EMC Filtration Market Size, Share & Industry Analysis, By EMC Filter Type (1-Phase EMC Filters, 3-Phase EMC Filters, DC Filters, IEC Inlets, and Chokes), By Power Quality Filter Type (Passive Harmonic Filters, Active Harmonic Filters, Output Filters, and Reactors), By Technology (Surface Mount Technology, Thick Film Technology, Thin Film Technology, and Through-Hole Technology), By Application (Industrial Equipments, Building Technologies, Consumer Electronics, IT and Telecom, Medical Devices, Automobiles, and Others), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

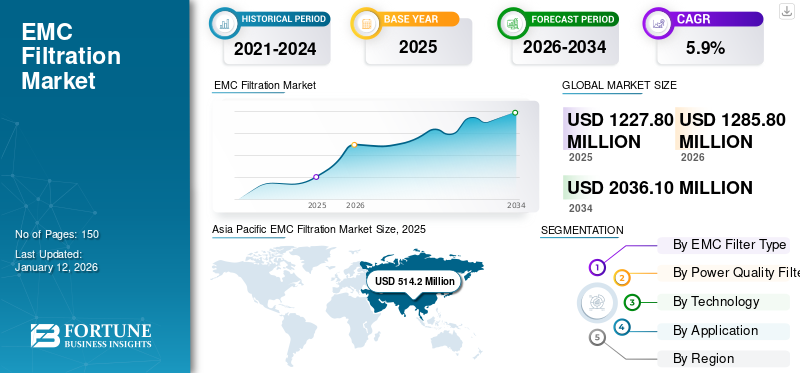

The global EMC filtration market size was valued at USD 1,227.80 million in 2025. The market is projected to grow from USD 1,285.80 million in 2026 to USD 2,036.10 million by 2034, exhibiting a CAGR of 5.9% during the forecast period.

EMC filters are key components in the successful operation of any electronic device or system, which controls the electromagnetic interference. It finds critical applications in another wide spectrum of applications, such as medical devices, automobiles, industrial equipment, and consumer electronics, where intrusions impact the performance and reliability of electronic devices.

EMC filtration is witnessing significant market growth mainly due to the increasing use of renewable energy and the rising need for consumer electronics and industrial automation. The emergence of smart technologies, including IoT devices and electric vehicles is driving the market share.

According to iea.org, in 2025, global electric car sales are projected to increase by 25% compared to last year. Moreover, the globalization of markets and the growth of global trade have increased the demand for EMC solutions, hence, accelerating the market growth. These elements are helping in the expansion of market share for EMC Filtration.

The COVID-19 pandemic impacted the demand for EMC filtration negatively in the short term due to supply chain disruptions. Furthermore, increased focus on healthcare, adoption of EVs, and demand for remote work further boosted the demand for EMC filters in the market.

Download Free sample to learn more about this report.

IMPACT OF GENERATIVE AI

Integration of Generative AI with EMC Filtration by Enhancing Capabilities to Fuel Market Growth

Generative AI is transforming this sector by optimizing design processes, facilitating adaptive and predictive functionalities, enhancing customization, and delivering insights that can be acted upon in the market. These improvements are establishing new benchmarks for efficiency and dependability within a progressively complex electromagnetic landscape.

IMPACT OF RECIPROCAL TARIFFS

The effect of reciprocal tariffs has brought considerable difficulties and strategic changes within the electromagnetic industry by raising costs, complicating market access, and disrupting the supply chain. These effects may slow global growth and pressurize manufacturers to make cost-effective components. Furthermore, the players are focusing on reducing risks by managing inventory effectively and spreading their suppliers.

MARKET DYNAMICS

EMC Filtration Market Trends

Rising EV Applications in EMC Filters to Emerge as a Key Market Trend

Electromagnetic compatibility devices play a crucial role in maintaining a vehicle's performance throughout its lifespan by eliminating external interferences that could negatively affect the operations of EVs. EMC filters safeguard delicate electronic components within automotive vehicles and enable effective integration between various vehicle parts. The importance of EMC filtering in the protection of EV charging systems has a significant contribution to the reliability and safety of the automotive sector. On the other hand, further development in EV technology, such as high charging capacities, introducing hybrid models, and continuous development in charging infrastructure, will create awareness and demand for EMC filters from end-users.

Market Drivers

Increasing Use of Renewable Energy to Aid Market Growth

Renewable energy systems depend significantly on electronic components to transform and control electrical energy. As renewables are incorporated into both national grids and microgrids, they need to meet strict EMC standards to avoid EMI interference with other connected equipment. This demand increases the importance of improved EMC filtering processes. Moreover, utilizing renewable energy features the importance of sustainability and environmentally friendly practices.

Market Restraints

High Cost of Initial Investment to Hinder Market Expansion

The EMC filtration market growth to be limited owing to the high cost of the first investment in the filters. Better EMC filtering ways have to use hard materials and parts such as ferrite cores. Additionally, EMC filters are products of meticulous engineering. Current industry stakeholders may restrict the ultimate use of EMC filters because of the unstable global economy at this time.

