Data Diode Solution Market Size, Share & Industry Analysis, By Type (Regular Data Diode and Ruggedized Data Diode), By Application (Government, Energy and Power, Manufacturing, Oil and Gas, Aerospace and Defense, Critical Infrastructure, and Others), and Regional Forecast, 2026 – 2034

DATA DIODE SOLUTION MARKET SIZE AND FUTURE OUTLOOK

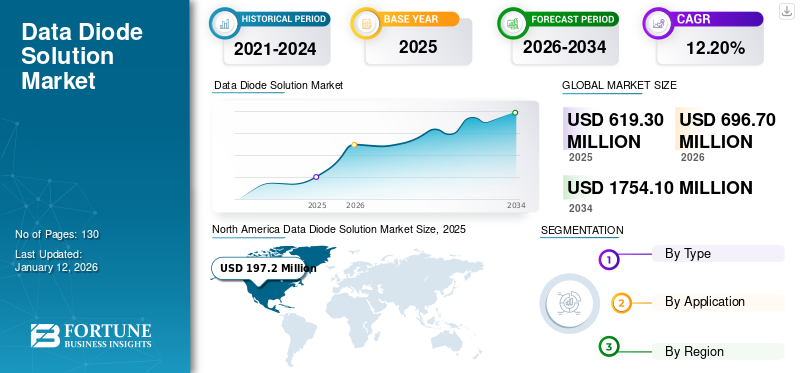

The global data diode solution market size was valued at USD 619.3 million in 2025. The market is projected to grow from USD 696.7 million in 2026 to USD 1754.1 million by 2034, exhibiting a CAGR of 12.20% during the forecast period. North America dominated the market with a share of 31.80% in 2025.

Data diode solutions are various hardware-based cybersecurity systems designed to ensure unidirectional data flow, prevent cyber threats and unauthorized access, and enable secure data transmission. These are widely adopted in critical infrastructure, defense, government, and industrial control systems where data integrity and confidentiality are paramount.

Increasing concerns over cybersecurity threats, regulatory compliance requirements, and growing adoption of industrial automation and IoT technologies drive the market. Additionally, advancements in artificial intelligence and machine learning have also enhanced data diode capabilities, further expanding their application scope.

The COVID-19 pandemic accelerated digital transformation and remote work adoption, thus increasing the demand for secure data transmission solutions. However, supply chain disruptions and budget constraints during the pandemic temporarily hindered the market growth.

The market also consists of various major players, such as BAE Systems plc, Belden Inc., Siemens, ST Engineering, Fibersystem AB, Everfox, Owl Cyber Defense, Fend Incorporated (OPSWAT Inc.), Advenica AB, and Patton LLC.

DATA DIODE SOLUTION MARKET TRENDS

Adoption of Data Diode Solutions in the Healthcare Industry to be a Prominent Trend in Upcoming Years

The digitization of laboratories and medical records has made it easier to access patient information and drive care procedures in the current era of healthcare digital transformation. Therefore, adopting digital medical equipment has brought higher accuracy and saved time, thus enhancing the efficiency of the patient experience.

However, this shift has increased the vulnerability of health systems to numerous types of cyberattacks.

- The largest breach of protected health information occurred in 2024 at UnitedHealth, a HIPAA-regulated entity, surpassing the earlier record of 78.8 million individuals set by Anthem Inc. in 2015. At least 100 million individuals, or nearly one-third of the U.S. population, had their PHI compromised in this ransomware attack.

- During the first half of 2024, around 387 data breaches affecting over 500 were reported to the U.S. Department of Health and Human Services’ Office for Civil Rights (OCR), showing a notable increase of 8.4% from the first half of 2023.

Data diodes ensure that sensitive information, such as clinical device data, healthcare documents, telemedicine, and diagnostic images, are secured from cyberattacks while enabling safe data sharing. As cyberattacks in the healthcare sector continue to rise rapidly, data diodes are anticipated to offer a crucial safeguard to maintain privacy and compliance.

MARKET DYNAMICS

Market Drivers

Growing Government Initiatives to Establish Effective Cybersecurity Framework in Industrial Environments to Drive Market Growth

The industrial control system has evolved significantly in recent years. It includes a wide range of interconnected devices which help companies understand and analyze the operational environment. While these benefits are significant, interconnected devices and technological advancements also bring various challenges, including cybersecurity risks and vital infrastructures vulnerabilities.

