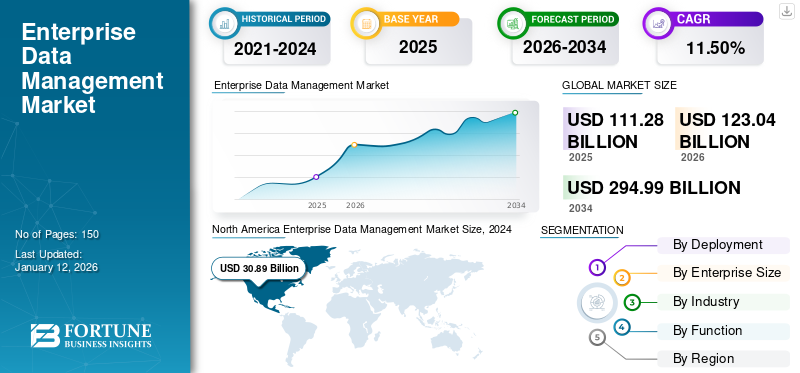

Enterprise Data Management Market Size, Share & Industry Analysis, By Deployment (Cloud and On-premise), By Enterprise Size (Small & Medium Enterprises (SMEs) and Large Enterprises), By Industry (BFSI, Retail, Healthcare, IT & Telecom, Manufacturing, Government, and Others), By Function (Data Warehouse, Data Governance, Data Integration, Data Security, Master Data Management, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

The global enterprise data management market size was valued at USD 111.28 billion in 2025. The market is projected to grow from USD 123.04 billion in 2026 to USD 294.99 billion by 2034, exhibiting a CAGR of 11.50% during the forecast period. North America dominated the global market with a share of 29.90% in 2025.

In the scope of the study, we have included companies such as IBM Corporation, Sap SE, Oracle Corporation, Teradata Corporation, and others that offer innovative and advanced on-premises and cloud-based solutions. Enterprise data management solutions are a hybrid data management platform designed for any cloud computing and analytics solution. Various functions of EDM include data warehouse, data governance, data integration, data security, and master data management, which support businesses in quickly accessing data and enhancing customer experience.

MARKET DYNAMICS

Market Drivers

Rise of Data Management and Risk Management Solutions to Boost Product Demand

The organizational risk of the data is growing at a high amount. Poor data management might lead to privacy concerns. In order to minimize the risk, enterprises are using an effectual risk management tool that prevents data breaches. Hence, the need to manage the data and reduce the risk of privacy concerns is raising the demand for risk management solutions.

Maintaining the data is quite important to Enterprise Data Management (EDM), as it can considerably affect the productivity and decision-making of the enterprises. Moreover, enterprises' growing need for real-time data management is positively influencing market growth.

Market Restraints

Costly System Installation Procedures and Lack of Awareness about the Technology May Impede Market Growth

The demand from small-medium enterprises can offer high growth opportunities for the enterprise data management market. However, poor implementation of this tool in SMEs, as well as lesser obtainability of resources in these firms, hinder the implementation of this high-end technology. Most SMEs are affected by legacy systems and software, which restricts the adoption of contract management technology. Enterprise software can automate the complete enterprise operations. It can manage countless data with beneficial modifications through this technology. The features and benefits of contract management are immense. However, a lack of awareness about the technology is expected to hamper the pace of adoption. Furthermore, the accessibility of data Silos is likely to restrict the growth of the enterprise data management market during the anticipated period.

Market Opportunities

Massive Investments into Technologies to Provide Lucrative Growth Opportunities for Market Players

The investment in enterprises technologies is growing especially in new-gen management solutions. Additionally, the adoption of contract management technology will rise in upcoming years owing to the massive investments in this area, creating high growth opportunities for the enterprise data management market. These technologies aid in delivering exceptional customer experience and improve sales revenue, making them valuable asset for any company. The developing regions with high financing power, such as North America, are anticipated to witness increased investments in the forecast period. Furthermore, the integration of enterprise data management with technologies such as Artificial Intelligence (AI) and the Cloud offers growth opportunities that will further boost the enterprise data management market.

Market Trends

Increasing Adoption of Product to Handle Master data to Fuel Market Growth

Enterprise data management (EDM) is a strategy for defining, retrieving, and integrating data from both internal applications and external communications. Internal applications includes HR, finance, CRM, ERP, and business intelligence, where as external sources include partners, shareholders, suppliers, regulators, and others. By having an integrated strategy, managing data such as EDM enables organizations to effectively handle master data. These factors represent some of the key trends fueling market growth.

Furthermore, several aspects of initiating and enhancing EDM programs come with functions such as analytical capabilities, business alignment, data quality management, data governance, master and metadata management, data integration, security and privacy, and data supervision.

These factors are likely to propel the enterprise data management market growth during the forecast period.

