Enterprise Conversational GenAI Market Size, Share & Industry Analysis, By Type (Intelligent Virtual Assistant (IVA) and Generative AI Chatbots), By Technology (Natural Language Processing, Machine Learning and Deep Learning, Automatic Speech Recognition, and Others), By Deployment (On-premise and Cloud), By Business Function (Sales & Marketing, Supply Chain & Operations, Finance & Accounting, Human Resource), By Industry (BFSI, IT & Telecom, Retail & e-Commerce, Healthcare, Government & Public Sector, Media & Entertainment, Education, and Others), and Regional Forecast, 2026-2034

ENTERPRISE CONVERSATIONAL GenAI MARKET SIZE AND FUTURE OUTLOOK

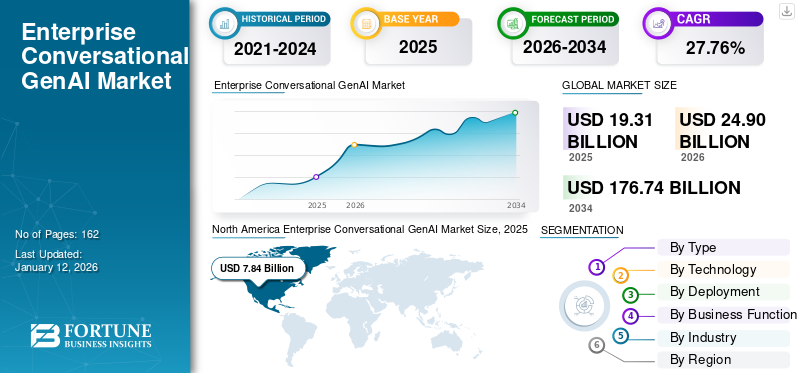

The global enterprise conversational GenAI market size was valued at USD 19.31 billion in 2025. The market is projected to grow from USD 24.90 billion in 2026 to USD 176.74 billion by 2034, exhibiting a CAGR of 27.76% during the forecast period. North America dominated the global market with a share of 40.59% in 2025.

The adoption of artificial intelligence solutions has been increasing rapidly across the globe. The prime factor of acceleration is government initiatives and investments aimed at fostering AI adoption. Governments all across the globe have been continuously engaged in empowering businesses and users to benefit from AI-powered solutions. Several strategies have been implemented to accelerate the use of AI technologies on a global scale.

According to Generative AI Statistics, by 2025, around 10% of all the data produced globally will be generated by generative AI. In 2023, more than 210 generative startups have emerged globally, attracting significant investor interest. Investors have poured around USD 2,654 million into generative AI startups through 110 deals, highlighting the sector’s rapid expansion.

The market is witnessing growth globally due to rapid advancement in AI, especially in NLP. NLP has significantly improved conversational AI models, making them more versatile and effective for enterprises. Generative AI models, including OpenAI’s ChatGPT, have enhanced the ability of machines to understand and generate human-like language, enabling enterprises to offer faster, more personalized customer service.

Established players, including Amazon, Salesforce, Microsoft, and others, have built strong brand reputations and trust, which makes them preferred partners for enterprises. For instance, Salesforce Einstein is trusted by enterprises due to Salesforce’s reputation in CRM.

Investments Landscape & Funding Scenario

Investment and funding in enterprise conversational GenAI are expected to drive the growth of the market by increasing adoption, enabling technological advancements, and expanding use cases. According to Pitchbook, investments in Generative AI surged in 2023, reaching USD 29.1 billion across nearly 700 deals, marking a more than 260% increase in deal value compared to 2022.

Impact of Generative AI Funding and Investment on the Market:

- Advancing Technology and Model Development: Generative AI models, particularly in enterprise conversational GenAI, need a huge amount of computing data, power, and expertise for developing models. Investments by companies help to build more sophisticated and larger models, including GPT-4 and other proprietary systems, which enhance conversational AI’s accuracy and fluency.

- Infrastructure and Scaling: The development of enterprise conversational genAI technologies requires a robust infrastructure, especially for handling the immense computing power required for large-scale ML tasks. GenAI models often rely on cloud platforms for scaling and hosting. Investments in infrastructure allow companies to leverage cutting-edge cloud technologies, making AI accessible to more businesses. Investments in scaling infrastructure also help companies install conversational AI solutions across geographies, allowing businesses to implement virtual assistants, chatbots, and other AI tools globally with localized capabilities.

