Edible Animal Fat Market Size, Share & Industry Analysis, By Type (Butter, Tallow, Lard, and Others), By Source (Cattle, Pig, and Others), By Application (Food and Non-food), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

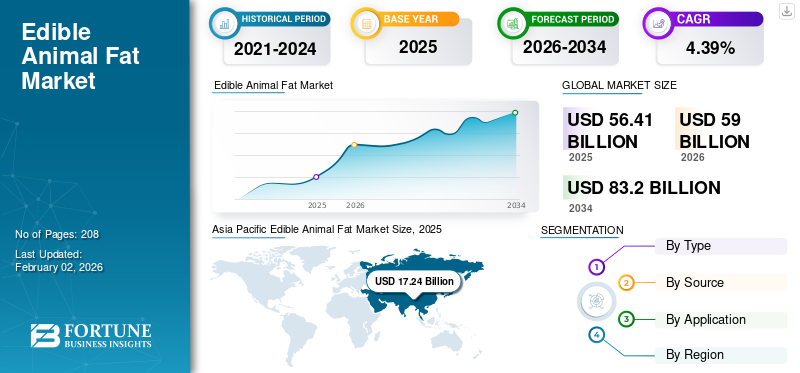

The global edible animal fat market size was valued at USD 56.41 billion in 2025 and is projected to grow from USD 59.00 billion in 2026 to USD 83.20 billion by 2034, exhibiting a CAGR of 4.39% during the forecast period. Asia Pacific dominated the edible animal fat market with a market share of 30.55% in 2025. Moreover, the edible animal fat market size in the U.S. is projected to grow significantly, reaching an estimated value of USD 19.86 billion by 2032, driven by a rise in demand for animal fat in the food processing and food service sector.

The global COVID-19 pandemic has been unprecedented and staggering, with edible animal fat witnessing lower-than-anticipated demand across all regions compared to pre-pandemic levels.

The major factor driving the edible animal fat market growth is the increased adoption of animal fats in preparing food items in the foodservice industry. The use of these products helps to enhance the flavor and taste of the food products. They are ideal for frying, stirring, and baking products as they provide a crispy layer to the cooked food. Thus, these fats are widely used in restaurants and fast-food chains to prepare different deep-fried products. Furthermore, they are also used to enhance the nutrition profile in animal feed products; hence, they also have applications in the animal feed industry.

GLOBAL EDIBLE ANIMAL FAT MARKET OVERVIEW

Market Size & Forecast:

- 2025 Market Size: USD 56.41 billion

- 2026 Market Size: USD 59.00 billion

- 2034 Forecast Market Size: USD 83.20 billion

- CAGR: 4.39% (2026–2034)

Market Share:

- Asia Pacific dominated the edible animal fat market with a 30.55% share in 2025, supported by rising disposable income and growing demand for processed and baked foods.

- By Type: Butter holds the largest market share due to its widespread use in food processing, sauces, and bakery items.

- By Application: Food industry accounts for the majority of the market share, with growing non-food applications in animal feed products.

- By Source: Cattle-based fats lead the market, especially butter and tallow, driven by strong consumer preference.

Key Country Highlights:

- United States: Projected to reach USD 19.86 billion by 2032, driven by increasing demand for animal fat in food processing and food service sectors.

- Asia Pacific: Largest regional market with traditional preference for butter and lard in cooking, bakery, and feed products. Rising incomes and adoption of Western diets further fuel growth.

- Europe: Moderate consumption; countries like Germany, the U.K., and Belgium utilize animal fats in bakery, confectionery, and foodservice sectors.

- South America & Middle East & Africa: Brazil leads in South America as a major consumer and producer; MEA sees increased adoption due to affordability and Western dietary trends.

Edible Animal Fat Market Trends

Rapid Adoption of Western Diets Positively Influences the Market Growth

In China, India, Indonesia, and other Asian countries, the disposable income of the population is increasing owing to rapid industrialization. This factor resulted in a shift in the dietary pattern of the consumers, with more consumers preferring processed food and bakery items.

With the increasing popularity of fast food products in the region, many fast-food restaurants operating have also increased significantly. Moreover, the restaurants successfully integrate local cuisines and baked food items into their menu to increase their popularity in the region. Furthermore, due to the traditional popularity of lard in China, these food items are widely used in baking and cooking food items.

Thus, the rise in disposable income and the rapid adoption of western diets in Asia positively impacted the adoption of edible fats derived from animals.

Download Free sample to learn more about this report.

Edible Animal Fat Market Growth Factors

Increased Sales of Animal Fat Owing to its High Adoption in Food Processing Industry to Boost Market Growth

Oil is the most crucial ingredient used for cooking food products. The type of oil used for cooking food items stems from the long-standing tradition and culture associated with a particular cuisine. Edible animal fats such as butter and lard have been used for cooking food products since ancient times and their popularity continues to increase among consumers. For instance, lard is used in the bakery industry to allow steam and air to enter the baked goods. This factor helps improve the texture of the bakery items, especially by improving their flakiness. In fast-food restaurants, products such as butter and lard are used to prepare innovative food items and attract new consumers who prefer to experience new food items. Hence, such products are used to prepare biscuits, pies, and cakes.