SEGMENTATION ANALYSIS

By Deployment

Cloud to Capture Major Market Share Owing to Swift Digital Transformation

By deployment, the market is fragmented into cloud and on-premise.

The cloud holds the highest market share and is also expected to grow at the highest CAGR in the forecast period due to its several applications, such as cloud-based deployment, which enables quicker distribution, a decrease in cost, minimal maintenance, and an increase in scalability. Additionally, the rising adoption of cloud-based services among developed countries such as the U.S., Germany, France, and the U.K is expected to increase the demand for EDM solutions. According to the European Commission Organization Report 2023, in Europe, cloud services adoption increased by 43% amid the COVID-19 pandemic.

Though the on-premise execution augmented the software deployment charge along with upgradation charges, the on-premise installation witnessed a noteworthy share in the market in 2024. Many companies are adopting on-premise deployment owing to enhanced security features. In addition, a few EDM solutions do not need an internet connection and can be customized to the business needs.

By Enterprise Size

Large Enterprises Had Largest Share Owing to Rising Data Generation and a Surge in Demand for Data Storage.

Based on enterprise size, the market scope includes SMEs and large enterprises.

The large enterprises segment is projected to dominate the market with a share of 60.68% in 2026. This is primarily attributed to rising investments by key players for the adoption of EDM and cloud computing-based solutions. Additionally, large-scale enterprises are investing a considerable amount in the digital transformation of business processes. According to the Digital Investment Index, in 2022, large-scale companies are making considerable investments in digital transformation, increasing by up to 65% compared to 2020.

SMEs are growing at a moderate pace owing to the rising shifting trend from the on-premises to the cloud among enterprises. Additionally, leading players are acquiring SMEs to promote digital transformation, which will increase the enterprise data management market share.

By Industry

IT & Telecom Segment to Generate High Revenue Owing to Increase in Need for Data Management

Based on industry, the market scope consists of BFSI, retail, healthcare, IT & telecom, manufacturing, government, and others (media & entertainment and education).

The IT & telecom segment is expected to account for 21.86% of the market in 2026, attributed to the rising demand for data storage and data management across leading IT firms around the globe. Furthermore, IT and telecom companies continue to extend innovation activities to assist long-term projects in potential strategic areas. For instance,

- In April 2024, Informatica launched its Master Data Management (MDM) Extension for Google Cloud BigQuery, making it faster to get trusted MDM data that can be leveraged for generative AI applications and analytics across industries such as financial services, retail, and healthcare.

The BFSI sector is growing at a moderate CAGR during the forecast period. In the BFSI sector, the EDM is used for validating, acquiring, validating operational risk, analysis, and customer and financial data management. It builds a single version of the truth in a transparent, consistent, and fully audited environment.

To know how our report can help streamline your business, Speak to Analyst

By Function

Data Warehouse is expected to have Largest Share owing to Rising Demand for the Data Storage among the Enterprises

Based on function, the market is divided into data warehouse, data governance, data integration, data security, master data management, and others (quality, data synchronization, etc.).

The Data warehouse segment is forecast to represent 20.89% of total market share in 2026. This is owing to a surge in demand for data storage among enterprises, with soaring investment in cloud technology. According to the industry experts, in 2022, cloud IT infrastructure spending is anticipated to grow to USD 90 billion from USD 66.8 billion in 2019.

Master data management function is growing with the highest CAGR during the forecast period. Organizations around the world have shifted to EDM suppliers for a range of solutions and services. The trend is expected to remain strong in the anticipated period as it aids enterprises by providing them with complete solutions, including enhanced features such as increased visibility, control over their data, and support for ongoing regulations and compliance.

ENTERPRISE DATA MANAGEMENT MARKET REGIONAL OUTOOK

In terms of region, the market is categorized into Europe, North America, the Asia Pacific, South America, and the Middle East & Africa.

North America

North America Enterprise Data Management Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 33.27 billion in 2025 and USD 35.96 billion in 2026, owing to the increased adoption of cloud, artificial intelligence, and analytics across business operations in various industries in the U.S. and Canada. Many companies in the region, such as Oracle Corporation, Amazon.com Inc., and IBM Corporation are present in this region. Furthermore, the rising adoption of next-gen technologies, such as big data analytics, IoT, AI, and machine learning, aids the market growth. The U.S. market is projected to reach USD 22.37 billion by 2026.

Download Free sample to learn more about this report.

The U.S. enterprise data management market is expected to grow at a healthy pace during the forecast period. The growing need for risk management solutions and the increasing need for timely, authentic information are driving the demand for EDM solutions in the U.S.

Europe

Europe is growing at a moderate pace for the global market during the forecast period. This is owing to companies across European countries such as France, Germany, and the U.K. implementing data management tools to gain insights and analysis of the customers and their business to plan future strategies. The UK market is projected to reach USD 5.49 billion by 2026, while the Germany market is projected to reach USD 5.68 billion by 2026. For instance,

- In January 2023, Amdocs, a provider of software and services to communications and media companies, was selected by Telefonica Germany to improve user experience for its enterprise customers.