Market Opportunities

Miniaturization of Electronic Devices to Create Lucrative Market Opportunities

The miniaturization of electronic devices resulted in a greater vulnerability to EMI. As electronic parts become more compact and closely arranged, the likelihood of EMI increases, leading to a higher need for EMC filtering. This trend towards miniaturization is particularly evident in various applications that demand effective EMI reduction to guarantee improved device functionality and adherence to regulations.

SEGMENTATION ANALYSIS

By EMC Filter Type

Rising Need in Broad Application Areas Provided by 1-Phase EMC Filters to Boost Market Demand

Based on EMC filter type, the market is segmented into 1-Phase EMC filters, 3-Phase EMC filters, DC filters, IEC inlets, and chokes.

The 1-Phase EMC filters segment dominated the market share of 30.16% in 2026. This growth is due to their extensive use in telecommunications, industrial equipment, consumer electronics, etc., to ensure product safety and compliance.

The IEC inlets segment is expected to see the highest compound annual growth rate (CAGR) throughout the forecast period. These inlets are typically utilized in electronic devices that need standardized power entry modules. They are increasingly adopted in various modern applications where compactness and integrated EMI mitigation are crucial.

By Power Quality Filter Type

Increasing Usage of Output Filters for Enhanced Capability to Aid Market Growth

Based on power quality filters type, the market is segmented into passive harmonic filters, active harmonic filters, output filters, and reactors.

The category of output filters segment produced the highest revenue share 34.54% in 2026. The growth of this segment is attributed to the proliferation of high-frequency electronics and expanding use of power electronics. These filters are typically installed at the output stage to block EMI and RFI emitted by the device.

The reactors segment is anticipated to register the highest CAGR during the forecast period. Reactors are normally used to reduce high-frequency noise and EMI in applications mainly related to variable frequency drives, industrial automation, and renewable energy systems. Increasingly vital as electronic systems grow more complex, their ability to enhance power quality and protect sensitive equipment.

By Technology

Surface Mount Technology Dominated the Market with Its Cost-Effective Capabilities in the Field of EMC Filtration

Based on technology, the market is categorized into surface mount technology, thick film technology, thin film technology, and through-hole technology.

By 2025, the surface mount technology segment is expected to lead the market share of 35.51%, owing to its advantages, such as more solid form, lower production costs, and ease of integration into the latest electronic devices. This technology is commonly used in both consumer electronics and industrial applications.

The thin film technology segment is expected to record the highest CAGR during the forecast period. This segment enables the production of compact, high-precision filters suitable for advanced electronic devices where space and performance are critical.

By Application

To know how our report can help streamline your business, Speak to Analyst

Consumer Electronics Segment Dominated the Market with Increasing Rising Demand for Electronic Devices in the Market

Based on the application, the market is categorized into industrial equipment, building technologies, consumer electronics, IT and telecom, medical devices, automobiles, and others.

The consumer electronics segment held the largest market share in 2024. With the rising prevalence of electronic devices, it is expected that the devices will operate smoothly without producing or being impacted by EMI. EMI can lead to performance issues, errors, and breakdowns, which could have expensive or hazardous repercussions depending on the application. The increase in fast data transfer speeds and the expansion of wireless communication technologies feature the concern regarding EMI. As these developments continue, there is a greater demand for effective EMC filtering solutions to guarantee smooth operation.

The medical devices segment is expected to register the highest CAGR during the forecast period due to the rising device complexity, regulatory requirements, and the expanding use of digital and connected health technologies.

EMC FILTRATION MARKET REGIONAL OUTLOOK

Based on the region, market is studies across North America, Europe, Asia Pacific, South America, and Middle East & Africa.

Asia Pacific

Asia Pacific EMC Filtration Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific dominated the market with a valuation of USD 514.2 million in 2025 and USD 539.4 million in 2026. Technological advancements, industrialization, and urbanization drive this region’s growth. Countries such as China, Japan, South Korea, and Taiwan are at the forefront of electronic manufacturing, playing a key role in the demand for EMC filters. The strong industrial foundation of the region, along with governmental efforts to enhance domestic production, particularly in India, has resulted in a rise in the output of consumer electronics, automotive electronics, and industrial machinery, all of which necessitate effective EMC solutions, thus, generating new opportunities in the market. The Japan market is projected to reach USD 116.9 million by 2026, the China market is projected to reach USD 173.4 million by 2026, and the India market is projected to reach USD 74.6 million by 2026.

Recognized for its strong manufacturing capabilities, China remains a key player in regional production. According to the National Bureau of Statistics of China, increasing factory wages are driving the demand for industrial robots and automation solutions. Manufacturers, both domestic and international, are investing in automation technologies within China to improve efficiency.

To know how our report can help streamline your business, Speak to Analyst

South America

The market for EMC filtration in South America is undergoing stable growth due to recent shifts in the local economy and initial government funding for research initiatives.

Europe

Europe is estimated to grow at the highest rate during the forecast period. The country possesses a robust legal framework to ensure compliance with EMC standards, which encourages the adoption of superior EMC filter solutions. This stringent regulatory landscape highlights the necessity for advanced filtration technologies, leading to considerable market demand for manufacturers in the region. The UK market is projected to reach USD 52.7 million by 2026, while the Germany market is projected to reach USD 51 million by 2026.

