Enterprise LLM Market Size, Share & Industry Analysis, By Component (Software, Hardware, and Services), By Deployment (Cloud, On-premise, and Hybrid), By Model (General-Purpose LLMs, Domain-Specific LLMs, and Custom/Proprietary LLMs), By Enterprise Type (Large Enterprises and Small and Medium-sized Enterprises), By Industry (BFSI, Healthcare, Retail & E-commerce, Legal and Compliance, Manufacturing, and Others [Education, etc.]), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

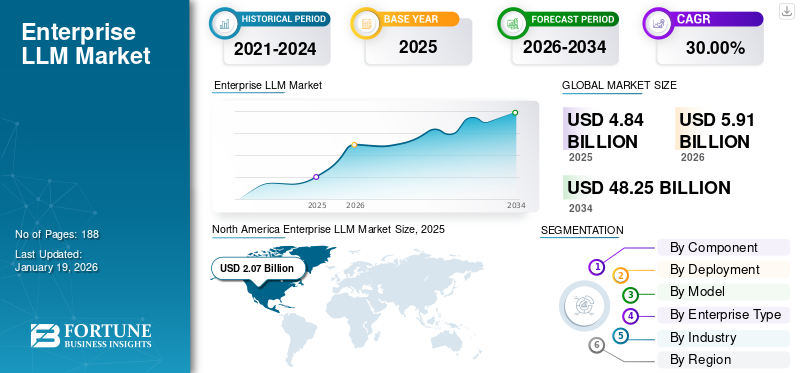

The global enterprise LLM market size was valued at USD 4.84 billion in 2025. The market is projected to grow from USD 5.91 billion in 2026 to USD 48.25 billion by 2034, exhibiting a CAGR of 30.00% during the forecast period. North America dominated the global market with a share of 42.70% in 2025.

Enterprise Large Language Models (LLMs) are advanced artificial intelligence systems designed to comprehend, analyze, and generate human language, specifically for businesses. They apply deep learning and neural network architectures, such as transformers, in order to analyze large amounts of text.

The market is experiencing significant growth for various reasons. There is an increasing demand for AI-driven automation and improved decision-making capabilities, which makes enterprise LLMs attractive to a number of industries. The surge in digital transformation, cloud computing capabilities, and the rising volume of unstructured data also drives this growth.

Some of the leading players in the market are Microsoft, Open AI Corporation, IBM Corporation, Amazon Web Services, Inc., Google LLC, and Anthropic PBC.

Impact of Generative AI

Gen AI Drives Automation, Boosts Productivity, and Unlocks Revenue Streams

Generative AI is transforming the global enterprise landscape globally by allowing companies to utilize large language models (LLMs) that go beyond simple task automation. For instance, LLMs can create domain-specific text, support strategic decision-making, and simplify an organization’s operational performance parameters across multiple industry verticals. The potential of generative AI can help organizations improve employee productivity, achieve greater operational efficiencies and even identify new revenue models. LLMs are becoming a key innovation driver for companies to create personalized customer experiences, optimize workflows, and ultimately gain a competitive advantage within a data-driven global market.

MARKET DYNAMICS

Market Drivers

Growing Demand for Intelligent Automation Drives the Market Development

The market is accelerating as organizations are using AI technology to automate processes and enhance productivity. The increase in demand for intelligent automation is demanded due to the requirement for workflow optimization, better decision-making, and customer engagement improvement across industries.

Notably, the World Economic Forum highlights that 23% of global jobs are expected to change within five years mainly due to advancements in AI, including LLMs. This indicates a fundamental shift in enterprise strategies, driven by LLMs’ capacity for content generation, structured data extraction, and automation, helping enterprises stay cost-effective and competitive while navigating digital transformation.

Market Restraints

Operational Disruptions During Transition Hampers the Market Growth

Although LLMs have great prospects to offer, there still are considerable limitations to their adoption mostly because of the disruptions involved with operations and the complications that arise during compliance with transition. Businesses need to consider the potential of sensitive data, the risks of compliance with frameworks such as GDPR and HIPAA, and the possible misuse of data. Advanced model integration is bound to require adaptation of the IT systems, employee retraining, and infrastructure enhancements, which can add cost and complexities. These operations and compliance obstacles can cause delay or hesitation in enterprise-wide implementation, temporarily slowing the enterprise LLM market growth speed.

