Engineering Services Market Size, Share & Industry Analysis, By Services (Software Product Engineering, Embedded Engineering, Mechanical Engineering, Network Engineering, and Manufacturing Engineering), By Vendor Category (Broadbased and Pureplay), By Industry Vertical (Automotive & Mobility, Healthcare & Life Science, Manufacturing & Mining, BFSI, Retail & Consumer goods, Aerospace & Defense, IT & Telecom, and Others (Media & Entertainment)), and Regional Forecast, 2026–2034

ENGINEERING SERVICES MARKET SIZE AND FUTURE OUTLOOK

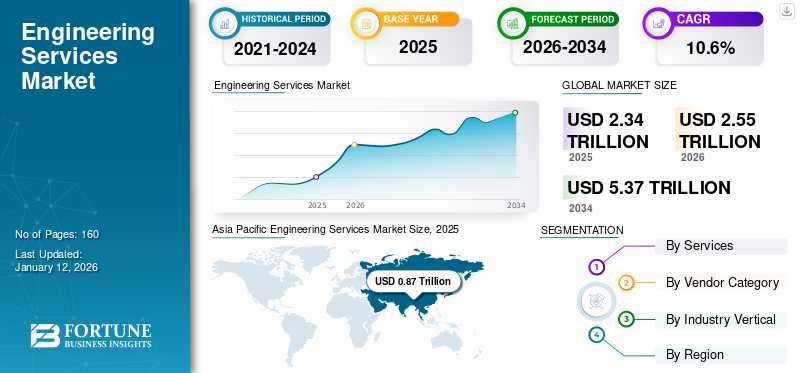

The global engineering services market size was valued at USD 2.34 trillion in 2025. The market is projected to grow from USD 2.55 trillion in 2026 to USD 5.37 trillion by 2034, exhibiting a CAGR of 10.60% during the forecast period. Asia Pacific dominated the engineering services market with a share of 37.30% in 2025.

The global engineering services (ES) market is vast, multifaceted, and continuously evolving, providing a diverse array of services, including software product engineering, embedded engineering, mechanical engineering, network engineering, and manufacturing engineering. The market demonstrates a blend of stability and growth potential, influenced by technological advancements and rising needs across industries such as automotive, aerospace, manufacturing, BFSI, retail, IT, and healthcare. In established regions such as North America and Europe, growth is underpinned by technology innovation and infrastructure upgrades. Meanwhile, regions including the Asia Pacific, the Middle East & Africa, and South America are experiencing significant expansions due to industrialization, urbanization, and supportive government policies.

Global Engineering Services Market Overview

Market Size:

- 2025 Value: USD 2.34 trillion

- 2026 Value: USD 2.55 trillion

- 2034 Forecast Value: USD 5.37 trillion

- CAGR: 10.60% from 2026 to 2034

Market Share:

- Regional Leader: Asia Pacific leads the global market with a share of 37.30% in 2025, supported by strong service demand and a large talent pool

- Leading Service Segment: Software product engineering commands the largest share due to its strategic role in digital transformation

- Industry Leader: The IT & Telecom sector dominates industry adoption, leveraging advanced engineering services for innovation

Industry Trends:

- Strong growth in digital engineering services (including software product development and R&D outsourcing)

- Rising penetration of AI, IoT, and digital tools across engineering workflows

- Expansion of cross-disciplinary engineering projects and global delivery models

Driving Factors:

- High demand for digital services and smart solutions across verticals

- Accelerated adoption of digital transformation and automation in industries worldwide

- Increasing outsourcing of engineering functions to access specialized talent and scale

- Growth across IT & Telecom sectors fueling investment in related engineering services

Market players operating in market are facing a dynamic trend, Thus, major companies such as Infosys, Wipro, and global MNCs are focusing on accommodating to digital engineering solutions that shapes digitalization in the industries including (automotive, smart industry, and rail transport).

