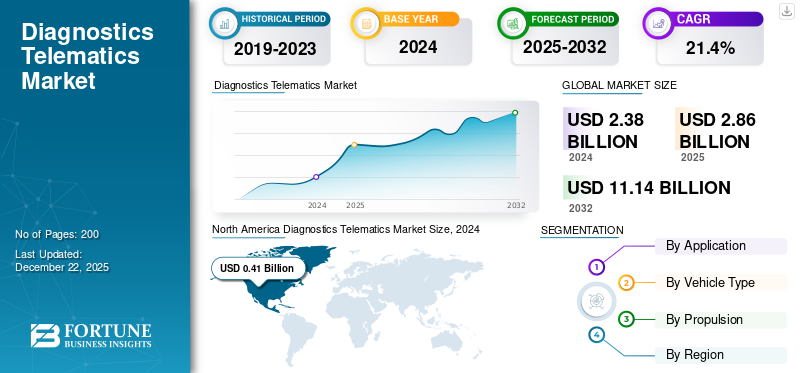

Diagnostics Telematics Market Size, Share & Industry Analysis, By Application (Vehicle & Fleet Management, Driver Monitoring & Safety, and Others), By Vehicle Type (Passenger Cars and Commercial Vehicles), By Propulsion (BEV and Hybrid), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

The global diagnostics telematics market size was valued at USD 2.38 billion in 2024. The market is projected to grow from USD 2.86 billion in 2025 to USD 11.14 billion by 2032, exhibiting a CAGR of 21.4% during the forecast period. North America dominated the global market with a share of 17.23% in 2024.

Vehicle diagnostics telematics refers to using telecommunications and informatics to remotely monitor and analyze a vehicle's health, performance, and behavior. This involves collecting data from various sensors and systems within the vehicle and transmitting it wirelessly to a central server or platform for analysis. The power of diagnostics telematics lies in its ability to provide real-time insights into a vehicle's operational status. This data can encompass a broad range of information, including engine performance, fuel efficiency, battery health, tire pressure, braking system integrity, and even driver behavior such as speeding or harsh braking. By constantly monitoring these parameters, diagnostics telematics can identify potential problems early, often before they escalate into major repairs. The market dynamics is supported by stringent regulatory requirements for vehicle safety and emissions, particularly in North America and Europe, driving the market’s growth. Moreover, Geotab Inc., Samsara Inc., and Verizon are the leading players in the market that are actively involved into product expansion and strategies including partnerships and collaborations, to increase their market potential.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Push for Predictive Maintenance to Augment Market Growth

Traditionally, vehicle maintenance has been reactive – waiting for something to break before fixing it. Telematics enables a shift toward predictive maintenance, using data analytics to forecast potential problems before they occur. This allows for timely repairs, preventing costly breakdowns and extending the vehicle's lifespan. This plays a pivotal role for fleet management, where downtime can significantly impact operational efficiency.

The system can predict a failure of components fail by analyzing historical and real-time data. Instead of relying on rigid, time-based maintenance schedules, they can adopt a condition-based approach, focusing resources where they are most needed. Think of it like this: instead of changing oil every 5,000 miles regardless of driving conditions, the system analyzes oil quality and engine performance data to find the optimal oil change interval, potentially extending it and saving money.

MARKET RESTRAINTS

Data Security and Privacy Concerns May Affect Market Growth During Forecast Period

One of the most significant hurdles is the inherent concern surrounding data security and privacy. The constant stream of data transmitted from vehicles, including driving habits and vehicle health information, raises legitimate questions about data ownership and its usage. Consumers are wary of potential misuse, such as targeted advertising based on driving behavior or insurance companies using data to justify higher premiums based on detected driving habits. Robust and transparent regulations are needed to define data ownership, usage limitations, and security protocols. Without clear guidelines, consumer distrust will continue to impede adoption. Strong encryption protocols and data anonymization techniques can mitigate these risks, protecting sensitive information.

MARKET OPPORTUNITIES

Favorable Trends Associated with Usage-Based Insurance to Drive Market Growth

The future of insurance is inextricably linked to the evolution of diagnostics telematics. As technology advances, consumers expect to witness more sophisticated diagnostics capabilities integrated into UBI programs. A future where your insurance company proactively alerts you to a potential engine problem, schedules a service appointment, and offers discounts on preventative maintenance, all based on data collected from your vehicle.

