Genetic Testing Market Size, Share & Industry Analysis, By Type (Products {Equipment, and Consumables} and Services), By Technique (Next-generation Sequencing (NGS), Polymerase Chain Reaction, Microarrays, In-situ Hybridization, and Others), By Application (Oncology, Prenatal Testing, Pharmacogenomics, Cardiology, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

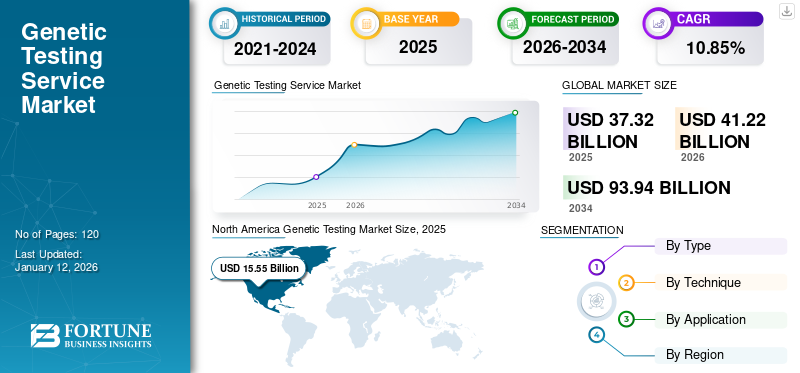

The global genetic testing market size was valued at USD 37.32 billion in 2025. The market is projected to grow from USD 41.22 billion in 2026 to USD 93.94 billion by 2034, exhibiting a CAGR of 10.85% during the forecast period. North America dominated the genetic testing market with a market share of 41.67% in 2025.

Genetic testing is a medical procedure that analyzes an individual's DNA, chromosomes, or proteins to identify genetic changes, known as mutations or variants that may cause or increase the risk of genetic conditions. It serves various purposes, including confirming diagnoses, assessing risks for inherited conditions, and guiding treatment decisions. The market includes products and services.

The technology is emerging as a remarkably advanced tool in modern healthcare, characterized by its high reliability and accuracy. The market is expected to increase significantly over the forecast period. This growth is driven by increasing awareness of genetic disorders, the rising prevalence of chronic diseases, and advancements in testing technologies such as Next-Generation Sequencing (NGS). Additionally, the growing demand for personalized medicine and direct-to-consumer genetic testing services is contributing to market expansion. Hoffmann-La Roche Ltd., Illumina, Inc., QIAGEN, and Quest Diagnostics Incorporated are some of the key players operating in the market.

Global Genetic Testing Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 37.32 billion

- 2026 Market Size: USD 41.22 billion

- 2034 Forecast Market Size: USD 93.94 billion

- CAGR: 10.85% from 2026–2034

Market Share:

- North America dominated the genetic testing market with a 41.67% share in 2025, driven by increasing awareness of the benefits of genetic testing services, advancements in molecular biology, and a strong emphasis on personalized medicine.

- By technology, the Next-Generation Sequencing (NGS) segment is expected to retain its largest market share owing to the rising demand for precision medicine, industry investments, regulatory approvals, and the introduction of innovative bioinformatics tools and products.

Key Country Highlights:

- United States: Growing adoption of direct-to-consumer (DTC) genetic testing services, coupled with strategic collaborations for test development and integration with Electronic Health Records (EHR), is driving market growth.

- Europe: Investments in genomic research and partnerships for early-stage oncology testing are enhancing access to advanced genetic testing services.

- China: Strong government initiatives promoting precision medicine, combined with increasing healthcare investments and rising prevalence of genetic diseases, are key growth drivers.

- Japan: Advances in genomic research and a national focus on preventive healthcare are accelerating the adoption of genetic testing solutions.

MARKET DYNAMICS

MARKET DRIVERS

Rising Prevalence of Chronic Disorders to Augment Market Growth

The growing elderly population, tobacco use and exposure, sedentary lifestyles, and overall poor health behavior are increasing the prevalence of chronic disorders such as diabetes, cystic fibrosis, sickle cell disease, down syndrome, and breast cancer.