Middle East and Africa

The Middle East and Africa region has a smaller market presence. The expanding smart infrastructure projects and government initiatives have created a positive impact while economic diversification could be a challenging aspect.

North America

The North American market for EMC filtration is witnessing substantial growth opportunities. The adoption of digital technologies and political pressures to manufacture consumer electronics in the region itself create an immense amount of opportunities for the market. The U.S. leads the North American market due to its growing electronic sector, strong innovation, and investment ecosystem. The U.S. market is projected to reach USD 257.1 million by 2026.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Market Players to Use Merger & Acquisition, Partnership, and Product Development Strategies to Expand Business Reach

Key players operating in this market are providing EMC filters to enable users to ensure their equipment and systems can operate effectively in the presence of electromagnetic interference (EMI). They are focusing on signing acquisition agreements with small and local firms to increase their business operations. Moreover, partnerships, mergers & acquisitions, and key investments will also boost the demand for this technology.

List of Key EMC Filtration Companies Studied

- Schaffner Holding AG (Switzerland)

- ETS-Lindgren (U.S.)

- Panasonic Corporation (Japan)

- Murata Manufacturing Company, Ltd. (Japan)

- TDK Corporation (Japan)

- KEMET Corporation (Taiwan)

- TE Connectivity Ltd (Ireland)

- Schurter Holding AG (Switzerland)

- PREMO Corporation S.L. (Spain)

- REO Ltd. (Germany)

- BLOCK Transformatoren-Elektronik GmbH (Germany)

- DEM Manufacturing Ltd. (U.S.)

- Astrodyne Corporation (U.S.)

- Cornell Dubilier (U.S.)

- MTE Corporation (U.S.)

- Rohde & Schwarz GmbH & Co. KG (Germany)

- Teseq AG (Switzerland)

- Laird plc. (U.S.)

- Shanghai Eagtop Electronic Technology Co. Ltd. (China)

- Yageo Corporation (Taiwan)

…and more

KEY INDUSTRY DEVELOPMENTS

- November 2024: AstrodyneTDI launched the RP395 EMI filter, a high-performance 3-phase delta power line filter made for 1000 VAC high voltage AC systems. This filter provides universal connection options and operates efficiently across a range of frequencies, making it ideal for power conversion applications.

- June 2024: Schaffner, a player in the EMC filtration, introduced its newest RT series N choke that offers improved attenuation levels compared to earlier models while maintaining the same mechanical dimensions.

- January 2024: TDK Corporation expanded its range of single-phase EMC filters. These components are suitable for both AC and DC applications, with voltage up to 250V and current ranging from 6A to 30A. This ability allows them to be utilized in the growing DC infrastructure within the industrial and construction sectors.

- November 2023: Astrodyne TDI launched the newest member of its DC EMI filter range - the RP681 series. This solution features a slim, compact design and can handle voltages of up to 1000V.

- June 2023: TDK Corporation revealed its latest series (TCM0403T) of common mode filters designed for noise reduction in high-speed differential transmission interfaces.

INVESTMENT ANALYSIS AND OPPORTUNITIES

The industry offers robust investment prospects fueled by electrification, automation, digital advancements, and adherence to regulatory standards in various sectors. Businesses have the chance to allocate resources toward research and development to produce more compact, efficient, and high-performing EMC filters. Additionally, organizations that launch smart EMC filter designs or implement miniaturization and integration technologies can easily enter into new market opportunities. Therefore, presenting a huge opportunity for the players operating in the this market.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, products/types, and leading applications of the product. Besides, it offers insights into the EMC Filtration industry trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.9% from 2026 to 2034 |

|

Unit |

Value (USD million) |

|

Segmentation |

By EMC Filter Type

By Power Quality Filter Type

By Technology

By Application

By Region

|

|

Companies Profiled in the Report |

Schaffner Holding AG (Switzerland) ETS-Lindgren (U.S.) Panasonic Corporation (Japan) Murata Manufacturing Company, Ltd. (Japan) TDK Corporation (Japan) KEMET Corporation (Taiwan) TE Connectivity Ltd (Ireland) Schurter Holding AG (Switzerland) PREMO Corporation S.L. (Spain) REO Ltd. (Germany) |

Frequently Asked Questions

The market is projected to reach a valuation of USD 2,036.10 million by 2034.

In 2025, the market was valued at USD 1,227.80 million.

The market is projected to record a CAGR of 5.90% during the forecast period.

By EMC filter type, the 1-Phase EMC filters segment led the market in 2025.

Increasing use of renewable energy to aid market growth.

Schaffner Holding AG, ETS-Lindgren, Panasonic Corporation, Murata Manufacturing Company, Ltd., TDK Corporation, KEMET Corporation, TE Connectivity Ltd, Schurter Holding AG, PREMO Corporation S.L., and REO Ltd. are the top players in the market.

Asia Pacific held the highest market share in 2025.

By application, the medical devices segment is expected to record the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us