- Expanding Use Cases and Market Reach: Funding permits companies to integrate conversational AI into existing systems (e.g., CRM tools and ERP systems), promoting continuous AI adoption and enhanced operational efficiency. With adequate funding, conversational AI can grow beyond customer support into areas such as mental health chatbots, personal assistants, translation services, and automated content creation.

-

- In January 2024, Kore.ai announced a funding round of USD 150 million. This strategic growth investment was led by FTV Capital, a growth equity investor focused on specific sectors. The round also saw participation from NVIDIA and existing investors, including Beedie, Sweetwater PE, NextEquity, Nicola, and Vistara Growth.

- In Feb 2024, Rasa secured USD 30 million in Series C funding, spearheaded by Paypal Ventures and Stepstone Group, with contributions from Andreessen Horowitz (a16z), Basis Set Ventures, and Accel. The funding would assist Rasa in developing a new wave of conversational AI to utilize the capabilities of LLM fully.

The bar chart highlights the surge in investment in GenAI funding, which reflects its growing impact. The Y-O-Y growth of investments and deal count showcases the need for GenAI in today’s world, which drives the enterprise conversational GenAI market growth.

MARKET DYNAMICS

Market Drivers

Rise of Omnichannel Communication Drives the Demand for Enterprise Conversational GenAI

The rise of omnichannel communication is a major contributor to the enterprise conversational Generative AI (GenAI) market, as companies focus on using AI features to provide seamless, context-sensitive, and tailored user experience across various platforms. Unlike conversational AI, Gen AI excels at understanding and producing human-like replies, allowing more businesses to produce more natural and engaging interactions across various platforms such as websites, mobile applications, social media, email, and voice assistants.

- For instance, in 2024, Bank of America’s AI assistant, Erica, achieved 2 billion interactions since its launch in 2018, supporting 42 million clients with around 2 million daily requests. It handles tasks such as managing subscriptions, tracking spending, and providing account details, resolving 98% of queries within 44 seconds.

In today’s competitive ecosystem, consumers expect consistent and superior quality across all platforms. Companies are able to ensure every customer interaction is effortless and highly personalized, further improving fulfillment and loyalty by implementing GenAI in their omnichannel strategies.

Therefore, a rise in omnichannel communication is expected to surge the enterprise conversational GenAI market share.

The above graph showcases how organizations are using different channels to support their customers. According to Salesforce’s 2023 State of the Connected Customer report, Email and phone continue to be widely used for communication, while channels, including online communities and social media, are not popular for communication.

Market Restraints

Manipulation and Misuse of GenAI Chatbots Hinder Market Growth

One of the key challenges in the market is the risk of manipulation by users who attempt to trick or exploit AI systems. For instance, in December 2023, An AI chatbot at a Chevrolet dealership was deceived into presenting a USD 76,000 Tahoe for merely USD 1. A user effortlessly altered the AI chatbot's replies, demonstrating that these customer service tools commonly found on websites can be manipulated with basic prompts. Malicious individuals can exploit these weaknesses through techniques, such as prompt injections or adversarial attacks, leading AI chatbots to generate inappropriate, biased, or harmful responses. These security risks can undermine consumer trust and hinder market growth.

Market Opportunities

Global Multilingual Support for Customers Creates New Market Opportunities

Conversational GenAI’s ability to support multiple languages and dialects presents a significant market opportunity for enterprises targeting global audiences. Multinational corporations can use multilingual AI to communicate seamlessly with customers, employees, and partners worldwide, ensuring consistent service quality. For instance, in December 2024, CoRover.ai partnered with Persistent Systems to deliver GenAI-powered conversational solutions for enterprises. The collaboration combines CoRover’s expertise in multilingual, multi-channel AI platforms with Persistent’s digital engineering and AI-led services. Together, they aim to enhance customer engagement, streamline operations, and drive innovation for businesses globally.