DIAGNOSTICS TELEMATICS MARKET TRENDS

Growing Integration with Connected Services to Drive Market Growth

As the automotive industry moves toward connected vehicles, diagnostics telematics is becoming integral to a broader ecosystem of connected services. These technologies work to create a holistic view of vehicle performance and user behavior. Connected services can range from roadside assistance notifications based on real-time data to tailored insurance solutions that take driving behavior into account. This integration enhances the user experience and creates new revenue streams for manufacturers and service providers.

Download Free sample to learn more about this report.

Segmentation Analysis

By Application

Rising Demand for Vehicle & Fleet Management will Drive Growth of Diagnostics Telematics

Based on application, the market is segmented into vehicle & fleet management, driver monitoring & safety, and others.

Vehicle & fleet management dominated in 2024 as rising fuel costs are a major concern for fleet managers. Diagnostics telematics provides granular insights into fuel consumption patterns, identifying areas for improvement, such as aggressive driving habits, idling time, and inefficient routes. This data empowers managers to implement fuel-saving strategies, significantly reducing operational expenses. Diagnostics telematics can provide real-time alerts in case of theft or unauthorized vehicle use, allowing for faster recovery and minimizing potential losses.

The driver monitoring & safety segment is expected to grow at a rapid CAGR during the forecast period. Once primarily focused on vehicle health and tracking, the industry is now heavily investing in technologies that actively analyze driver behavior and offer real-time feedback to mitigate risks and improve overall safety. This shift is fueled by a confluence of factors, including stricter regulations, rising insurance costs, and a growing awareness of the impact of driver error on accidents.

By Vehicle Type

Rising Importance of Driver Monitoring and Safety to Boost Growth in Passenger Cars Segment

By vehicle type, the market is divided into passenger cars and commercial vehicles.

The passenger cars segment accounted for the largest share of the market in 2024. Diagnostics telematics allows car owners to anticipate potential problems before they escalate into costly repairs. By monitoring parameters such as engine temperature, oil pressure, and brake pad wear, the system can alert drivers to potential issues, enabling them to schedule preventive maintenance and avoid unexpected breakdowns.

Commercial vehicles will grow at a steady pace within the forecast period. Diagnostics telematics provides fleet managers with key information that can be used to make informed decisions about everything from route optimization to fuel management. It can track key performance indicators such as fuel efficiency, idle time, and driver behavior, in real time.

By Propulsion

BEV Propulsion Leads Owing to Critical Role of Battery in Electric Vehicles

Based on propulsion, the market is bifurcated into BEV and hybrid.

The BEV segment dominated the diagnostics telematics market share in 2024. The battery is the most critical and expensive component of electric vehicles. Diagnostic telematics provides real-time data on battery health, including state of charge, state of health, temperature, and charging patterns. This information allows for early detection of potential degradation, optimized charging strategies, and predictive maintenance, ultimately extending battery lifespan and minimizing unexpected failures.

The hybrid segment will capture considerable market share during the forecast period. Diagnostics telematics can help drivers adopt more fuel-efficient driving habits by monitoring driving behavior and identifying potential inefficiencies. This lowers fuel consumption and contributes to reducing emissions, aligning with the core principles of HEV technology.

Diagnostic Telematics Market Regional Outlook

By region, the market is categorized into North America, Europe, Asia Pacific, and the rest of the world.

North America

North America Diagnostics Telematics Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominates the market and generated a revenue of USD 0.41 billion in 2024. Consumers increasingly demand connected car services beyond basic navigation and entertainment. Diagnostics telematics is a crucial component of these services, offering features such as remote vehicle monitoring, proactive maintenance alerts, and even automatic emergency assistance in an accident. Numerous startups are also entering the diagnostics telematics market, offering innovative solutions tailored to specific needs. For example, some companies are developing AI-powered platforms to predict vehicle failures more accurately, while others focus on providing affordable diagnostic tools for individual consumers.

