Deutetrabenazine Market Size, Share & Industry Analysis, By Application (Huntington's Disease, Tardive Dyskinesia, and Others), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies & Drug Stores, and Online Pharmacies), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

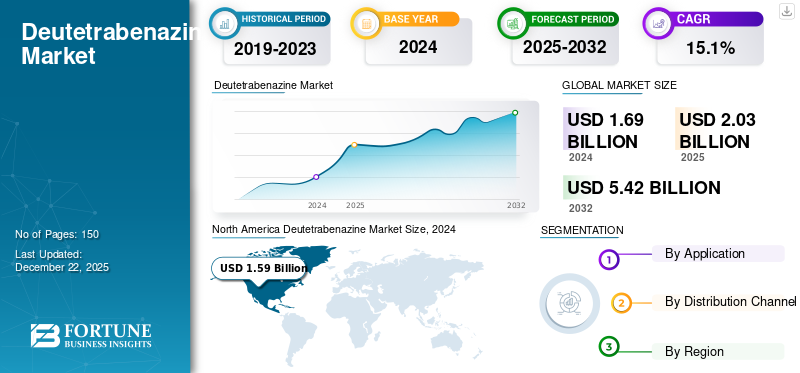

The global deutetrabenazine market size was valued at USD 0.350 billion in 2025. The market is projected to grow from USD 0.377 billion in 2026 to USD 0.418 billion by 2032, exhibiting a CAGR of 1.32% during the forecast period. North America dominated the deutetrabenazine market with a market share of 30.61% in 2025.

Deutetrabenazine is a vesicular monoamine transporter 2 (VMAT2) inhibitor that helps manage involuntary movements. The introduction of extended-release formulations and growing regulatory approvals across regions are accelerating the adoption rate. The market is exhibiting strong growth, driven by the increasing prevalence of neurodegenerative disorders, especially Huntington's disease and tardive dyskinesia. Along with this, the increasing focus of pharmaceutical companies on expanding applications of this drug is also expected to support market growth.

Teva Pharmaceutical Industries Ltd. is a prominent market player with an approved product offering. Currently, the drug is patent-protected; thus, the generic versions of this product are unavailable.

Global Deutetrabenazine Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 0.350 billion

- 2026 Market Size: USD 0.377 billion

- 2034 Forecast Market Size: USD 0.418 billion

- CAGR: 1.32% from 2026–2034

Market Share:

- North America dominated the deutetrabenazine market with a 30.61% share in 2025, driven by the high prevalence of Huntington’s disease and tardive dyskinesia, frequent regulatory approvals, and strong R&D presence.

- By application, the tardive dyskinesia segment held the largest market share in 2024, attributed to high disease prevalence and rising awareness initiatives leading to increased diagnosis and treatment adoption.

Key Country Highlights:

- United States: Strong adoption of new therapies, significant presence of Teva Pharmaceutical Industries Ltd., and active awareness campaigns supporting disease education.

- Europe: Growing public healthcare funding, increasing disease awareness, and expanding use of deutetrabenazine in treatment protocols driven by EMA approvals.

- China: Rising focus on expanding neurological care infrastructure, increased regulatory approvals for AUSTEDO, and initiatives to boost early diagnosis.

- Japan: Steady rise in awareness for neurodegenerative disorders, expansion of specialized healthcare services, and growing adoption of advanced VMAT2 inhibitors for disease management.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Prevalence of Neurodegenerative Disorders to Propel Market Growth

The increasing prevalence of neurodegenerative disorders, especially tardive dyskinesia (TD) and Huntington's disease (HD), is the major factor driving the deutetrabenazine market growth. Factors contributing to the rising prevalence include increased diagnostic awareness, availability of genetic testing, and potentially improved life expectancy for people with HD. Predictive genetic testing allows individuals to determine if they carry the HD gene even before symptoms appear, leading to earlier diagnosis. Additionally, as more people are aware of HD and the genetic testing options, earlier and more accurate diagnoses are possible. All these factors result in a high number of patient populations, in turn increasing the demand for therapeutics such as deutetrabenazine, which is approved for both tardive dyskinesia (TD) and Huntington's disease (HD).

- For instance, according to the data provided by the Rare Disease Advisory in August 2023, the estimated prevalence of Huntington’s disease is 8.87 per 100,000 persons in North America.