- For instance, data published by the Institute for Health Metrics and Evaluation showed that the number of people living with sickle cell disease increased by 41.4% from 2000 to 2021, from 5.46 million to 7.74 million. Such an increase in prevalence is expected to stimulate the demand for these tests over the upcoming years.

Additionally, the rising number of patients with autoimmune disorders such as rheumatoid arthritis and celiac disease, combined with growing awareness regarding these conditions for early diagnosis and treatment, is significantly boosting the demand for genetic testing services and products across the globe.

Surge in New Product Launches to Boost Market

The rising incidences of cancer, hematological disorders, and genetic diseases is a significant factor contributing to the increasing demand globally. Additionally, the aging population intensifies the chances of developing these diseases, further boosting the need for these tests during the forecast period.

Moreover, leading industry players are focusing on introducing innovative clinical and diagnostic tests for various major diseases, including cancer and cardiac conditions, which is expected to drive genetic testing market growth.

- For instance, in September 2022, SRL Diagnostics introduced Heart Assure, a specialized test designed to assess an individual's risk of experiencing a cardiac event by measuring even minuscule levels of Troponin I in the blood.

Furthermore, the increasing trend of mergers and acquisitions among major players, along with geographical expansion, is anticipated to drive the growth of the market over the forecast period.

RESTRAINING FACTORS

Shortage of Skilled Testing Personnel to Deter Market Growth

One of the major challenges for market expansion is the shortage of testing personnel, particularly in emerging markets. Additionally, insufficient availability of equipment and the lack of skilled healthcare professionals may hinder the market growth during the forecast period.

- For instance, an article published by Clinical Lab Products (CLP) in September 2022 reported a shortage of 20,000 to 25,000 laboratory technologists in the U.S. Such a deficit in laboratory technicians may pose a constraint on the services market in the future.

Additionally, resource-constrained environments, characterized by limited equipment availability, inadequate resources, and substandard laboratory materials, often prevent effective diagnostic practices, which are further expected to hamper the market growth.

MARKET OPPORTUNITIES

Digitalization in the Data Management is Anticipated to Fuel Market Growth

The integration of genetic testing with digital health solutions, particularly Electronic Health Records (EHR), presents significant opportunities for enhancing healthcare delivery and patient outcomes. Digital genomics decision support tools and chatbots are emerging as effective means to scale genetic counseling processes, making it easier for patients to understand their genetic information and make informed health decisions.

Collaborations between companies and Electronic Health Record (EHR) vendors enhance clinical workflows by allowing providers to order tests and review results directly within their existing systems. This integration supports timely clinical decisions and optimizes treatment protocols based on genetic insights.

MARKET CHALLENGES

Regulatory Dynamics of Various Region to Challenge Market Progression

The market is experiencing rapid growth but it faces significant ethical and regulatory challenges that impact its development and adoption. The collection and utilization of genetic data raise critical issues regarding informed consent, data security, and potential discrimination.

In addition, the landscape is complicated by varying regulations across various regions, which can impede the development and distribution of genetic tests. Inconsistent regulatory frameworks are expected to create challenges for companies to meet compliance, as this regulatory fragmentation can stifle innovation and limit access in certain markets.

Moreover, cost poses significant challenges for the market. Although the costs associated with these testing have decreased over time, the expense remains prohibitive for many consumers, limiting widespread adoption. High out-of-pocket costs can deter individuals from pursuing testing that could provide valuable health insights or inform treatment decisions.

GENETIC TESTING MARKET TRENDS

Shift to At-Home Genetic Testing and Digitalization is the Leading Market Trend

The shift to at-home and Direct-to-Consumer (DTC) genetic testing services is rapidly gaining traction in the market due to advances in genetic testing technologies. The increase in the number of affordable and accessible testing kits that allow individuals to understand their genetic predispositions is currently on the surge in the market. This trend is fueled by growing awareness of preventive healthcare. Additionally, the COVID-19 pandemic has accelerated the use of at-home tests.