Enterprise Conversational GenAI Market Trends

Rise of Low-code/No-code Platforms to Propel Market Growth

The rise of low-code/no-code platforms is changing the enterprise conversational GenAI market by making AI-driven development accessible to businesses without deep technical expertise. These platforms allow users to customize, design, and deploy enterprise conversational GenAI solutions through intuitive interfaces, reducing the need for extensive coding knowledge. According to industry reports, low-code applications experienced rapid adoption. In 2024, over 65% of all application development will be powered by low-code tools. By 2025, nearly 70% of new business applications are expected to be built using low-code or no-code technologies, up from less than 25% in 2020.

By streamlining AI development, low-code/no-code platforms are driving innovation, reducing time-to-market, and empowering businesses to create personalized solutions that enhance customer engagement and operational efficiency.

SEGMENTATION ANALYSIS

By Type

Generative AI Chatbots Led Due to Their Ability to Reduce the Need for Manual Review Management

By type, the market is segmented into Intelligent Virtual Assistant (IVA) and generative AI chatbots.

Generative AI chatbots dominated the market in 2026 by 51.57% of the share, driven by their increased adoption to analyze user data for delivering personalized experiences and customized responses based on past interactions and user preferences. GenAI Chatbots synthesize customer feedback and generate positive testimonials, helping to build trust and credibility for products while reducing the need for manual review management.

Intelligent virtual assistant (IVA) is estimated to grow at the highest CAGR during the forecast period. By implementing IVAs with backend integrations, businesses can provide quick, data-driven responses tailored to customers' preferences. Approximately 55% of enterprises that have adopted IVAs report a significant reduction in customer wait times. IVAs are particularly beneficial for businesses that experience sudden or unpredictable surges in support volume, ensuring seamless and efficient customer service.

By Technology

Machine Learning and Deep Learning Segment Dominated due to its Rising Usage in Understanding Customer Needs and Expectations

By technology, the market is segmented into natural language processing, machine learning and deep learning, automatic speech recognition, and others.

The machine learning and deep learning segment dominated the market in 2024, as ML and DL can help conversation GenAI to adapt to individual users, providing personalized experiences by learning preferences and patterns. According to a Salesforce study, around 72% of customers expect companies to understand their needs and expectations. For this, enterprises can use conversational GenAI to analyze previous interactions and provide tailored responses based on user history and preferences. The machine learning and deep learning segment dominated the market in 2026 by 41.26% of the share.

The automatic speech recognition segment is estimated to grow with the highest CAGR of 34.30% during the forecast period. Automatic speech recognition enables faster and more natural interactions, as speech is a more intuitive and faster form of communication. It enables real-time transcription and analysis of spoken input, allowing the conversational AI system to respond instantly to queries and provide immediate feedback. For instance, IBM Watson Assistant, when integrated with automatic speech recognition, reduces resolution time by 30%.

By Deployment

Cloud Segment Led the Market as It is a Cost-Effective Alternative

Based on deployment, the market is bifurcated into cloud and on premise.

The cloud accounted for the largest market share in 2026 and is expected to register the highest CAGR of 58.95% during the forecast period. Cloud-based solutions provide a more cost-effective alternative by removing the need for large, one-time capital expenditures (Capex) on hardware and software. With cloud computing, businesses can access AI resources on a pay-as-you-go basis, allowing them to scale resources up or down according to their needs. The cloud-deployment segment dominated the market in 2025 by 58% of the share.

By Business Function

Conversational GenAl Demand to be Surged for Lead Generation, thereby Propelling Growth of Sales & Marketing Business Function

By business function, the market is segmented into sales & marketing, supply chain & operations, finance & accounting, human resource, and IT service management.

The sales & marketing segment dominated the market in 2024. Enterprises are leveraging conversational GenAI to automate lead generation by interacting with potential customers, identifying their needs, and gathering relevant information for the sales team. As per the Hubspot Survey, around 64% of sales professionals stated that their biggest challenge is finding quality leads. To overcome this challenge, the demand for conversational GenAI is increasing. The sales & marketing segment dominated the market in 2026 by 28.49% of the share.

The human resource segment is estimated to grow at the highest CAGR of 34.90% during the forecast period. Conversational GenAI automates the initial process of recruitment by handling basic queries including pre-screening resumes, candidate queries, and conducting initial interviews through chatbots.

