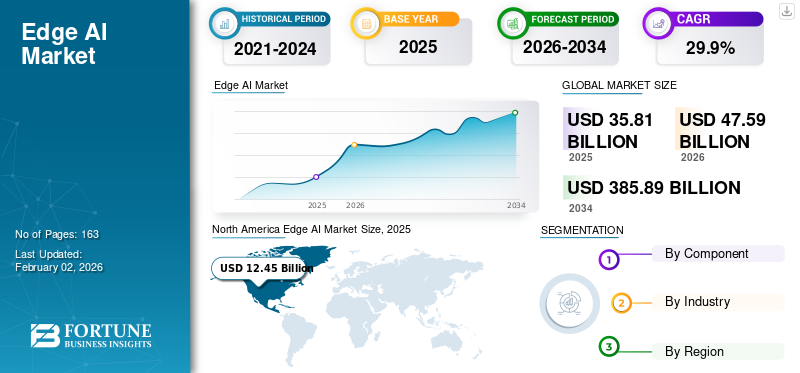

Edge AI Market Size, Share & Industry Analysis, By Component (Hardware, Network, Edge Cloud Infrastructure, Software, and Support Services), By Industry (Automotive, Manufacturing, Healthcare, Energy & Utility, Retail & Consumer Goods, IT & Telecom, and Others), and Regional Forecast, 2026-2034

Edge AI Market Size

The global edge AI market size was valued at USD 35.81 billion in 2025. The market is projected to grow from USD 47.59 billion in 2026 to USD 385.89 billion by 2034, exhibiting a CAGR of 33.30% during the forecast period. North America dominated the edge AI market with a market share of 34.8% in 2025.

In the scope, we have considered edge AI solutions and services provided by key players, such as ADLINK Technology Inc., Synaptics Incorporated, Intel Corporation, and IBM Corporation.

Edge AI is a combination of edge computing and Artificial Intelligence (AI) technology. This solution allows a set of artificial intelligence algorithms to run on local devices with edge computing capacity for critical applications. This solution allows local devices to real-time data processing without internet connectivity. These devices are leveraged across various industries such as automotive, manufacturing, healthcare, energy and utility, consumer goods, IT and telecom, and others.

The market players are developing platforms for edge computing on 5G networks for better digital transformation of enterprises across all industries. For instance,

- In February 2021, Telstra collaborated with AWS to combine Telstra's 5G network with AWS's edge technology. With this partnership, Australia’s Telstra explored AWS’s edge computing offerings integrated into its 5G network to improve the performance of 5G applications.

Moreover, the COVID-19 pandemic moderately impacted the market. During the early phase of the outbreak, the edge hardware market experienced a slowdown as the production of edge computing products and devices was halted due to trade restrictions imposed by governments across various countries. However, with the increasing number of Internet of Things (IoT) devices globally, the market is expected to grow in the coming years.

Edge AI Market Trends

Rising Applications of Edge Devices in Healthcare Sector to Propel Market Growth

Applications of artificial intelligence in the healthcare sector are rapidly increasing, owing to the accurate output results provided by such solutions. Some of the applications include image analysis, virtual diagnostics, robotics-assisted surgery, and electroceuticals. The tools help healthcare institutions analyze health data and allow doctors to connect with patients remotely. Also, edge-based cybersecurity is used in safeguarding sensitive health data.

The major companies in this market are trying to invent and organize new advances in this technology. Moreover, infusion of this technology with healthcare will aid the industry in accelerating and providing high performance. For instance,

Download Free sample to learn more about this report.

· In September 2022, Nvidia expanded its Edge Artificial Intelligence technology for healthcare and robotics. The Nvidia IGX Platform is targeted at both industrial and medical use cases to accelerate performance and extract real-time insights.

Thereby, rising applications of edge devices in healthcare sector to propel edge AI market share.