- According to the IBM X-Force Threat Intelligence Index 2024, the manufacturing sector was the top attacked industry by cybercriminals in 2023, accounting for around 25.7% of incidents within the top 10 attacked industries. Malware attacks (45%) make up the majority of those incidents, followed by ransomware (17%).

Cyber-related events involving control systems used to manage industrial operations are rising in the manufacturing sector. Programmable Logic Controllers (PLCs), distributed control systems, industrial IoT devices, and embedded systems are a few examples of these systems. These control systems comprise the operational technologies (OT) that allow facilities to operate effectively.

The integration of IT and OT increases the attack surface for businesses. Hence, the demand for unidirectional data transfer is augmenting the adoption of data diodes. Data diodes offer hardware-enforced security, ensuring that sensitive systems are protected from cyberattacks.

Governments worldwide are progressively allocating resources to combat security breaches and enhance industrial cybersecurity. For instance,

- The U.S. Federal Budget for FY 2025 continues to fund various cybersecurity programs to safeguard the nation from cyber threats. These investments focus on countering cyberattacks, strengthening federal cybersecurity measures, and protecting critical infrastructure. The Cybersecurity and Infrastructure Security Agency (CISA) receives approximately USD 3 billion from the budget. This comprises USD 41 million for critical infrastructure protection coordination, USD 470 million for network tool deployment, and USD 394 million for CISA's internal cybersecurity and analytical capabilities.

Hence, the data diode solution market growth is significant due to increased government support and spending by companies worldwide to counter cyberattack risks.

Market Restraints

High Costs Associated with These Solutions and Budget Constraints for Small & Medium-Sized Enterprises to Hinder Market Growth

To combat different cyberattacks, improved cybersecurity solutions are required as there is a growth in advanced threats and smarter attack tools. Traditional cybersecurity solutions cannot protect businesses from risks posed on cloud servers, networks, applications, and endpoints. To develop an advanced cyber framework integrated with data diode solutions, a company needs to invest significantly, which is a constraint for small and medium-sized businesses.

The initial cost of implementing data diode solutions is high. Significant upfront investments are required to replace aging cybersecurity infrastructure, set up field-level devices, implement advanced technologies, such as predictive maintenance IT/OT in companies for transmission networks between end-users, and manage new and existing systems within premises. High post-deployment operating and maintenance expenses are also a major challenge for cybersecurity and management authorities. Furthermore, restricted funds hinder the implementation of sophisticated technology and solutions by governments and commercial companies. All these factors collectively hamper the demand for these solutions during the forecast period.

Market Opportunities

Proliferation of Industrial Internet of Things (IIoT) to Offer Ample Growth Opportunities to Market Players

The emergence of the Internet of Things (IoT) is resulting in an unprecedented digital shift in industrial technology trends. This connects traditional industrial infrastructure with the latest technologies, including edge computing, machine learning, and cloud computing. It assists businesses in optimizing industrial processes to boost production and efficiency. However, IIoT devices often lack robust security capabilities, making them potential targets for cybercriminals.

- The SonicWall Cyber Threat Report published in mid-2024 revealed a year-to-date alarming rise of 107% in IoT malware attacks.

A security breach in an IIoT environment results in sensitive information leaks, operational failure, and harm to industrial controls, among others. Hence, enforcing strong endpoint security, including intrusion prevention systems, anti-malware software, and endpoint data diode solutions, can help defend IIoT devices from cyber threats.

Thus, the proliferation of IIoT offers ample growth opportunities to the data diode market as industries focus on securing critical infrastructure while enabling the real-time flow of data. Data diode offers a unidirectional security layer and ensures that the flow of data is outward while preventing inbound cyberattacks. Furthermore, traditional firewalls are enforced by configuration that is effective in showing threats and not stopping them. Software barriers provided by a firewall are capable of stopping minor threats. However, modern cyberattacks are more complex and coordinated attacks that require hardware-enforced isolation to reduce the threat of malware infiltration.

SEGMENTATION ANALYSIS

By Type

Ruggedized Data Diodes Lead the Market Due to Rising Demand for High Durability and Reliability

By type, the market is divided into regular data diode and ruggedized data diode.