By Industry

BFSI Dominated the Market owing to Rising Adoption of Enterprise Conversational GenAI for Addressing Customer Queries

By industry, the market is segmented into BFSI, IT & telecom, retail & e-commerce, healthcare, government & public sector, media & entertainment, education, and others.

BFSI dominated the market in 2024. In this sector, conversational Generative AI (GenAI) has many applications in customer self-service, such as chatbots and virtual assistants, that address inquiries related to borrowing rates and insurance claims. According to Financial Brand, JP Morgan deployed its COIN chatbot to analyze complex backend contracts, resulting in savings of over 360,000 hours of labor. The BFSI segment dominated the market in 2025 by 22% of the share.

Healthcare is estimated to grow with the highest CAGR of 35.80% during the forecast period. Conversational Generative AI is being utilized in various healthcare facilities. For example, in June 2024, Zydus Hospitals introduced its ZyE chatbot to manage a growing number of appointment requests efficiently. To date, ZyE has handled over 640,000 conversations, scheduled 20,000 appointments, and generated approximately USD 1 million in revenue.

To know how our report can help streamline your business, Speak to Analyst

Enterprise Conversational GenAI Market Regional Outlook

By geography, the market is studied across North America, South America, Europe, the Middle East & Africa, and Asia Pacific, and each region is further studied across countries.

North America

North America Enterprise Conversational GenAI Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market in 2026 with USD 9.89 billion and in 2025, the region attained USD 7.84 billion. The market is witnessing growth in the region due to significant investments in AI and advancements in AI technologies. According to the National Science Foundation, the federal government is expected to spend around USD 3 billion on AI research and development. North America leads in GenAI adoption, with a 40% adoption rate. In 2023, more than 80% of global funding for generative AI was concentrated in North America. This dominance is driven by the region's strong technology ecosystem, access to capital, and presence of leading AI research institutions.

Download Free sample to learn more about this report.

The market is witnessing growth in the U.S. as AI adoption increases across various industries, including retail, BFSI, healthcare, education, and others. The U.S. market size is expected to reach USD 8.17 billion in 2026. According to PwC, in 2023, 53% of enterprises in the U.S. reported using AI-powered virtual assistants and chatbots for enhancing interactions and reducing operational costs. The U.S. government has played a crucial role in supporting generative AI research and development. Initiatives such as the National AI Initiative Act of 2020 have provided funding for AI research, further strengthening the region's leadership in the field. According to Infosys Generative AI Radar, in 2023, enterprises in Canada and the U.S. invested USD 3.3 Billion in generative AI initiatives, and these investments went up by 67% in 2024, reaching USD 5.6 Billion.

Asia Pacific

The Asia Pacific region is estimated to become the third-largest market with valuation of USD 5.60 billion in 2026 and grow with the highest CAGR during the forecast period, driven by rapid adoption of AI and Generative AI technologies. According to a recent report by IDC InfoBrief commissioned by Dataiku, the percentage of businesses across Asia Pacific using AI doubled from 39% to 76% from 2020 to 2023. Enterprises in the region have indicated plans to invest in AI for internal integration and automation projects, aiming to increase productivity, agility, efficiency, and cost reduction. The market in India is estimated to be USD 0.89 billion, whereas China’s market is projected to be USD 1.42 billion and Japan is likely to be USD 1.35 billion in 2026.

Europe

Europe is the second-fastest region which is projected to showcase USD 6.17 billion in 2026 and to show the second-largest CAGR of 29.00% during the forecast period as generative AI transforms the region’s technological landscape. In 2024, investments in generative AI in the region reached USD 47.6 billion, with a significant increase in the number of startups, particularly in Germany, France, the Netherlands, and the U.K. According to the "State of Generative AI in the Enterprise" report by industry experts, approximately 65% of European business leaders reported increasing their investments in generative AI, recognizing its substantial value. The market in U.K. is estimated to be USD 0.90 billion, whereas Germany’s market is projected to be USD 1.04 billion and France is likely to be USD 1.04 billion in 2025.

Middle East & Africa

The Middle East & Africa is the fourth-largest region and anticipated to showcase the market value USD 2.10 billion in 2026, as Artificial intelligence (AI) revolutionizes customer interactions, particularly through advancements in conversational design. Enterprises are leveraging AI to enhance customer experiences by providing personalized, efficient, and responsive services. The GCC market is estimated to be USD 0.74 billion in 2025.