Edge AI Market Growth Factors

Rising Demand for Autonomous Vehicles & Robotics to Drive Market Growth

Self-driven vehicles need to communicate their data to the cloud in real-time to perform efficiently. Advanced artificial intelligence and machine learning technologies aid these autonomous driving systems in decision-making. Autonomous vehicles connect to the edge to enhance efficiency, reduce accidents, improve safety, and decrease traffic congestion.

Moreover, these applications in robotics are gaining popularity owing to reducing latency and bandwidth requirements. AI-based robot systems, drones, smart factories, and smart ports are some of the places where such technology-infused robotics are applied. For instance,

- March 2024: WeRide and Lenovo Vehicle Computing established a strategic alliance to develop Level 4 autonomous driving solutions customized for commercial use. The advanced intelligent driving system, a collaboration between Lenovo Vehicle Computing and WeRide, utilizes Lenovo's newly revealed AD1 autonomous driving domain controller. This controller is powered by the NVIDIA DRIVE Thor platform, featuring the innovative Blackwell architecture optimized for generative AI and transformer tasks. The system's training is facilitated by NVIDIA's cutting-edge data center AI solutions.

Therefore, rising demand for autonomous vehicles & robotics will drive the edge AI market growth.

RESTRAINING FACTORS

Susceptible Malware Infiltration & Security Flaws to Hinder Market Growth

Edge device applications are exposed to security threats as the data secured and stored is cyber sensitive. This is one of the emerging advancements, and the lack of expertise and knowledge in this field is overseen across all sectors.

Moreover, edge computing heavily depends on the hardware and requires standardized units. The time taken to build the prototype is high, and deploying it in production is time-consuming. Also, the cost incurred on resources, training, and R&D is high. Many factors such as use cases, power consumption, memory requirements, and processors make implementation of this technology challenging.

Edge AI Market Segmentation Analysis

By Component Analysis

Growing Use of Smartphones, Wearables, and Smartwatches to Augment Demand for Edge Hardware

Based on component, the market is segmented into hardware, network, edge cloud infrastructure, software, and support services.

The hardware segment dominated the market and it is expected to continue its dominance by recording the highest CAGR during the forecast period. Edge chipsets have high processing power with less consumption, owing to which they are significantly used in Internet of Things (IoT) devices. The segment dominated the market with a share of 62.41% in 2026.

Smartphones, automobiles, and industrial robots hold a considerable growth potential for this hardware. The chipset includes GPU, CPU, ASIC, and FPGA. AI-at-the-edge chips in smartphones provide users with many benefits, including speedy learning and long life.

Moreover, Brazil is cooperating with Taiwan for its semiconductor capital to grow its advanced semiconductor chip industry. This aids Brazil in growing its USD 50 billion tech industry.

The software segment is anticipated to record a prominent CAGR during the forecast period as it allows users to get data in real-time by running AI algorithms on local devices.

- In August 2022: Voyager Labs showcased its edge-AI investigation tools at the Credence Security Middle East Roadshow. Using Edge computing technology in investigation tools enhances the ability to investigate and identify attacks.

By Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Adoption of Edge Hardware for Improving Safety in Vehicles Boosted Automotive Segment Growth

Based on industry, the market is categorized into automotive, manufacturing, healthcare, energy & utility, retail & consumer goods, IT & telecom, and others.

Automotive industry dominated the market in 2023 owing to rise in the adoption of edge solutions in autonomous vehicles, where real-time analysis is critical. Adoption of edge solutions in autonomous vehicles helps enhance efficiency, improve safety, reduce accidents, and decrease traffic congestion, owing to which the automotive sector is expected to register the highest CAGR in the coming years. The segment is expected to capture 24.54% of the market share in 2026.

However, the consumer goods segment is expected to record a significant CAGR during the forecast period owing to the increase in smart wearables, smart speakers, and other digital devices. As per industry experts, around 1.3 million units of smartwatches and smart bands were sold in 2019.

The retail & consumer goods segment is anticipated to grow with a considerable CAGR of 35.30% during the forecast period (2024-2032).

