artificial Intelligence (AI) is contributing positively toward the crystal oscillator market by improving design, manufacturing, and quality checking procedures. AI algorithms facilitate predictive modeling for optimizing oscillator performance, frequency stability, and minimizing power consumption. During the manufacturing process, AI supports early defect and anomaly detection, enhancing efficiency and yield. Furthermore, AI-based systems within end-market applications such as 5G, autonomous cars, and IoT, require precision timing. As AI technologies develop, they offer smarter integration of oscillators in system-on-chip (SoC) designs for faster data processing and improved synchronization in intricate, real-time communication and control systems.

Crystal Oscillator Market Trends

Miniaturized Surface-Mount Oscillators Enabling Compact, Efficient, and High-Performance Electronics

The crystal oscillator industry is witnessing a shift the move toward mini surface-mount oscillators, fueled by the need for smaller, lighter electronic devices. These are heavily used in smartphones, wearables, and IoT devices, where space constraints and low power usage are essential. Surface-mount technology also allows for automatic assembly and improves the manufacturing process. In addition to compact size, there is emphasis on improving temperature stability, frequency accuracy, and environmental robustness. Integration with system-on-chip (SoC) designs is on the rise, facilitating faster communication. Manufacturers are creating oscillators with better jitter and low phase noise to address the requirements of high-speed, precision applications.

Download Free sample to learn more about this report.

Market Dynamics

Market Drivers

Growing Demand for Precision Timing Fuels Crystal Oscillator Adoption in Next-Gen Electronics

The growing demand for precision timing in electronic systems pushes the crystal oscillator market growth. Smartphones, tablets, laptops, and wearables are dependent upon oscillators for synchronization, wireless connectivity, GPS, and media streaming. The expansion of smart home automation systems and IoT devices surge demand for compact, energy-efficient oscillators. 5G, AI, and edge computing also require high-frequency, low-latency oscillators for reliable operation. Crystal oscillators ensure timing accuracy throughout these systems for smooth communication.

Market Challenges

Volatility in Quartz Price and Emerging MEMS Alternatives Affect Market Development

Despite strong demand, the crystal oscillator market growth faces key challenges. Quartz price volatility affects production costs and supply stability, with high-purity quartz crystals being limited and expensive. The rise of MEMS-based oscillators, such as small size, low power, and high durability, among other advantages, is a growing concern. MEMS oscillators are gaining traction in applications where ultra-high precision is not critical, threatening quartz's dominance, especially in low and mid-range markets. Additionally, the need for high-performance, smaller devices raises production costs. Such setbacks drive manufacturers to emphasize value differentiation, innovation, and supply chain resilience to remain viable in the dynamic market.

Market Opportunities

Strong Growth Opportunities in Automotive, 5G, and IoT Drive Market Expansion

The crystal oscillator market offers lucrative opportunities, particularly in automotive electronics, 5G infrastructure, and IoT. In autonomous and connected cars, oscillators enable real-time GPS, radar, infotainment, and ADAS. These applications demand precise timing and reliability under changing conditions. For example, the worldwide deployment of the 5G network and expanding IoT ecosystems require ultra-stable oscillators to provide synchronization and efficient data processing. Industrial IoT, smart manufacturing, and edge computing also rely on predictability. As the trend goes for miniaturized, low-energy, and low-power designs, the industry can meet escalating demand with high-performance solutions that are adaptable to evolving technology needs.

Segmentation Analysis

By Type

TCXO Leads with Superior Temperature Stability for Smartphones and Telecom

On the basis of type, the market is sub-divided into simple packaged crystal oscillator (SPXO), temperature-compensated crystal oscillator (TCXO), voltage-controlled crystal oscillator (VCXO), over-controlled crystal oscillator (OCXO), and others (frequency-controlled crystal oscillator (FCXO), etc.).

TCXOs are leading with a share of 37.49% in 2026 their frequency stability over temperature variations, used extensively in smartphones, telecom, and GPS-based navigation systems. In 2026, the temperature-compensated crystal oscillator (TCXO) segment garnered USD 1.22 billion.

OCXOs will grow at the fastest rate, with superior frequency stability suitable for aerospace, defense, and high-precision telecom systems that require ultra-reliable timing. During the forecast period, the over-controlled crystal oscillator (OCXO) segment is estimated to register a CAGR of 7.43%.

By Packaging

Surface-Mount Oscillators Dominate Due to Compact Size and Easy Integration in Telecom and Consumer Electronics

On the basis of packaging, the market is split into surface mount (SMT/SMD) and through-hole.

Surface-mount oscillators are highly preferred owing to their compact size with a share of 71.38% in 2026, simplicity of PCB mounting, and extensive application in telecom and small consumer electronics devices. In 2024, the sub-segment held a significant value of USD 2.33 billion and is also expected to grow at a CAGR of 5.93% during the projected timeframe.

Through-hole oscillators increase slowly, primarily applied in legacy and rugged industrial markets where new and compact offerings are less appropriate.

By End-user

Telecommunications is the Leading End-user with Demand for Precise Timing in Communication Networks

On the basis of end-user, the market is classified into consumer electronics, telecommunications, automotive, industrial, aerospace & defense, healthcare, and others (energy & utilities, etc.).

Telecom dominates the crystal oscillator market with a share of 30.42% in 2026, as crystal oscillators are necessary for timing and frequency control for mobile communication networks, broadband systems, and satellites. The sub-segment held its leading position in 2024 with USD 0.99 billion.