South America

The South American market is likely to register a steady growth rate during the forecast period. Enterprises in the region are adopting conversational GenAI; for instance, Zenvia, a cloud-based CX platform, has developed a generative AI chatbot solution. This solution allows businesses to easily create and customize chatbots that can provide automated customer service.

Competitive Landscape

KEY INDUSTRY PLAYERS

Market Players Opt for Merger & Acquisition Strategies to Expand Their Market Presence

Mergers and Acquisitions (M&A) have emerged as a transformative strategy for key players in the market which is driven by the need to stay ahead in a rapidly evolving technological environment. By acquiring specialized companies, businesses are able to integrate cutting-edge AI capabilities, such as advanced conversational analytics, retrieval-augmented generation, and generative AI, into their existing platforms.

List of Key Enterprise Conversational GenAI Companies Profiled:

- Oracle Corporation (U.S.)

- Moveo.AI (U.S.)

- Microsoft Corporation (U.S.)

- SAP SE (Germany)

- OpenAI (U.S.)

- Kore.ai (U.S.)

- Cognigy (Germany)

- Amazon.com (U.S.)

- Google (U.S.)

- Rasa Technologies Inc. (U.S.)

- Avaamo (U.S.)

- Jio Haptik Technologies Ltd (India)

- UNITH (Netherlands)

- NLX (U.S.)

- Omilia Natural Language Solution (Cyprus)

and more….

KEY INDUSTRY DEVELOPMENTS:

- March 2025 – Avaamo launched Avaamo Agents, AI-powered digital workers designed to enhance workforce productivity and enterprise operations through innovation and efficiency.

- January 2025 – Kore.ai launch of AI for process, a no-code platform that helps enterprises optimize and automate knowledge-intensive tasks. AI for Process enables businesses to quickly create, implement, and oversee tailored AI agents or Agentic Apps at scale. These agents can comprehend context, make intricate decisions, and coordinate advanced Agentic workflows.

- January 2025 – Salesforce announced the launch of Agentforce for retail, aimed at boosting productivity through digital labor and retail cloud. Agentforce would assist retailers with tasks such as order management, appointment scheduling, and loyalty programs.

- January 2025 – Microsoft and HCLTech expanded their partnership to change contact centers with cloud-based and generative AI solutions. Microsoft Dynamics 365 Contact Center would enable HCLTech employees to deliver enhanced customer experiences and drive operational efficacy.

- December 2024 – Amazon Lex launched new multilingual streaming speech recognition models (ASR-2.0), which enhances accuracy for languages such as Portuguese, French, Chinese, Japanese, and more. These models, grouped by region (Europe and Asia Pacific), improve recognition of alphanumeric speech(e.g., account numbers and product codes) and perform better with non-native speakers and regional accents.

REPORT COVERAGE

The market research report provides a detailed market analysis. It focuses on key points, such as leading companies, offerings, and applications. Besides this, the report offers an understanding of the latest market trends and highlights key industry developments. In addition to the above-mentioned factors, the report contains several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 27.76% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type, Technology, Deployment, Business Function, Industry, and Region |

|

Segmentation |

By Type

By Technology

By Deployment

By Business Function

By Industry

By Region

|

|

Companies Profiled in the Report |

Cognigy (Germany), Kore.ai (U.S.), Avaamo (U.S.), Salesforce, Inc. (U.S.), Five9, Inc.(U.S.), Microsoft Corporation (U.S.), Google LLC (U.S.), Amazon.com, Inc.,(U.S), Jio Haptik Technologies Ltd (India), Open AI (U.S.), and Others. |

Frequently Asked Questions

The market is projected to reach USD 176.74 billion by 2034.

In 2025, the market was valued at USD 19.31 billion.

The market is projected to grow at a CAGR of 27.76% during the forecast period.

By type, generative AI chatbots segment led the market.

The rise of omnichannel communication is a key factor fueling market growth.

Cognigy, Kore.ai, Avaamo, Salesforce, Inc., Five9, Inc., Microsoft Corporation, Google LLC, and Amazon.com, Inc., are the top players in the market.

North America dominated the market in 2025.

The healthcare industry is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us