- For instance, in April 2024, Infosys announced a strategic acquisition of a engineering service provider In-Tech. The primary aim is to expand engineering services portfolio by offering solutions such as e-mobility, connected and autonomous driving, off road vehicle, electric vehicles, and railroad.

The COVID-19 pandemic spurred digital adoption across engineering services, making remote project management and virtual simulations mainstream. This shift greatly contributed to the digitization of the engineering domain. In addition, geo-political shifts, trade policies, and foreign investment trends heavily influenced the market. For instance, trade tensions and shifts in supply chain strategies among major countries such as the U.S. and China have reshaped demand for engineering solution services in emerging countries such as India, Vietnam, Singapore, and the UAE. Furthermore, cross-border project collaborations are often impacted by foreign policy changes, which can either open new opportunities in the long term or present barriers in the short term.

IMPACT OF GENERATIVE AI

Adopting Gen-AI Competences to Automate Processes Amplifies Product Demand

Generative AI is transforming this industry by automating daily routine tasks and enhancing design processes. The cutting edge technology allows engineers to focus on complex problem-solving and innovation and maximize productivity among the workforce. The shift is driving significant growth in the industry, with global engineering service sector focusing on integrating AI tools, such as GPT and other AI productivity plugins. Moreover, there is a growing influx of Foreign Direct Investment (FDI) into the sector, particularly in regions such as Asia Pacific and Latin America. As the sector continues to evolve, the strategic adoption of generative AI will be pivotal in maintaining competitive advantage and driving sustainable growth.

- For instance, in March 2023, Altoura, a prominent AI-enabled training service provider, announced the launch of Altoura 6, an immersive AI next-generation training platform for Engineering Services. It includes AI beta for its new AI services that help scale and automate training content.

ENGINEERING SERVICES MARKET TRENDS

Increasing Integration of AI Tools to Optimize Processes is Shaping Trends in Industry

The ES market trends are shaped by the increasing integration of Gen AI in multiple applications that help to design and optimize the processes in the industry. AI-powered tools are being used for design optimization, while predictive analytics is increasingly being adopted. Furthermore, a collaboration of data pools with innovative analytical applications helps the media and information technology industry increase product adoption and improve productivity for businesses. Meanwhile, the integration of artificial intelligence and machine learning capabilities helps businesses automate complex and repetitive tasks and optimize inventory through analytics that support the growth of the engineering services market size during the forecast period.

- For instance, in November 2023, Bpifrance and Capgemini collaborated to develop a next-generation digital factory. The digital factory would provide BpiFrance’s IT teams with the latest technologies, particularly in the fields of data processing and artificial intelligence (AI).

Download Free sample to learn more about this report.

MARKET DYNAMICS

Market Drivers

Surge in Demand for Digital Services to Empower Market Growth

The ES sector has been observing a rise in the adoption and development of digital products that connect and collaborate in various ways. Digital platforms are driving the adoption of digital services by offering cloud-based, low code, no code, scalable, resilient, and secure platforms. Additionally, it helps develop solutions that combine various systems and services to efficiently deliver a business solution that includes design experience, operation optimization, and application improvements to leverage real-time analytics and minimize downtime for businesses. Several technologies and digital tools ensure resilient data structure and web security that secure them from potential threats and empower engineering services market growth.

- For instance, in February 2024, Capgemini announced a new partnership with one of the innovative and dynamic new players in artificial intelligence, Mistral AI. Together, they aimed to accelerate the evolution of more accessible, cost-effective, and versatile generative AI implementation at scale.

Market Challenges

Digital Privacy Risks and Vacillate Investments are Potential Constraints for Market Development

The sector faces notable challenges in the short term owing to the high cost of implementation and complex infrastructure requirements. Implementing a digital engineering solution demands no significant upgrades, which could be a substantial benefit for small and medium enterprises (SMEs). However, high potential risks with the integration of new systems and misconceptions about compromising cyber threats create concerns for data privacy and cybersecurity risks. As the potential of IoT devices and AI increases, exposure to potential cyber threats also increases, which could affect enterprises' investments. Thus, potential cyber risks and low interest of investors could hinder the seamless adoption of engineering across various industries in the short term.