Ruggedized data diodes held the largest market share with 66.99% in 2024. This growth is attributed to their widespread adoption in critical sectors such as defense, aerospace, and industrial automation, where harsh environmental conditions demand high durability and reliability. These solutions offer enhanced protection against extreme temperatures, vibrations, and physical tampering, making them ideal for military and industrial applications.

Meanwhile, regular data diodes hold the second-highest share as they are widely used in commercial enterprises, government networks, and financial institutions where environmental conditions are less stringent.

By Application

Growing Demand for Robust Cybersecurity Drives the Product Demand across the Critical Infrastructure Sector

Based on application, the market is divided into government, energy and power, manufacturing, oil and gas, aerospace and defense, critical infrastructure, and others.

Critical infrastructure accounts for the highest market share of 22.02% in 2025, due to industries such as defense, transportation, and government agencies prioritize robust cybersecurity solutions to protect sensitive data from cyber threats and nation-state attacks. The increasing frequency of cyberattacks on essential services has led to stricter regulations and greater investments in secure data transfer technologies.

Energy and power are expected to grow at the highest CAGR due to the rising adoption of smart grids, industrial IoT, and digitalization in power plants, which require secure and uninterrupted data flow to prevent cyber intrusions and operational disruptions.

Oil and gas segment is expected to grow at the highest CAGR of 12.64% during the forecast period (2025-2032).

To know how our report can help streamline your business, Speak to Analyst

DATA DIODE SOLUTION MARKET REGIONAL OUTLOOK

The market is segmented by region into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America Data Diode Solution Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America

North America accounted for the largest market share with a valuation of USD 197.2 million in 2025 and USD 221.2 million in 2026. Due to its technologically advanced infrastructure, high defense and government investments, and the presence of major market players such as Owl Cyber Defense, Forcepoint, and Cisco. The U.S. market value stood at USD 127 million in 2026 and is leading the region with its stringent data protection laws and the growing adoption of secure data transfer solutions in critical infrastructure, finance, and healthcare sectors. Additionally, increasing cyber threats and nation-state attacks also drive continuous investments in advanced cybersecurity technologies.

Download Free sample to learn more about this report.

Asia Pacific

Asia Pacific holds the third largest-market share with a valuation of USD 162.1 million in 2026 and is expected to grow at the highest CAGR due to rapid digitalization, increasing cyber threats, and government-led cybersecurity initiatives in countries such as China, India, Japan, and South Korea. China market continues to expand, projected to reach USD 41 million in 2026. The expansion of critical infrastructure projects, smart cities, and industrial automation is driving demand for secure data transfer solutions across the region. Additionally, rising geopolitical tensions and cyber warfare concerns are pushing governments and enterprises to strengthen their cybersecurity frameworks in the region. India is anticipated to reach a market value of USD 21.8 million in 2026, while Japan is expected to be valued at USD 26.7 million in the same year.

Europe

Europe holds the second-highest market share of USD 188.9 million in 2026, exhibiting a CAGR of 13.27% during the forecast period (2026-2034). This growth is driven by strict data protection regulations such as GDPR and growing concerns over cyber threats in sectors such as finance, defense, and transportation. Countries such as the U.K., Germany, and France are investing heavily in secure communication networks to comply with regulatory requirements and protect national security assets. The U.K. market continues to expand, projected to reach USD 33.5 million in 2026. Additionally, the increasing adoption of industrial automation and connected systems further fuels the demand for data diode solutions. Germany is expected to reach a market value of USD 35.8 million in 2026, while France is anticipated to be valued at USD 26.92 million in 2025.

Middle East & Africa and South America

The Middle East & Africa and South America are experiencing average growth in the market due to gradual digital transformation and increasing awareness of cybersecurity risks. The Middle East & Africa market value stood at USD 77.1 million in 2026. This region is witnessing growth due to investments in critical infrastructure protection and national cybersecurity strategies. GCC is projected to reach a market value of USD 33.55 million. South America’s market is driven by regulatory advancements and modernization efforts in sectors, such as energy and finance However, budget constraints and limited cybersecurity infrastructure in some regions pose challenges to rapid market expansion.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Strategic Alliances and Investments Pave the Way for Growing Business Trajectories

The market players are updating their existing products and developing new products to meet the changing customer requirements. Innovations, advancing present portfolios, and new integrations help businesses increase their product expertise, deliver better user experience, and determine measurable evaluations and analyses for marketers. In addition, strategic agreements, partnerships & collaborations, and mergers & acquisitions are prominent fundamental business strategies adopted by every market player to expand their business operations and geographical presence. The strategy aids in the overall development and expansion of the data diode solution market share.