Market Opportunities

Smaller/Mid-size LLMs & Efficient Models Offers Lucrative Growth Opportunities

The shift toward smaller/mid-size LLMs and optimized generative AI frameworks offers attractive growth prospects for organizations. Smaller and medium-sized models, developed by quantization, pruning, and efficient fine-tuning, are powerful in capability and yet economical and easier to deploy. These developments significantly reduce the compute and resource strains traditionally associated with large LLMs, making them accessible for a wide range of use cases. By embracing efficient, domain-oriented models, businesses can enable greater AI adoption, improve ROI, and build competitive advantages in a scalable and sustainable manner.

ENTERPRISE LLM MARKET TRENDS

Rapid Growth of Domain Specific/Custom LLMs as a Prominent Market Trend

The enterprise large language model (LLM) market is witnessing rapid growth of domain-specific and custom models, which is one of the strongest trends currently seen around the world. Organizations in many industries are recognizing that general LLMs, while very capable, often lack the contextual capability and compliance accuracy demanded by sector-specific use cases. Healthcare, finance, and legal companies, especially prefer fine-tuned LLMs that address sectoral jargon, regulatory requirements, and nuanced workflows. This rising preference indicates an enterprise shift toward using customized AI deployments for better decision making, regulatory safety, and increased productivity.

SEGMENTATION ANALYSIS

By Component

Software Segment Dominates Market as it Forms the Core of Enterprise LLM Solutions

In terms of component, the market is divided into software, hardware, and services.

The software component segment is projected to dominate the market with a share of 51.71% in 2026. Software leads as the key enabler of value creation, including foundational models, development platforms, and integration tools. With its central role in powering applications and enabling scalability, software is the most important and broadly adopted component.

Services segment accounts for 32.8% of the market share and are projected to witness the highest CAGR. The growth of the segment is attributable to organizations increasingly seeking expert aid in terms of integration, customization, and subsequent maintenance, enabling seamless technology adoption and optimized performance.

By Deployment

Scalability, Flexibility, and Cost-Efficiency to Drive the Cloud Segment Growth

Based on the deployment, the market is segmented into cloud, on-premise, and hybrid.

The cloud deployment segment is expected to lead the market, accounting for 62.21% of the total market share in 2026. This segment takes the lead among all the segments as it provides enterprises with the scalability, flexibility, and cost-efficiency, making it the preferred choice for organizations integrating Large Language Models (LLMs). In addition, the cloud segment is estimated to account for 33.3% and is expected to register the highest CAGR among all segments. Growth in this segment is mainly driven by the increasing need for remote access, as well as the growing emphasis on adopting hybrid cloud strategy models, which provide scalability, flexibility, and cost-effectiveness.

By Model

Widespread Adoption Across Various Industries Help General-Purpose LLMs Segment to Lead the Market

In terms of model, the market is segmented into general-purpose LLMs, domain-specific LLMs, and custom/proprietary LLMs.

The general-purpose LLMs model segment is anticipated to hold a dominant market share of 54.47% in 2026. The segment’s growth is attributable to their unparalleled versatility, which enables its adoption across various industries including healthcare, finance, retail, and technology. This broad applicability leads to widespread adoption of these models making them the best choice for organizations, who are looking for an adaptable and scalable AI solution.

Domain specific LLMs is the fastest-growing segment with a CAGR of 35.1%. Increased demand from organizations for customized models that can be tailored to meet industry specific demands drives the growth.

By Enterprise Type

Availability of Greater Resources to Invest in LLM Technologies Augments the Large Enterprises Segment Growth

In terms of enterprise type, the market is segmented into large enterprises and small and medium-sized enterprises.

The general-purpose LLMs model segment is anticipated to hold a dominant market share of 54.47% in 2026. The segment’s growth benefits from their greater resources to invest in advanced LLM technologies. In addition, their access to extensive amounts of data and the need for sophisticated AI solutions to streamline complex and large-scale operations also drives this growth.

Small and Medium-sized Enterprises (SMEs) represent 34.5% of the market and account for the highest CAGR. This rapid growth has been mainly fueled by the growing availability of reasonably priced, scalable LLM solutions. With a growing awareness of AI’s strategic advantages, SMEs are also enabling the adoption of state-of-the-art technology to improve efficiency and gain a competitive advantage.