Asia Pacific

Asia Pacific is projected to witness notable growth in the forecast period due to rising government investments in developing IT infrastructure and a surge in cloud infrastructure investments. The Japan market is projected to reach USD 4.9 billion by 2026, the China market is projected to reach USD 6.12 billion by 2026, and the India market is projected to reach USD 4.83 billion by 2026. For instance,

- In September 2022, ThoughtSpot Cloud Analytics Company invested around USD 150 million in IT infrastructure development. The investment aimed to increase the research and development in next-generation IT technologies such as cloud computing AI and others.

Middle East & Africa

The Middle East and Africa countries, such as GCC, Turkey, and South Africas are allotting dedicated funds for digital transformation through the adoption of advanced technologies. This is expected to boost the adoption of EDM in the region.

South America

In South America, growing investments by Chile, Argentina, Brazil, and Columbia governments are improving the adoption of digitalization, thereby driving market growth. The COVID-19 pandemic surged the adoption of digital technologies in the region.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players Emphasize Advanced Enterprise Data Management to Strengthen their Positions

The global market comprises a vibrant startup ecosystem. Over 100 startups are anticipated to develop and innovate EDM solutions for customers in the market. Such a market is projected to build robust competition, imposing current organizations to update and implement new advances in product offerings continuously. The companies are offering managed services for data transmission and management among enterprises.

List of Companies Profiled in the Report

- Oracle Corporation (U.S.)

- IBM Corporation (U.S.)

- SAP SE (Germany)

- Amazon.com Inc. (U.S.)

- Cloudera, Inc. (U.S.)

- Commvault (U.S.)

- Mindtree Ltd. (India)

- Teradata Corporation (U.S.)

- Talend (U.S.)

- Informatica Inc. (U.S.)

- SAS Institute (U.S.)

- Snowflake (U.S.)

- DataStax (U.S.)

- TIBCO Software (U.S.)

- Micro Focus (U.K.)

- Domo (U.S.)

- Paxata (U.S.)

- Ataccama (Canada)

- Wipro (India)

- Axxiome (Switzerland)

…and more

KEY INDUSTRY DEVELOPMENTS

- June 2024: Telefónica Tech and IBM signed a new collaboration agreement to drive the development of analytics, AI, and data management solutions for enterprises. The collaboration agreement helps to promote education and training initiatives to scale digital transformation projects in the public administration and business sector.

- November 2023: Amazon Web Services, Inc. and SnapLogic, a commercial software company, announced a collaboration for providing turnkey data management solutions to its customers globally. The collaboration includes SnapGPT, which uses open-source and proprietary AI.

- October 2023: Amazon Web Services, Inc. launched ‘Amazon DataZone’, a data management service designed to catalog, analyze, share, and govern data at the global level for organizations. The service provide data visibility and help data producers and customers across various businesses to share data securely.

- September 2023: Amazon Web Services, Inc. and Cloudera, an American data lake software company, announced a partnership to drive enterprise generative AI. The partnership would scale up and accelerate cloud-based data management and data analytics on AWS.

- May 2023: Informatica, an enterprise cloud data management provider, announced the expansion of its Intelligent Data Management Cloud (IDMC) at Informatica World 2023. The IDMC includes services for data engineering and data observation.

INVESTMENT ANALYSIS AND OPPORTUNITIES

Many companies invest heavily in continuous innovation to enhance the security, efficiency, and customization of cloud-based solutions. The key market players include IBM Corporation, Oracle Corporation, SAP SE, and Informatica Inc. These players are focusing on making recurring investments in research and development activities to launch new solutions.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 11.50% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Deployment

By Enterprise Size

By Industry

By Function

By Region

|

|

Companies Profiled in the Report |

Oracle Corporation (U.S.), IBM Corporation (U.S.), SAP SE (Germany) , Amazon.com Inc. (U.S.), Cloudera, Inc. (U.S.), Commvault (U.S.), Mindtree Ltd. (India), Teradata Corporation (U.S.), Talend (U.S.), and Informatica Inc. (U.S.) |

Frequently Asked Questions

The market is projected to reach USD 294.99 billion by 2034.

In 2025, the market was valued at USD 111.28 billion.

The market is projected to grow at a CAGR of 11.50% during the forecast period.

By industry, IT & telecom led the market.

Rise of data management and risk management solutions are key factors boosting market growth.

Oracle Corporation, IBM Corporation, SAP SE, Amazon.com Inc., Cloudera, Inc., Commvault, Mindtree Ltd., Teradata Corporation, Talend, and Informatica Inc. are the top players in the market.

North America held the highest market share in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us