Market Opportunities

Advanced Network Technologies and AI-Enabled Infrastructure Present Significant Growth Aspects

The market showcases immense potential due to the growing investment in 5G network infrastructure and cutting-edge computing technologies. These data technologies enable clientele to control real-time data and computing capabilities, making digital services more accessible and easy to integrate. Furthermore, the integration of AI analytics into the data-controlled infrastructure offers an impeccable opportunity through scalable and customizable solutions. These advanced analytics help businesses collaborate between innovative technologies, unlocking innovative service models that will grow engineering services market share during the forecast period.

- For instance, in November 2022, Mercedes Benz and Microsoft Corporation collaborated to develop the MO360 data platform, connecting 30-passenger car plants to Microsoft Cloud. The unified data platform is standardized on Microsoft Azure, providing Mercedes with flexibility and cloud computer power to run AI and analytics on a global scale.

SEGMENTATION ANALYSIS

By Services

Growing Demand for AI-enabled Services Boosts Software Product Engineering Segment Growth

By services, the market is divided into software product engineering, embedded engineering, mechanical engineering, network engineering, and manufacturing engineering.

The software product engineering segment dominates the services segment due to the high demand for AI-enabled services and the benefits of data science in predictive analytics and risk management. Additionally, digital engineering solutions help businesses expand digitally, extending the limits and services to the regional boundaries that drive businesses to generate more profitability in the long term.

Mechanical engineering is associated with the design and analysis of mechanical equipment and components, which significantly reduce process time and maximize business productivity.

Network engineering is in increasing demand due to a lack of a skilled workforce and the need to minimize downtime of the servers to improve services. Furthermore, the growing integration of IoT and embedded electronics into equipment has created ample opportunities for businesses to leverage data for advanced analytical processes, expanding the market potential in the long term.

The manufacturing engineering segment held the dominant market share of 26% in 2024.

By Vendor Category

Extensive Service Offerings and Customized Solutions by Broadbased Vendors Make Them Dominant in the Market

As per the vendor category, the market is classified into broadbased and pureplay.

Broadbased vendors are dominating the segment owing to wide service offerings and customizable solutions that can easily be integrated with modern AI and design software. Providers are experimenting with generative AI to enhance overall efficiency, improve customer experience, reduce turnaround time, boost team member productivity, and achieve cost savings. These benefits demonstrate the immediate value of embracing sustainable consulting practices in the market. The segment is expected to hold 27.40% of the market share in 2026.

Continuous investment by major industries in software-defined processes has driven the evolution of both automotive and medical devices, benefiting the pureplay businesses in the long term. Pureplay segment is likely to exhibit a CAGR of 9.02% during the forecast period.

By Industry Vertical

To know how our report can help streamline your business, Speak to Analyst

Emphasis on Integrating AI into Every Software Solution Drive IT & Telecom Dominance

By industry vertical, the market segment is categorized into automotive & mobility, healthcare & life science, manufacturing & mining, BFSI, retail & consumer goods, aerospace & defense, IT & telecom, and others (media & entertainment).

The IT and telecom sector dominates the segment with the highest market share owing to the growing research and integration of AI-based software. This sector emphasizes investment in building AI-enabled solutions that help businesses automate repetitive tasks and minimize costs. The segment is likely to exhibit a CAGR of 11% during the forecast period.

Automotive & mobility showcases progressive growth as it utilizes virtual prototyping and mobility simulation in testing and manufacturing, which is driving market growth in the long term. The segment is likely to hold 15% of the market share in 2025.

The retail & consumer goods industry is further supporting the market potential, with the FMCG industry utilizing AI and machine learning to increase customer retention and minimize supply chain risk by optimizing inventory.

Manufacturing & mining are witnessing stable growth due to the increasing adoption of automation and Industry 4.0 to maximize efficiency by utilizing modern machinery software to smoothen operations with maximum efficiency and sustainable practices.