MARKET RESTRAINTS

Manufacturing and Regulatory Complexity to Limit Market Expansion

The manufacturing of the drug is a complex process, resulting in higher manufacturing costs. The deuteration process increases the production cost of this drug, affecting pricing strategies and limiting affordability in emerging economies. Additionally, adverse reactions associated with long-term consumption of products hinder product adoption, in turn limiting the market growth.

Furthermore, extensive U.S. Food and Drug Administration and EMA requirements for post-marketing surveillance, labeling changes, and safety monitoring prolong the time-to-market for newer formulations. This also negatively impacts the overall market growth.

MARKET OPPORTUNITIES

Introduction of Extended-Release Versions is Expected to Impact Market Growth Positively

In the past few years, the pharmaceutical company involved in offering these medications has shifted its focus to the development of extended-release versions of this drug. This is expected to offer a lucrative growth opportunity in the market due to increasing adoption. For instance, In May 2024, Teva Pharmaceuticals has launched AUSTEDO XR, an extended-release tablet, which simplifies the dosing regimen to once daily to enhance patient compliance and convenience.

MARKET CHALLENGES

Competition from Other VMAT2 Inhibitors to Hamper Market Growth

VMAT2 inhibitors face competition from other drugs, mainly from within the VMAT2 inhibitor class and from alternative therapies for conditions such as tardive dyskinesia (TD). Key competitors include Xenazine (tetrabenazine) and Ingrezza (valbenazine). All of these drugs are VMAT2 inhibitors with varying dosing regimens and side effect profiles. Additionally, certain atypical antipsychotics and adjunctive therapies may offer alternative management strategies for TD. Furthermore, drugs, including valbenazine (Ingrezza), also treat tardive dyskinesia, creating competitive pricing and market share pressures.

Deutetrabenazine Market Trends

Geographical Expansion and Patent Lifecycle Management

Currently, AUSTEDO is the only approved drug of this class, the company is focusing on geographical expansion to capture the untapped avenues of the market. High growth potential in Asia Pacific, particularly in China, India, and South Korea, due to rising diagnosis rates, healthcare funding, and awareness campaigns, has resulted in increasing availability of drugs in these countries.

On the other hand, major players are extending product life cycles via strategic patent filings and formulation improvements, limiting early generic competition, and maintaining market exclusivity.

- For instance, multiple patents, with estimated generic launch dates post-2030, protect AUSTEDO.

Download Free sample to learn more about this report.

Segmentation Analysis

By Application

Rising Prevalence and Product Adoption to Support Tardive Dyskinesia Segment Growth

Based on application, the market is divided into Huntington's disease, tardive dyskinesia, and others.

The tardive dyskinesia segment held the largest deutetrabenazine market share in 2024. The high prevalence of the disease, coupled with rising government initiatives to increase awareness, resulting in growing disease diagnosis and treatment, are the major factors driving the segment growth.

- For instance, in May 2022, in the first full week of May, the U.S. government organized Tardive Dyskinesia Awareness Week.

The Huntington’s disease segment is projected to grow at a notable CAGR during the projected period. The growth is driven by the rising focus on research & development for innovative drugs by the operating players.

By Distribution Channel

Increase in Patient Flow Supported Hospital Pharmacies Segment Growth

Based on distribution channel, the market is segmented into hospital pharmacies, retail pharmacies & drug stores, and online pharmacies.

The hospital pharmacies segment captured the dominating share in 2024. These medications need to be prescribed by medical professionals only, resulting in higher patient flow in hospitals. Owing to this, the distribution of drugs through hospital pharmacies is increasing.

The retail pharmacies & drug stores segment is expected to show notable growth in the coming years, fueled by a growing number of pharmacies offering these drugs.

Deutetrabenazine Market Regional Outlook

By geography, the market is categorized into Europe, North America, Asia Pacific, and the rest of the world.

North America

North America Deutetrabenazine Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America held the largest market share in 2024. This dominance of the region can be attributed to a high prevalence of Huntington’s disease and tardive dyskinesia, frequent regulatory approvals for newer versions of existing drugs, and a strong research base involved in the development of innovative products for the management of these diseases.

U.S.

The U.S. remains the core contributor in the North American region owing to the early adoption of new therapies, Teva's market penetration, and continuous investment in research and development activities. Along with that, a high number of individuals affected with neurological disorders strong presence of a robust research base in the country, further supported the market growth. Awareness campaigns also played an important role in market growth.