REGIONAL INSIGHTS

Geographically, the market is divided into five key regions: North America, South America, Europe, the Middle East & Africa, and Asia Pacific. They are further categorized into countries.

North America

North America Edge AI Market Size, 2025 (USD Billion) To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a USD 12.45 billion in 2025 and USD 16.122 billion in 2026. North America market’s growth is driven by a significant focus on the adoption of advanced technologies, including AI, deep learning, and machine learning, by enterprises in the region, especially the U.S., which plays a vital role in helping the region stay ahead in the competition.

The U.S. government is majorly focusing on the adoption of artificial intelligence technology across the country. For instance, in March 2024, Innodisk, a provider of AI solutions, showcased its knowledge in integrating edge AI at NVIDIA GTC in San Jose, U.S., specializing in customizable AI solutions accessible across diverse industries, Innodisk actively disseminates its research and practical edge AI implementations globally. The company demonstrates how its camera modules seamlessly integrate with NVIDIA's specialized AI visual technology, emphasizing practical applications across industries. Thus, advancements in AI technology are expected to fuel the market growth rate in the region. The U.S. market is projected to reach USD 11.988 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Europe

Europe is the third leading region set to gain USD 8.91 billion in 2025. Europe is expected to hold a prominent share in the market owing to the growing popularity of these solutions in manufacturing, automotive, energy & utility, and other sectors in the U.K., Germany, France, and Italy. Market players are focusing on the development of these solutions by making huge investments in their R&D activities. The UK market is projected to reach USD 2.779 billion by 2026, while the Germany market is projected to reach USD 2.145 billion by 2026. while France is expected to reach USD 1.65 billion in the 2025.

Middle East & Africa

The Middle East & Africa is the fourth largest market expected to reach USD 2.73 billion in 2025. The Middle East & Africa market is driven by the rising deployment of emerging technologies in the region. For instance, the UAE's Ministry of Industry and Advanced Technology (MoIT) considers Industry 4.0 as its key focus area. This program supports manufacturers in the adoption of 4IR technologies (VR, AR, ML, IoT, AI) that are launched. The GCC market is poised to stand it USD 1.20 billion in 2025.

Asia Pacific

Asia Pacific is the second largest market expected to gain USD 9.83 billion in 2025, registering a CAGR of 37.50% during the forecast period (2024-2032). The Asia Pacific market is expected to record the highest CAGR. The Chinese market is estimated to be vakued at USD 3.31 billion in 2025. Key players in the region are expanding their geographical presence by offering advanced technological solutions across developing nations. In Japan, companies are developing edge AI solutions for the automotive and manufacturing sectors. The Japan market is projected to reach USD 2.483 billion by 2026, the China market is projected to reach USD 4.466 billion by 2026, and the India market is projected to reach USD 2.174 billion by 2026. For instance,

- In October 2021, Blaize and NEXTY Electronics Corp., a member of Toyota Tsusho Group, declared NEXTY as a distribution partner of Blaize to serve industrial and automotive markets for edge and AI applications in Japan.

South America is gaining popularity in the market owing to the funds and investments received by the region for deploying these technologies. For instance, in January 2024, the EDGE Group collaborated with the São Paulo State Government for a significant public security initiative. Known as 'Crystal Ball', the project focused on intelligent monitoring to enhance surveillance and support in the central districts of São Paulo city. It involved deploying advanced technologies, including Smart CCTV Monitoring Solutions, Intelligent Drones, and Artificial Intelligence (AI).

KEY INDUSTRY PLAYERS

Key Players are Creating Highly Differentiated Product Portfolios to Attract, Reward, and Retain Customer Base

Continuous innovation and technological advancements create potential among industries and enterprises to reinvent and expand their product portfolio. Key players in the market are adopting this strategy to sustain competency and walk in pace with digital economic growth. Innovations and new product launches will attract a vast customer base, thereby improving revenue. For instance,

- March 2024: Edge Impulse Inc. introduced a direct integration with Arm Keil MDK that offers access to advanced ML and AI models. This initiative also makes it easier for embedded specialized individuals to collaborate with other related teams to develop edge AI tools and bring them to market.

