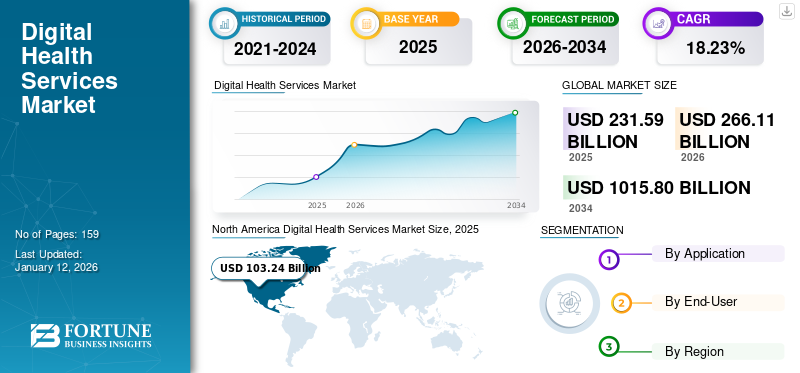

Digital Health Services Market Size, Share & Industry Analysis, By Application (Teleconsultations, Remote Monitoring, Public Health Surveillance, and Others), By End-User (Business to Business and Business to Consumer), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global digital health services market size was valued at USD 231.59 billion in 2025. The market is projected to grow from USD 266.11 billion in 2025 to USD 1,015.80 billion in 2034, exhibiting a CAGR of 18.23% during the forecast period. North America dominated the digital health services market with a market share of 44.58% in 2025.

The global digital health services market is transforming, driven by the convergence of healthcare and digital technology. The growth trajectory of the market is reflecting a significant expansion fueled by increased healthcare digitization, smartphone penetration, and AI-driven innovation. With the increasing usage of the internet, and telecommunication, the market is witnessing a significant increase in the number of service providers with unique service offerings in the market thereby driving the adoption of digital health services.

Major factors driving the market’s growth include, a surge in demand for remote health monitoring, the expansion of telehealth services post-pandemic, government investments in digital health infrastructure, and the rising prevalence of chronic diseases requiring continuous care.

Furthermore, some of the prominent market players, including Amazon Web Services, Inc., IBM, AdvancedMD, Inc., eClinicalWorks, and others, are actively engaged in offering services with the integration of advanced technologies to maintain their market position.

MARKET DYNAMICS

MARKET DRIVERS

Rise of Virtual Hospitals and Remote Healthcare to Propel Market Growth

In recent years, the healthcare market space has shifted toward digitalization with increasing penetration of telecommunication and internet. The recent COVID-19 pandemic was a propelling factor, resulting in an increased number of virtual hospitals and the subsequent transition toward remote healthcare. Virtual hospitals, leveraging telemedicine and other technologies, are becoming increasingly popular due to their ability to improve access to care, reduce costs, and enhance efficiency. These digital platforms offer remote consultations, monitoring, and treatment options, particularly for chronic conditions and in underserved areas.

Saudi Arabia is pioneering virtual hospitals allowing remote surgeries, diagnostics, and consultations, especially in underserved areas. These virtual facilities offer 24/7 access to specialists without requiring physical visits. Additionally, digital triage has revolutionized primary care by allowing patients to submit symptoms online and get directed to the appropriate care level.

- For instance, according to an article published in Pulse PCN in January 2025, patient satisfaction in the U.K. has significantly improved, with ease of access increasing from 60% in 2024 to 72% in 2025 with the use of digital services.

Thus, all these factors are anticipated to drive the adoption of digital health in the forecast period.

MARKET RESTRAINTS

Data Privacy and Cybersecurity Risks Coupled with Skepticism among Healthcare Professionals toward AI Limit Market Growth

The increasing demand for digital health services has created several challenges for players. One such challenge is the risk related to data privacy and cybersecurity. The growing volume of sensitive patient data stored on cloud platforms has made digital health systems increasingly vulnerable to data breaches and cyberattacks. This has also resulted in regulatory frameworks struggling to keep pace with evolving threats. This confluence leads to more pressure on service providers to keep patient data safe and secure. Despite the rising efforts, there have been several instances of data breaches in healthcare.

- For instance, in June 2025, the Kettering Health healthcare network faced a cyberattack from the Interlock ransomware gang, compromising the data from its 14 medical centers and over 120 outpatient facilities in western Ohio.

Additionally, due to these risks, some practitioners remain hesitant to trust AI-based diagnostic systems or telehealth platforms due to concerns over accuracy, liability, and lack of in-person interactions.