Healthcare & life sciences and BFSI are experiencing significant growth owing to their growing use in advanced engineering and process technologies that reduce production time.

Aerospace & defense and other segments are growing significantly due to the investor's interest and emphasis on developing more advanced technologies for these sectors.

ENGINEERING SERVICES MARKET REGIONAL OUTLOOK

Based on the region, the market is studied across Asia Pacific, North America, Europe, South America, and Middle East & Africa

Asia Pacific

Asia Pacific Engineering Services Market Size, 2025 (USD Trillion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific is the dominant region, holding the largest market share due to the rapid adoption of Industry 4.0 and high foreign direct investments (FDI) in advanced AI technologies that automate tasks and minimize operational costs for businesses in the long term. Additionally, the region's expanding 5G infrastructure and increasing investments in countries such as China, Japan, India, and Asia Pacific countries are driving the growth engineering services market share during the forecast period. The regional market value in 2025 was USD 0.87 trillion, and in 2026, the market size was standing at USD 0.97 trillion.

China in the Asia Pacific region is witnessing extensive growth owing to rapid digitalization and favorable investment policies for industries. Furthermore, its innovation capabilities and AI advancements help businesses integrate IT services seamlessly with Industry 4.0. Following China, India is projected to withstand progressive growth owing to its well profound startup ecosystem and huge talent pool that drives market size and forecasts. Additionally, Japan and other Asian countries are witnessing steady growth due to their increased emphasis on integrating AI services into their processes to maximize productivity. The market in China is likely to reach USD 0.36 trillion in 2026, whereas India is projected to hit USD 0.12 trillion and Japan is anticipated to reach USD 0.21 trillion in 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

North America's engineering services market is witnessing progressive growth as the market is propelled by rapid digitalization coupled with human intelligence AI technologies. The region is expected to be the third-largest market globally, with a value of USD 0.56 trillion in 2026. Additionally, the region's supportive government policies to innovate and capitalize on services across the globe are benefitting the sector's growth. U.S. is the dominating country in North America focusing on advance applications of edge AI and IIoT for the advancements of engineering services. Also, it is expected to register the fastest growth during the forecast period, driven by niche requirements in sectors like aerospace and renewable energy. The U.S. market size is estimated to be USD 0.45 trillion in 2026.

South America

South America is a growing region with increasing interest in manufacturing and engineering services startups due to increasing investments in data infrastructure, which aims to improve global data storage and analytic problems. Furthermore, the adoption of advanced edge computing among technology-enabled software companies for collaborative research and analytics is supporting the near-term growth of technology adoption.

Europe

Europe is anticipated to account for the second-highest market size of USD 0.68 trillion in 2026, exhibiting the second-fastest growing CAGR of 10.10% during the forecast period. Europe is showcasing steady growth in the engineering services sector owing to its huge, robust, and early technology adoption and a strong prominence for implementing Industry 4.0 for productivity and sustainability. Countries including Germany, the U.K., and Italy are dominating the adoption of these technologies, which could benefit engineering simulation with more optimized product development. The U.K. market size is estimated to hit USD 0.12 trillion in 2026. On the other hand, Germany’s market is likely to hold USD 0.16 trillion and France is likely to hit USD 0.08 trillion in 2025.

Middle East & Africa

The Middle East & Africa (MEA) region is projected to showcase a value of USD 0.17 trillion in 2026 as the fourth-largest market with a significant growth during the forecast period. The businesses in this region are focusing on integrating advanced futuristic technologies for sustainable growth and green energy. Companies are increasingly using advanced software and simulation to minimize operational risks, particularly in the construction and infrastructure sectors. The GCC market size is projected to hit USD 0.07 trillion in 2025.

Competitive Landscape

KEY INDUSTRY PLAYERS

Focus on Growing Investment by Market Players for Innovative Product Development to Extend Market Potential

The emergence of AI amplifies the market potential of engineering services by focusing on research and the integration of AI for innovation. These modern technologies are driving revenue for businesses by minimizing lead times in product development. The competitive landscape of the market is shaped by the adoption of innovative technologies, strategic partnerships, and increased focus on a sustainable ecosystem for the industry to expand. Companies differentiate themselves through global execution, customer-centric solutions, and specialized expertise, which profoundly impact their position in the market.