- September 2021: ADLINK Technology Inc. launched EVA SDK, an edge vision analytics software to aid users in building a POC for AI-powered machine vision solutions. EVA SDK comprises a no-code graphical user interface and supports more than 10 types of cameras.

List of Key Companies Profiled:

- NVIDIA Corporation (U.S.)

- Alphabet, Inc. (U.S.)

- Microsoft Corporation (U.S.)

- IBM Corporation (U.S.)

- Amazon.com, Inc. (U.S.)

- Intel Corporation (U.S.)

- Synaptics Incorporated (U.S.)

- ADLINK Technology Inc. (Taiwan)

- Edge Impulse (U.S.)

- Viso.ai (Switzerland)

KEY INDUSTRY DEVELOPMENTS:

- March 2024: Advantech revealed an extension of its partnership with NVIDIA, now serving as an official distributor of industrial PCs certified with the NVIDIA AI Enterprise software platform. This collaboration aims to facilitate the deployment and development of AI applications, including GenAI. The recently unveiled NVIDIA AI Enterprise 5.0 introduces users to a catalog of microservices, with NVIDIA NIM, a collection of microservices optimized for inference across over two dozen AI models.

- March 2024: HPE unveiled a range of GenAI training and inference products and intentions to utilize microservices and Nvidia GPUs software. HPE introduced an edge to data center, on-premises, hybrid, and public cloud methods within the GenAI portfolio. Additionally, it declared the availability of GenAI supercomputing systems featuring Nvidia components.

- March 2024: Microsoft (MSFT) has established a new entity named Microsoft AI, dedicated to the development and advancement of the company's consumer-oriented artificial intelligence products, technology, and research. This organization will concentrate on consumer-facing AI products and research. Existing Microsoft AI teams, such as Copilot, Bing, and Edge, will be consolidated under this newly formed organization.

- March 2024: Vapor IO, known for its expertise in edge networking and real-time, pervasive AI and the developers of Kinetic Grid platform, introduced its Monetize the AI Edge partner program. This reseller program was crafted to aid partners in expediting the delivery of real-time AI by offering bundled AI services through Vapor IO's neutral and shared host infrastructure.

- March 2024: Neural Magic and Akamai Technologies revealed a strategic collaboration aimed at enhancing deep learning features on Akamai’s distributed computing infrastructure. This collaboration aims to stimulate invention in edge-AI inference across various industries.

REPORT COVERAGE

The research report highlights leading regions across the world to offer a better understanding of the user. Furthermore, the report provides insights into the latest industry and edge AI market dynamics and analyzes technologies deployed at a rapid pace at the global level. It further highlights some growth-stimulating factors and restraints, helping the reader gain in-depth knowledge about the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 29.9% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Component, Industry, and Region |

|

Segmentation |

By Component

By Industry

By Region

|

Frequently Asked Questions

The market is projected to record a valuation of USD 385.89 billion by 2034.

In 2025, the market value stood at USD 35.81 billion.

The market is projected to record a CAGR of 29.9% over the forecast period of 2026-2034.

The automotive segment holds the largest share of the market based on industry.

The rising demand for autonomous vehicles and robotics will drive the market growth.

Alphabet Inc., Amazon.com, Inc., Microsoft Corporation, IBM Corporation, Nutanix, Inc., Intel Corporation, Synaptics Incorporated, ADLINK Technology Inc., Gorilla Technology Group, and Viso.ai are the top players in the market.

North America is expected to hold the highest market share.

Asia Pacific is expected to register the highest CAGR.

Get 20% Free Customization

Expand Regional and Country Coverage, Segments Analysis, Company Profiles, Competitive Benchmarking, and End-user Insights.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us