By Industry

To know how our report can help streamline your business, Speak to Analyst

Heavy Reliance on LLMs for Risk Analysis and Regulatory Compliance Augments the BFSI Segment Growth

Based on the industry, the market is segmented into BFSI, healthcare, retail and e-commerce, legal and compliance, manufacturing, and others.

At USD 1.07 billion, BFSI constituted the largest share of the market as financial institutions increasingly leverage LLMs for risk prevention, fraud detection, automated customer support, and compliance while ensuring efficiency and reliability. The market dependency on AI solutions makes BFSI a dominating industry in the market.

The healthcare industry, with a market share of 34.4% is the fastest-growing segment along with the highest CAGR. This growth can be attributed to the increased adoption of AI in medical research, diagnostics and personalized treatment, and accelerated demand for patient management solutions.

ENTERPRISE LLM MARKET REGIONAL OUTLOOK

Geographically the market is segmented into North America, Europe, Asia Pacific, South America and Middle East & Africa.

North America

North America Enterprise LLM Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America is witnessing a strong growth, valued at USD 1.49 billion in 2023 and increasing to USD 1.74 billion in 2024, making it the strongest region globally. North America continues to be the biggest market due to the early technology adoption, home to the leading AI companies, and significant enterprise spending on AI infrastructure. The U.S. market is projected to reach USD 1.95 billion by 2026.

The U.S. alone is projected at USD 1.62 billion in 2025, fueled by the widespread integration of AI in major corporations, advanced digital ecosystems, and strong research and development investments.

Download Free sample to learn more about this report.

Europe

The Europe market is estimated at USD 1.10 billion in 2025, with strong adoption in major economies driven by digital transformation and AI integration in enterprises. The U.K. leads at USD 0.31 billion in 2025, supported by advanced financial services and early AI adoption. Germany is valued at USD 0.26 billion in 2025 is inspired by industry 4.0 initiatives and automation. France at USD 0.19 billion in 2025, benefits from government-backed AI strategies. The UK market is projected to reach USD 0.37 billion by 2026, while the Germany market is projected to reach USD 0.31 billion by 2026.

Asia Pacific

The market for Asia Pacific is set to grow with a valuation of USD 3.76 billion by 2025, increasing at the fastest pace with a remarkable CAGR of 35.40%. The region is the fastest-growing, bolstered by fast-tracked digital transformation, increased investment in AI, and enterprise demand for scalable, multilingual LLM solutions. China contributes USD 0.31 billion, fueled by the country’s vast and robust AI infrastructure and its government-backed digital initiatives. India valued at USD 0.17 billion is growing rapidly with enterprise AI adoption and an emerging technology ecosystem. The Japan market is projected to reach USD 0.24 billion by 2026, the China market is projected to reach USD 0.38 billion by 2026, and the India market is projected to reach USD 0.22 billion by 2026.

South America and Middle East & Africa

In 2025, South America is anticipated to record a market valuation of USD 0.26 billion. The region's growth is driven by a high adoption of AI-led automation solutions and the rapid digitalization of the banking, retail, and telecommunications sectors. In the Middle East & Africa, the market is expected to reach a value of USD 0.48 billion in 2025, and the GCC countries are accounted for USD 0.12 billion in value. The region is growing with strong government-led digital strategies, growing cloud adoption, and growing AI infrastructure expenditure.

COMPETITIVE LANDSCAPE

Key Industry Players

Prominent Companies Invest in Advanced Model Development and Strategic Partnerships to Remain Competitive

The market continues to witness a surge in growth as leading competitors strive for market leadership through cutting-edge technological developments and product launches. Several key companies including OpenAI, Google, Anthropic, Microsoft, IBM, and Cohere have all enhanced their investment in advancing models, collaborative partnerships, and mergers & acquisitions. Initiatives such as continuous technological upgrades and tailored enterprise solutions allow these companies to sustain competitive advantage.

LIST OF KEY ENTERPRISE LLM COMPANIES PROFILED

- Microsoft (U.S.)

- Open AI Corporation (U.S.)

- IBM Corporation (U.S.)

- Amazon Web Services, Inc. (U.S.)

- Google LLC (U.S.)

- Anthropic PBC (U.S.)

- Cohere (U.S.)

- Aleph Alpha Gmbh (U.S.)