Tallow fat is rich in vitamins A, D, K, E, B12, and other fatty acids. Due to the high smoke point, tallow provides high heat to food products and helps roasting, frying, and baking food items. Hence, chefs use these products to enhance the flavor of their dishes. Thus, the use of such products for preparing food items is expected to remain steady.

Additionally, in emerging economies such as India and China, the rise in disposable income influences the consumption pattern with consumers shifting rapidly toward western food habits. Thus, the demand for fried food products and baked goods is rapidly rising in the country. Furthermore, restaurant chains and bakeries that use animal fat for food preparation are rising significantly. This acts as a major factor boosting the growth of edible animal fat market.

Sustainable Manufacturing of Animal Fat Products to Propel Market Growth

Although the popularity of plant-based oils, such as palm oil and coconut oil, is rising among consumers, their production process is highly unsustainable and negatively impacts the environment. Large quantities of tropical forest in several countries were cut down to develop palm plantations. This factor threatened the habitat of animals such as tigers, elephants, rhinos, among others. Adoption of such cultivation methods along with deforestation also leads to soil erosion and environmental pollution.

On the other hand, the products are manufactured by processing animal waste generated in meat processing facilities. Instead of dumping the waste in the landfills, animal carcasses are processed to make edible products like lard, tallow, and other animal fats. Thus, animal waste processing helps reduce the carbon emission from landfills and acts as a sustainable alternative to plant oils manufactured unsustainably.

RESTRAINING FACTORS

Increasing Consumer Concern About Negative Health Impacts of Animal Products Impedes Market Growth

Consumers have significant health concerns about the impact of edible animal fats such as butter, lard, and similar products consumption. With excessive consumption, it causes an increase in LDL (low-density lipoprotein) cholesterol, which causes several cardiovascular problems and obesity. Hence, nutritionists advise consumers to adopt low-calorie oil and fat products in their diet to prevent such disease. This factor acts as a major factor impacting the sales of the products and restrains their market growth.

There is a rising awareness among consumers about the impact of animal agriculture on the health of animals. Most animals are placed in highly confined spaces and raised only for meat. Hence, people concerned about animal health advocate using plant-based products to reduce animal cruelty. Furthermore, a few consumers also adopted a vegan diet, which is sustainable and helps reduce obesity. This change in dietary patterns also impacts the growth of the market.

Edible Animal Fat Market Segmentation Analysis

By Type Analysis

Butter Segment to Dominate Market Owing to its Increased Use in Food Processing Industries

By type, the market is segmented into butter, lard, tallow, and others. Butter is the most widely used and holds a significant market share of 69.73% in 2026.

Butter is widely used to prepare various food items globally. It helps enhance the flavor of food items and compliments food flavors. It is also used in preparing sauces and fluffy bakery food products.

Lard constitutes the second-largest edible fat product in the global market. It is used for making traditional Asian cuisines. Furthermore, lard is also used in preparing various western food items.

By Source Analysis

Cattle Segment to Hold Highest Share Owing to Higher Consumer Preference for Butter and Tallow Products

The market includes cattle, pigs, and others based on the source. High consumer preference for cattle-based products such as butter and tallow makes cattle a dominant market share with 82.81% in 2026 .

The pig segment is also expected to register significant growth in the market. Lard is useful in frying, roasting, and grilling food items, due to which its use in the food industry is increasing rapidly.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Non-food Industry to Register Faster Growth Due to Increased Demand for Animal Feed Products Globally

Due to higher volume sales of such fats in the food industry, the food application of these products accounts for the majority market share of 68.07% in the global market in 2026.

Edible animal fats are used in food processing and non-food industries (mainly feed industries). The addition of these products in feed manufacturing helps to promote production and growth. With the increasing demand for feed products that promote animal growth, the use of these products to make animal feed products is expected to increase significantly. With the increasing demand for these feed products, which promote animal growth, the use of these products to make animal feed products is expected to increase significantly.

REGIONAL INSIGHTS

Asia Pacific

Asia Pacific Edible Animal Fat Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific stood at USD 17.24 billion in 2025 and is one of the largest edible animal fat markets globally. Consumption of butter and lard is high in this region. The large consumption of animal fats can be attributed to the traditional cooking style in some countries, which use butter and lard as their main cooking ingredients. The Japan market is projected to reach USD 0.77 billion by 2026, the China market is projected to reach USD 6.54 billion by 2026, and the India market is projected to reach USD 7.86 billion by 2026.