Commercial transportation plays an important role in the U.S. economy, leading to a surging demand for efficient fleet management solutions. Fleet operators are increasingly adopting telematics systems to monitor vehicle performance, optimize routes, manage fuel consumption, and reduce downtime and cost. The emergence of diagnostic telematics in vehicles is supported by legislative measures that aim to improve vehicle emissions and safety standards. The U.S. government has been tightening regulations on emissions, directly impacting how manufacturers develop car diagnostic systems. The introduction of real-time emission monitoring has become a focal point for companies seeking to comply with these standards while also appealing to environmentally conscious consumers. States including California have also pioneered telematics legislation, mandating telematics systems in fleet vehicles for real-time emissions monitoring. As more states consider similar regulations, the market for diagnostic telematics is likely to expand.

Europe

The European Union's ambitious goal of reducing greenhouse gas emissions by at least 55% by 2030, diagnostic telematics is crucial in optimizing vehicle efficiency and reducing fuel consumption. By monitoring and analyzing vehicle data, telematics solutions can provide drivers and fleet managers with actionable insights, helping them make informed decisions to reduce their carbon footprint.

Asia Pacific

Asia Pacific is projected to be the fastest-growing region, with a CAGR of around 23.8% in the forecast period. The demand for diagnostics telematics in the Asia Pacific region is driven by several factors, including the increasing adoption of connected cars, the growing need for efficient fleet management systems, and the rising awareness of the benefits of this technology in improving vehicle safety and reducing maintenance costs. As the connected car and fleet management markets continue to grow in the region, the demand for diagnostics telematics is expected to rise, providing opportunities for companies operating in this space. For example, in China, the government has been promoting the adoption of connected cars and intelligent transportation systems through initiatives such as the "Smart City, Smart Transportation" program. This program aims to promote the development of smart transportation systems, including connected cars, intelligent transportation systems, and smart traffic management systems. As a result, the diagnostics telematics market growth in China is expected to be significant in the coming years.

Rest of the World:

The market in the rest of the world is expected to witness considerable growth in the near future. Public transportation authorities in Dubai and Abu Dhabi are utilizing diagnostics telematics systems to monitor the performance of their buses and trains, ensuring passenger safety and optimizing route schedules. This also allows for preventative maintenance, reducing disruptions to public transportation services.

COMPETITIVE LANDSCAPE

Key Industry Players

Product Differentiation and Development Will Play a Key Role in Business Expansion

The global diagnostics telematics market includes Geotab Inc., Samsara Inc., Motive Technologies, Inc., Quartix Inc., Lytx, and Verizon. These players are focused on product differentiation and development, expansion of production capacity, and diversification of sales & distribution network to gain a competitive advantage. Moreover, these companies are partnering with other automotive manufacturers to gain additional profitability.

LIST OF KEY DIAGNOSTICS TELEMATICS COMPANIES PROFILED

- Samsara (U.S.)

- Motive Technologies Inc. (U.S.)

- Quartix Inc. (U.S.)

- Lytx (U.S.)

- Verizon Communications Inc. (U.S.)

- Azuga, Inc. (U.S.)

- IntelliShift (U.S.)

- iTriangle Infotech Pvt Ltd. (India)

- Webfleet Solutions (U.K.)

- ABAX (U.K.)

KEY INDUSTRY DEVELOPMENTS

- March 2025: Samsara Inc. and Hyundai Translead announced a strategic partnership to integrate Samsara’s Safety Solution with Hyundai Translead’s HT LinkVue system.

- January 2025: Samsara Inc. expanded its strategic collaboration with Stellantis to enable access to millions of connected vehicles across Europe.

- August 2024: Motive announced new Driver Safety and Fleet Management solutions across the U.S. FedEx Freight fleet to enhance safety and compliance.

- May 2024: Motive announced the expansion in Mexico by introducing AI-powered safety, security, and fleet management solutions.

- February 2021: Lytx delivered an AI-powered video telematics solution for the commercial fleets of Bacton Transport.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 21.4% from 2025-2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Application

|

|

By Vehicle Type

|

|

|

By Propulsion

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 2.38 billion in 2024 and is projected to reach USD 11.14 billion by 2032.

In 2024, the market value stood at USD 0.41 billion.

The market is expected to exhibit a CAGR of 21.4% during the forecast period of 2025-2032.

The passenger cars segment led the market by vehicle type.

The increasing demand for driver monitoring and safety solutions is the key factor driving the market.

Geotab Inc., Samsara Inc., Motive Technologies, Inc., Quartix Inc., Lytx, and Verizon are the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us