- For instance, according to the article published by the National Alliance on Mental Health (NAMI) in August 2022, 42 organizations received a grant of USD 2,500 each. This mini-grant is used to educate individuals about TD and how it affects an individual’s daily life.

Europe

Europe is the second-largest market for this drug, supported by rising public healthcare funding and increasing awareness in Germany, the U.K., and France about neurodegenerative diseases. EMA approval paves the way for wider use in treatment protocols. Moreover, the increasing prevalence of Huntington’s disease in the region increases the demand for therapeutics, in turn driving the market growth.

- For instance, according to the data provided by the Rare Disease Advisory in August 2023, the estimated prevalence of Huntington’s disease is 6.37 per 100,000 persons in Europe.

Asia Pacific

The market in Asia Pacific is expected to register a significant CAGR over the forecast period. This can be attributed to rising neurology departments in tier-1 hospitals and the expansion of healthcare infrastructure. Additionally, increasing government initiatives and campaigns aimed at increasing disease awareness, along with the constantly increasing number of patients due to growing patient diagnoses, are supporting regional market growth. Furthermore, increasing regulatory approvals for AUSTEDO in Asian countries also propelled market growth.

- For instance, in May 2020, AUSTEDO by Teva Pharmaceutical Industries Ltd. was approved by China’s National Medical Products Administration (NMPA) for the treatment of chorea associated with Tardive Dyskinesia (TD) and Huntington's disease (HD) in adults.

Rest of the World

The rest of the world includes Latin America & the Middle East & Africa markets. These regions are anticipated to demonstrate comparatively slower growth in the coming years. This is due to a slower rate of disease diagnosis owing to the lack of awareness among the general population about neurodegenerative diseases.

COMPETITIVE LANDSCAPE

Key Industry Players

Presence of Approved Products to Strengthen Company’s Market Dominance

Currently, the market space for deutetrabenazine is highly consolidated, with only one market player offering approved products across several countries in the world. Teva Pharmaceutical Industries Ltd. is the only manufacturer of the approved deutetrabenazine. Thus, the company dominates the global market.

- For instance, in April 2017, the U.S. FDA approved Teva Pharmaceutical Industries Ltd.’s AUSTEDO tablets for the treatment of chorea in Huntington’s disease (HD).

Furthermore, some other major players, such as Lupin Pharma and Aurobindo Pharma, are expected to launch generic versions of this drug in the coming years. This is anticipated to create competition in the market.

LIST OF KEY DEUTETRABENAZINE COMPANIES PROFILED

- Teva Pharmaceutical Industries Ltd. (Israel)

- Other Prominent Players

KEY INDUSTRY DEVELOPMENTS

- February 2024: Teva Pharmaceutical Investments Singapore Pte Ltd (TPIS) partnered with Jiangsu Nhwa Pharmaceutical Co., Ltd for the marketing and distribution of Teva’s AUSTEDO (deutetrabenazine) in China.

- May 2023: Teva Pharmaceutical Industries Ltd. launched AUSTEDOXR 6 mg, 12 mg, and 24 mg tablet strengths in the U.S. market.

- February 2023: The U.S. FDA approved USTEDOXR (deutetrabenazine) extended-release tablets for adults with tardive dyskinesia (TD) and chorea associated with Huntington’s disease (HD).

- June 2022: Teva Pharmaceutical Industries Ltd. signed agreements with Lupin Pharma and Aurobindo Pharma to begin selling generic versions of AUSTEDO in the U.S. in April 2033 or earlier under certain circumstances.

- October 2021: Brazil’s regulatory body ANVISA, approved Teva Pharmaceutical Industries Ltd.’s AUSTEDO for the treatment of tardive dyskinesia and chorea associated with Huntington’s disease treatment.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 1.32% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Application

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 0.350 billion in 2025 and is projected to reach USD 0.418 billion by 2034.

In 2025, the market value stood at USD 0.319 billion.

The market is expected to exhibit a CAGR of 1.32% during the forecast period of 2026-2034.

The hospital pharmacies segment led the market by distribution channel.

The key factors driving the market are the rising awareness regarding the disease symptoms, the growing prevalence of movement disorders, and the active involvement of the research community in research & development.

Teva Pharmaceutical Industries Ltd. is a prominent player in the market.

North America dominated the market with a share of 30.61% in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us