- AI21 Labs (Israel)

- Mistral AI (France)

- Dextra Labs (Singapore)

- InData Labs (Cyprus)

KEY INDUSTRY DEVELOPMENTS

- September 2025- German startup DeepL, known for its AI-based translator, has introduced a new product — DeepL Agent, which should automate routine processes in companies and become a competitor to solutions from OpenAI, Anthropic, and Microsoft.

- July 2025- Zoho introduced its in-house developed Zia LLMs in three sizes for enterprise use, integrated across its business apps, prioritizing data privacy and cost-efficiency to drive AI innovation in India.

- March 2025- Canada’s leading large-language model (LLM) developer Cohere has unveiled its new Command A model, which the company claims is faster and uses less computing power than other global competitors.

- March 2025-ai, a leader in open-source Generative AI and Predictive AI platforms, today announced H2O Enterprise LLM Studio, running on Dell infrastructure. This new offering provides Fine-Tuning-as-a-Service for businesses to securely train, test, evaluate, and deploy domain-specific AI models at scale using their own data. Built by the world’s top Kaggle Grandmasters, Enterprise LLM Studio automates the LLM lifecycle — from data generation and curation to fine-tuning, evaluation, and deployment. It supports open-source, reasoning, and multimodal LLMs such as DeepSeek, Llama, Qwen, H2O Danube, and H2OVL Mississippi.

- March 2025- AI21, a leader in frontier models and AI systems, unveiled Maestro, the world's first AI Planning and Orchestration System designed to deliver trustworthy AI at scale for organizations. Introduced at the HumanX 2025 conference, Maestro is a significant step for enterprise AI, which drives the instruction following accuracy of paired LLMs by up to 50% with guaranteed quality, reliability, and observability.

REPORT COVERAGE

The global report provides a detailed analysis of the market and focuses on key aspects such as prominent companies, deployment modes, types, and end users of the product. Besides this, it offers insights into the enterprise LLM market trends and highlights key industry developments and market share analysis for key companies. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Growth Rate |

CAGR of 30.00% from 2026-2034 |

|

Historical Period |

2019-2023 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component · Software · Hardware · Services |

|

By Deployment · Cloud · On-premise · Hybrid |

|

|

By Model · General-Purpose LLMs · Domain-Specific LLMs · Custom/Proprietary LLMs |

|

|

By Enterprise Type · Large Enterprises · Small and Medium-sized Enterprises |

|

|

By Industry · BFSI · Healthcare · Retail & E-commerce · Legal and Compliance · Manufacturing · Others [Education, etc.]) |

|

|

By Region · North America (By Component, Deployment, Model, Enterprise Type, Industry, and Country/Sub-region) o U.S. (By Industry) o Canada (By Industry) o Mexico (By Industry) · Europe (By Component, Deployment, Model, Enterprise Type, Industry, and Country/Sub-region) o U.K. (By Industry) o Germany (By Industry) o France (By Industry) o Italy (By Industry) o Spain (By Industry) o Russia (By Industry) o Benelux (By Industry) o Nordics (By Industry) o Rest of Europe (By Industry) · Asia Pacific (By Component, Deployment, Model, Enterprise Type, Industry, and Country/Sub-region) o China (By Industry) o Japan (By Industry) o India (By Industry) o South Korea (By Industry) o ASEAN (By Industry) o Oceania (By Industry) o Rest of Asia Pacific (By Industry) · South America (By Component, Deployment, Model, Enterprise Type, Industry, and Country/Sub-region) o Argentina (By Industry) o Brazil (By Industry) o Rest of South America (By Industry) · Middle East & Africa (By Component, Deployment, Model, Enterprise Type, Industry, and Country/Sub-region) o Turkey (By Industry) o Israel (By Industry) o GCC (By Industry) o North Africa (By Industry) o South Africa (By Industry) · Rest of the Middle East & Africa (By Industry) |

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 4.84 billion in 2025 and is projected to reach USD 48.25 billion by 2034.

The market is expected to exhibit steady growth at a CAGR of 30.00% during the forecast period.

Growing demand for intelligent automation drives the market growth.

Microsoft, Open AI Corporation, IBM Corporation, Amazon Web Services, Inc., Google LLC, and Anthropic PBC are some of the top players in the market.

The North America region held the largest market share.

North America was valued at USD 2.07 billion in 2025.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us