- For instance, in February 2024, Capgemini and Unity, the world’s leading platform for creating and growing real-time 3D (RT3D) content. It announced an expansion of its strategic alliance that will take on Unity’s digital twin professional arm. It will allow end users to envision, understand, and interact with physical systems.

List of Engineering Services Companies Profiled

- Capgemini SE (France)

- Accenture (Ireland)

- Deloitte (England)

- Tata Consultancy Services (India)

- HCL Tech (India)

- Cognizant (U.S.)

- Wipro (India)

- Tech Mahindra (India)

- GlobalLogic (U.S.)

- L&T Technology Services (India)

- Alten (France)

- Akkodis (Switzerland)

- AFRY (Sweden)

- Cyient (India)

- Infosys (India)

- AVL List GmBH (Austria)

- Globant (Argentina)

- KPIT (India)

- IBM (U.S.)

- EPAM (U.S.)

KEY INDUSTRY DEVELOPMENTS

- December 2024: Tata Consultancy Services, a leading IT service provider, extended a partnership with Telenor Denmark (TnDK), the second-largest mobile operator in the Danish market. Through collaboration, TCS would continue to deliver strategic insights and technological expertise.

- November 2024: C3 AI, an enterprise AI software solution company, and Capgemini announced the expansion of their partnership. The collaboration is designed to accelerate and enhance the delivery of Enterprise AI solutions, offering clients significant benefits, such as improving productivity efficiently and reducing operational costs.

- October 2024: TCS expanded its collaboration with NVIDIA to launch industry-specific solutions and offerings that would help customers adopt Artificial Intelligence (AI) faster and at scale. These solutions and offerings will be delivered through TCS's new business unit, enabling customers to adopt artificial intelligence (AI) faster and at scale.

- September 2024: TCS, a global leader in IT services and business solutions, expanded its partnership with Google Cloud to offer new cybersecurity solutions for customers. The partnership aimed to strengthen cyber resilience for enterprises across industries and empower them with cutting-edge technologies.

- July 2024: Capgemini announced an acquisition of Lösch & Partner to augment its capabilities in application lifecycle management and systems engineering for German automotive manufacturers. As a business partner, Capgemini enables the future competitiveness of manufacturing companies to enable the convergence of software and hardware.

REPORT COVERAGE

The market research report provides a detailed analysis of the market and focuses on key aspects such as leading companies, service types, and leading ES industry of the product. Besides, the report offers insights into the market trends, market sizes and forecasts, and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 10.60% from 2026 to 2034 |

|

Unit |

Value (USD Trillion) |

|

Segmentation |

By Services, Vendor Category, Industry Vertical, and Region |

|

Segmentation |

By Services

By Vendor Category

By Industry Vertical

By Region

|

|

Key Market Players Profiled in the Report |

Capgemini SE (France), Accenture (Ireland), Deloitte (England), Tata Consultancy Services (India), HCL Tech (India), Cognizant (U.S.), Wipro (India), Tech Mahindra (India), GlobalLogic (U.S.), and L&T Technology Services (India) |

Frequently Asked Questions

The market is projected to reach USD 5.73 trillion by 2034.

In 2024, the market was valued at USD 2.34 trillion.

The market is projected to grow at a CAGR of 10.6% during the forecast period.

Software product engineering is leading the services segment in the market.

Rising demand for digital services are the key factors driving market growth.

Capgemini SE, Accenture, Deloitte, Tata Consultancy Services, HCL Tech, Cognizant, Wipro, Tech Mahindra, GlobalLogic, and L&T Technology Services are the top key players in the market.

Asia Pacific dominated the engineering services market with a share of 37.30% in 2025.

By industry, the IT & Telecom segment dominates the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us