- In May 2022, Laboratory Corporation of America introduced an at-home collection device for diabetes risk assessment. Such new product launches and strategic initiatives further boost the adoption of these at-home testing.

Additionally, tailored medical treatment to individual genetic profiles is becoming more prevalent, enhancing treatment efficacy and reducing adverse effects. Furthermore, integration with Electronic Health Records (EHRs), such as incorporating genetic data into EHRs, facilitates comprehensive patient care and informed clinical decisions and is currently trending in the market.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

COVID-19 Boosted Demand for PCR Testing Leading to Enhanced Market Growth

The COVID-19 pandemic significantly impacted the market, initially declining the demand for non-essential genetic tests due to lockdowns and restrictions on healthcare services. In 2020, the market growth rate slowed as many elective testing procedures were postponed or canceled. However, the pandemic also spurred an increase in genetic testing for COVID-19 diagnosis, which contributed to a shift in focus within the industry.

- For instance, Laboratory Corporation of America’s Dx segment, which includes a wide range of clinical, anatomic pathology, genetic, and genomic tests, witnessed an increase of 32.2% in its revenue in 2020 compared to 2019. Furthermore, the company grew to 15.3% in its revenue in 2021 compared to 2020. Also, the company grew to 15.3% in its revenue in 2021 compared to 2020.

In 2022, the service demand returned to pre-pandemic levels and continued to expand, driven by advancements in technology and an increasing emphasis on early disease detection and preventive care.

SEGMENTATION ANALYSIS

By Type

Services Segment Dominated Market due to Rising Number of Laboratories

Based on type, the market is segmented into products and services. The products segment is further classified into equipment and consumables.

The services segment dominated the market in 2024. The segment’s growth is attributed to the increasing number of laboratories for genetic and genomic testing across the globe. Additionally, the strategic collaboration between the service providers and new test incorporation is expected to propel the market.

- For instance, in November 2022, NeoGenomics Laboratories Inc. and ImmunoGen, Inc. launched a novel biomarker testing program for patients with epithelial ovarian cancer. They provided eligible Epithelial Ovarian Cancer (EOC) patients with FRα-expression testing through NeoGenomics.

Such initiatives are expected to drive the market growth.

The product segment is contributing 48.81% globally in 2026. The dominance of the segment is attributed to the higher number of tests conducted for the early diagnosis of genetic disorders and cancer testing, which is essential for personalized treatment approaches. Additionally, an increasing number of new equipment and kit launches for new indications are expected to significantly boost the consumables segment growth.

- For instance, in December 2023, HiMedia Laboratories launched a one-step RT-PCR kit for the detection of the COVID-19-JN1 variant.

To know how our report can help streamline your business, Speak to Analyst

By Technique

NextGeneration Sequencing (NGS) Segment Dominates Due to Escalated Precision Medicine Demand

Based on technique, the market is segmented into Next-Generation Sequencing (NGS), polymerase chain reaction, microarrays, in-situ hybridization, and others.

The NextGeneration Sequencing (NGS) segment holds the largest share of the market. The factors driving growth include the increased patient demand for precision medicine in the developed regions, industry investment, rising regulatory approvals, extensive R&D initiatives, and the introduction of futuristic products, services, and bioinformatics tools.

The polymerase chain reaction segment is accounting for 46.0% market share in 2026. Increasing research and development activities and growing demand for innovative tests have led to the introduction of various PCR technologies offering great benefits. The introduction of innovative devices and the launch of new kits by key market players is anticipated to drive market growth. Moreover, the introduction of these tests in clinical laboratories is expected to propel the segment growth.

- For instance, in November 2019, Bio-Rad Laboratories, Inc., announced the launch of the QX ONE Droplet Digital Polymerase Chain Reaction System, which provides an absolute measurement of target DNA molecules with more accuracy, precision, and sensitivity.

Such technological advancements in dPCR are expected to fuel the market during the forecast timeframe (2025-2032).

By Application

Oncology Segment Dominated Due to Increasing Prevalence of Cancer

By application, the market is classified as oncology, prenatal testing, pharmacogenomics, cardiology, and others.