MARKET OPPORTUNITIES

Increasing Investments Offer a Strong Growth Opportunity to the Market

With the growing trend of care delivery through digital means, the market is witnessing a strong influx of investments along with an increasing number of collaborations and partnerships between the operating players. This has created lucrative opportunities for well-established and emerging companies to expand their market presence. With these investments and partnerships, the companies are also expanding their service offerings.

- For instance, in January 2023, Netsmart Technologies, Inc. and Jefferson Center entered into a strategic collaboration aimed at improving integrated remote patient monitoring and engagement for behavioral health services.

MARKET CHALLENGES

Digital Divide and Accessibility Issues Coupled with Fragmented Regulatory Environments Pose a Critical Challenge

Many rural and low-income communities lack the infrastructure for reliable internet access or devices, hindering the widespread adoption of digital health services. The lower penetration of internet in the low-and-middle income countries, when compared to developed nations, limits the access to the telehealth services, which is likely to impede the adoption. The adoption of telehealth requires the deployment of the latest telecommunication devices and high-speed internet with high bandwidth and storage capacity for the integration and transmission of medical data, which is still lacking in many developing countries.

- According to the 2022 statistics published by the Internet Society, internet penetration in Africa was around 43.0% by the end of December 2021. Whereas, the internet penetration was about 83.0% in the Americas and 89.0% in Europe in 2022, according to the International Telecommunication Union.

DIGITAL HEALTH SERVICES MARKET TRENDS

Rapid Development of Telecommunication Sector, with AI and Predictive Analytics Integration

Prompt advancements in the telecommunication sector, such as the introduction of 4G LTE offered various opportunities for digital health service providers to flourish. Owing to the introduction of such facilities, developing regions that lack proper communication capabilities will have the opportunity to experience an enhanced network facility, thereby witnessing the benefits of digital services.

Additionally, AI and ML technologies are embedded in diagnostics, treatment planning, and patient engagement. These tools allow faster decision-making, predictive modeling, and enhanced operational efficiencies. Furthermore, wearable devices such as smartwatches, fitness trackers, and medical-grade sensors are being integrated into remote monitoring systems, allowing real-time data transmission to healthcare providers, increasing the demand for digital health services.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Application

Increasing Implementation of Teleconsultation Services Boosted Segment's Dominance

Based on application, the market is segmented into teleconsultations, remote monitoring, public health surveillance, and others.

In 2024, the teleconsultations segment dominated with the highest digital health services market share. The factors contributing to the dominance of the segment include, accessibility, affordability, increasing usage by both patients and physicians, and technological advancements in service offerings. There is a growing preference for remote consultations, with many consumers expressing interest in using teleconsultations even after the pandemic.

- For instance, in November 2024, Amazon introduced Amazon Clinic for Indian users to offer online consultation services for over 50 medical conditions.

On the other hand, the remote monitoring segment is anticipated to grow with a notable CAGR during the forecast period. This growth is particularly evident in the adoption of digital devices and mobile technologies to track vital signs and health information remotely. Additionally, more patients and providers are becoming aware of the benefits of RPM (remote patient monitoring), such as early intervention, improved patient outcomes, and enhanced convenience.

By End-user

Growing Need to Manage Administrative Workload in a Structured Manner to Drive the Segment Growth

On the basis of end-user, the market is categorized into business to business and business to customers.

The business to business segment held the dominant share of the market in 2024. The demand for these services by business providers is increasingly driven by the increasing number of collaborations between operating players, advancements in technology leading to innovative service offerings, and other factors.

- For instance, in December 2024, SHL Technologies, and DocGo Inc. expanded their partnership to enhance access to cardiovascular care.

The business to customers segment is anticipated to witness notable growth in the coming years. This is primarily due to the increasing adoption of digital health services by patients.

DIGITAL HEALTH SERVICES MARKET REGIONAL OUTLOOK

By region, this market is divided into Europe, North America, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Digital Health Services Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The market in North America was valued at USD 103.24 billion in 2025. The region is expected to dominate the global market throughout the study period. High adoption of EHRs and telehealth platforms, strong regulatory support, and high insurance coverage are some of the factors promoting the digital health services market growth in the region.

U.S.

The U.S. dominated North America with a leading market share in 2024. Higher acceptability of digital healthcare by patients and physicians coupled with well-developed digital infrastructure has majorly driven the country’s market growth. In addition, an increase in the number of e-visits and rising preference for online consultation along with increasing partnerships to introduce technological advanced services is driving the country’s growth.