Automotive demonstrates the highest CAGR of 12.88%, fueled by increasing application of oscillators in ADAS, infotainment, navigation, and connected vehicle technologies.

To know how our report can help streamline your business, Speak to Analyst

Crystal Oscillator Market Regional Outlook

The market is studied in-depth and covers the following regions: North America, South America, Europe, the Middle East & Africa, and Asia Pacific.

Asia Pacific

Asia Pacific holds the leading position in the market and is estimated to hit USD 1.72 billion in 2026. The region leads the crystal oscillator market share with the fastest growth rate based on its electronics manufacturing capability, most active telecom growth, and high consumer demand across China, Japan, South Korea, and Taiwan. Based on these factors, India will reach USD 0.32 billion, while China will attain a market value of USD 0.49 billion in 2026 and The Japan market is projected to reach USD 0.41 billion by 2026.

North America and Europe

For 2026, North America and Europe’s anticipated market values are USD 0.9 billion in 2025 and USD 0.94 billion in 2026 respectively, where the U.S. is boosting North America’s growth with an anticipated valuation of USD 0.56 billion. North America and Europe continue steady growth, bolstered by well-established semiconductor industries, early mover advantage in adopting superior technologies, and uniform demand from telecom, defense, and automotive markets. Germany, France, and the U.K. are projected to reach market values of USD 0.13 billion, USD 0.13 billion, and USD 0.15 billion respectively, bolstering Europe’s market growth in 2026.

South America and the Middle East & Africa

South America and the Middle East & Africa are anticipated to grow gradually due to weak manufacturing infrastructure, decreased adoption of advanced electronics, and slower digital build-out. Anticipated by these factors, in 2025, South America will reach USD 0.14 billion and the Middle East & Africa will capture USD 0.20 billion. GCC is expected to capture a market value of USD 0.06 billion in 2025.

Competitive Landscape

Key Industry Players

Industry Leaders Focus on Innovation and Miniaturization to Maintain Dominance

The crystal oscillator market is competitive, with major companies like Seiko Epson Corporation, Murata Manufacturing Co., and Kyocera Corporation holding sway. They offer a range of precision oscillators for various applications in consumer electronics, telecom, and automotive industries. SiTime Corporation, known for its MEMS-based oscillators, is also becoming popular by offering energy-saving, compact versions of the traditional quartz oscillators. These industry leaders are pushing further innovation by focusing on performance, miniaturization, and low-power design to dominate the dynamic market.

List of Key Companies Profiled in the Report:

- Seiko Epson Corporation (Japan)

- Nihon Dempa Kogyo Co., Ltd. (Japan)

- TXC Corporation (Taiwan)

- Kyocera Corporation (Japan)

- Murata Manufacturing Co., Ltd. (Japan)

- SiTime Corporation (U.S.)

- Daishinku Corporation (Japan)

- Microchip Technology Incorporated (U.S.)

- Rakon Limited (New Zealand)

- Abracon LLC (U.S.)

Key Industry Developments:

- March 2025 – Rakon Limited's new Oven-Controlled Crystal Oscillator (OCXO) meets the accuracy needs of defense and military technology. The oscillators are intended to provide stable and accurate frequency control in critical mission systems under hostile and unstable conditions.

- January 2025 – Seiko Epson has released a portfolio of ultra-miniature quartz oscillators for wearable technology devices. They are designed for health monitoring devices, offering high frequency stability and power efficiency in a very small package that is needed for next-generation fitness wearables and medical wearables.

- June 2024 – Murata Manufacturing released new temperature-compensated crystal oscillators (TCXOs) for autonomous vehicles. The oscillators support real-time processing of data, GPS navigation, and radar systems in providing precise timing in autonomous driving systems under different environmental conditions.

- April 2024 – SiTime introduced a new generation of MEMS-based oscillators exclusively optimized for 5G telecommunications. The oscillators offer ultra-low jitter, low power, and high frequency stability, and are optimized for 5G infrastructure and edge compute applications.

- September 2023 – Kyocera launched its new generation of crystal oscillators to enable smart cities and industrial IoT solutions. The products offer high accuracy, long-term reliability, and low power, suitable for sensors, smart meters, and connected infrastructure in urban cities.

Report Coverage

This report offers an in-depth study of the crystal oscillator market including major trends, growth drivers, challenges, and opportunities. It analyzes top market players, technological trends, and regional themes and provides insights into new developments and competitive themes. The report further comprises detailed projections, enabling stakeholders to make informed choices based on prevailing market segments and future prospects.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

| ATTRIBUTE | DETAILS |

| Study Period | 2021–2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026–2034 |

| Historical Period | 2021–2024 |

| Growth Rate | CAGR of 5.40% from 2026 to 2034 |

| Unit | Value (USD Billion) |

| Segmentation |

By Type

By Packaging

By End-user

By Region

|

Frequently Asked Questions

As per Fortune Business Insights, the market’s value was USD 3.64 billion in 2025 and is anticipated to reach USD 5.53 billion by 2034.

The market is expected to depict a CAGR of 5.40% over the forecast period.

The market’s growth is primarily driven by the product’s high adoption in advanced electronics.

The surface mounted segment dominates and is anticipated to lead the market in future.

Asia Pacific holds the dominating market share and held a market value of USD 1.62 billion in 2025.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us