The oncology segment accounted with a share of 55.63% in 2026. The increasing prevalence of genetic disorders and cancer drives the demand for precise diagnostic tests. Advances in technology, such as high-throughput screening and DNA sequencing, enhance the ability to detect diseases early, leading to better patient outcomes. Additionally, the expansion of diagnostics laboratories is expected to drive the segment growth.

- For instance, in November 2022, Agilus Diagnostics announced the launch of the upgraded laboratory at Gurugram, which is equipped to perform high-volume diagnostic testing services.

The pharmacogenomics segment is expected to grow significantly due to the rising emphasis on personalized medicine, where treatments are tailored based on individual genetic profiles. The rising acceptance of pharmacogenomics testing among healthcare providers and patients is driving segment growth.

GENETIC TESTING MARKET REGIONAL OUTLOOK

North America

North America Genetic Testing Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with USD 15.55 billion in 2025 and is projected to expand at a substantial CAGR during the forecast period. In North America, particularly the U.S., the market is projected to grow significantly due to increasing awareness of the benefits of these testing services, advancements in molecular biology, and a strong emphasis on personalized medicine. The high prevalence of chronic and genetic disorders drives the demand for testing services, while government support for direct-to-consumer testing enhances accessibility. Additionally, an increasing number of new product launches are expected to fuel the region’s growth in the near future. The U.S. market is projected to reach USD 15.64 billion by 2026.

- For instance, in September 2023, Integrated DNA Technologies, Inc., launched xGen NGS products specially designed for the Ultima Genomics UG 100 platform. The xGen NGS products include primers, adapters, and universal blockers for various applications.

These factors are expected to boost product adoption in the near future.

Europe

Europe is anticipated to grow at a moderate rate due to strong volumes in infectious diagnostics and increased investments in research and development, enhancing the availability of advanced testing solutions. Germany and the U.K. are benefitting from a robust healthcare infrastructure and government funding for genomic research, which promotes the integration of advanced genetic technologies into clinical practice. Additionally, strategic initiatives by key players, such as acquisitions and partnerships, are expected to drive the growth of the region. The UK market is projected to reach USD 2.02 billion by 2026, while the Germany market is projected to reach USD 2.35 billion by 2026.

- For instance, in April 2023, Quest Diagnostics announced the acquisition of Haystack Oncology to enhance the focus on early-stage oncology testing to aid in the early and accurate detection of residual or recurring cancer.

Asia Pacific

In Asia Pacific, the market is projected to grow at the highest CAGR over the forecast period. This can be attributed to improvements in healthcare infrastructure, a high burden of genetic diseases such as thalassemia and sickle cell anemia, and rising public awareness about the advantages of these testing for early diagnosis and treatment. In China, increasing healthcare investments and a rising prevalence of genetic diseases are key drivers supported by government initiatives promoting precision medicine. The Japan market is growing fueled by advancements in genomic research and a focus on preventive healthcare. The Japan market is projected to reach USD 2.07 billion by 2026, the China market is projected to reach USD 2.24 billion by 2026, and the India market is projected to reach USD 0.98 billion by 2026.

Latin America

Latin America is expected to expand significantly due to increasing clinical studies evaluating novel genetic tests and efforts to improve healthcare systems, which support greater access to services and products in the near future.

Middle East & Africa

The Middle East & Africa is expanding fueled by increasing healthcare investments, rising awareness of genetic disorders, and advancements in medical technology. Such advancements facilitate the development of innovative testing solutions in countries such as Saudi Arabia and the UAE and are expected to fuel regional growth.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Hoffmann-La Roche Ltd. and Illumina, Inc. Hold Significant Shares due to Strong Product Portfolio

The global market is partially consolidated with key players such as Hoffmann-La Roche Ltd., Illumina, Inc., QIAGEN, and Quest Diagnostics Incorporated. Hoffmann-La Roche Ltd. is recognized for its strong focus on innovation and integration of genomic technologies into clinical practice, particularly in oncology and rare diseases.