- For instance, in March 2022, American Well and LG Electronics collaborated to develop a new device-based service solution to make it easier for patients to access care, whether in a hospital or at home.

Europe

Europe is projected to grow with a significant market share during the forecast period. Emphasis on digital sovereignty and interoperability, and focus on chronic disease management through digital therapeutics are some of the prominent factors driving the regional market growth.

-

For instance, in February 2022, the Swiss-based medtech startup OnlineDoctor announced the acquisition of the Germany-based startup A.S.S.I.S.T to bring Artificial Intelligence (AI) technology to teledermatology services.

Asia Pacific

The market in Asia Pacific is anticipated to witness notable growth in the coming years. Increasing digitalization through government initiatives in emerging countries such as China, India and expansion of internet connectivity have propelled the regional market.

- For instance, in December 2022, PING AN HEALTHCARE AND TECHNOLOGY COMPANY LIMITED partnered with the Wuxi Government to launch a "Pandemic Prevention Consultation Platform" on the Lingxi App. This platform offers pandemic prevention-related consultation services provided by professional medical teams, which are available to users anytime and anywhere.

Latin America and the Middle East & Africa

The markets in Latin America and the Middle East & Africa are estimated to witness comparatively slower growth. However, increasing expansion of the services, increase in the number of online consultations, strategic collaborations, and technological advancements in the services fuel market growth.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Expansion of Service Offerings by Prominent Players to Propel Market Progress

The market space for digital health services reflects a fragmented structure and comprises various market players. Some of which include Amazon Web Services, Inc., IBM, AdvancedMD, Inc., and eClinicalWorks. These players focus on collaborations with other companies and healthcare providers, and the launch of new services to maintain their market presence.

Other notable players in the global market include UI8, LLC., NXGN Management, LLC, CareCloud, Inc., and others. These companies also focus on various strategic initiatives to boost their digital healthcare services market share during the forecast period.

LIST OF KEY DIGITAL HEALTH SERVICES COMPANIES PROFILED

- Siemens Healthineers AG (Germany)

- IBM (U.S.)

- Amazon Web Services, Inc. (U.S.)

- American Well (U.S.)

- Teladoc Health, Inc. (U.S.)

- AdvancedMD, Inc. (U.S.)

- eClinicalWorks (U.S.)

KEY INDUSTRY DEVELOPMENTS

- February 2025: Teladoc Health, Inc. acquired Catapult Health, a virtual preventive care service provider, with an aim to utilize Catapult Health's innovative patient-centric at-home diagnostic testing and clinical support model.

- December 2024: The Union Ministry of Health and Family Welfare, India, launched telemedicine services to all AIIMS and Postgraduate Institute of Medical Education and Research (PGI) institutions as part of a nationwide initiative to reduce hospital burdens and streamline patient care.

- September 2024: Iris Telehealth unveiled the Virtual Clinic and Iris Insights platforms. These platforms provide a suite of services that empower healthcare organizations to seamlessly integrate behavioral healthcare into their patient journeys, addressing the urgent need for improved access to quality mental health services.

- August 2023: Medanta, in collaboration with GE HealthCare, launched the Medanta e-ICU Command Centre, which provides 24/7 advanced consultation, care, and near-real-time monitoring for critically ill patients.

- June 2022: Brazil’s Ministry of Health launched the Brazil Telehealth Program and invested USD 2.7 million to develop Digital Basic Health Units in 326 rural and geographically remote municipalities with an aim to expand remote healthcare access in the region.

REPORT COVERAGE

The global digital health services market report comprises of key aspects such as an overview of cutting-edge technologies, the regulatory environment in major countries, and the challenges faced in adopting and implementing tech-based solutions. The market forecast also provides notable industry developments, including mergers, partnerships, and acquisitions. Furthermore, the report covers detailed regional analysis of various segments and market dynamics.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 18.23% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Application

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 231.59 billion in 2025 and is projected to reach USD 1,015.80 billion by 2034.

In 2025, North America stood at USD 91.46 billion.

Registering a CAGR of 18.23%, the market will exhibit rapid growth over the forecast period (2026-2034).

Based on application, the teleconsultation segment is expected to lead the market during the forecast period.

Rising adoption of remote healthcare and shift toward online consultation are some of the key factors driving the market.

IBM, American Well, and Amazon Web Services Inc. are some of the prominent players in the global market.

North America dominated the market in terms of share in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us