Major Players in the Data Diode Solution Market

To know how our report can help streamline your business, Speak to Analyst

The key players in the market hold a 65–70% market share due to their strong brand presence, extensive R&D investments, and established customer base across critical industries such as defense, government, and energy. These companies offer advanced, highly secure, and regulatory-compliant solutions, making them the preferred choice for organizations with stringent cybersecurity requirements. Additionally, strategic partnerships, mergers, and acquisitions further strengthen their market dominance by expanding their technological capabilities and global reach.

List of Key Data Diode Solution Companies Profiled:

- BAE Systems plc (U.K.)

- Belden Inc. (U.S.)

- Siemens (Germany)

- ST Engineering (Singapore)

- Fibersystem AB (Sweden)

- Everfox (U.S.)

- Owl Cyber Defense (U.S.)

- Fend Incorporated (OPSWAT Inc.) (U.S.)

- Advenica AB (Sweden)

- Patton LLC (U.S.)

- Fox-IT (U.S.)

- Deep Secure Ltd. (U.K.)

- Oakdoor (U.K.)

- Rohde & Schwarz GmbH & Co (Germany)

- Rovenma (Turkey)

- VADO Security Technologies Ltd. (Israel)

- Garland Technology (U.S.)

- Waterfall Security Solutions Ltd. (Israel)

KEY INDUSTRY DEVELOPMENTS:

In December 2024, OPSWAT acquired Fend Incorporated, a cybersecurity firm specializing in securing operational technology. This acquisition enhances OPSWAT’s portfolio with advanced Data Diodes and Unidirectional Gateways, integrating proprietary technologies for threat prevention and data protection.

In November 2024, Patton, a provider of cybersecurity for communication networks, announced the launch of its advanced Data Diode Controller Software. This innovative solution enhances cybersecurity by enabling secure file transfers, data extraction, and log export across air-gapped, unidirectional Data Diode segments.

In June 2024, Advenica launched a second-generation Gigabit Ethernet-based data diode, DD1G. This hardware can be used as a standalone cybersecurity solution or integrated with Advenica’s Data Diode Engine proxy software for advanced applications.

In April 2024, Owl Cyber Defense Solutions announced the launch and general availability of Owl Talon 3, the next generation of its flagship data diode software. This release marks the first in a series of planned advancements in Owl’s hardware-enforced one-way data transfer technology.

In March 2024, Advenica launched a new service for its Data Diode Engine, introducing support for the MQTT IoT messaging standard in version 1.1. The Data Diode Engine is a proxy software that facilitates efficient and safe data transfer through Ethernet-based data diodes, supporting network segmentation across various installation environments.

INVESTMENT ANALYSIS AND OPPORTUNITIES

The market presents strong investment potential, driven by increasing cybersecurity concerns, regulatory compliance mandates, and rising adoption in critical infrastructure sectors such as defense, energy, and finance. Key opportunities lie in technological advancements, including AI-driven security enhancements, integration with cloud-based solutions, and expansion into emerging markets, including Asia Pacific and the Middle East. Additionally, growing investments in industrial automation, IoT security, and secure data transfer for remote operations create lucrative prospects for market expansion and innovation.

REPORT COVERAGE

The global market report covers an overview of the market and centers on central characteristics such as main players, their product/service types, and their use cases in the market. Besides, the report offers insights into the market trends and highlights current market-related improvements. In addition, the report covers the competitive landscape of the overall market. Further, the report also comprises several factors that backed the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 12.20% from 2026 to 2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Type, By Application, and Region |

|

Segmentation |

By Type

By Application

By Region

|

|

Companies Profiled in the Report |

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 1754.1 million by 2034.

In 2025, the global market was valued at USD 619.3 million.

The market is projected to grow at a CAGR of 12.20% during the forecast period.

By application, the critical infrastructure segment led the market in 2026.

Increasing government initiatives to establish effective cybersecurity framework in industrial environments to drive market growth.

BAE Systems plc, Belden Inc., Siemens, ST Engineering, and Fibersystem AB are the top players in the market.

North America held the highest market share in 2026.

By type, the ruggedized data diode is expected to grow at the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us