Illumina, Inc.'s strong portfolio of sequencing products and services, coupled with its wide presence globally, drives the growth of the company. In addition, these players are constantly focusing on strategic initiatives, such as the introduction of new products & services and expansion of their offerings through partnerships and other initiatives.

- For instance, in December 2023, Illumina Inc. and HaploX collaborated to provide locally manufactured sequencing instruments in China.

Quest Diagnostics, another key player, is growing owing to the portfolio comprising diverse application areas such as autoimmune diseases, various diseases, and cardiovascular conditions.

Additionally, companies such as GeneDx and 23andMe Offer DTC testing services and provide insights into ancestry and health predispositions, which enhances their growth.

LIST OF KEY MARKET PLAYERS PROFILED

- Hoffmann-La Roche Ltd. (Switzerland)

- Illumina, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Bio-Rad Laboratories, Inc (U.S.)

- Oxford Nanopore Technologies plc. (U.K.)

- Laboratory Corporation of America Holdings (U.S.)

- Agilent Technologies, Inc. (U.S.)

- Myriad Genetics, Inc. (U.S.)

- QIAGEN (Germany)

- Quest Diagnostics Incorporated. (U.S.)

- Danaher Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS

- May 2023: Laboratory Corporation of America announced an agreement with Jefferson Health. This relationship would help expand the scope and productivity of specialty lab testing.

- March 2023: Quest Diagnostics unveiled advanced diagnostics and support services designed to broaden access to laboratory tests for transplanting solid organs, human cells, and tissue.

- February 2023: Quest Diagnostics acquired laboratory services of New York-Presbyterian, allowing patients wider access to advanced, quality laboratory services.

- January 2023: Illumina, Inc., signed an agreement with Amgen to accelerate therapeutic development through large-scale genomics and establish a preeminent clinico-genomic data set.

- July 2022: Sonic Healthcare USA began testing for Monkeypox (MPXV), using the Centers for Disease Control and Prevention (CDC) Non-variola Orthopoxvirus, high complexity NAAT (RT-PCR) molecular assay in the U.S.

TRADE PROTECTIONISM AND REGULATORY LANDSCAPE

Trade policies and variations in regulation significantly impact the market by influencing the import and export of testing technologies and services. For instance, tariffs and restrictions on medical devices can increase costs for companies that want to bring innovative solutions to market, ultimately limiting access for healthcare providers and patients. Additionally, regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) play crucial roles in overseeing the safety and efficacy of genetic tests. Their stringent regulations necessitate that market players navigate complex compliance landscapes to ensure that their products meet safety standards, which can delay market entry and increase operational costs. Furthermore, the lack of a cohesive global regulatory framework for direct-to-consumer testing exacerbates these challenges.

FUTURE OUTLOOK

Ongoing Research and Development (R&D) efforts in the market are primarily focused on enhancing the accuracy, speed, and affordability of genetic tests, which are crucial for meeting the growing demand for personalized healthcare solutions. Innovations in artificial intelligence (AI) and machine learning are increasingly being integrated into testing processes, enabling the interpretation of complex genetic data with greater precision. This technological advancement accelerates the diagnostic process and also facilitates the development of tailored treatment plans based on individual genetic profiles. These innovations and digitalization in the market are expected to surge the demand for precise diagnostics, further driving growth.

REPORT COVERAGE

The report provides an in-depth analysis of the industry. It focuses on market segments, such as type, technique, application, and region. Besides, it offers the market forecast in relation to the current market dynamics, the impact of COVID-19, and the latest market trends. Additionally, the report consists of the global market share by various segments and the factors driving the market growth. The report also provides the competitive landscape of the market.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 10.85% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Technique

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 37.32 billion in 2025 and is projected to reach USD 93.94 billion by 2034.

In 2025, the market value stood at USD 15.55 billion.

The market will exhibit a steady CAGR of 10.85% during the forecast period of 2026-2034.

By type, the services segment led the market in 2025.

Rising prevalence of chronic disorders and new product launches are key factors anticipated to drive the market growth.

Hoffmann-La Roche Ltd., and Ilumina, Inc. are the major players in the market.

North America dominated the market in 2025 by holding the largest share.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us