Due to the rise in disposable income, more consumers purchase processed food products and bakery products. New restaurants that opened in the region use butter and lard for making different dishes that are customer favorites. Additionally, a large quantity of animal fats is used to manufacture high-quality animal feed products, resulting in increased consumption in the region.

To know how our report can help streamline your business, Speak to Analyst

North America

North America is another major market with high consumption of edible animal fats such as butter and lard among consumers. Butter is the most widely used edible animal fat to cook various dishes in the region. Furthermore, tallow and poultry fats are used to manufacture animal feed products. However, due to the growing awareness about the negative impact of these products on cardiovascular health, the sales of products in the region have slowed down in recent years. The U.S. market is projected to reach USD 14.92 billion by 2026.

Europe

Compared to other markets, the consumption of butter and lard is low in Europe. Germany, Russia, the U.K., and Belgium are some major consumers of tallow and butter used in various foodservice industries. In addition, consumers prepare locally sourced, fresh products to support the local farm owners. Edible animal fats are also used to prepare various traditional food items. They are also used in various foodservice industries and for different confectionery and bakery products in Germany and the rest of the European market. The UK market is projected to reach USD 0.94 billion by 2026, and the Germany market is projected to reach USD 3.06 billion by 2026.

South America

Brazil is one of the major consumers of edible animal fat products in South America. Butter and lard are used in cooking various food products in the region. Furthermore, Brazil is one of the region's largest producers of rendered meat products. These products are used to manufacture high-quality animal feed and pet food products. Hence, this region is a potential opportunity for animal fat manufacturers to increase their presence.

Middle East & Africa

Compared to vegetable oil, edible animal fat products are cheaper alternatives and are suitable for cooking various food products. One of the major factors influencing the growing adoption of animal fat products in cooking is the adoption of western food habits in the Middle East & Africa. Consumption of snacks, biscuits, and other bakery goods has increased significantly in recent years.

KEY INDUSTRY PLAYERS

Companies Focus On Launching Innovative Products to Expand their Global Market Share

The market is semi-consolidated, with several major players and small players operating worldwide. Major manufacturers include Bunge Limited, Sonac (Darling Ingredients Inc.), Cargill, Incorporated, Leo Group Ltd., and family-owned companies such as Ten Kate Vetten B.V., York Foods Pty Ltd., and others. Established players such as Cargill and Sonac develop edible fat products that are region-specific to meet the local demands. Furthermore, companies are developing sustainable food ingredients devoid of trans fatty acids (TFA) due to rising health consciousness. Such a manufacturing process helps make the product healthy and suitable for consumption. Due to the popularity of edible fat products, such as lard and butter, the companies are developing new customized products to suit the growing demand.

List of Top Edible Animal Fat Companies:

- Ten Kate Vetten B.V. (Netherlands)

- Sanimax (Canada)

- Hubberts Industries (Canada)

- Cargill, Incorporated (U.S.)

- Sonac (Darling Ingredients Inc.) (U.S.)

- Bunge Limited (U.S.)

- York Foods Pty Ltd (Australia)

- Leo Group Ltd. (U.K.)

- Boyer Valley Company, LLC. (The Lauridsen Group) (U.S.)

- Coast Packing Company (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- October 2023 – iD Fresh Food, an Indian fresh food brand, announced the launch of iD Twist and Spread Butterstick. The new product is convenient to use and easy to store and has been launched in major markets in the country.

- December 2022 – KTC Edibles launched a new premium Italian lard, Premio Italian Lard, in the U.K. The new product would provide food manufacturers with a new superior option for bakery, frying, and roasting.

- March 2022 - Coast Packing Company, the U.S.-based company, launched a press release and promotional campaign named “LardAtRetail” to increase the sales of edible animal fat shortening products in the market.

- May 2020- Sanimax entered into an alliance with Colombia-based rendering company Agrosan & Proteicol to procure raw materials for animal fat processing. This alliance helped the company expand their business in the Colombian market.

- May 2018- Neste Corporation acquired a majority share in the IH Demeter B.V. by purchasing 51% share in the company. The company improved its logistics for manufacturing animal fats and proteins with the acquisition.

REPORT COVERAGE

The research report provides a detailed analysis of the market and focuses on key aspects such as leading companies, type, source, and application. Besides this, the report offers insights into the market trends and highlights key industry developments and the competitive landscape. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.39% over 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Type

By Source

By Application

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global edible fat market size was USD 56.41 billion in 2025 and is projected to reach USD 83.20 billion by 2034.

In 2025, the Asia Pacific market value stood at USD 17.24 billion.

Growing at a CAGR of 4.39%, the market will exhibit steady growth over the forecast period (2026-2034).

Based on application, the food industry segment is expected to lead the market.

High adoption in the food industry is a significant factor driving the growth of the market.

Cargill, Inc. and Ten Kate Holdings are a few major players in the global market.

Asia Pacific dominated the market share in 2025.

Factors such as high meat production and consumption are expected to drive the adoption of the product.

Get 20% Free Customization

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us